"Fengkou Research Report · Company" energy storage+beach coating photovoltaic+offshore wind power+garbage power generation.

Author:Federation Time:2022.07.18

① Energy storage+beach coating photovoltaic+offshore wind power+garbage power generation. The company has also obtained the exclusive gravity energy storage technology authorization in China. It has become a number of state -owned enterprises cooperatives. It is expected to be put into operation during the year. In the year, this retail -end ODM leader "small batch+multi -variety+fast delivery" model was the key to success, and logic similar to Weixing shares.

"Fengkou Research Report" Today Introduction 1. Company 1: ① The company is a global environmental service group. The experience and technical advantages form unique competitiveness. Among them, the waste incineration power generation business covers many places at home and abroad. A total of 11550 tons of scale; ② The company has obtained the exclusive gravity energy storage technology authorization through the EV company. Compared with other energy storage methods, gravity energy storage has low cost, high energy storage efficiency, and small environmental damage. The cost is relatively high. At present, it has signed a cooperation agreement with Xinneng Company, the State Grid Jiangsu comprehensive, and China Power Construction Hydropower. The People's Government signed the "New Energy Industry Investment Agreement" to reach in -depth strategic cooperation on new energy business such as photovoltaic power generation, sea wind power, energy storage, hydrogen energy, and zero carbon data center; With the demonstration effect, the future business prospects are broad. It is expected that the net profit of the mother-in-law of 2022-24 is 7.64/10.24/1.381 billion yuan, respectively, and the year-on-year growth rate is 5%/34%/35%, respectively. 10.5 times; ⑤ risk factors: The commercialization of gravity energy storage technology is still immature, and the construction speed of power grids and energy storage facilities has slowed down.

2. Company 2: ① The company announced that it is expected to have a net profit of 183 million yuan to 188 million yuan in the first half of the year, a year-on-year increase of 257%-267%, which is expected to exceed 186 million yuan last year. It is mainly sold overseas, mainly for the settlement of the US dollar, Zhejiang Shang Securities Ma Li believes that the depreciation of the renminbi increases net profit. It is optimistic about the company's focus on the overseas retail market and the global customer channel layout drives long -term growth. Model is the key to business success. It has established long -term cooperative relationships with many head retail brands such as Bellkin, Anke Innovation, Amazon, etc., and is more similar to the one -stop supplementary materials of clothing. The rapid popularization of the Type-C interface and the expansion of the company's Vietnam base. Mary is optimistic about the company's performance growth and continuous growth potential. It is expected to achieve a net profit of 2.9/3.8/520 million yuan in 2022-24, a year-on-year increase of 53.3%/33.8% /35.6%; ⑤ Risk factor: product expansion progress is not as good as expected and exchange rate fluctuations.

Theme one

Energy storage+beach coating photovoltaic+maritime wind power+garbage power generation. The company has also obtained the exclusive gravity energy storage technology authorization in China. It has become a number of state -owned enterprises. It is expected that the project will be put into operation within the year

Recently, the news about the "distributed photovoltaic power generation project of the Wuhan North Lake Sewage Treatment Plant is about to grieve power generation", making the new model of "environmental protection+new energy" a hot spot.

Guohai Securities Yang Yang deeply covers China Tianyi (000035). The company is a global environmental service group. The experience and technical advantages form unique competitiveness. They also work together to enter the new energy field with EV companies to expand their business space with gravity energy storage.

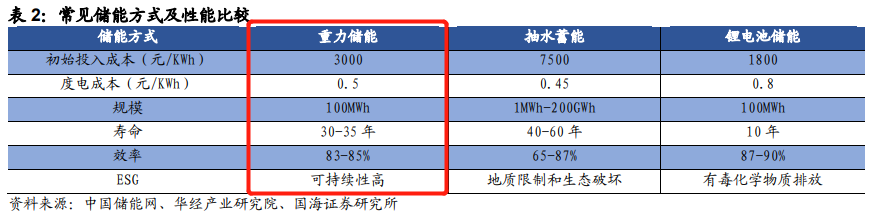

The company has obtained the authorization of exclusive gravity energy storage technology in China by investing in EV. Compared with other energy storage methods, gravity energy storage has the advantages of low degree of electricity cost, high energy storage efficiency, and small environmental damage.

At the same time, the company has signed the "New Energy Industry Investment Agreement" with the People's Government of Rudong County to reach in -depth strategic cooperation on new energy businesses such as photovoltaic power generation, sea wind power, energy storage, hydrogen energy, and zero carbon data center.

Yang Yang is optimistic that the company and local governments sign an agreement have a demonstration effect. In the future, the business prospects are broad. It is expected that the net profit attributable to the mother of 2022-24 will be 7.64/10.24/1.381 billion yuan, respectively, with a year-on-year growth rate of 5%/34%/35%. The corresponding PE is 19/14/10.5 times, respectively.

China Tianyi joined hands with EV Company to enter the new energy field to develop gravity energy storage technology expansion business space

The cost of gravity energy storage is about 60%of the energy storage of lithium battery, the project life can reach 30-35 years, and the efficiency is 83%-85%. Compared with other energy storage methods, the cost of electricity is low and the energy storage efficiency is high. , Destroy the environment and other advantages, and have a high cost.

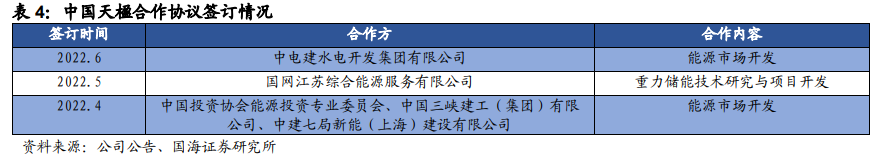

The company has obtained the exclusive gravity energy storage technology authorization through the EV company. In the first quarter of 2022, the company built the world's first 100MWH gravity energy storage project in Jiangsu Rusong. The power generation power was 25MW. It is expected to be put into operation within the year.

China Tianyi signed an investment agreement with the local government to deepen new energy cooperation

The company has the environmental protection business layout in Rudong County, and has a subsidiary such as Dongtianyu, which has a good foundation with the local government.

In November 2021, the company signed the "New Energy Industry Investment Agreement" with the People's Government of Rudong County to reach new energy businesses such as photovoltaic power generation, sea wind power, energy storage, hydrogen energy, and zero carbon data centers. Cooperation to break through the new energy field as a breakthrough.

At the same time, the company actively sought cooperation. It has signed cooperation agreements with new energy companies, State Grid Jiangsu comprehensive, and China Power Construction Hydropower. With the blessing of market demand and cooperatives, the future business prospects are broad. China Tianyu has cultivated environmental protection business for many years, and experience and technical advantages have formed unique competitiveness

The company's urban environmental service business includes the intelligent classification of garbage, the wisdom of garbage, smart cleaning, and recycling of regeneration resources, and has full process service capabilities.

The company's waste incineration power generation business covers many places at home and abroad, with 12 operating projects, with a total daily processing scale of 11,550 tons.

Relying on the advantages of advanced technologies and environmental friendship such as one -stop triple treatment, the company has a significant advantage in the bidding session, the project reserves are rich, and the business scale is expected to maintain high -speed growth in the future.

Theme two

The company's performance in the first half of the year is expected to catch up with the whole year of last year. This retail ODM leader "small batch+multi -variety+fast delivery" model is the key to success. Logic is similar to Weixing Co., Ltd.

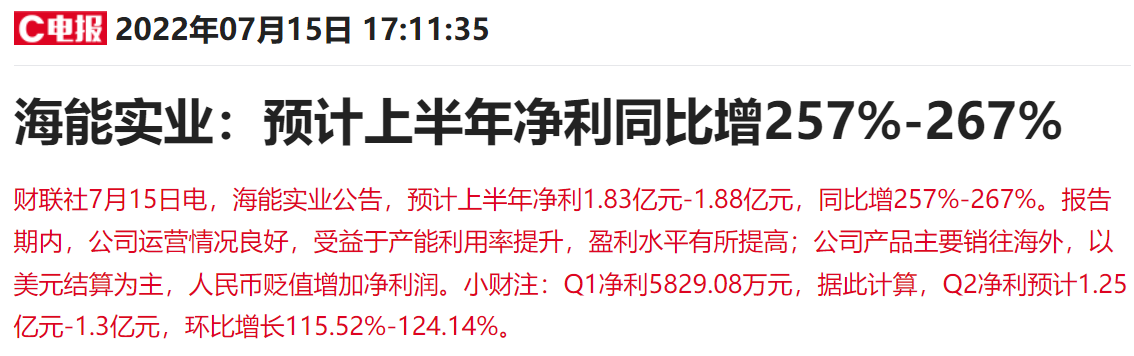

Event: Hai Neng Industrial Announcement, it is expected that net profit in the first half of the year is 183 million yuan to 188 million yuan, a year-on-year increase of 257%-267%.

Yesterday, this column quoted Huaxin Securities Bao Youchen's point of view, and believed that the same shares benefited from the rise of exports in the first half of the year and the depreciation of the RMB against the US dollar. It is expected that the net profit attributable to 3457-4.57 million yuan in the second quarter was expected to achieve a net profit of 3457.457 million yuan, an increase of 7940%month- 10265%.

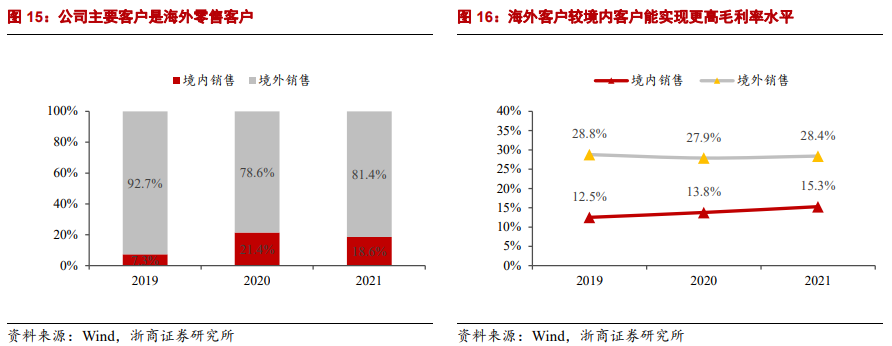

Today, Zheshang Securities Mali deeply covers Haineng Industrial (300787). The company is the ODM leader of the consumer electronics retail market. The products are mainly sold overseas, mainly US dollars settlement, RMB depreciation increases net profit. Customer channel layout drives long -term growth.

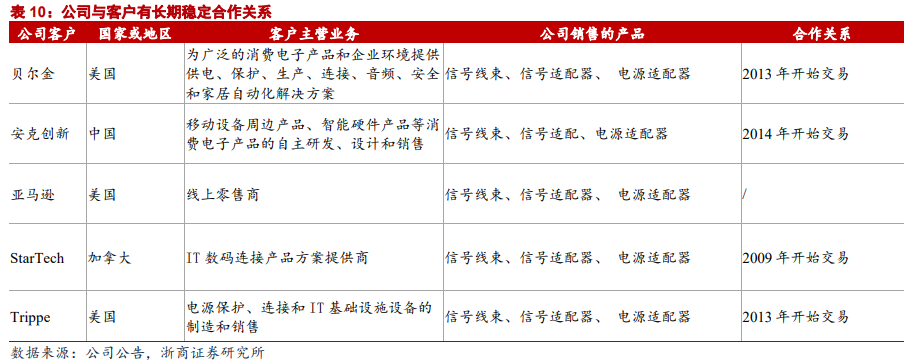

The company's small -scale, multi -variety, and fast delivery business model is the key to business success. It has established long -term cooperative relationships with many head retail brands such as Bellkin, Anke Innovation, Amazon, etc., and is more similar to the one -stop supplementary material of the clothing. Essence

Fast charging infiltration rate has increased significantly, and product iterations help the industry to prosper

The company's consumer electronic products cover wire beam, signal adaptation, and power products. In 2021, the revenue accounted for 27%/41%/31%, respectively.

(1) The current fast-charging permeation rate has been greatly improved. The downstream host manufacturers cancel the standard with the charging head. With the rapid popularization of the Type-C interface, the demand for cable beam products will increase.

(2) At the same time, the company's signal product benefit interface standard iteration+light and light trend of consumer electronics products.

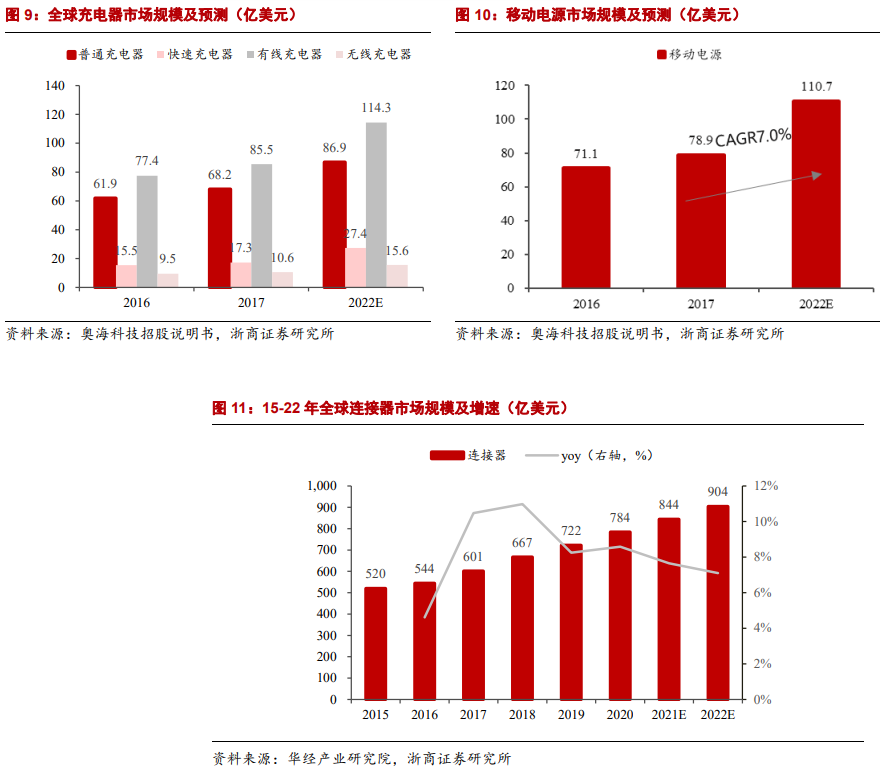

Mali expects that the global wired charger+wireless charger+mobile power market size will reach US $ 24.1 billion in 2022, and the global connector market regulations will reach US $ 90.4 billion.

Hai Neng Industry Efficient R & D and production management, global customer channel layout

Unlike Lixun and Olympic Sea, the company's net profit margin is expected to maintain above 10%, and high growth and high profit margins are based on the following:

(1) Attach importance to R & D and original design: R & D investment continues to exceed 5%, matrix -type architecture empower research and development, and the four major mechanisms help innovation.

(2) Elastic production advantage: provides small -scale multi -product customized products with sales production.

(3) Production layout advantage: The four major production bases have significant advantages in Vietnam.

(4) Customer channel advantages: global customer channels, bind high -quality retail brands.

Hai Neng Industrial adjustment period has passed, and the release period of performance release

The tariff rate has been increased due to the increase in the relationship between the major powers, the preliminary investment and management running costs of the Vietnamese base, the large-scale running-in costs, and the appreciation of the renminbi. In 2018-20, the company's net profit was hovering.

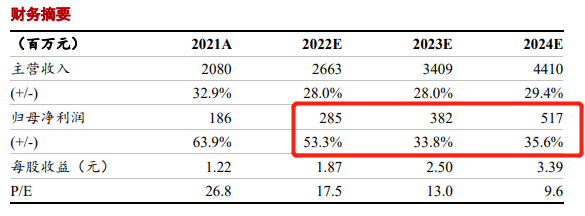

With the mature operation of the Vietnamese base, even if it was affected by the Vietnamese epidemic in 2021, revenue still achieved 2.08 billion yuan, an increase of 32.9%year -on -year, and the net profit attributable to mothers was 186 million yuan, an increase of 63.9%year -on -year. The expansion of the Vietnamese base also shows confidence in future development.

Mali believes that the company's profit in the first half of the year is expected to exceed the whole year of last year. It is optimistic about the high performance growth and continuous growth potential. It is expected that the net profit attributable to the mother will be 2.9/3.8/520 million yuan in 2022-14 years, a year-on-year increase of 53.3%/33.8%/35.6% Essence

- END -

Retirement does not fade, and flood prevention is urgent!Shaoguan organized retired soldiers to rescue nearly 2,000 people

Text/Yangcheng Evening News all -media reporter Zhang Wen correspondent Deng QinPh...

Obta 10 years · Dizhou Tour 丨 Ili Kazakh Autonomous Prefecture: Duowu Red Flower Ying Smile Face

On July 10th, the saffron was full of hillside. Photo by reporter Basha TiegusRepo...