There are counts | The scale and yield of bank structural deposits and yields have declined slightly

Author:Cover news Time:2022.07.18

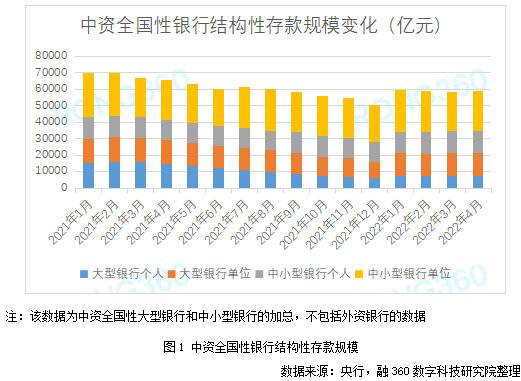

According to data released by the People's Bank of China, as of the end of May 2022, the balanced deposit balance of Chinese national banks was 5840.735 billion yuan, a decrease of 1.42%month -on -month and a year -on -year decrease of 8.04%. On the whole, the scale of structural deposits in recent months has not changed much, which has increased compared to the end of last year. Specifically, the scale of personal structural deposits and unit structural deposits of large banks decreased by 1.4%and 3.07%, respectively. Small and medium -sized banks' personal structural deposits and unit structural deposits decreased by 1.69%and 0.37%respectively.

Structural deposit yield fell slightly

According to the incomplete statistics of Rong 360 Digital Science and Technology Research Institute, the average time limit for RMB structural deposits issued by banks in June 2022 was 149 days, which was the same as last month; The yield was 3.58%, a decrease of 1bp from the previous month.

From the perspective of income trend, the average intermediate return of structural deposits has declined since this year. From the perspective of the structural deposits of different hook bids, the average duration of the structural deposit of the linked exchange rate in June was 95 days, the average expected intermediate yield was 2.97%, and the average expected maximum yield was 3.32%; the structural structure of the linked gold was structural The average period of deposit is 79 days, with an average expected intermediate yield of 2.97%, and the average expected maximum rate of return is 3.2%; the average period of the structural deposit of the hook index is 329 days. The rate is 4.41%; the average period of the structural deposit of the hook funds and stocks is 521 days, and there is no three -layer revenue structure products. The average expected maximum return rate is 6.25%.

The average expected maximum returns rate of state -owned banks and shares have fallen

From the perspective of different types of banks, the average structural deposit period of state banks in June was 91 days, and the average expected maximum rate of return was 3.29%, a decrease of 3bp from the previous month; 3.55%, a decrease of 2bp from the previous month; the average period of structural deposits of urban commercial banks is 116 days, and the average expected maximum return rate is 3.48%. , Rising 21bp from the previous month.

State -owned banks expect the highest rate of return on the overall low rate, and many of them are closer to the actual yield, especially the Agricultural Bank; joint -stock banks expect a structural deposit with a maximum rate of yields below 3.5%. Therefore, although the expected maximum yield cannot represent the actual yield, it can also reflect the actual return on the actual return to a certain extent. Since the beginning of this year, the structural deposit yields of state -owned banks and joint -stock banks have fallen to a certain extent.

There are four state -owned banks issuing structural deposits. In June, the structural deposit period of Agricultural Bank was between 3 and 6 months. The highest rate of expected maximum rate was only 2%, and the average expected maximum return was 1.88%. Last month, it fell 5bp, which remained at 1.93%in the past six months; the average expected maximum return rate of Construction Bank was 3.08%, an increase of 11bp from the previous month; the average expected maximum return rate of Bank of China was 3.31%, down 1bp from the previous month; The expected maximum rate of return was 3.36%, down 13bp from the previous month.

Structural deposits are stable, and the yield still has a slight decrease in space

Since May 2020, affected by regulatory, the scale of structural deposits has continued to drop. In December 2021, the scale of structural deposits decreased by 58.12%compared with the peak period in April 2020. However, since 2022, the scale of structural deposits has stopped the continuous drop. Although banks still have the pressure to reduce costs, some banks still have a certain dependence on structural deposits, and there are limited space for structural deposits in the future.

This year, the general deposit interest rate of banks has lowered. From April to May, national banks and local banks have successively lowered ordinary fixed deposits, large deposit orders, and special deposits interest rates. The long -term interest rate has decreased significantly. However, since June, the interest rate of ordinary deposits has stopped and stabilized. The adjustment of this round of interest rates is temporarily coming to an end, and the interest rate may enter a relatively stable period. Structural deposit yields are still declining channels. Compared with ordinary fixed deposits, the cost of savings is still higher, and there may still be room for a slight decline in the future.

For investors, the safety of structural deposits is relatively high. The structural deposits issued by Chinese banks have kept the capital and have a revenue rate. However, the yield of some products is large uncertain. The expected yield of the product needs to read the product's income rules carefully before purchasing to understand the conditions for the product to reach different yields.

Cover reporter Ran Zhimin

- END -

Datian County Meteorological Observatory lifted lightning yellow warning [Class III/heavier]

On June 08, 2022 at 00:46, Oshta County Meteorological Station lifted the thunder and yellow warning signal.

乔 乔 忆 我们 我们 我们: Let's write a group song for Nanjing's "Little Red Flower"

Jiao Dian News Writer Qiao Yu died of illness in Beijing in the early morning of t...