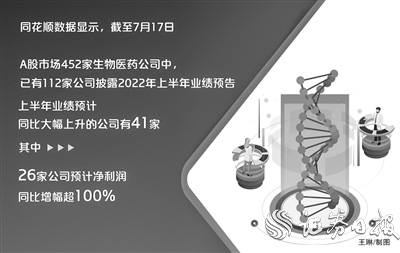

112 biomedical companies have disclosed that the first half of the year's performance preview 26 companies is expected to double the net profit

Author:Securities daily Time:2022.07.18

According to the data of the same flower, as of July 17th, the press publishing, 112 of the 452 biomedical companies in the A -share market have disclosed the results of the first half of 2022. Among them, there are 41 companies that are expected to rise sharply year -on -year in the first half of the year. 26 companies such as Jiu'an Medical, Kaiye, and Kailei are expected to increase by more than 100%year -on -year. Twenty companies including Kehua Biological, Weiming Pharmaceutical, Harbin Pharmaceutical, and Sitai Lili are expected to decline significantly year -on -year in the first half of the year. Among them, companies are expected to decline by 96.72%year -on -year net profit.

A pharmaceutical industry practitioner who did not want to be named told the Securities Daily that in the biomedical industry, there were a lot of demand for in vitro diagnosis, vaccine research and development, and traditional Chinese medicine. Therefore, many companies' performance in the first half of the year showed positive growth.

Jiu'an medical net profit pre -increased by more than 270 times

From the perspective of subdivisions, the company that is expected to grow significantly year -on -year in the first half of this year's performance is mainly concentrated in several sectors such as chemical preparations, raw materials, in vitro diagnosis, medical research and development, and traditional Chinese medicine.

On July 15th, Jiu'an Medical's release of the semi -annual performance forecast of 2022 showed that the company is expected to be between 15.1 billion yuan and 15.5 billion yuan in the first half of this year, with a year -on -year increase range of 27466.36%to 28196.6%. Regarding the reasons for the increase in performance in the first half of the year, the company said that the IHEALTH kit was authorized by the IHEALTH kit during the performance period, and at the same time due to government orders and business orders, sales revenue increased significantly.

Although Jiu'an Medical's performance increased significantly in the first half of this year, in terms of quarterly, the net profit in the first quarter of this year was 14.312 billion yuan, which means that the net profit in the second quarter was between 788 million yuan and 1.188 billion yuan. Essence Therefore, on the day of the announcement of the pre -announcement of the performance, Jiu'an Medical's stock price closed down 6.45%to close 58.48 yuan/share.

The above -mentioned practitioners who are unwilling to be named have pointed out that in the field of medical research and development, my country's CDMO (contract research and development and production services) is currently in a high -speed development stage. Public information shows that from 2021 to 2025, the global CDMO market compound annual growth rate of 13.79%. Compared with foreign markets, my country has the advantages of engineer dividends and cost advantages, so the development trend of the industry is better.

As a medical research and development outsourcing enterprise, Kailai is expected to have a operating income range of 4.791 billion yuan to 50.58 billion yuan in the first half of this year, with a year -on -year increase range of 172.18%to 187.37%; the expected net profit range is 1.644 billion to 1.743 billion yuan, year -on -year, year -on -year, year -on -year, year -on -year, year -on -year, year -on -year, year -on -year, year -on -year The increase was between 282.99%and 305.97%. The company pointed out that during the performance period, the company further optimized the operating system, the capacity utilization rate and operating efficiency were effectively improved, and the high -speed growth of operating income also brought about the release of scale benefits, which promoted the great improvement of profitability.

The development prospects in the field of Chinese medicine are optimistic

Puyin International Research Report pointed out that the support policy of the traditional Chinese medicine industry has been accelerated in 2021, and the state has a clear attitude towards support for the development of the Chinese medicine sector. The "Fourteenth Five -Year Plan" Chinese Medicine Development Plan released in March 2022 set a tone for the development of the Chinese medicine industry by 2025.

Among the biomedical companies that have released the performance trailer, there are a large number of Chinese medicine companies. Among them, the opening industry is expected to achieve a net profit of 27.5 million yuan to 29.5 million yuan in the first half of this year, with a growth rate of 362.60%to 396.25%.公司表示,业绩期内,上海市各项防疫物资的需求大幅上升,公司全资子公司雷西公司充分发挥作为医药流通企业在渠道、配送等方面的优势,积极开展防疫物资的供应销售,致使The company's overall performance has increased significantly year -on -year.

Biotech Innovation Pharmaceutical Medical Consultant Cao Bo told the Securities Daily reporter: "With the enhancement of the public's health awareness, more and more Chinese medicine can play a role. In addition to the support and tilt of national policies, the future development of the pharmaceutical industry must be It will be fine. "

According to the industry research report released by Debon Securities before, in the short mid -term, the traditional Chinese medicine sector will continue to receive market attention, and stocks with low valuations+excellent performance are expected to continue to rise. The traditional Chinese medicine sector may become the strongest sub -sector in the pharmaceutical and biological industry this year. The policies are expected to quickly transmit to the income and performance level of listed companies.

Many brokers are optimistic about the biomedical sector

Recently, many brokerage companies have released research reports that they are optimistic about the growth prospects of the performance of the biomedical sector.

The first research report released by the Pioneering Securities stated that the valuation of the biomedical industry has returned to a historical low, and in the long run, it has high investment cost -effective.

In the research report, Hualong Securities pointed out that in recent years, the performance and valuation of the biomedical industry have "double -kill". In 2021, the overall rising and falling of the industry was at the middle and lower levels, and the Shanghai and Shenzhen 300 Index was lost. In the first half of 2022, Chinese medicine and medical service sectors, which performed relatively well, were driven by the favorable policies of the industry, and the prosperity has been pushed back.

The above -mentioned practitioners who are unwilling to be named said that from the perspective of market conditions, normalized testing, vaccine, oral new crown drugs, etc. will become the main means in the process of epidemic prevention, and the relevant sectors and corporate performance growth will be high. In addition, brand Chinese medicine products have high recognition in the user group, and the support and encouragement of national policies, the expectations of related companies' future performance will be greater.

Our reporter Xie Ruolin, a trainee reporter Zhang An

- END -

Wanling Ridge in the adventure nature reserve, the highest peak Baiyun tip of Wenzhou!

Wen Tu: DatianYang Mei was familiar, and Mei Yu also followed, fascinated and rais...

When the wind is up again!"Three firsts" record a top -level wisdom collision in the prefabricated vegetable industry

A few days ago, the World Food Capital Foshan Shunde was sunny and the event appea...