Didi payment was punished!There are 12 types of illegal acts

Author:China Urban News Time:2022.07.16

On July 15, the publicity of administrative punishment information released by the Business Management Department of the People's Bank of China (Silver Management Punishment [2022] No. 27) showed that Beijing Didi Payment Technology Co., Ltd. was warned for 12 types of illegal acts and fined 4.27 million yuan Essence

The 12 types of illegal acts involved in Didi Pay include the error of uploading transaction information, and the requirements of the real, complete, and traceable transaction information of the transaction information are not implemented; the real -name system requirements of the customer's identity have not been strictly implemented, and the legal person's account opening will be verified in accordance with regulations; Customer identity real -name system requirements, no relevant materials are retained in accordance with regulations; setting up the receipt settlement account in violation of regulations; paying payment accounts for financial enterprises or enterprises engaged in financial business; no transaction background investigations on personal abnormal transactions; ; Non -reporting major risk incidents in a timely manner; not filing the format of the payment service agreement in accordance with regulations; failure to fulfill the obligation to identify customer identity in accordance with regulations; infringe the right to protect consumers' financial information in accordance with the law; Fair and unreasonable regulations.

At the same time, Chen Xi, then the general manager of Beijing Didi Payment Technology Co., Ltd. and the leader of the anti -money laundering leadership group, was responsible for the 4 category of illegal facts of Beijing Didi Payment Technology Co., Ltd., and was warned by the Central Bank Business Management Department and fined 17.4 10,000 yuan. These 4 types of illegal facts are: uploading transaction information errors, and the requirements of the real, complete, and traceable transaction information of the transaction information; the real -name system requirements of the customer's identity are not strictly implemented, and the legal person's account opening will be verified in accordance with regulations. Requirements are not reserved in accordance with regulations; the obligation to identify customer identity is not fulfilled in accordance with regulations.

In addition, Jiao Yang, then the general manager of Beijing Didi Payment Technology Co., Ltd. and the leader of the anti -money laundering leadership group, was responsible for the fact that the 5 category of illegal facts of Beijing Didi Payment Technology Co., Ltd. was warned by the Central Bank Business Management Department and a fine 206,000 yuan. These 5 illegal facts are: uploading transaction information errors, and the requirements of the real, complete, and traceable transaction information of the transaction information; the real -name system requirements of the customer's identity are not strictly implemented, and the legal person's account opening will be verified in accordance with regulations. Requirements are required, no relevant materials are retained in accordance with regulations; the obligation to identify customer identity is not fulfilled in accordance with regulations;

■ Source: Comprehensive from the Business Management Department of the People's Bank of China

■ Zhu Lina sorting

- END -

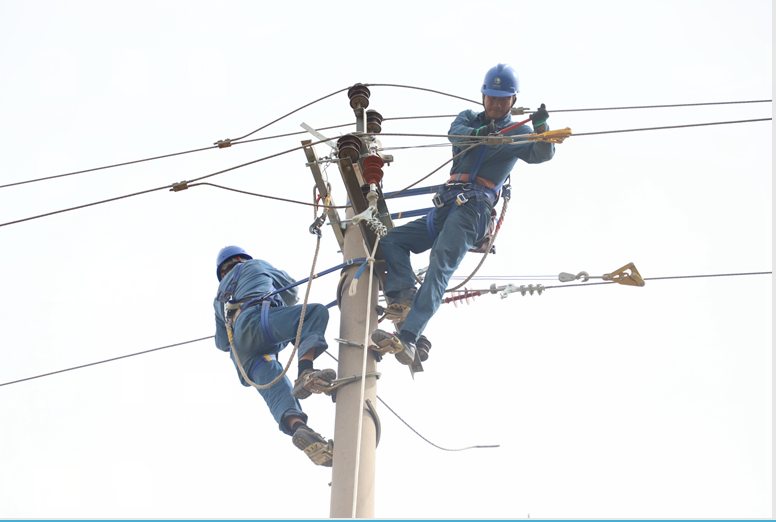

State Grid Yumen City Power Supply Company: Fighting War "High temperature" guardian power grid security

The weather is very hot. Although everyone is already in a hundred battles, the op...

Tour the West Jiuhua Mountain · Zhongyuan Zhuzhai, feel the romantic and dreamy world!(Original)

Not forget your original intentionKeep in mind the missionRed birthdayToday is Jul...