The national stock transfer company released the results of the municipal business evaluation in the second quarter. Last year, the best city merchant Kyushu Securities ranking declined

Author:Daily Economic News Time:2022.07.15

On July 15th, the National Stock Transfer Company released the results of the market business evaluation in the second quarter of 2022. The evaluation target was 69 municipal businessmen developed in the second quarter of 2022.

The top 13 of the evaluation results were qualified for handling fees for market transactions, and a total of nearly 3 million yuan in handling of market transactions was reduced, accounting for 70.43%of the total handling fees for the market in the second quarter.

Half a year ago, Kyushu Securities was rated by the national stock transfer company as the best city merchant in 2021. However, from the results of the market evaluation in the first and second quarters of this year, the ranking of Kyushu Securities has declined.

The results of the city merchant evaluation in the second quarter of the New Third Board were released

Today, the National Stock Transfer Company released the results of the municipal business evaluation in the second quarter of 2022. The market transaction has been operating for 8 years in the New Third Board, which has made important contributions to the liquidity of the New Third Board.

According to statistics from the national stock transfer company, in the first quarter of 2022, the total turnover of the city's stock was approximately 13.488 billion yuan, accounting for 53.86%of the total market transactions. In the second quarter of 2022, the total turnover of the market's stock was about 9.141 billion yuan, accounting for 49.44%of the total market transactions.

In recent years, the national stock transfer company will evaluate the marketing merchants every quarter, and the market merchant evaluation system has set up 7 multi -dimensional evaluation indicators from three aspects: the market size, liquidity provision and quotation quality. Municipal business transaction records, monitoring records and regulatory records were evaluated.

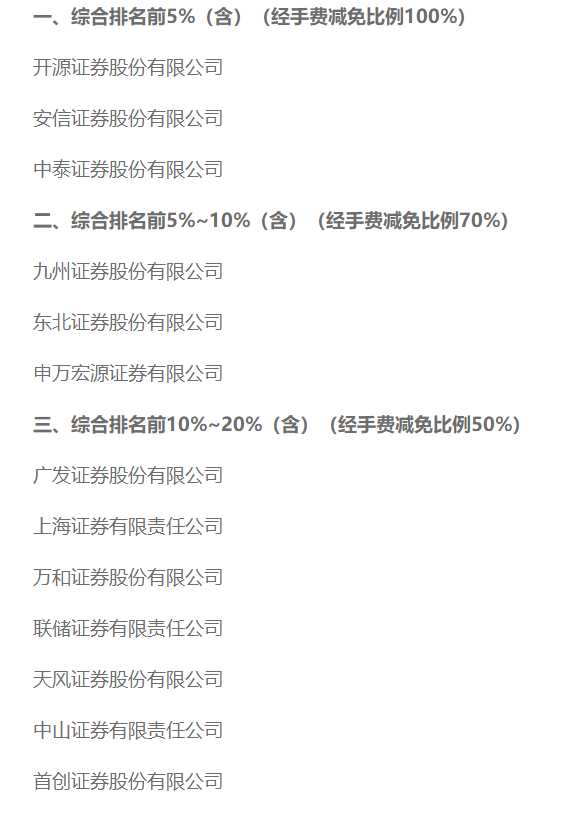

Screenshots of the brokerage firms in the second quarter of the market evaluation results: The official website of the national stock transfer company

Judging from the results of the municipal business evaluation in the second quarter of this year, a total of 13 brokers in the top 20%of the comprehensive rankings, of which the top 5%of the brokerage firms were open source securities, Anxin Securities, and Zhongtai Securities; the top 5%of the comprehensive ranking ~ 10%of the brokerage firms are Kyushu Securities, Northeast Securities, and Shen Wanhongyuan; the top 10%to 20%of the brokerage firms are Guangfa Securities, Shanghai Securities, Wanhe Securities, Federal Securities, Tianfeng Securities, Zhongshan Securities, and the first securities.

According to the "National Small and Medium Enterprise Transfer System for Municipal Merchants Evaluation Guidelines (Trial)", the 13 municipal merchants will obtain the qualifications for handling and exemption of market transactions, and the total number of market transactions will be nearly 3 million yuan, accounting for the second quarter of the second quarter 70.43%of the total handling fee for the city.

Compared with the results of the market business evaluation in the first quarter of this year, the top six in the second quarter of the industry are still the six brokers; and the top 10%-20%of the brokers in the second quarter have changed. %-20%of Haitong Securities (SH600837, stock price 9.15 yuan, market value of 103.3 billion yuan), Changjiang Securities (SZ000783, stock price 5.4 yuan, market value 29.9 billion yuan) ranking in the second quarter declined, and then dropped out the industry's comprehensive ranking ranking The top 20%.

The ranking of Kyushu securities industry declined

Half a year ago, Kyushu Securities was rated by the national stock transfer company as the best market businessman in 2021. However, from the results of the market evaluation in the first and second quarters of this year, the ranking of Kyushu Securities has declined, ranking fifth in the first quarter, and ranked fourth in the second quarter.

According to CHOICE statistics, in the second quarter of this year, the number of open source securities, Anxin Securities, Zhongtai Securities, Northeast Securities, and Shen Wanhongyuan in the first sixth year of the industry's evaluation results were increased by the number of stocks in the first half of this year.

Among them, at the end of the first half of this year, the number of open source securities was 107, and 94 at the end of last year; at the end of the first half of this year, the number of Anxin Securities made 81 stocks, and at the end of last year. Thai Securities (SH600918, stock price of 7.1 yuan, market value of 49.5 billion yuan) is 74 stocks, 71 at the end of last year; at the end of the first half of this year, Northeast Securities (SZ000686, 6.63 yuan, market value 15.5 billion yuan) as the market stocks as the market stock The number was 97, and at the end of last year, it was 80; at the end of the first half of this year, Shen Wanhongyuan (SZ000166, the stock price was 4.04 yuan, and the market value was 94.2 billion yuan).

In contrast, since this year, the number of stocks in Kyushu Securities has basically been stagnant. At the end of the first half of this year, the number of stocks in the company was 87, and 86 at the end of last year.

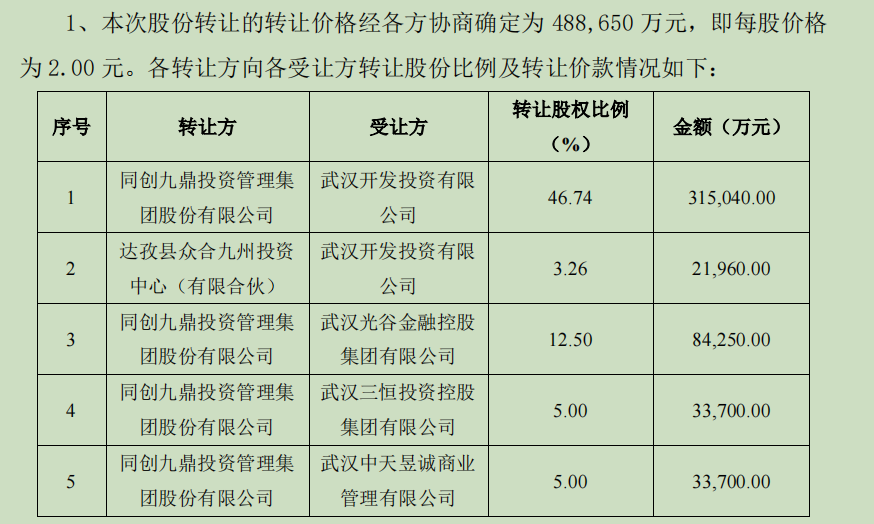

Screenshot from: Jiuding Group Announcement

It is worth noting that in late April this year, Jiuding Group issued the "Announcement on the Sales of 72.5%Equity of Kyushu Securities Co., Ltd.". According to this announcement, Jiuding Group and subordinate companies intend to transfer 2.443 billion shares of Kyushu Securities, accounting for 72.5%of the total share capital of Kyushu Securities, and the transaction price is 4.887 billion yuan. This transaction opponent is Wuhan Development Investment Co., Ltd., Wuhan Optics Valley Financial Holding Group Co., Ltd., Wuhan Sanheng Investment Holding Group Co., Ltd., Wuhan Zhongtian Yucheng Business Management Co., Ltd. Among them, Wuhan Development and Investment Co., Ltd. and transferor of the transfer party and the transferor two hold a total of 1.685 billion shares, accounting for 50%of the total share capital. 12.5%of the share capital; 168.5 million shares held by the transfer company of Wuhan Sanheng Investment Holding Group Co., Ltd., accounting for 5%of the total share capital; 168.5 million shares held by Wuhan Zhongtian Yucheng Commercial Management Co., Ltd. , Account for 5%of the total share capital.

Public information shows that the actual control of Wuhan Development Investment Co., Ltd., Wuhan Optics Valley Financial Holding Group Co., Ltd., Wuhan Sanheng Investment Holding Group Co., Ltd., and Wuhan Zhongtian Yucheng Business Management Co., Ltd. are state -owned assets of Wuhan.After the transaction is completed, Kyushu Securities will also change from a private securities firm to a state -owned enterprise securities firm.However, the transaction also needs to be reviewed and approved by the Securities Regulatory Commission.Daily Economic News

- END -

11 numbers read the report of the 14th Party Congress of the Provincial Congress (3)

Transfer from: New Gansu client

Tuanfeng County held a new era of the construction of the new era of the construction of the civiliz

\u0026 nbsp; \u0026 nbsp; \u0026 nbsp; \u0026 nbsp; \u0026 nbsp; \u0026 ...