Fortune revenue stabilization rebate tax refund effects appear

Author:Ministry of Finance Time:2022.07.15

General public budget revenue in the country increased by 3.3%in the first half of the year-

Fortune revenue stabilization rebate tax refund effects appear

On July 14, data released by the Ministry of Finance showed that the general public budget revenue in the country in June increased by 5.3%, and the increase was from negative to positive. In the first half of the year, the national general public budget revenue was 10522.1 billion yuan, of which the reserved tax refund revenue was 1840.8 billion yuan. After deducting the retained tax refund factor, the cumulative increase in the first half of the year increased by 3.3%. With the general improvement of the domestic epidemic prevention and control situation, and accelerating the implementation of a policy of stabilizing the economy, the implementation of a nation's general public budget revenue in June has stabilized. In the first half of the year, the implementation of the large -scale tax refund policy effect was centrally released, and the new special bonds used for project construction were basically issued.

"Compared with the negative growth in May, the increase in general public budget revenue in the country in June has been negatively transferred. Fiscal revenue is one of the important indicators reflecting economic operations. It can be seen through data that my country's economic operation is returning to normal growth tracks. Feng Qiaobin, deputy minister of the Macro Department of the Development Research Center of the State Council.

Li Xuhong, director of the Institute of Finance and Tax Policy and Application of the Beijing Academy of Accounting, believes that with the gradual improvement of the epidemic prevention and control situation, the results of the resumption of production and re -production in June, my country's economy has gradually recovered, and fiscal revenue has stabilized. The economic situation in the second half of the year is good Social expectations.

From the perspective of tax revenue, in the first half of the year, after deducting the retained tax refund factor, national tax revenue increased by 0.9%and decreased by 14.8%according to the natural caliber. From the perspective of tax division, the domestic value -added tax deduction deduction of tax refunds decreased by 0.7%, of which, in June, a decrease of 1.1%, a significant narrowing in April and May, mainly due to the industrial added value, service industry production index and other related economic indicators. Gradually improve. Enterprise income tax increased by 3.2%. Among them, the growth of the profit growth of coal and crude oil industry drove related corporate income tax to grow rapidly. The value -added tax and consumption tax of imported goods increased by 14.9%, which was mainly driven by factors such as the growth of general trade imports. Export tax refund refunded 191.3 billion yuan over the same period last year, an increase of 21.2%, which has effectively promoted the steady development of exports.

From the perspective of fiscal expenditure, in the first half of the year, the general public budget expenditure across the country was 1288.87 billion yuan, an increase of 5.9%over the same period last year, higher than the increase in fiscal revenue. The expenditures such as people's livelihood and other key areas have been strongly guaranteed. Among them, science and technology, agriculture, forestry and water, health, education, social security, and employment expenditure increased by 17.3%, 11%, 7.7%, 4.2%, and 3.6%, respectively.

Xing Li, deputy dean of the Chinese Academy of Fiscal Sciences, believes that the fiscal expenditure in the first half of the year has remained steady growth, and expenditures in key areas have been effectively guaranteed. "Insurance" requires to strengthen the management of expenditure budgets, actively revitalize financial stocks, and ensure key expenditure needs such as people's livelihood.

"From the perspective of the later trend, as the State Council's policies and measures for the stability of the economy have been effective, efficiently coordinating the prevention and control of epidemic and economic and social development has continued to emerge. The economy is expected to continue to rise in the second half of the year. "Said Xue Yanqian, deputy director of the Treasury Payment Center of the Ministry of Finance.

The implementation of large -scale value -added tax refunds is a key measure to stabilize the macroeconomic market this year. Statistics show that from April 1st to June 30th, a total of 1.865 million taxpayers across the country handled 1722.2 billion yuan in tax refund, plus the previous quarterly implementation of 123.3 billion yuan in tax refund policies, a total of 18455 in the first half of the year, a total of 18455 The tax refund of 100 million yuan has been refunded to the taxpayer account, which has reached 2.9 times the tax refund scale last year.

"Overall, the tax refund policy has been implemented since April, and the effectiveness of helping enterprises has appeared." Wei Yan, deputy director of the Taxation Department of the Ministry of Finance, said that by implementing the large -scale tax refund policy, it effectively alleviated the pressure of corporate funds. Injecting cash live water for corporate equipment updates and technological transformation, providing strong motivation for stabilizing the employment of market players to stabilize the employment, and play an important role in boosting the confidence of market entities, expanding consumer investment, enhancing the development of internal vitality, and stabilizing the macroeconomic market.

Special bonds are an important starting point for implementing active fiscal policies, playing an important role in driving effective investment and stable macroeconomic markets. In 2022, my country arranged a special bond amount of 3.65 trillion yuan to maintain a high scale. In accordance with the requirements of the State Council's solid policy and measures to stabilize the economy of economy, the rhythm of the distribution and use of the country will be accelerated.

Statistics show that as of the end of June, there were 3.41 trillion yuan of new special bonds in various places. "The amount of new special bonds used in project construction in 2022 was basically issued, which was greatly advanced from the previous year, which reflected the requirements of active fiscal policies." Song Qichao, director of the center, said that the issued new special bonds supported more than 23,800 projects.

Feng Qiaobin believes that since this year, active fiscal policies have continued to make efforts and stabilized their growth and protecting resistance.

"Overall, the effect of reserved tax refund, small and medium -sized enterprises, tax and fees, special bonds, etc. The effect of stabilizing economic policies has gradually emerged. Fiscal taxation is closely related to economic development, and policy measures will drive the economic recovery in the second half of the year." Li Xuhong said.

Reporter Zeng Jinhua

(Source: Economic Daily)

- END -

Baoding, Hebei: Lianchi District Yongzan South Road Primary School carried out the activity

In order to deepen patriotic education and revolutionary traditional education, gu...

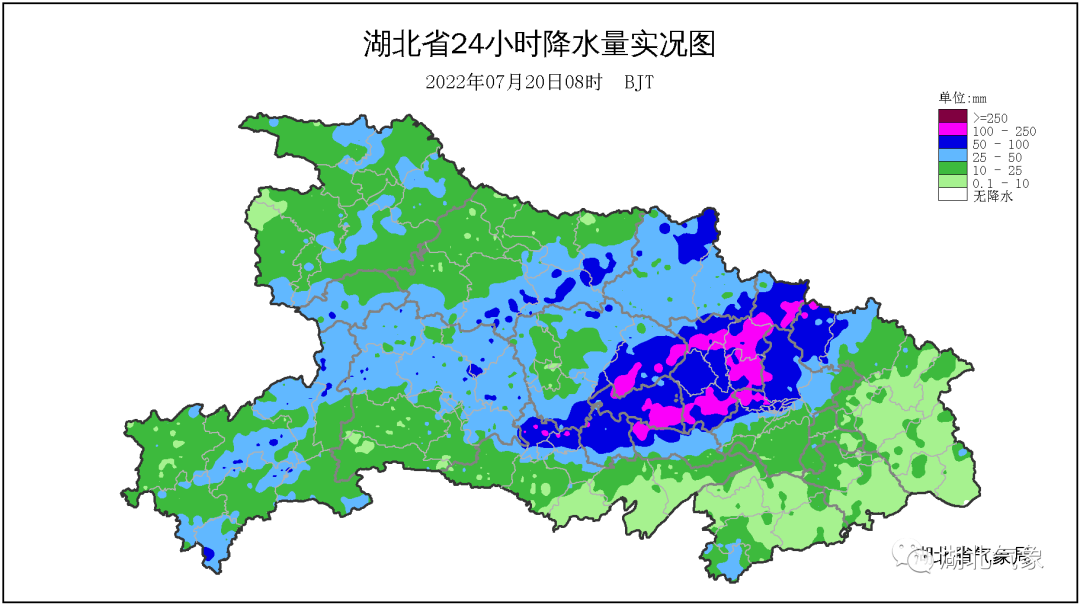

Tomorrow the rainwater will start a new round of precipitation from the day after rest and will start again

Weather reviewYesterday (19th) to 08:00 today, most of our province was covered by...