In the first half of the year, the sales of commercial housing in the country fell by 28.9%. In June

Author:Daily Economic News Time:2022.07.15

In the first half of the year, the national real estate data were released.

Today (July 15), the National Bureau of Statistics issued the "National Real Estate Development Investment and Sales and Sales" and "Sales Price of the Sales Price of Commodity Housing in 70 large and medium-sized cities in June 2022".

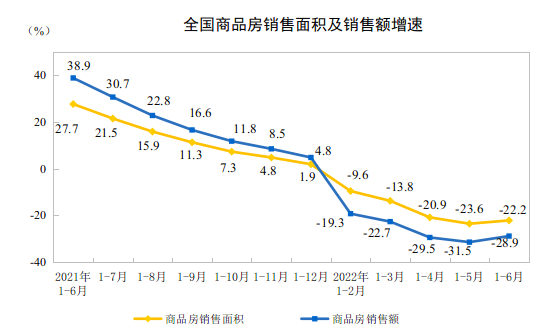

Data show that from January to June this year, the national real estate development investment was 6831.4 billion yuan, a year-on-year decrease of 5.4%: the national commercial housing sales area was 689.23 million square meters, a year-on-year decrease of 22.2%; the sales of commercial houses were 6607.2 billion yuan, a decrease of 28.9%. In terms of housing prices, in June 70, the prices of new houses in 31 cities rose month -on -month, and second -hand housing prices in 21 cities rose from the previous month, all of which increased significantly from May.

The growth rate of investment continues to decline, and the sales side of the new house first recovered

From the perspective of the sales area and sales growth rate of commercial housing in the country, since this year, the bottom of the "wide U -shaped" has been built.

Specifically, the sales area of commercial housing in the first half of the year was 689.23 million square meters, a year -on -year decrease of 22.2%, of which the residential sales area fell by 26.6%; the sales of commercial houses were 6607.2 billion yuan, a decrease of 28.9%, of which residential sales fell by 31.8%. At the end of June, the area of commercial housing to be sold was 547.84 million square meters, an increase of 7.3%year -on -year, of which the residential area increased by 13.5%.

Source: National Bureau of Statistics

"In the short term, there are signs of stability in the real estate market in the country, but stable recovery still faces certain pressure." According to the analysis of the China Finger Research Institute, from the short -term trend of the market, the scale of commercial housing transactions in July may decline from June or in June. However, during the same period last year, the high base effect was weakened and the real estate regulation policy still had room for power. The year -on -year decline in the market size was expected to continue the narrowing situation.

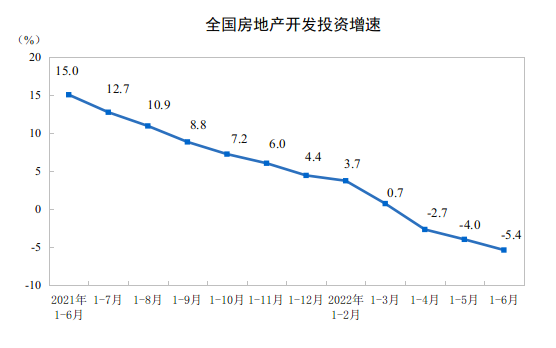

According to data from the National Bureau of Statistics, the national real estate development investment was 6831.4 billion yuan in June, a year -on -year decrease of 5.4%; of which, residential investment was 5180.4 billion yuan, a decrease of 4.5%.

Source: National Bureau of Statistics

In the first half of the year, the house construction area of real estate development enterprises was 848.812 million square meters, a year -on -year decrease of 2.8%. Among them, the residential construction area was 5994.29 million square meters, a decrease of 2.9%. The new construction area of the house was 66.423 million square meters, a decrease of 34.4%. Among them, the new construction area of the residential house was 488 million square meters, a decrease of 35.4%. The completion area of the house was 286.36 million square meters, a decrease of 21.5%. Among them, the completion of the residential house was 20.858 million square meters, a decrease of 20.6%.

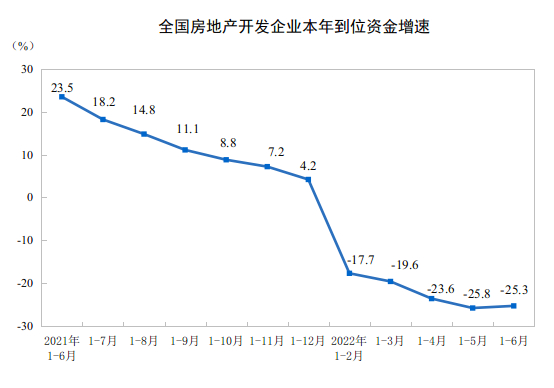

In addition, in the first half of the year, real estate development enterprises were in place of 7684.7 billion yuan, a year -on -year decrease of 25.3%. The land purchase area of real estate development enterprises was 36.28 million square meters, a decrease of 48.3%; the land transaction price was 204.3 billion yuan, a decrease of 46.3%.

According to the analysis of the China Finger Research Institute, from the perspective of supply -side data, in recent months, the cumulative decline in real estate development investment and new start -up scale has continued to expand. In June, the year -on -year decrease of real estate development investment and new construction area of houses expanded by 1.6 and 3.2 percentage points from May. The signs of enterprise investment and construction improvement were not obvious, and the repairs of the supply end were weaker than the demand side.

In the short term, under the requirements of the "insurance delivery", the project completion process may improve, and the overlay cities trading market gradually stabilizes the restoration of the promotion of enterprises' expectations, and the development of investment is expected to improve margin. However, under factors such as corporate funds and land acquisition scale dragging down, the new start repair momentum is still weak.

Source: National Bureau of Statistics

Housing prices have stabilized in an overall month.

In June, the overall housing prices in 70 large and medium cities across the country began to narrow, and the number of cities began to increase.

In the interpretation of the Chief Statistical Division of the National Bureau of Statistics, when the National Day Division of the Urban Division of the National Bureau of Statistics pointed out that the sales price of commercial housing in June stabilized the overall month -on -month and continued to decrease year -on -year. The sales prices of new commercial housing in first -tier cities rose 0.5%month -on -month, an increase of 0.1 percentage points from the previous month; the sales price of second -hand residential residentials turned from flat to 0.1%from last month to 0.1%. The sales prices of new commercial housing in second -tier cities decreased from the previous month to 0.1%; the sales price of second -hand residential houses decreased by 0.1%month -on -month, and the decrease was narrowed by 0.2 percentage points from the previous month. The sales prices of new commercial housing in third -tier cities decreased by 0.3%month -on -month, and the decrease was the same as last month. The sales price of second -hand residential houses decreased by 0.3%month -on -month, which was narrowed by 0.2 percentage points from the previous month.

Xu Xiaole, the chief market analyst of Shell Research Institute, told the reporter of "Daily Economic News" through WeChat today that the price of new houses in 31 cities in June increased from the previous month. The performance of the overall repair of house prices has increased.

"Price restoration is driven by market transactions. In June, the decline in mortgage interest rates and increased housing support policies have increased, which promoted the release of housing demand. According to data from the National Bureau of Statistics, the sales area and sales of new commodity housing in June were More than 65%, the growth rate has expanded significantly compared with the previous month. Data from Shell Research Institute showed that the number of second -hand housing sets of shell 50 cities in June increased by nearly 30%. Continued.

However, behind the data, there are still signs of weakening housing prices in some cities. According to the statistics of the Housing Price Index announced by the Easy House Research Institute, after the price index of new housing and second -hand housing in third -tier cities decreased year -on -year, the price index of primary housing in the second -tier cities in June also fell for the first time in 7 years. Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, told the reporter of the Daily Economic News through WeChat this morning, "This shows that the pressure of second -tier cities is relatively high, so the current risk of housing prices in some second -tier cities should be prevented. The effectiveness of the policy is reflected, and the improvement of data from the previous month is fully stated that the house price indicators are striving to get out of the cooling channel. "

Regarding the market outlook, many institutions believe that the real estate market will remain stable in the second half of the year. The Shell Research Institute believes that the effect of local policy support will continue to be released, and market expectations will be further improved. From the perspective of the existing transaction, it is expected that the market transactions will continue to improve in the later period of market transactions.

[Original real estate, if you like it, please pay attention to WeChat Real-ESTATE-CIRCLE]

Daily Economic News

- END -

The centralized demonstration activities of the "Sanxia Township" of Anhui Province and Ma'anshan City were held

On July 5th, the centralized demonstration activities of Anhui Province and Ma'ans...

Chen Yan made a special counseling report in the special training class of the 13th Qiannan State CPPCC members

On July 14, Chen Yan, vice chairman of the Provincial Political Consultative Confe...