Xiongyuan et al.: In the second half of the year, real estate prosperity is expected to be restored slightly

Author:Zhongxin Jingwei Time:2022.07.15

Zhongxin Jingwei, July 15th.

Author Xiongyuan Guosheng Securities Chief Economist

Yang Tao Guosheng Securities Macro researcher

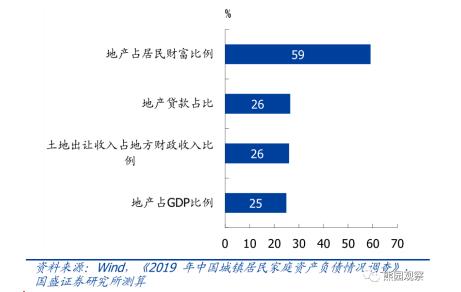

The importance of real estate is self -evident. For residents, houses are the most important assets. In 2019, residential housing assets accounted for 59.1%of total household assets. For banks, mortgage is an important loan investment. In the first quarter of 2022, real estate loan balance accounted for 26.5%of all loans; Land transfer income is the main source of income, which accounts for about 1/4 of the total local fiscal revenue; for the country, real estate accounts for nearly 25%of GDP.

Figure 1: House prices are expected to be low, and the willingness to buy a house will continue to fall

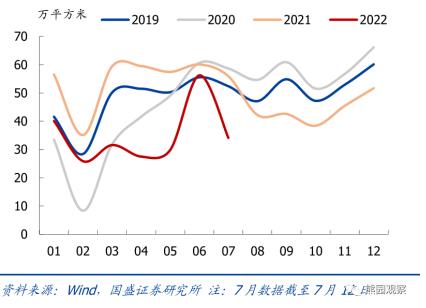

After the real estate sales rebounded in June, it fell significantly again in early July. Since the second half of 2021, real estate prosperity has continued to decline; with the control of the epidemic in June, the real estate prosperity has recovered well, and the sales of real estate sales of 30 cities narrowed to -6.4%year-on-year.

Figure 2: The importance of real estate to the Chinese economy

With reference to Shenzhen experience, after the epidemic is controlled, real estate sales may show a trend of rising first and then down, and then gradually recovering; the real estate rebound is more due to the release of the backlog, and the subsequent real estate prosperity recovery may still have twists and turns. Data from July showed that the "as scheduled" of real estate sales fell. As of July 12, the year-on-year growth rate of the transaction area of commercial housing in 30 cities fell to about -39%(June was -6.4%).

Figure 3: July 30 City's commercial housing transaction area declined significantly

How to understand the pressure on the current development of real estate?

From the perspective of the policy, the long -term trend of "housing does not fry" and the common prosperity has been set. Although at least 200 cities have relaxed real estate regulation in the past six months, the core constraints have not been obviously loose. Since 2016, the industry has adhered to the positioning of "housing and not frying", and it has been difficult for real estate to relax and stimulate the consensus of the whole people. Since 2020, the policy has further strengthened supervision through loan concentration management and three red lines.

Under the common prosperity guidance, the central government has begun to promote the construction of housing and real estate tax in affordable rental housing. Although the real estate tax is suspended, the trend has also been obvious. Under the general tone of the overall strictness, the short -term real estate policy is mainly based on the policy of the city, and the overall restraint is manifested as the current looseness of the real estate policy of the first -tier cities (especially the core first and second lines such as the north and the Shenzhen), and the national mortgage interest rate The decline is also significantly lower than the previous round.

From the perspective of demand, the three constraints of worsening, high leverage, and three constraints of population pressure jointly suppressed the demand for house purchase. Since the fourth quarter of 2021, real estate policies have continued to loosen, but the current decline in real estate sales is still large. In addition to the policy side and supply -side factors, the core is that the demand for house purchase of residents has indeed declined significantly. We can understand from three segments.

Expecting deterioration: In recent years, "houses do not fry" have become deeply rooted in people's hearts, the epidemic is repeated, economic and environmental pressure has increased, and residents have a significant deterioration of real estate prosperity and medium- and long -term housing prices. The latest questionnaires of the central bank show that in the second quarter of 2022, the proportion of "expected to increase housing purchase expenditure in the next three months" and "expected to rise in housing prices in the future" fell to 16.9%and 16.2%, respectively, all of which have continued to fall since the end of 2017.

Figure 4: House prices in residents are expected to be low, and the willingness to buy a house will continue to fall

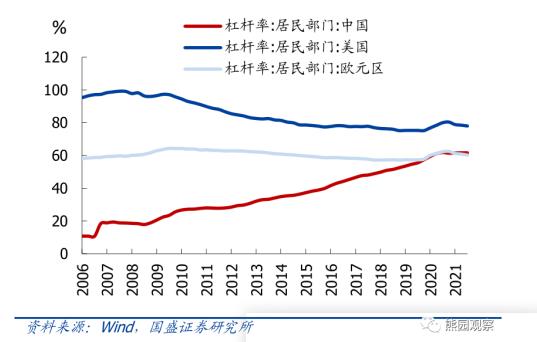

Heights of leverage: At the end of 2021, the leverage rate of Chinese residents reached 61.6%, which was close to the level of Europe and the United States, and further increased leverage space. After the economic impact, residents would be more cautious and conservative, and the willingness to increase leverage has also declined.

Figure 5: The leverage ratio of the Chinese residential department is close to the level of European and American countries

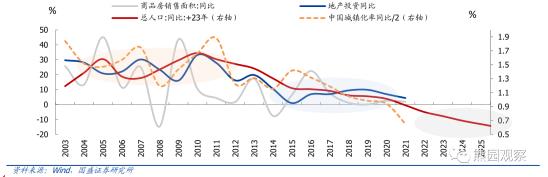

Population pressure: From a longer period of perspective, the fundamental decisive factor of real estate prosperity is the population. During the "14th Five -Year Plan" period, the growth rate of the age population in China from 1%to 0.65%, which determines that the downlink pressure on real estate needs will continue to increase the decline in demand for real estate needs. Essence

Figure 6: Population factor determines that China's real estate cycle tends to down in the middle and long term

From the perspective of the supply side, the transformation of the operating model of the housing enterprise, the tension of the capital chain has not been significantly relieved. In 2020, with the implementation of a series of regulatory policies, the industry has gone through a period of in -depth adjustment, and the housing company's capital chain is tight; although many central departments have recently emphasized that "optimize the supervision of pre -sale funds for commercial housing" and "keep real estate financing stable and orderly", But at present, the tension of the housing company's funds has not been relieved significantly.

We believe that in order to stabilize and employment to promote the maintenance of China's economic operation in a reasonable range, it is necessary to avoid real estate "hard landing".

Considering that the current real estate policy has limited effects, it is expected that the real estate policy in the second half of the year will still have further substantial loosening, such as moderate relaxation of real estate policies of core first- and second -tier cities, strengthening the financing support of housing enterprises, and further optimizing pre -sale funds. It is also expected to continue to be restored; however, due to the three constraints of the demand end, it is expected that the repair rate of real estate will be significantly weak in this round of real estate, and the growth rate of real estate sales may still be 10%to 20%of the year. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

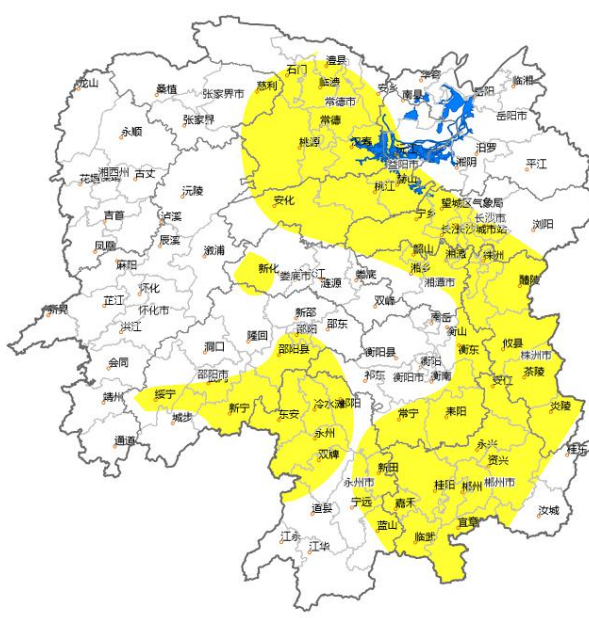

Add Hunan to high -temperature "group chat" on weekends to turn on the steaming "sauna" mode

Add high -temperature group chat in HunanThe weekend is coming, what is the weathe...

Zichuan District Meteorological Bureau issued a thunderbolt yellow warning [III class/heavier]

The Zichuan District Meteorological Bureau issued a thunderbolt yellow warning signal at 04:59 on June 10, 2022: Lightning and electricity activities have appeared in our district. It is expected that