Li Qiosuo et al.: What are the interconnection ETFs for fund preferences?

Author:Zhongxin Jingwei Time:2022.07.15

Zhongxin Jingwei, July 15th: What interconnection ETFs are interconnected?

Author Li Qiosuo Zhongjin Company Research Department Director and Strategic Analysts

Huang Kaisong Zhongjin Company Strategic Analysts

Wang Hanfeng Zhongjin Corporation Chief Strategy Analyst and Managing Directors

Recently, the first ETF transaction under the interconnection mechanism was officially launched, further enriching the types of transaction products, and provided more convenience for foreign investment in the Chinese capital market. The first batch of interconnection ETFs have 83 land -shaped Stock ETFs and 4 Hong Kong stocks ETFs. The flexibility of investment in the northbound capital investment is relatively high. Specifically, the first batch of products have the following characteristics.

First, the average scale of ETF is relatively high, and the liquidity may be relatively good. The first batch of ETFs of the ETF of Land Stock Connect had a total of 83, with a total scale of approximately 637.8 billion yuan, with an average scale of about 7.684 billion yuan, of which the average scale of 25 width -based ETFs was 11.46 billion yuan. The latest scale of ETFs exceeds 1 billion yuan, which is higher than the median size of 250 million yuan in ETF products in the Mainland market. Hong Kong dollar, the overall scale of the first ETF is large, which may have a better liquidity for transaction participants.

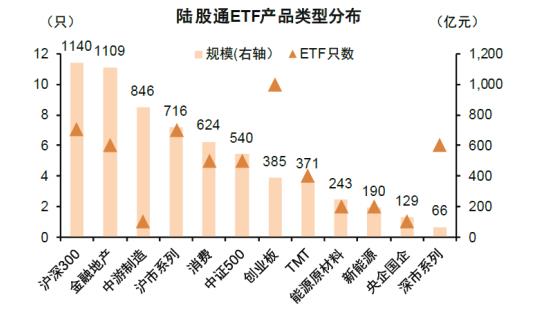

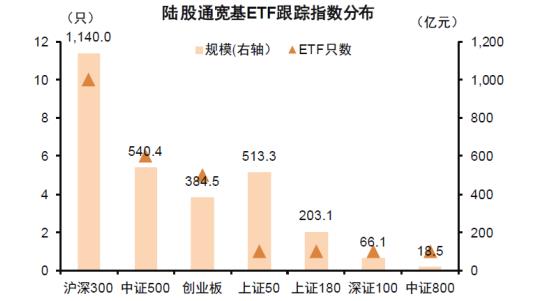

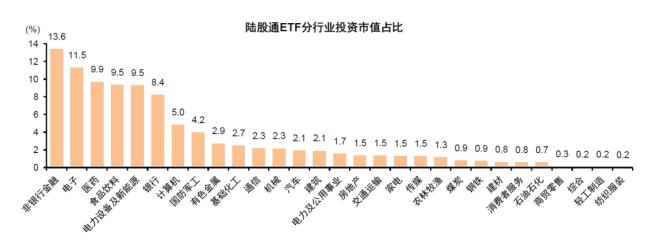

Second, the benchmark of broad -foundation ETFs is mainly based on key broad -foundation indexes, and industry -themed ETFs are more new in the economic industry. At present, among the 25 Land Stock Connect Wide -based ETFs, there are 10/6/4 of the products based on the Shanghai and Shenzhen 300/CSI 500/GEM index, accounting for 80%. They are the mainstream indexes of Hong Kong stocks. Judging from the distribution of industry -themed ETFs, the first six major industries mainly include non -bank finance, electronics, medicine, food, beverage, electricity equipment and new energy and banks, the number of ETFs in the old economy industry such as traditional energy and raw materials, as well as the overall industry positions of the industry. Relatively low, the characteristics of the positioning of the positions also have a high degree of coincidence with the A -share industry with northbound capital preferences.

Third, the heavy positions of the industry theme ETF have a certain deviation from the stock preferences of foreign funds and active public offering funds. Only one of the top 5 heavy positions of the 58 industry theme ETFs is the top 10 companies in foreign capital holdings. This may mean that there is a certain deviation of the current positioning characteristics of passive index products and active investors holding shares.

Figure 1: ETF in the ETF ETF ETF of Land Stock Connect accounts for 70%. Source: Wind, CICC Research Department

Figure 2: The total size of the ETF ETF of Land Stock Connect is about 637.8 billion yuan, and the average scale is about 7.684 billion yuan. Source: Wind, CICC Research Department

Figure 3: All 83 Land Stock Connect ETF Type Distributed Information Source: Wind, CICC Research Department

Figure 4: 40%of the Wide -based ETF Tracking Index of Land Stock Connect is CSI 300 Data Source: Wind, CICC Research Department

Figure 5: The top three heavy warehouse industries of the theme of land stock industry ETFs are non -bank finance, electronics and pharmaceutical data sources: Wind, CICC Research Department

Table 1: Source of the top 30 heavy stocks of the top 30 heavy stocks of the theme of land stock industry: Wind, CICC Research Department; Note: As of July 11

What is the situation of the first week of the ETF interconnection?

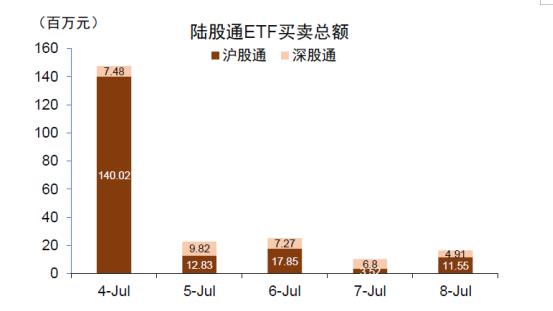

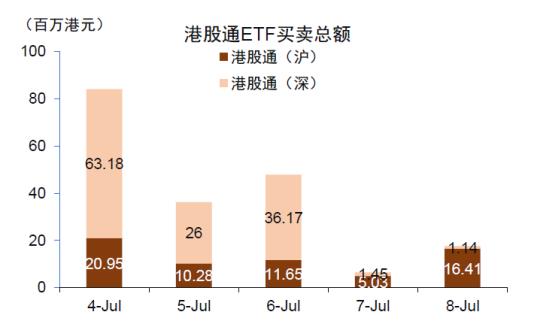

In the first week, the total amount of weekly transactions of the ETF of the Land Stock Connect was about 222 million yuan, of which the first day of the start of the transaction was about 148 million yuan, and the transaction subsequently cooled slightly. The overall transaction popularity of the Hong Kong Stock Connect is slightly better than the ETF of the Land Stock Connect.

Generally speaking, the transaction activity of ETF interconnection is still further enhanced. The total transaction volume of 83 ETFs of the Land Stock Connect exceeded 100 billion yuan last week. In contrast It is less than 1%, and there is still a large gap between the proportion of the transaction value of about 5%to 7%of the northbound capital.

We believe that it is mainly due to the current initial stage of the launch of the mechanism. The participation and cognition of investors still take a certain period of time. The current richness of ETF products of land stocks is not low. The scale of transaction may still have a large space.

Figure 6: ETF Interconnection starts the first week of land stocks ETF sales of 222 million yuan Source: Hong Kong Stock Exchange, China Gold Company Research Department

Figure 7: In the first week, Hong Kong Stock Connect ETF's total sales and sale of 92 million Hong Kong dollars Source: Shanghai Stock Exchange, CICC Research Department

What ETFs may be preferred by north -south funds and the impact on the market?

The characteristics of the north -south capital of the company's preference for the company may have a certain reference significance on the configuration of the follow -up ETF in the interconnection.

First of all, consumption, advanced manufacturing theme land stocks ETF may be attracted more attention from northbound funds.

In terms of wide -foundation index, the overall preference for the overall Shanghai and Shenzhen 300 component stocks is still high, and the degree of preference for the GEM has also increased year by year. Considering that the overall scale of the corresponding wide -based ETF is relatively high, the impact of north -directional funds on the corresponding broad -based ETF may be limited.

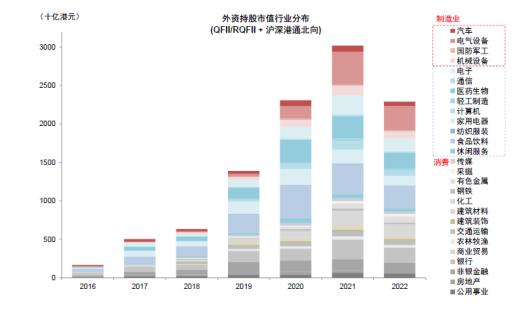

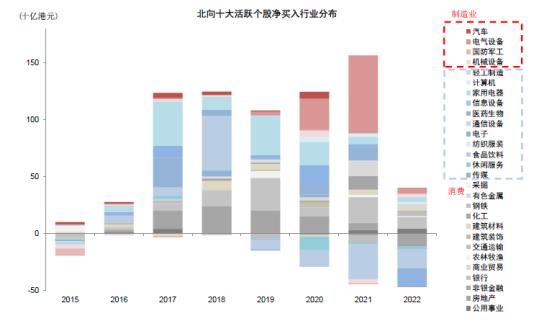

From the perspective of the industry, the top 5 heavy warehouse industries in the Northbound funds currently include power equipment and new energy, food, beverage, medicine, banking and home appliances. In the early days, northbound funds were more preferred to consume and finance. The recognition of the long -term trend has increased, and the northern direction capital has continued to increase the field of Chinese manufacturing growth. Since 2021, the photovoltaic industry chain and new energy automotive industry chain such as power equipment and new energy and basic chemicals have been in 2021. The key inflow of funds has increased, and the proportion of positions is particularly obvious. At the same time, power equipment and new energy, food, beverages, medicine and banks are also the first batch of heavy warehouse industries for ETFs of land stocks. We predict that ETFs in this type of industry may get more attention from northbound funds in the future, especially products with relatively scarce products or tracks of some themes or tracks. product. Secondly, the preferences of southern funds on the Hong Kong Stock Connect ETF may be more balanced.

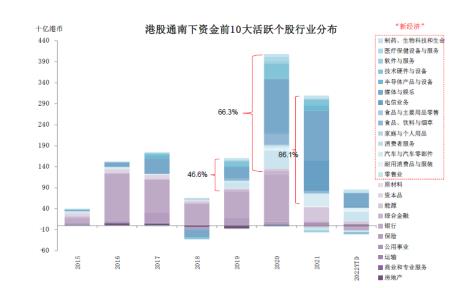

At present, the Hong Kong Stock Connect ETF mainly involves the Hang Seng Index, the Hang Seng China Enterprise Index, and the Hang Seng Technology Index. The overall product richness needs to be further improved. We expect that the southbound fund preference for the Hong Kong Stock Connect ETF may be more balanced. Whether the surface and valuation are attractive enough.

Figure 8: Northbound heavy warehouse individual stocks are concentrated in the consumption and manufacturing field Source: Wind, CICC Research Department

Figure 9: Since 2021, foreign investment has even preferd the A -share manufacturing sector. Source: Wind, CICC Research Department

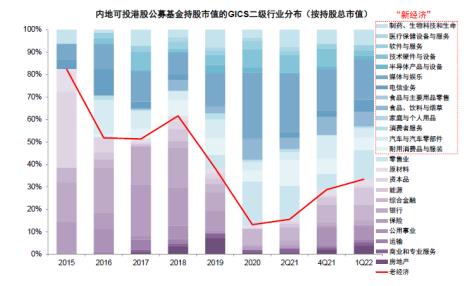

Figure 10: Hong Kong Stock Connect Southern Fund Funding Media Entertainment, Retailing Industry and other new economic industries Note: Data as of May 2022 Data Source: Wind, CICC Research Department

Figure 11: Public fund -raising funds currently invested in Hong Kong stocks in the Mainland account for more than 60%of the new economy positions. Source: Wind, CICC Research Department

Overall, incorporating the qualification ETF is another iconic expansion incident in the interconnection mechanism. Although the short -term impact may not be great, the impact of the medium and long term is profound. With the enrichment and mechanisms of future transactions, more recognition of the mechanism, interconnection ETF is expected to gradually become an important investment area for investors in the two places, which means that the types of products that can be traded in the two places are further enriched and invested in foreign investment in China. The capital market provides more convenience, and at the same time, it is of great significance to promote the integration of the capital markets between the two places, which is also of great significance to the opening of China's capital market. (Zhongxin Jingwei APP)

Editor in charge: Wang Lei

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Sister of remittance to his son

□ Hu YouzhiThat day, I went to the post office to withdraw money. A white -haired elder sister came to me and said to me, Little brother, help me, help me fill in a remittance list, I don't understa...

游戏 Qin: "Game of Thrones -Analysis of Ancient Chinese Hat Top"

The second issue of Shangwu read was published. Design: Liu ZhenyueFengyun on the ...