The China Banking Regulatory Commission responded to the "suspension of loan", and 15 banks spoke intensively!

Author:Southern Plus client Time:2022.07.15

Recently, the owners of many places have attracted widespread concern due to the incident of post -loan repayment due to the extension of real estate. In response, the person in charge of the relevant departments of the CBRC responded on the 15th:

Recently, we are also paying attention to the extension of the extension of the real estate of individual real estate companies. The key to this incident is to "keep the property", which we pay great attention to this.

In the next step, the CBRC will adhere to the positioning of "the house is used for living, not for speculation", adheres to the stable price, stable house prices, stable expectations, maintains the continuity and stability of the real estate financial policy, and maintains the stable real estate financing financing stable Order, support the commercial housing market to better meet the reasonable housing needs of home buyers, guide the marketization of financial institutions to participate in risk disposal, strengthen the work with the housing and construction departments and central banks, and support local governments to actively promote the "keeping transportation, protecting people's livelihood, and stable stability". Work, do a good job of relevant financial services in accordance with laws and regulations, and promote the virtuous cycle and healthy development of the real estate industry.

At the same time that the "suspension of loan incidents" continued to attract attention and heated discussion, the bank sector on the A -share market declined as a whole in the past two days. In response to the "suspension incident" of the Internet, starting from noon on the 14th, as of press time, 15 banks including Industrial and Commercial Bank of China, Agricultural Bank, Bank of China, Construction Bank, and Industrial Bank have issued announcements to disclose the investigation.

Bank of China:

Personal housing loan business overall risk controlled

The Bank of China issued an announcement saying that since this year, the bank's real estate financing is smooth and orderly, the real estate development loan investment and the support for the mergers and acquisitions of the project of difficult real estate projects have been increasing, and the new real estate development loans are at the forefront of the industry. The housing loan policy supports rigid and improved housing demand; during the epidemic, it provides customers with a number of relief policies such as extension and repayment of principal and interest. The quality of assets remains stable, and the overall risk of personal housing loan business is controllable.

ABC:

Preliminary identification of the "insurance delivery building" risk mortgage loan balance of 660 million yuan, the overall risk is controllable

Agricultural Bank issued an announcement saying that in response to the recent risk exposure of individual real estate enterprises and the extension of housing development projects, the Agricultural Bank of China attached great importance to it and moved rapidly. Essence As of the end of June 2022, the balance of personal housing loans of the entire bank was 5.34 trillion yuan. Among them, there are 57,000 cooperative real estate in one -handed building, and the balance of mortgage loans of first -hand buildings is 3.97 trillion yuan.

The Agricultural Bank stated that the real estate that has initially determined that there is a risk of "guarantee of the property" involving the balance of overdue mortgage loans of 660 million yuan, accounting for 0.012%of the entire mortgage loan balance, and 0.017%of the balance of one -handed mortgage loan. At present, the business scale involving the risk of "insurance delivery" is small and the overall risk is controllable.

ICBC:

The suspension project involves a non -performing loan balance of 637 million yuan, and the risks are controllable

ICBC issued an announcement saying that recently, some real estate development enterprises have been exposed, and the development of individual real estate development projects has been postponed. The bank attaches great importance to it and moves rapidly. After investigation, the current suspension project involves a non -performing loan balance of 637 million yuan, accounting for 0.01%of the entire mortgage loan balance, and the risks are controllable.

According to the ICBC, as of the end of June 2022, the bank's personal housing loan balance was 6.36 trillion yuan, with a non -performing rate of 0.31%, and the quality of assets was stable. The bank will strictly implement the requirements of financial supervision, actively cooperate with local governments to do relevant financial services, and promote the steady and healthy development of the real estate market.

Construction Bank:

In some areas, the real estate has not been delivered on time.

CCB issued an announcement saying that the current suspension of work in some areas and the failure to deliver the real estate on time involved the bank's small scale and the overall risk controlled.

The bank stated that it will pay close attention to the situation of cooperative companies and real estate, actively cooperate with local governments to do a good job of customer service, communicate with customers, and promote the steady and healthy development of the real estate market.

The announcement pointed out that CCB adheres to the positioning of "housing does not speculate", adheres to the risk preferences of prudent and stable, firmly implements the housing leasing strategy, and promotes the virtuous cycle and healthy development of the real estate industry.

Bank of Communications:

The amount of risk real estate involves a amount of 099.8 billion yuan, and the scale accounts for a relatively small risk.

The Bank of China issued an announcement saying that the bank strictly implemented the national credit policies, adhered to the positioning of "housing and not frying", and actively supported residents to reasonably live self -occupation and purchase needs. Since the beginning of this year, the bank's mortgage loan has operated well. As of the end of June, the balance of mortgage loans in domestic houses was nearly 1.5 trillion yuan, and the quality of assets was stable.

Recently, the risks of individual real estate companies have been exposed, which has led to suspension and delay in projects in some cities. After preliminary investigation, the balance of the bank's overdue housing mortgage loans involved in the risk of the media reported in the media reported was 99.8 million yuan, accounting for 0.0067%of the balance of housing mortgage loans in the bank.

In the next step, we will pay close attention to the status of cooperative enterprises and real estate, strictly implement the requirements of regulatory agencies, and actively cooperate with local governments to do a good job in financial services for "keeping in delivery, protecting people's livelihood, and stable", maintaining the stable and healthy development of the real estate market, maintaining the legitimate rights and interests of consumers. Essence

Postal Savings Bank:

The preliminary determination of the suspension project involves the overdue amount of housing loans of 127 million yuan, and the risk is controllable

The Postal Savings Bank issued an announcement saying that the bank pays close attention to the suspension of the construction and the failure to deliver the real estate on time in some areas, and conduct in -depth investigations. The preliminary suspension of the suspension project involves the overdue amount of housing loans. Controlled. The Postal Savings Bank said that the next step will resolutely implement the decision -making and deployment of the Party Central Committee and the State Council, adhere to the positioning of "housing and not fry", strictly implement financial supervision requirements, and actively do customer service. For customers affected by the epidemic, provide support for postponed repayment and credit reporting to rescue customers. ‘‘

Industrial Bank:

The mortgage amount that has stopped repayment is 384 million yuan, which does not have a significant impact on the operation.

The Industrial Bank issued an announcement saying that the company recently launched a investigation into the real estate involved in the news of the "suspension of loans" on the Internet. After investigation, as of now, the company has involved the balance of mortgage loans related to the "suspension of loans" of 1.6 billion yuan (of which the balance of non -performing loans was 75 million yuan), and the mortgage amount that had stopped repayment was 384 million yuan, which was mainly concentrated in Henan. Thanks to the company's differentiated access and management requirements for mortgage loans in the early stage, the overall scale of mortgage loans that have been involved and risky risks have been small, which will not have a significant impact on the company's operations.

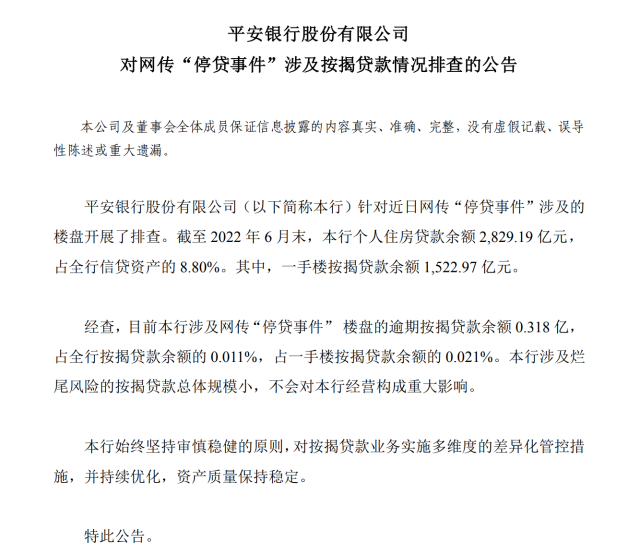

Ping An Bank:

The balance of overdue mortgage loans involved in the "suspension of loan incidents" is 31.8 million, which does not have a significant impact on the operation.

Ping An Bank issued an announcement that the real estate involved in the recent "suspension of loans" has been conducted investigating. As of the end of June 2022, the bank's personal housing loan balance was 282.919 billion yuan, accounting for 8.80%of the entire bank's credit assets. Among them, the balance of one -handed mortgage loan was 15.297 billion yuan.

After investigation, the bank's overdue mortgage loan balance of the "suspension of loan incidents" in the bank is currently 31.8 million, accounting for 0.011%of the entire mortgage loan balance, and 0.021%of the balance of one -handed mortgage loan. The bank's general scale of mortgage loans involving risk risks will not have a significant impact on operations. The bank has always adhered to the principle of prudent and stable, implemented multi -dimensional differentiated management and control measures on the mortgage loan business, continued to optimize, and the asset quality remained stable.

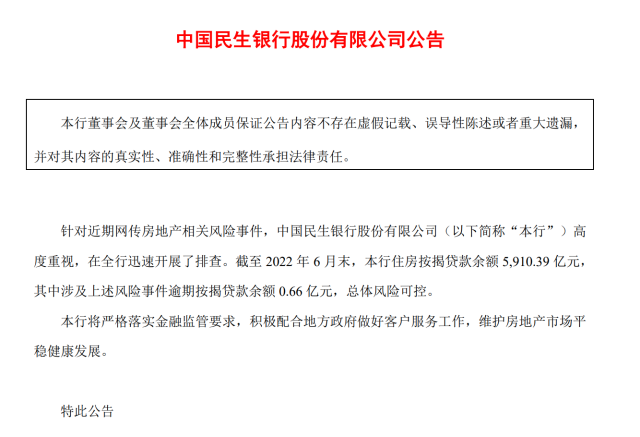

Minsheng Bank:

The balance of mortgage loans involved in risk incidents is 66 million yuan, and the overall risk is controllable

Minsheng Bank issued an announcement saying that in response to recent risk -related risk incidents on the Internet, China Minsheng Bank Co., Ltd. attaches great importance to it and quickly conducts investigation in the entire bank. As of the end of June 2022, the bank's housing mortgage loan balance was 591.039 billion yuan, of which the balance of mortgage loans involved the above risk incident was 66 million yuan. The overall risk is controllable. The bank will strictly implement the requirements of financial supervision, actively cooperate with local governments to do customer service work, and maintain the steady and healthy development of the real estate market.

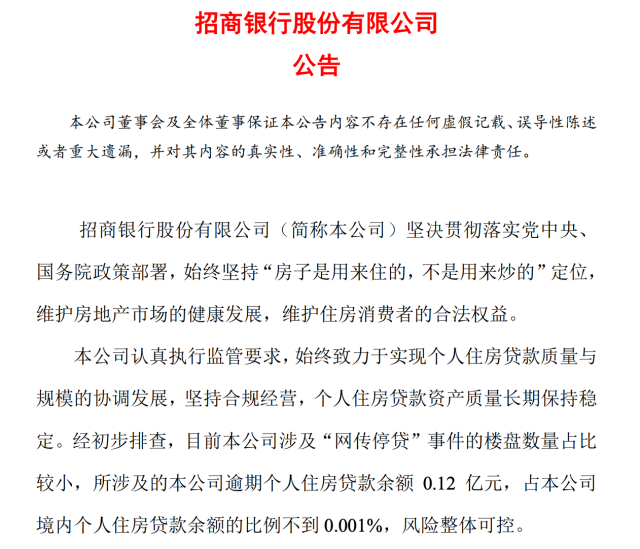

China Merchants Bank:

Overdue personal housing loan balances involved in the incident of "online biography" incident is 0.12 million yuan, and the risk is controlled as a whole

China Merchants Bank issued an announcement saying that after preliminary investigation, the number of real estate involved in the "Internet -to -loan" incident accounted for a relatively small amount, and the balance of the company's overdue personal housing loans involved was 122 million yuan, accounting for the proportion of personal housing loans in the company's domestic personal housing loans. By 0.001%, the risk is controlled as a whole. The bank will pay close attention to the development of the situation, comprehensively continue to follow up involving real estate conditions, actively take measures, communicate with customers, implement relevant requirements of government departments and regulatory agencies, protect the rights and interests of housing consumers develop.

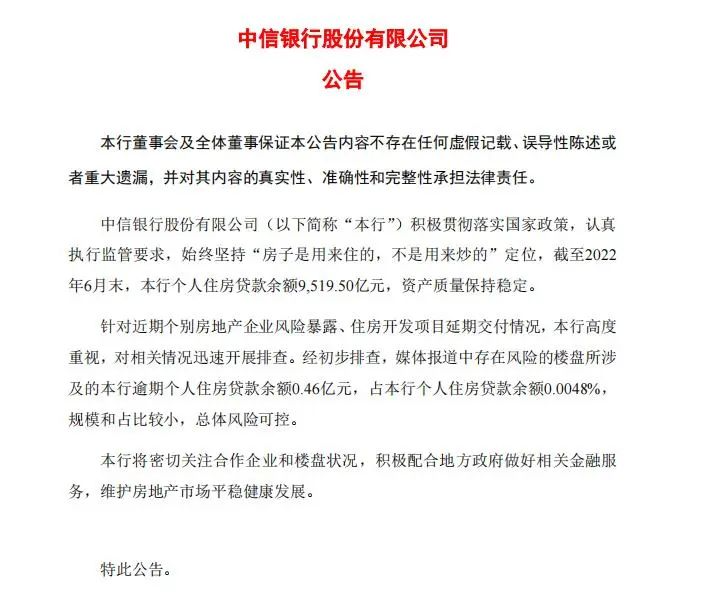

CITIC Bank:

Overdue personal housing loan balances involved in the incident of "online biography" incident is 46 million yuan, and the overall risk is controllable

CITIC Bank issued an announcement saying that in response to the recent risk exposure of individual real estate enterprises and the extension of housing development projects, after preliminary investigation, the balance of CITIC Bank's overdue personal housing loans involved in the risk in the media reports of RMB 46 million, accounting for the individual of CITIC Bank. The balance of housing loans is 0.0048%, the scale is relatively small, and the overall risk is controllable.

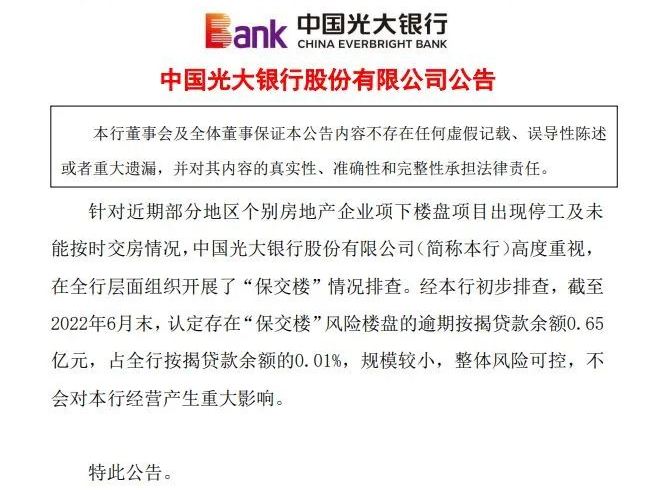

Everbright Bank:

There is an overdue mortgage loan balance of the "insurance delivery building" risk of RMB 65 million, and the overall risk is controllable.

Everbright Bank said that after a preliminary investigation of Everbright Bank, as of the end of June 2022, the balance of overdue mortgage loans of the risk real estate in the risk of "insurance transit" was determined that the balance of 0.01%of the mortgage loan balance of Guangda Bank's mortgage loan was small. The overall risk is controllable and will not have a significant impact on Everbright Bank's operations.

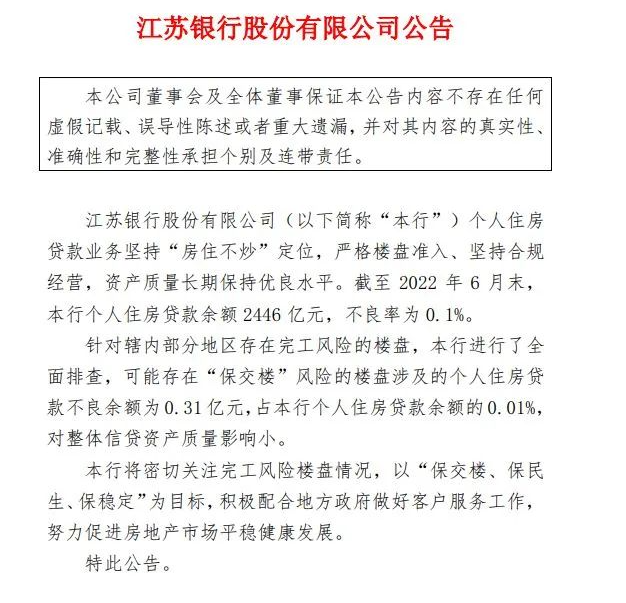

Bank of Jiangsu:

The poor balance of real estate personal housing loans with the risk of "insurance delivery" is 31 million yuan, and the quality of the overall credit assets is small

According to Bank of Jiangsu, a comprehensive investigation was conducted for the real estate with a risk of completion in the area under its jurisdiction. The poor balance balance of personal housing loans involved in the risk of "guarantee of the property" may be 0.31 million yuan, accounting for the balance of personal housing loans of Jiangsu Bank. 0.01%, which has a small impact on the quality of overall credit assets.

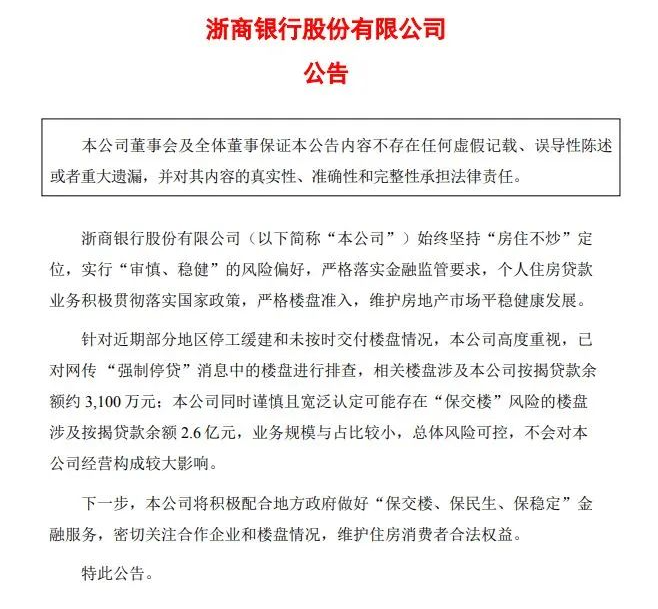

Zhejiang Business Bank:

The balance of mortgage loans that may have the risk of "insurance delivery" may be 260 million yuan, and the overall risk is controllable.

Zhejiang Commercial Bank said that the real estate in the news of the "mandatory loan" news on the Internet has been investigated, and the relevant real estate involves the balance of mortgage loans of Zhejiang Commercial Bank about 31 million yuan. The risk of real estate involves a mortgage loan balance of 260 million yuan. The business scale and accounting are relatively small. The overall risk is controllable and will not have a great impact on the operation of Zhejiang Commercial Bank. Bank of Nanjing:

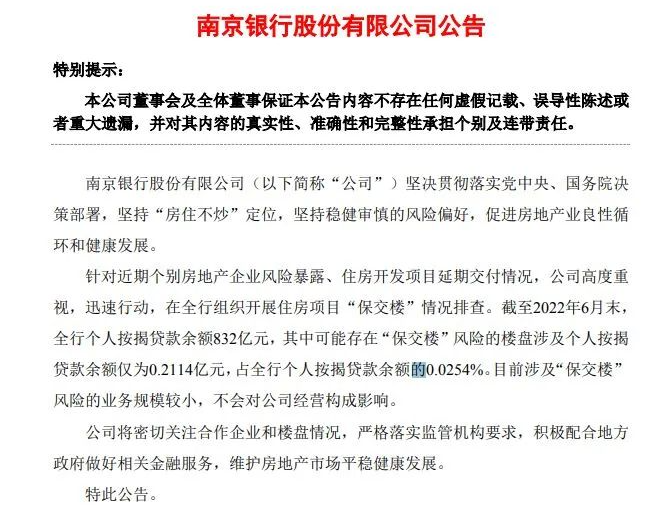

The business scale involved in the risk of "insurance delivery" is small

According to Bank of Nanjing, as of the end of June 2022, Nanjing Bank's personal mortgage loan balance was 83.2 billion yuan, of which real estate that may have the risk of "insurance bank" involved personal mortgage loan balance was only 0.211.4 billion yuan, accounting for the Bank of Nanjing Bank's personal mortgage loan. The balance is 0.0254%. At present, the business scale involved in the risk of "insurance transit" is small, and it will not affect Nanjing Bank's operations.

Expert voice

"From the announcement of various banks, the proportion of personal housing mortgage loans involved in the 'suspension of loan incidents' is very small, and the overall impact of the security of the banking system has little impact." Tell reporters that some buyers "disconnected" are not to not repay the loan, but hope to promote developers to resume work and deliver as soon as possible in this way.

Dong Ximiao said that at present this issue has been valued by multiple parties. "With the joint efforts of local governments, developers, and banks, the problem of rotten real estate should be properly resolved, but this takes time."

Newss

Southern Selection

Abe's emergency communication records were exposed after being shot! The suspect's mountains are also voicing

Search "Children" to pop up "sexy underwear", and there are more outrageous ...

Shenzhen company installation 1 -to -1 station camera anti -touch fish? Here is here!

Source | Southern+Client (Reporter Tang Liuwen), China News Network

Edit | Zhuo Peiyi

School counterpart | Fu Ruyu

- END -

The buses that are full of guests are anchoring, and high -speed transportation management road members are rescued quickly

At 00:58 am on July 7, when the members of Guangzhou Trading High -speed Transport...

The first infected husband of the Henan Biyang epidemic: My wife has been to the urban area once, I don’t know how to be infected

Jimu Journalist Zhang QiAs of 24:00 on July 9, four new crown pneumonians in Zhiya...