Banking Insurance Supervision talks about the operation of the banking industry recently

Author:Xinhua News Agency Time:2022.07.15

The person in charge of the relevant departments of the CBRC responded to the overall operation of the banking insurance industry, inclusive financial development, and real estate loans on the 14th.

The main business indicators of the banking industry insurance industry are in a reasonable range

The person in charge of the relevant departments of the CBRC said that since this year, the CBRC has further promoted the structural reform of the financial supply side, continued to improve the quality and efficiency of the real economy, and keeps the bottom line that does not have systemic risks. Reasonable interval.

Data show that at the end of June, the balance of non -performing loans of banking financial institutions was 3.8 trillion yuan, and the non -performing loan rate was 1.77%, a decrease of 0.05 percentage points from the beginning of the year. The balance is 7.6 trillion yuan, and the cover coverage rate is 201.3%.

The credit structure is further optimized. From January to June, the manufacturing loan increased by 3.3 trillion yuan, an increase of 1.9 times the same period last year. In the month of June, medium- and long -term loans increased by 1.85 trillion yuan, an increase of 1.23 trillion yuan over May.

The insurance business has maintained smoothly. From January to June, the insurance company's original insurance premium income was 2.8 trillion yuan, a year -on -year increase of 5.1%. The insurance industry compensation expenditure and payment cumulatively 776.8 billion yuan, an increase of 3.1%year -on -year.

The continuous incremental expansion of inclusive financial supply

The person in charge of the relevant departments of the CBRC said that since this year, the CBRC has strengthened supervision and assessment and supervision, clarified the goals and tasks of small and micro enterprises and agricultural credit growth throughout the year, and required to achieve the growth rate of loans and households of inclusive small and micro enterprises. The balance of agricultural loans continued to grow.

According to reports, as of the end of June, the balance of loans of small and micro enterprises across the country was 5.584 trillion yuan, of which the balance of inclusive small and micro enterprise loans was 2.177 trillion yuan, an increase of 22.64%year -on -year, which was 11.69 percentage points higher than the growth rate of various loans. The balance households were 36.813 million, a year -on -year increase of 710,200. In the first half of the year, the interest rate of new inclusive small and micro enterprises was issued by 5.35%, a decrease of 0.35 percentage points from 2021.

The person in charge stated that the Banking Regulatory Commission urged banking institutions to focus on accurate efforts in key areas, further optimize the financial supply structure, improve loan service methods, and alleviate the difficulty of financing turnover, mortgage, and mismatches of small and micro enterprises. At the end of June, small and micro enterprises renewed loans, credit loans, and medium- and long -term loans increased by 29.46%, 30.11%, and 17.22%year -on -year, respectively.

According to reports, preliminary statistics, as of June 15, banking financial institutions have handled loans to repay the principal and interest of 1.23 million small and medium -sized enterprises, individual industrial and commercial households, and truck drivers.

In terms of serving new citizens, the person in charge of the relevant departments of the Banking Insurance Regulatory Commission said that the CBRC guides bank insurance institutions to carry out product and service innovation according to local conditions and strengthen financial services for new citizens. As of now, 1798 bank insurance institutions have a total of 28,800 financial products cover new citizens.

Keep real estate financing smooth and orderly

The person in charge of the relevant departments of the CBRC stated that the CBRC adheres to the positioning of "the house is used to live, not for speculation", and closely focuses on the goal of "stable price, stable house prices, and stable expectations". Promote the steady and healthy development of the real estate market.

According to reports, in June, real estate loans increased by 158.4 billion yuan, and the overall operation of real estate credit was stable. Among them, real estate development loans increased by 41.5 billion yuan. Real estate loan adverse rate is at a lower level, and the risk is controllable as a whole.

"Recently, we are paying attention to the extension of the extension of the real estate of the real estate enterprises. The key to this incident is to" keep the property ", which we attach great importance to this." The person in charge said that the next step will be , Stability, maintain the stable and orderly real estate financing, support the commercial housing market to better meet the reasonable housing needs of buyers, guide the marketization of financial institutions to participate in risk disposal, strengthen work with the housing and construction departments and the People's Bank of China, and support local governments to actively promote the "insurance guarantee Work, keep people's livelihood, and stable "work, do relevant financial services in accordance with laws and regulations, and promote the virtuous cycle and healthy development of the real estate industry. (Reporter Li Yanxia)

![]()

[Editor in charge: Liu Yang]

- END -

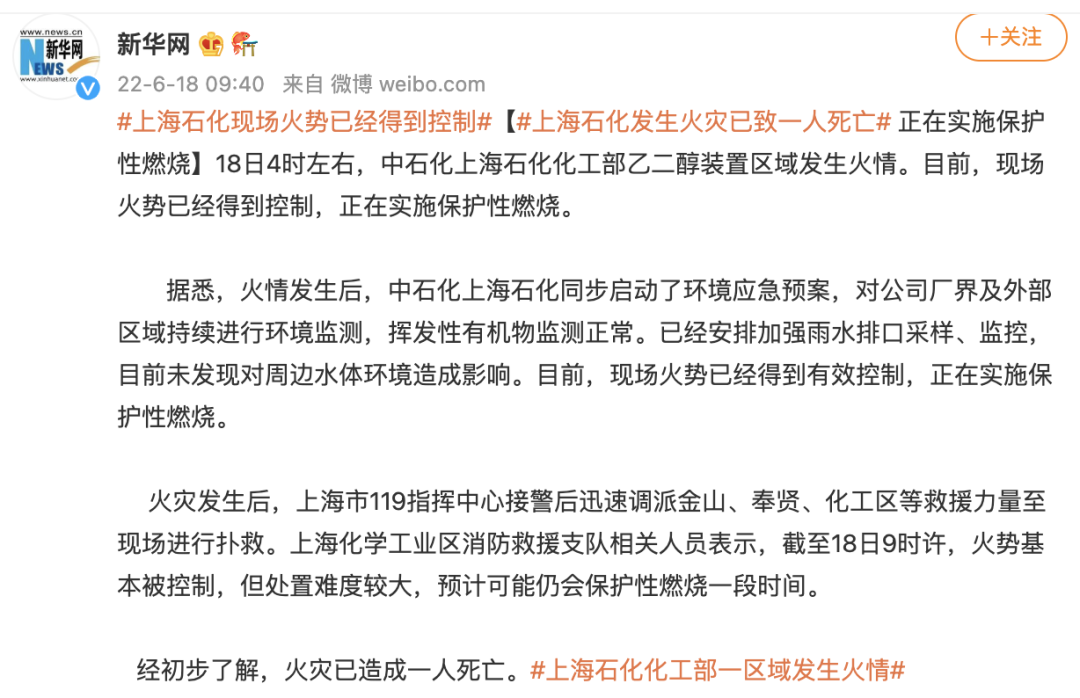

Shanghai Petrochemical Fire has caused one person to die

At 4:28 on June 18th, the ethylene glycol device on the one -petrochemical company...

Lianfeng Town carried out anti -drug propaganda activities

June 26, 2022 is the 35th International Anti -Drug Day. In order to comprehensivel...