A number of brokerage firms "Card Point" issued a interim performance preview. The loss of performance in the first half of the year may decline over 50%year -on -year.

Author:Daily Economic News Time:2022.07.14

According to the relevant provisions of the Shanghai -Shenzhen Exchange, the performance of the interim reported performance increased by more than 50%year -on -year or decreased by more than 50%, or the net profit was negative, or the net profit to turn losses to profit. Performance trailer.

Prior to today, there were almost no companies issued a semi -reporting preview of more than 40 companies in the A -share brokerage sector. Family brokers issued the interim results previews. The reasons that prompted these brokers' "card points" to release the performance of the interim reporting performance was that the performance of the first half of the year fell by more than 50%year -on -year or the performance loses.

Brokerage firms have released the interim report performance trailer

According to the relevant provisions of the Shanghai -Shenzhen Exchange, before July 15th, the window period of the Shanghai -Shenzhen Main Board Company issued a semi -reporting preview.

Prior to today, hundreds of companies in the A -share market have issued a condemnation of interim report performance, but the brokerage sector chose to collectively "silence". With the arrival of the final deadline on July 15th, listed companies in the brokerage sector finally started to act.

Since the close today, there have been many securities firms such as Oriental Securities, Hongta Securities, Dongxing Securities, Pacific, Xiangcai, Huaxi Securities, Southwest Securities, and Tianfeng Securities.

According to relevant regulations, the performance of the interim reported performance increased by more than 50%year -on -year or decreased by more than 50%, or the net profit was negative, or the net profit of the Shanghai -Shenzhen motherboard company with a net profit should be released.

Judging from the performance trailers released today, the reasons for triggering these brokers' "card points" announcement for the interim performance preview were mostly declined by more than 50%year -on -year performance in the first half of the year or the performance suffered losses.

Different from many brokerage companies this year, the preview of the reports in today's release is that the time that the brokerage firms released the interim performance preview last year in early July.

According to CHOICE data, nearly 20 securities firms released the interim performance preview last year, and these previews are mainly pre -joy. In addition, CITIC Securities, Soochow Securities, Zhongtai Securities, China Galaxy, China Merchants Securities, Zhejiang Business Securities and other securities firms have not reached the standard of compulsory performance previews last year, but these companies still actively release the performance forecast Essence

It is worth mentioning that these securities firms have increased a certain increase in the performance last year. As of now, these brokers have not released this year's interim performance preview.

Central Plains Securities and Pacific reported pre -losses

According to statistics from the non -banking team of Soochow Securities, the main reasons for the decline in the performance of brokerage firms in the first quarter of this year were the severe decline in self -operated business. However, with the recovery of the A -share market in the second quarter, many brokerage firms have improved in the second quarter.

A few days ago, the Guoyuan Securities, which released the first half of the year's performance, has been greatly improved due to the significant improvement of the second quarter performance and has been sought after by the market. In recent days, its stock price has led the brokerage sector.

Judging from the above -mentioned brokerage firms that have released the performance forecast of the interim report today, companies that have improved in the second quarter of the brokerage sector in the second quarter include the improvement of the first quarter of the first quarter. Securities, Hongta Securities, Tianfeng Securities, and Eastern Securities, of which Southwest Securities, Northeast Securities, West China Securities, Hongta Securities, and Tianfeng Securities' performance in the first half of the year turned losses from the first quarter of this year.

In the second quarter, the only companies that deteriorated in the first quarter of the first quarter were Central Plains Securities (SH601375, a stock price of 4.04 yuan, a market value of 15.2 billion yuan), Pacific (SH601099, stock price 2.88 yuan, and a market value of 19.63 billion yuan). The two brokerage firms in the first quarter of this year both achieved For profit, there are losses in the interim.

It is worth noting that the main reason for the loss of the Central Plains Securities in the first half of the year was the credit impairment loss of stock pledge in the second quarter. According to today's announcement, the company's merger statement in the second quarter of 2022 provided asset impairment preparation for the total of 163 million yuan, a decrease of the total profit of 163 million yuan in the second quarter of 2022.

The reason for the loss of the Pacific in the first half of the year is also prepared for the impairment of assets. According to the announcement, in the semi -year 2022, the Pacific Plan for the preparation of asset impairment of about 315 million yuan, deducting the income tax factors, affecting the company's net profit of about 237 million yuan, the main reason is that the stock price of pledged stocks continued to decline. Impairment of assets.

The securities sector trades in the freezing point

Since a wave of pulse market more than a month ago, the overall stages of the brokerage sector have fallen into a yin falling mode again.

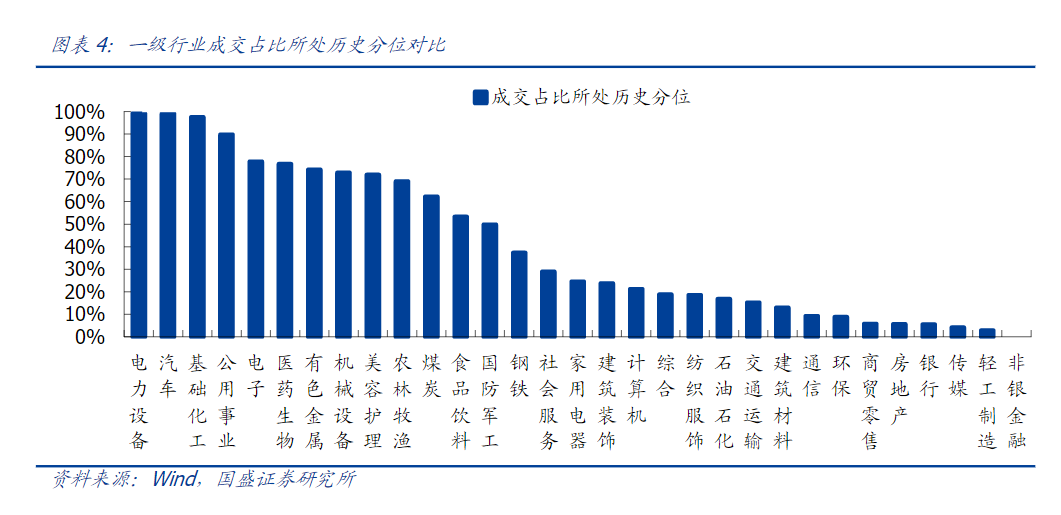

Picture from: Guosheng Securities Strategy Team

Judging from the structure of market transactions, the current market enthusiasm for the trading of the brokerage sector has fallen to the freezing point.

The research report released by the Guosheng Securities Strategy Team recently shows that the popularization of various sectors and industries in the A -share market in the near future is seriously differentiated. Many high -profile tracks have characterized the characteristics of crowded transactions, and some unpopular tracks are not asks.

According to statistics, as of July 8th, the proportion of transactions in power equipment, automobiles, basic chemicals and public utilities was before the history of 99.2%, 98.9%, 97.3%, and 89.6%, respectively.Focusing on the subdivided industries, the proportion of popular track transactions on market concerns such as photovoltaic, lithium battery, vehicles, semiconductors, and agricultural chemicals have also generally risen to historically high, and generally reached 95%of historical divisions.In contrast, the proportion of non -silver financial weekly transactions in the brokerage industry is refreshing in a new low in 10 years.It is worth mentioning that although the total market value of more than 40 listed companies in the A -share broker sector is nearly twice as much as the Ningde era, from the perspective of the daily turnover, the overall of the brokerage sector is as the Ningde Times (SZ300750, the stock price is 556.01 yuan, and the market value1.36 trillion yuan) The gap between a stock is not large.Taking today as an example, the overall turnover of the brokerage sector was 16.58 billion yuan, while the turnover of the Ningde Times today was 11 billion yuan; the overall turnover of the brokerage sector yesterday was 16.16 billion yuan, while the turnover of the Ningde Times was 12.9 billion yuan.

Daily Economic News

- END -

The results of the high school entrance examination were announced yesterday ● Since this year, Putian City has canceled the level reward bonus policy ● July 19 provincial -level standard schools

At around 11 o'clock yesterday, the results of the highly watched middle school entrance examination were announced. Grade eight grades and biological results were announced simultaneously.Calculation...

In 5 days, 10 children were unfortunately drowned 丨 clearly: Dingge accountability

Drowning has become elementary and middle school studentsThe number one killer who...