Ziguang Group's judicial reorganization chip business is to be broken

Author:Economic Observer Time:2022.07.14

"This reorganization is just the first step in the new Ziguang. It relieves the pressure of debt. It only solves the urgent urgentity of eyebrows. The characteristics of the long cycle of the integrated circuit industry determine that the development of Ziguang Group is still inseparable from the support of strategic funds and resources."

Author: Huang Yifan

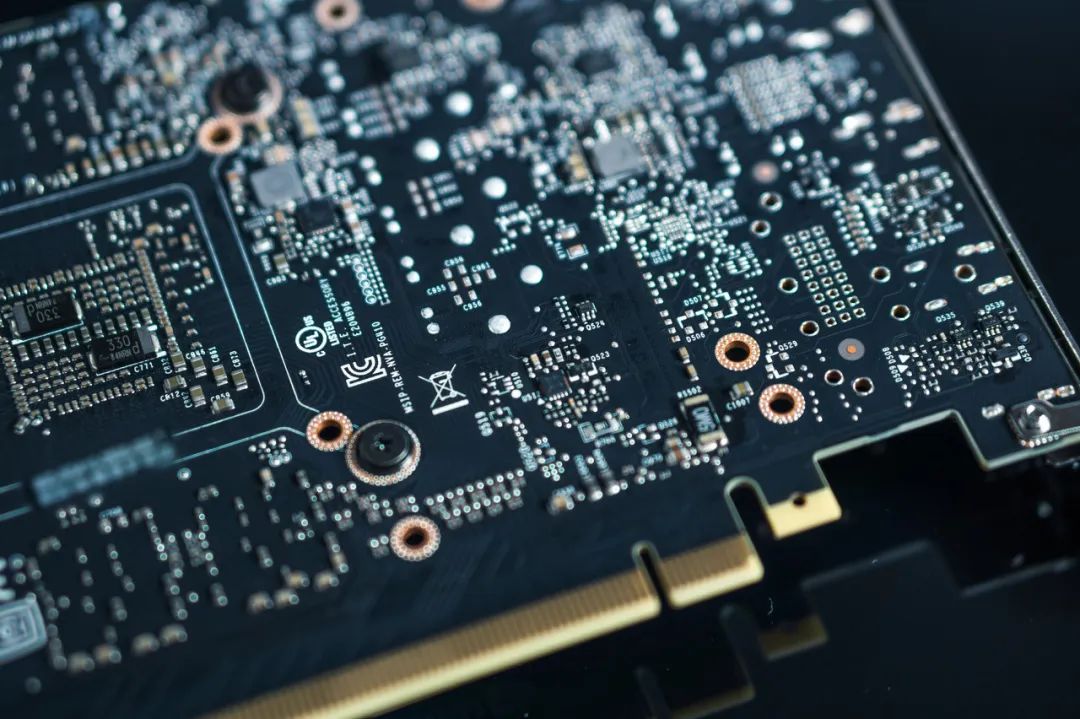

Figure: Tuwa Creative

Ziguang Group's judicial reorganization has been implemented.

On July 13, the reporter learned from Ziguang Group that the manager of Ziguang Group received (2021) Beijing 01 Breaking No. 128 "Civil Ruling" received by Beijing No. 1 Intermediate Court. According to the Civil Ruling, the Beijing First Intermediate People's Court determined that the reorganization plan of the substantial merger and reorganization plan of Ziguang Group Co., Ltd. was completed, and the reorganization procedures for seven enterprises such as Ziguang Group Co., Ltd.

In the previous two days, on July 11, Ziguang Group had completed 100%equity delivery. Two original shareholders Tsinghua Holdings Co., Ltd. and Beijing Jiankun Investment Group Co., Ltd. all withdrawn. The holding platform of the strategic investor "Zhilu Jianguang Unite" Beijing Zhiguangxin Holdings Co., Ltd. (hereinafter referred to as "Zhiguangxin Holdings" set up ) Undertake 100%equity of Ziguang Group.

On July 12, Ziguang Group paid all the cash settlement payments to all creditors. The manager completed the deposit of unpaid debt repayment resources, and made a proper arrangement for the subsequent review and settlement of claims that temporarily confirmed the claims and did not apply for claims. And submitted an application report to the court on time.

It is worth mentioning that on July 13, the official website of Ziguang Group also issued an open letter to all employees to all employees. In the letter, Li Bin said that in the near future, we must solve the current debt and capital issues, and to reshape the company's credit and reputation with a healthy balance sheet and fund management system, so that investors and creditors will regain confidence and restore the physical companies' companies’s parts of various physical companies Equity and debt financing capabilities. In this regard, he revealed that "we will use a large amount of equity funding funds to return the creditors, significantly reduce the debt ratio, and light up to create a good operating environment for each subsidiary."

Li Bin also said that in order to meet the development needs of leading industrial groups in the field of intelligent technology, the group will set up three headquarters in the future, namely business headquarters, empowerment headquarters and management headquarters.

"In fact, this reorganization completion is only the first step in the new Ziguang, alleviating the pressure of debt, just to solve the urgent urgentity of eyebrows. The characteristics of the long cycle of the integrated circuit industry determine that the development of Ziguang Group is still inseparable from the support of strategic funds and resources. This requires Ziguang Group to have good business management as the foundation and strong resource development capabilities, which is related to corporate governance and shareholder structure. After this reorganization, it is expected to solve this problem. " Essence

Change of equity structure

On the afternoon of July 11, Ziguang Group and subsidiaries issued an announcement saying that Ziguang Group has completed the company's equity and new directors, supervisors, and general managers based on the relevant laws and regulations and the "Reorganization Plan" agreement. Essence

Regarding this reorganization, the official evaluation of Ziguang Group is "debt crisis resolution and judicial reorganization work from the beginning to the end of only one year and 8 months. sequence."

It is worth noting that in terms of organizational governance, the new Ziguang Group is in the middle of the five -story structure, that is, the final investor, the investment holding company Zhiguangxin, the industrial management company Ziguang Group, the various industrial investment and financing platforms and industrial operations of Ziguang Group company.

Compared with before, an additional layer of investment holding company. The Ziguang Group said, "It is on this level that the manager introduces strategic investors, promoted the diversification of shareholders, and thickened the composition of state -owned assets."

On December 10 last year, after several rounds of competitive selection, Beijing Zhilu Asset Management Co., Ltd. and Beijing Jianguang Asset Management Co., Ltd. were selected as the "Zhilu Jianguang Union" to select the strategic investor in Ziguang Group. The above -mentioned investment holding company Zhiguangxin Holdings is the holding platform established by the "Zhilu Jianguang Unite".

Subsequently, the manager and Zhilu Jianguang officially signed an investment agreement and announced the plan. According to the plan, strategic investors adopt the "duration" reorganization model, and the industrial layout and core technology accumulated by Ziguang Group for many years can be completely retained; they agree to pay 60 billion yuan in cash for settlement of debt, and also take out the three listed companies of Ziguang Group's subordinates. Circular stocks with a market value of 23 billion yuan offset bonds at the market price, and finally arranged the remaining parts of the debt to delay the claim; creditors choose three settlement plans according to demand, obtaining 95%-100%ultra-high-definition compensation rate.

According to the disclosure, in the structure of Zhiguangxin Holdings, the majority of state -owned capital contributing to the vast majority, including Guangdong's state -owned assets, Hubei state -owned assets, and Hebei state -owned assets. State -owned capital has become the main subject and beneficiary entity of Xinziguang Group.

At the same time, in the perspective of state -owned asset -oriented patterns, from the perspective of equity, Zhiguangxin Holdings holding shares is relatively scattered. According to the disclosed information, 10 of the 10 shareholders of Zhiguangxin Holdings did not hold more than 25%of shareholders.

Ziguang Group said that because Zhiguangxin Holdings is the main fund, from the perspective of company management, Zhilu Capital and Jianguang Assets are invested by about 80%of them as GP or joint GP management. Operations can overcome the deficiencies of shareholders' diversification and non -controlling people at the level of investors, and supplement their professionalism with the diversification of shareholders, thereby ensuring the efficiency of concentrated operations at the level of operation management. At the same time, Zhilu Capital also invested some of its own funds, which not only showed its confidence, but also showed its determination to share the responsibility and co -creation of the cause. Chip to break the situation

Li Bin said in an open letter, "The development process of Ziguang Group is similar to the development of China's high -tech industry. It is both dangerous and organic, which is a microcosm of the growth of the Chinese technology industry." He said that although it has made breakthroughs in some fields And innovation, but the core technology of many products also depends on imports. "In the future, growth needs to organize the entire industrial chain elements such as design, manufacturing, sealing and testing, materials, equipment, software, and the introduction of innovative resources. It is also necessary to drive enterprises to actively participate in international competition and fully integrate into the global industrial chain. "

Earlier, Ziguang Group was positioned as an investment holding management platform. Therefore, the level of Ziguang Group actually reflects the platform function of investment and financing, and some views believe that the company's functional function in industrial operation management is lacking.

Li Bin reviewed the development experience of Ziguang Group. He said, "In addition to the mismatch of funds, we believe that there are two things that are lacking: First, industrial coordination, the companies in the group are all fighting, there is no resource sharing and collaborative management. There is no joint force; the second is the construction of the industrial chain. There are many subsidiaries, large systems, huge systems, but do not carry out a complete industrial chain layout, and there are obvious shortcomings in some key links. "

It is reported that the investment party designed the headquarters architecture and functions based on the "three headquarters" for the Xinzuang Group to construct the operating management model of "operational support, group empowerment, and business collaboration" between industrial groups and industry companies. The so -called three major headquarters are business headquarters, empowerment headquarters and management headquarters.

Li Bin explained that the empowerment headquarters will establish three centers: production capacity construction, scientific research innovation and international cooperation, and urgently need each subsidiary, but there is no enough industrial chain construction that has been independently completed by talents and talents. Integration of resource integration and increased efforts. Management Headquarters will provide financial, manpower, legal, information, informatization and other mid -back service support for the Group Holdings. He said that members of the core teams of major industrial subsidiaries will also participate in the overall strategic planning and industrial coordination of the group, and future incentives and authorization will also tilt to the front line of business, market, research and development, production and other departments.

"The possibility of clients, products, markets, and resources between the new Ziguang Group and Zhilu Jianguang's original industrial chain also has the possibility of cross -collaborative synergy." From upstream materials, chip design, manufacturing to seal testing and downstream consumer electronics, automotive electronics and IoT application industry chains. "In theory, it is expected to produce better and more synergistic effects on the three dimensions of vertical integration, multi -application scenarios, and scale levels of sub -scenario. As far as mobile Internet of Things chips are concerned, the current IP design IP design IP design IPs are currently designed. The RISC-V is in the initial stage at the same time. It is a direction that can extend the layout independently and master the upstream. "

Adopting a cow no longer "adopt a cow" Internet why the Internet is collectively nostalgic. I want to enter a state -owned enterprise

- END -

Fu Liang Public Security helps the college entrance examination to escort the dream

The 2022 college entrance examination kicked off on June 7th. In order to do a go...

Harbin's highest temperature in the southern part of the east on June 16th 23 ℃

Harbin Meteorological Observatory released on June 16th to the 16th to the city weather forecast on the 16th to night:Daily on the 16th: there are clouds or thunderstorms in the city, rain in the east