Haike Group: "Living water" to develop "blood veins" smoothly

Author:Hainan Agricultural Reclamatio Time:2022.07.14

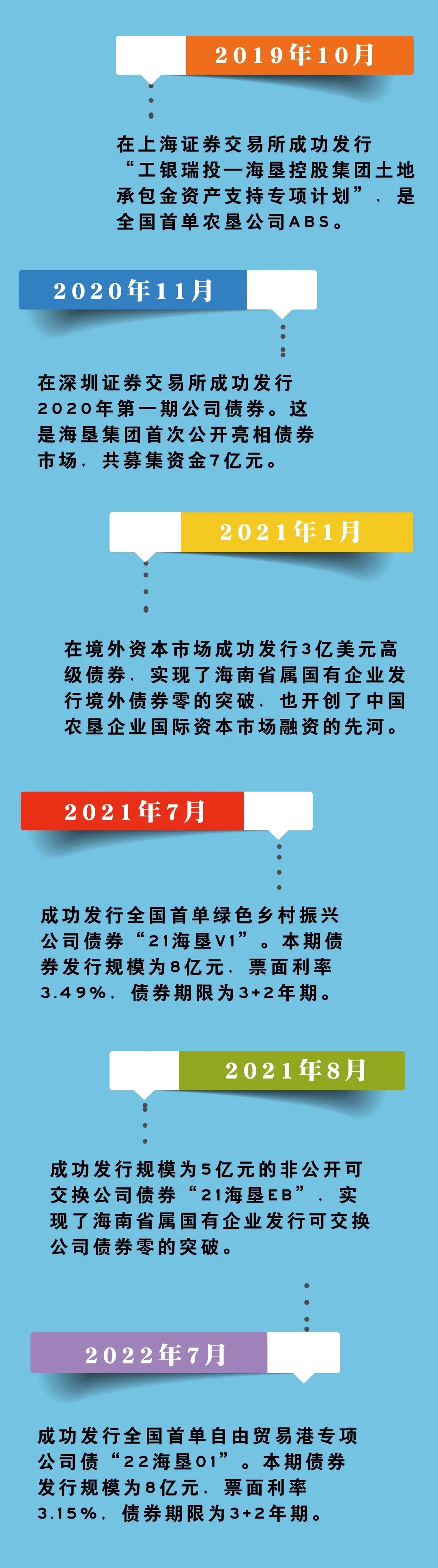

Haike Group actively explore financial innovation and successfully issued the nation's first single free trade port special corporate debt--

"Living water" to develop the "blood veins" smoothly

■ Reporter Lin Qian, a reporter from Haike Rong Media Center

On July 8th, with the strong support of the Shenzhen Stock Exchange, Haike Group successfully issued the nation's first free free trade port special corporate debt "22 Haike 01". The issue scale of bonds in this period is 800 million yuan, with a ticket interest rate of 3.15%, and the bond term is 3+2 years.

More than 50%of the funds raised by the bonds of the special company's special corporate company will be used for the construction of Hainan Free Trade Port Project. Through the sorting out the existing projects, Haike Group intends to incorporate projects such as cold chain warehousing and logistics construction, fruit and vegetable planting and processing industrial chain cultivation, and other projects into the scope of the raising funds for this free trade and port bonds.

The introduction of financial "living water" has made many companies in the reclamation area see hope. "There are 14 planning construction projects for fruit and vegetable groups this year, all of which require a lot of investment, especially the construction of 5,000 acres of vegetable standardized planting bases. This year, it is expected to invest 94 million yuan to increase the pressure on the company's cash flow." Chairman Li Guoqing told reporters. The successful issuance of the "22 Haike 01" bonds made the shortage of project construction funds that had troubled him before finally.

In recent years, the bond market has become an important channel for direct financing of enterprises. It has covered corporate bonds, corporate bonds, non -financial corporate debt financing instruments, etc., and has played an important role in supporting and serving the development of the real economy. At the same time, in order to implement the policy of financial support for financial support, Haike Group actively explore financial innovation, make full use of the bond market to carry out corporate financing to promote production, help the "August 8th Strategy" optimization and upgrade and Hainan Free Trade Port Construction.

Explore financial innovation

Help free trade port construction

Hainan Free Trade Port Construction supports financial reforms first. As the largest state -owned agricultural enterprise group in Hainan, in recent years, Haike Group has lived up to expectations in the financial field, and has achieved multiple "first orders" and "first strokes".

In October 2019, Haike Group successfully issued the "ICBC Ruitou -Haike Holding Group Land Contract Gold Support Special Plan" on the Shanghai Stock Exchange. Since then, Haike Group has successfully issued 300 million US dollars of bonds in the overseas capital market, successfully issued the nation's first single green rural corporate corporate bond "21 Haike V1", and 500 million yuan of private equity non -public issuance of exchangeable corporate bonds.

In order to implement the "Overall Plan for the Construction of Hainan Free Trade Port" and fully promote the construction of free trade ports with financial support, the SFC and the existing corporate bonds of the Shenzhen Securities Regulatory Commission and Shenzhen Communications have launched a special variety of free trade port bonds. 50%of the construction of free trade ports.

"On September 25, 2020, Haike Group received the China Securities Regulatory Commission's" Approval of Agree to Agreement of Hainan Agricultural Reclamation Investment Holding Group Co., Ltd. to publicize the registration of corporate bonds to professional investors. " According to the relevant person in charge of Haike Group, the Group has successfully issued the first phase of corporate bonds and the second single green rural corporate corporate bonds in 2020 and 2021.为落实实施金融创新支持自贸港建设相关政策,集团综合考虑宏观形势、融资期限、融资成本等因素,结合产业投资的资金需求,在资金面相对宽松、债券市场利率较低的背景下,充分Seize the favorable market window, actively docking the State -owned Assets Supervision and Supervision Bureau, on the basis of studying national financial policies, repeatedly demonstrated, and through the main underwriter CITIC Securities and the Shenzhen Stock Exchange, they have applied for discussions and cooperation. Trade and port special company debt issuance.

The reporter learned that this issue of bonds is a useful demonstration that promotes the strategic development of enterprises and the organic combination of Hainan Free Trade Port. As an innovative special bond, its successful issuance not only further enriches the variety of bonds, but also helps to play the role of the capital market to serve Hainan to serve Hainan. Construction and high -quality development of free trade ports.

Bond "gold content" high

Empower the development of industrial projects

The reporter noticed that the ticket interest rate of the bonds in this issue was 3.15%, which was lower than the LPR130 BP of the financial institution in the same period, and it has reached a low interest rate of similar bond tickets in the same period since 2021.

"Ticketing interest rates indicate that the issuer's economic strength and potential, the stronger the economic strength, the more financing methods, the lower the interest rate of its bond." Assets and income indicators have increased steadily, and the overall credit rating has received the highest domestic AAA rating, and has obtained international rating of Moody BAA2, an international authoritative evaluation agency. This not only fully confirms that the comprehensive strength of Haike Group is highly recognized by the investment entity, but also shows that the investment entity has strong confidence in the group's credit.

"According to the issuance cases and historical experience provided by the issuance bond agency, the issuance cost of innovative bond products is generally more than 5-10bp from the interest rate of the bonds of the same rated small public offerings in the same period. The issue cost is expected to be further reduced." The person in charge said.

This also means that the investment entity believes that the future development of the issuer Haike Group is expected to be better, and the risk of debt repayment is low. At the same time, it also fully illustrates that the market entity is full of confidence in the prospects of the construction of free trade ports.

According to statistics, there were 17 institutions participating in the purchase of investment on the same day, of which non -bank financial institutions were market investment entities outside Hainan Province, with a subscription multiple of 4 times.

"At present, Haike Group urgently needs to use industrial projects to drive rapid development. By issuing the funds raised by bonds of special company companies, on the one hand, it helps to establish a market image of the group's intentions and continuous innovation and enhance market influence; on the other hand, It helps to increase the proportion of direct financing of the group, reduce financing costs, and optimize the group's financing structure. "The relevant person in charge of Haike Group believes that in terms of policy opportunities, the identity, development strategy, and practical needs of modern agricultural state -owned enterprises, Haihai The beneficial exploration of the reclamation group in financial innovation will play a positive role in promoting the development of the Haike industry and the construction of free trade ports. In the next step, Haike Group will seize the historic strategic opportunities of Hainan Free Trade Port, continue to explore and use multi -level capital market tools, explore market financing through different paths and methods, give full play to the financing function of state -owned capital investment and operation platforms, and also give full play to the financing function of state -owned capital investment and operation platforms, and and also give full play to the financing function of state -owned capital investment and operation platforms. Based on the policy dividend of Hainan Free Trade Port, the policy advantage is converted into the capital advantage and real benefits to promote industrial development.

Disclaimer: Reprinted or quoted this public account news, please indicate the source and the original author.

Drawing | Yin Yingzi

Edit | Yin Yingzi

Editor in charge | Lu Yanan

Duty header | Zhong Ye

- END -

In the first half of the year, the "Shuangcheng Economic Circle" major projects completed more than 100 billion yuan in investment

Today, the Provincial Development and Reform Commission notified the progress of t...

Yiliang County Meteorological Observatory issued heavy rain blue warning [Class IV/general]

Yiliang County Meteorological Observatory issued a heavy rain blue warning signal at 18:31 on June 8, 2022: In the past 1 hour, the rainfall of Mihu Station in our county reached 34.9 mm, and the rain