Financial anti -corruption continues to make efforts, and the deputy governor of the bank is approved "escape resignation"

Author:China News Weekly Time:2022.07.14

Financial anti -corruption continues to deepen

On July 6, the website of the State Supervision Commission of the Central Commission for Discipline Inspection disclosed that Rao Guoping, former party committee secretary and president of the National Development Bank Xinjiang Branch, was investigated by serious disciplinary violations. Rao Guoping just retired in April this year, only three months away from the horse.

Since the former chairman of the country, Hu Huaibang, since its dismissal, the National Bank of China has continued to fluctuate, and at least 6 branches of branches have been investigated at least 6 branches in various regions.

This is the epitome of the continued deepening of anti -corruption in the financial field. According to the central level party and state organs, state -owned enterprises and financial units of the Central Discipline Inspection Commission's official website of the State Commission for Discipline Inspection, disclosed that from the beginning of the year to July 13, at least 34 financial monopoly mice were arrested. At the same time, financial corruption also shows new features. Some people are renovated and concealed, such as "escape resignation".

Jia Kang, the former vice president and secretary -general of the Chinese Society of Finance, told China News Weekly that many financial monopoly rats were investigated, indicating that financial anti -corruption deepening and unprecedented intensity. water surface. He believes that it is the fundamental measure to dig deep into the root of financial corruption.

Most of them are key positions.

These 34 financial monopoly rats are involved in 16 banking systems, 12 regulatory departments, and 6 in the insurance field. From the perspective of banking institutions, 9 banks involving China Construction Bank, National Development Bank, Bank of China, China Import and Export Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China Bank, Everbright Bank and China Merchants Bank.

Among them, the CCB's investigators were dense. The former president of the CCB Shenzhen Branch Wang Ye, the original risk director of the Shenzhen Branch Han Fenglin, Li Baodi, deputy dean of the South China Institute of Training Center of the Construction Bank, Huang Xi, former general manager of the business department of CCB, Zhang Xueqing, deputy president of Shenzhen Branch of CCB Essence

In addition, Tian Huiyu, the former party committee secretary and president of China Merchants Bank this year, have also worked in CCB for many years. The China Merchants Bank was established in 1987 and has served as the three presidents. Tian Huiyu is the third president.

From the perspective of the regulatory authorities, five people of the People's Bank of China (commonly known as the central bank) were dismissed, and 3 of them were dismissed.

In the field of insurance, the disrupted personnel involved five insurance companies of China Property and Insurance Corporation, People's Property Insurance Company, People's Insurance Investment Holding Company, China Export Credit Insurance Company, Taiping Property Insurance Company, and Insurance Security Fund Company.

In this round of anti -corruption, most of the people who dismissed were the key positions. The most typical is Sun Guofeng, the director of the Central Bank Monetary Policy Department. The Department of Monetary Policy is mainly to study, formulate a monetary policy regulation plan, and organize the implementation, and organize the relevant work of the coordination mechanism of the macro -control department.

The CSRC and the CBRC also have important posts. For example, Wang Zongcheng, former director of the CSRC's Accounting Department, and Jiang Liming, former director of the regulatory department of the former CBRC rural small and medium -sized financial institutions.

Corruption means renovation, hidden diverse

As the state increases anti -corruption, many people use the "rotation door of political and businessmen" to connect power with capital, to engage in "options" corruption, "building nests in advance" and "escape -type resignation". In June this year, "China Discipline Inspection and Supervision Magazine" specifically mentioned these phenomena in an article. The article mentioned that it is necessary to focus on resolute punishment of hidden corruption and new corruption issues. The more corruption is renovated, concealed, and the more punishment, the greater and stricter the punishment.

Corruption means renovation is also reflected in the financial field. On July 4, Zhang Huayu, the former deputy secretary of the party committee and vice president of Everbright Bank, was expelled from the party. The Central Discipline Inspection Commission reported him to blame him -it was a typical example of "building nests in advance" and "escape -type resignation". It is a typical typical typical of power and capital. Typical.

The official report said that Zhang Huayu resigned on the eve of retirement when he was in his job, resigned on the eve of retirement, and after resignation, he received a high salary of enterprises with a business association with the original position. He also arranged for dozens of relatives and relatives such as his son, son -in -law, brother, and his children to work in the Everbright System.

"Escape" also resigned was Zeng Changhong, the former first -level inspector of the Securities Regulatory Commission Investor Protection Bureau. Zeng Changhong has long been working in key positions in the issuance of securities issuance and "relying on review, eating and issuing trial", and was expelled from the party in April this year.

The report said that she was close to retirement, trying to avoid supervision and supervision, continued to collect money, and engaged in camps in various ways, and illegally accepted the property of others and the equity of listed companies.

"Shadow Company" is one of the top ten anti -corruption hot words in 2020. At the beginning of the year, the TV special film "Zero Ren Ren" mentioned that Sun Dushun uses "shadow companies" to use financial means to complete the typical type of interest transportation.

Sun Dushun has worked in the banking industry for more than 40 years. From the top -level cabinet of the bank outlets, he has grown into an official of the president of the State -owned Bank of China step by step. He believes that his business capabilities are superb. He arranged for two old subordinates as agents, and opened two investment platform companies. The so -called legal person at the front desk of the two companies was actually only the "shadow" of Sun Dushun. After the corporate owner obtains illegal interests, he will inject huge sums of money into the company controlled by Sun Dushun.

Since the beginning of the year, many financial monopoly rats have been "double -opened" or "expels the party." Judging from the contents of the "double opening" notification, they are mostly "relying on eating and eating", "supervision and supervision", and profit in the financial field, and some people even engage in family corruption.

How to curb "relying on finance to eat finance"

This year's financial anti -corruption is so great that there is a background worth mentioning.

From October to December last year, 15 inspection teams in the eighth round of the 19th Central Committee conducted regular inspections of 25 financial units. In late February this year, the inspection team completed the feedback. The inspection team mentioned that some units "eat finance by finance", and the risks of integrity in important positions, key areas and key links are relatively prominent, and there are many reflection of spiritual issues in violation of the eight central regulations. protrude. Wang Jun, director of the China Chief Economist Forum, told China News Weekly that since the 18th National Congress of the Communist Party of China, anti -corruption has been promoted to various fields, and finance is no exception. The characteristics of operating currencies and operating risks in the financial industry themselves are very easy to breed corruption. He said that from the perspective of the disaster data, the bank is the "severe disaster area", indicating that there are relatively many problems exposed in the field.

The dean of the Shenzhen Greater Bay District Financial Research Institute told Songyu to China News Weekly that the financial industry is relatively special, and it is always in the "Party A" position in the national economic system and is a fund provider. In the national economic chain, the financial industry is at the highest -end position, and has a strong right to dominate funds. This is an objective reason for the financial industry to breed corruption compared to other industries.

Among the financial officials who have fallen off this year, banks and regulatory authorities accounted for the largest proportion. Xiang Songyu analyzed that monopoly is easy to breed corruption. Entering the financial industry requires licenses, business needs permits, and supervision must be accepted. Some officials often use the power of grasping licenses, business licenses, business approval or supervision to conduct rights and money transactions.

In addition, he mentioned that the "rotating door" of the financial industry is also an important factor. Officials from regulatory authorities are more common in the industry when officials in financial institutions are as executives. This is easy to cause interest.

Xiang Songyu told China News Weekly that the personal psychological imbalance of financial institutions is also an important factor. Although the financial executive's own income is not low, it is far from the dominant funds. A financial enterprise executives who have fallen into the horse admitted that it is normal for the loan to be approved or provided by the provision of funds.

Experts have mentioned the importance of institutional construction on how to prevent financial corruption and "relying on finance" and other issues. The "key minority" such as the leadership of financial institutions should undergo strong supervision.

Xiang Songyi believes that to curb and eliminate corruption, it is not enough to rely on personal moral constraints and self -discipline awareness, but also strengthen external supervision and institutional construction.

Wang Jun mentioned that corruption of financial institutions has a great negative impact on the business and reputation of financial institutions, and it is also harmful to the development of the national economy. They distort the normal market mechanism and raise the cost of funds. The efficiency of the use of funds has greatly damaged the effectiveness of the financial service real economy. He believes that financial anti -corruption must continue to advance in depth, and anti -corruption to eliminate hidden risks in the financial system. The entire process of use of funds must be supervised to improve transparency, and at the same time, the supervision of the leadership of financial institutions should be strengthened.

Author: [email protected])

Edit: Li Zhiquan

- END -

[Luo Dingchuang is in action] Hollying together, setting off a new boom in a civilized city (5)

In the past few days, the towns and departments of Luoding City have made efforts ...

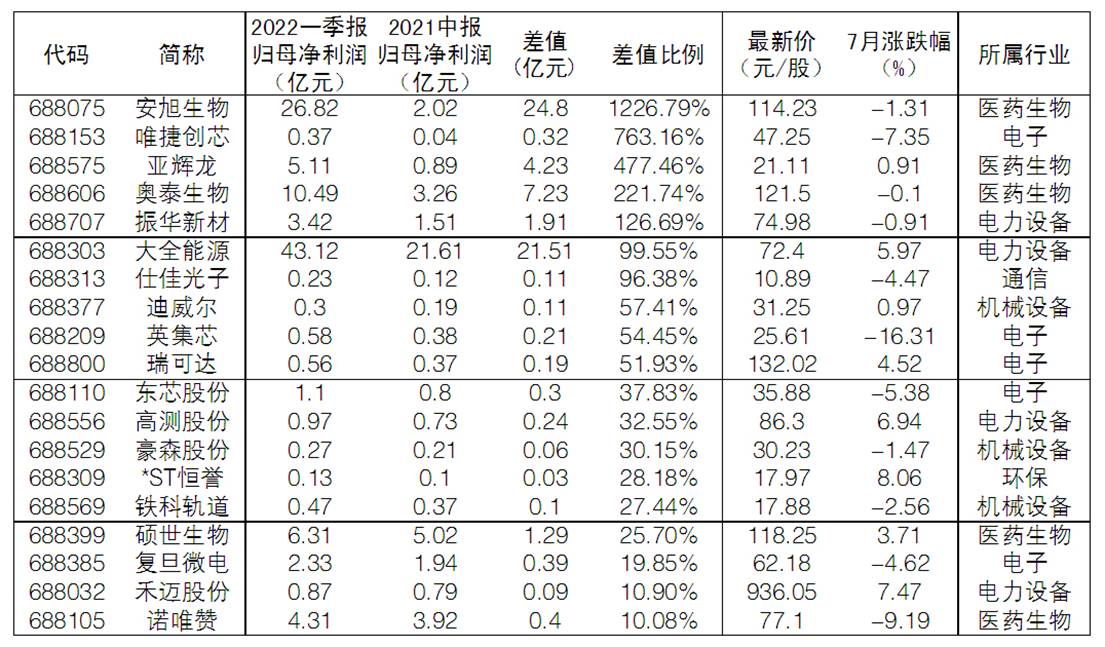

The interim report disclosure is approaching, and the four major standards sieve 19 potential pre -increased shares

As the interim report disclosure is approaching, the performance of the science an...