Pack money!The end of this month!

Author:South China Sea Release Time:2022.06.14

Pay attention!

Or you can withdraw money!

The deadline at the end of this month!

According to the announcement of the State Administration of Taxation, from March 1st to June 30th, 2022, individual residents who meet the relevant regulations need to handle the comprehensive payment of personal income tax for 2021.

According to the announcement, after the end of 2021, the residents need to summarize the income from four income obtained from the salary salary, labor remuneration, manuscript remuneration, and franchise fees from January 1, 2021 to December 31, 2021, and the expenses are reduced by 60,000 After the special deduction, special additional deduction, other deductions and eligible public welfare charities determined in accordance with the law, the personal income tax rate for comprehensive income is applicable and subtract the speed deduction. The tax amount has been paid in the year, and the amount of tax should be refunded or replenished, and the taxation or tax refund or taxation is applied to the tax authority.

Annual exchange calculation period

What tax deductions can be enjoyed

A picture takes you to understand quickly

Policy "red envelope"

Handling guide

1. What channels do you apply for annual exchange calculations?

There are three channels for the annual exchange calculations: network office, mailing office, and lobby office.

Taxpayers can handle annual exchange calculations through the Natural People Electronic Taxation Bureau, especially mobile phone personal income tax apps to handle taxes.

For the individuals who have obtained overseas income, the annual remittance calculation can be handled through the foreign income application function of the Natural Human Electronic Taxation Bureau.

If it is not convenient to use the network, it can also be handled by mailing or going to the tax service hall.

2. What can I choose?

There are three ways to handle annual exchange calculations: do it by yourself, unit, and ask people to do it.

Apply for annual exchange for the year.

Handling through the employee. It should be noted that the taxpayer's choice of annual exchange by the unit must be confirmed with the unit during the annual exchange period (before April 30). Before the taxpayer confirm, the unit shall not calculate the annual exchange for the taxpayer.

Entrusted tax -related professional service agencies or other units and individuals, taxpayers and trustees need to sign authorities.

3. What preparations do you need to do?

If you are not clear about your annual income, paid taxes, or cannot be sure that you should pay taxes or tax refunds, or you do n’t know if you are eligible for the conditions for the annual exemption, you can solve it through the following channels:

The deduction unit can be required to provide the income issued by the issuance and the prepaid taxes. According to the tax law, the unit has the responsibility to tell the taxpayer the above information.

You can log in to the Natural Man's Electronic Taxation Bureau (mobile personal income tax app) to inquire about the income and tax declaration information of the annual tax of his taxes.

After the annual exchange calculation starts, the tax authorities will provide the taxpayer's pre -filled service for the taxpayer through the Natural People Electronic Taxation Bureau. After the objection and confirmation, the system will automatically calculate or refund the tax, and the taxpayer can know whether they need to handle annual exchange.

How to choose a bonus tax method?

It is reminded that the country has decided to make a policy of income from a monthly salary and salary income of the annual annual bonus and the implementation of a monthly tax rate on a monthly basis, which lasted until the end of 2023. Therefore, when the tax exchange is performed this year, there will be a choice question for the year -end award: separate tax calculation or all income from comprehensive income tax.

Different tax calculation methods will affect the tax amount. Experts analyze that for those with relatively small salary and relatively many year -end prizes for the annual annual salary, they may choose to make the year -end award merged into the comprehensive income tax calculation method.

If you want to know which tax calculation method is more advantageous to yourself, a very simple way is to operate both tax calculation methods on individual tax apps, but don't confirm first, compare which tax calculation method is cost -effective. Just choose which one.

The taxation department reminds that the majority of taxpayers should handle personal income tax in accordance with laws and regulations, and carefully read the tax app to remind the reminder information carefully. Complete the application for taxation, do not trust all kinds of "tax refund secrets" on the Internet, let alone disseminate unofficial tax -related information on the online social platform, and be a taxpayer who is honest and trustworthy in accordance with the law.

Follow the video number of the South China Sea, master the latest information of the South China Sea

- END -

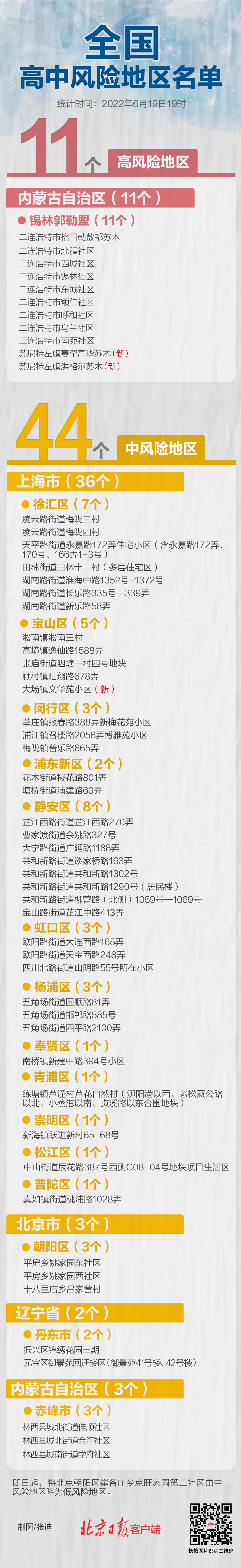

renew!Beijing, Shanghai, and Inner Mongolia have been adjusted in many places. There are 11+44 high school risk zones across the country.

On June 19th, the 216th press conference of the prevention and control of the new ...

Kangping County Meteorological Bureau issued a yellow fog yellow warning [Class III/heavier]

Large fog yellow warning signal: It is expected that in the next 1 to 2 hours, Kangping County will have a big fog weather with a visibility of less than 500 meters, and it will last for 2 to 3 hours.