Zhangxian tax: help stabilize the economic and stable growth to contribute to tax forces

Author:Zhangxian Rong Media Time:2022.07.14

In order to conscientiously implement a series of decision -making and deployment of the economic market, efficiently coordinate the prevention and control of the epidemic and the development of economic and social development, and strive to realize the high -quality catch -up and development of the county's economy. Strengthen publicity, implement various tax reductions and fees and fees, conscious taxes, go all out to the main body of the market, spare no effort to stabilize economic growth, continue to optimize the tax business environment, and actively contribute tax for the development of the county economy. Actual actions welcomed the 20th National Congress of the Communist Party of China.

Persist in fast and stable, and quickly implement the policy of value -added tax deduction. Fully understand the significance of new combined tax support policies such as large -scale value -added tax refund policies, resolutely carrying political responsibilities, set up leading groups and work classes, and strengthen coordination with fiscal, pedestrian and other departments. The second meeting was held to study related spirit, and the implementation of implementation measures for research and deployment. A series of stable and orderly retained tax refund work should be carried out, and the current tax refund rate should be retired. The current tax refund rate is 100%, ensuring that the retention tax refund policy is implemented.

Persist in enjoying and fully implementing other preferential policies. Adhere to the implementation of various tax preferential policies as the top priority to protect market entities and stable economic growth, continue to increase policy promotion and counseling, ensure that various reduction policies should be enjoyed, helping enterprises go through difficulty to develop better development, and more more developed, more developed, and more more developed, more developed. It helps to stabilize the macroeconomic market.

Adhere to efficient and convenient, and continue to optimize the tax business environment. Adhere to the optimization tax business environment as an important aspect of promoting economic development, continue to create a service package for up to once, the full online processing, etc., implement 233 "non -contact" tax payment matters, and realize the full process of 122 government services " Do it online. " Continuously regulate law enforcement behaviors, and promote the first disposable criminals, and make it easy for enterprises to enter the battlefield. Relying on the "Longshi Lei Feng" nail communication platform, one -on -one counseling taxpayers provide more convenient, accurate and efficient services for taxpayers.

In the next step, the Zhangxian Taxation Bureau will implement the combined tax support policy with a high sense of political responsibility, continue to optimize tax services, continue to protect the market entities, and help the county's economy's economy steady and efficient development.

(Li Jiaming)

- END -

Active service to help the development of enterprises

In order to thoroughly implement the deployment requirements of the county's 10,00...

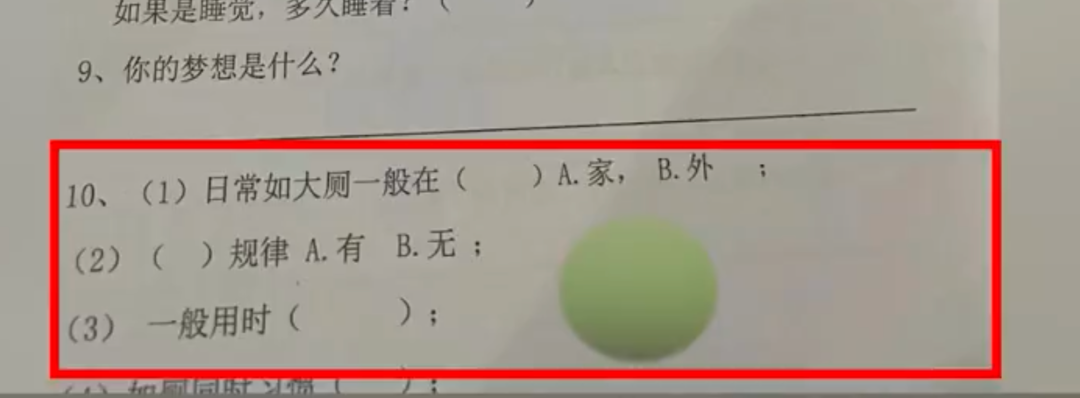

The company's interview actually asked at home or toilet?It is called "the basic situation of the personal basic situation" ...

Recently, some netizens broke the news:Interview questions for a company in Changs...