The net profit of Tianqi Lithium increased by more than 110 times in the first half of the year, and the Pilbara lithium concentrate mining price declined first

Author:Red Star News Time:2022.07.14

On July 14, Tianqi Lithium (002466.sz/09696.HK), the lithium industry just landed in the Hong Kong Stock Exchange, announced that as of six months of June 30, 2022, it belonged to the net profit range of the company's shareholders. It is expected to be RMB 9.6 billion to RMB 11.6 billion, a year -on -year increase of about 11089.14%to 13420.21%.

The net profit range after deducting non -recurring profit or loss is expected to be RMB 8.46 billion to RMB 10.38 billion, a year -on -year increase of about 43625.90%to 53549.51%.

The net profit of Tianqi Lithium has soared, mainly to benefit from the impact of the global new energy vehicle prosperity, the accelerated production capacity expansion of the lithium -ion battery manufacturer, and the heating of the order of the downstream positive pole materials. The average sales price increased significantly compared with the same period last year.

In addition, during the reporting period, SES Holdings PTE. LTD, which was shared by Tianqi Lithium, was listed on the New York Stock Exchange. Therefore, it was terminated to confirm long -term equity investment, and confirmed that it was a financial asset with other comprehensive income at fair value, and confirmed investment income. The investment income generated by the above -mentioned long -term equity investment due to passive shares is non -recurring profit or loss.

Not only Tianqi Lithium Industry, the current performance of Lithium Mine Company is generally premeditated in the first half of the year, mainly because the prices of the upstream material products of the lithium battery industry continue to rise.

Xia Juncheng, Executive Director and CEO of Tianqi Lithium Industry, said at the site of the Hong Kong Stock Exchange that for lithium prices, it needs to look at the scientific supply and demand relationship. At present, the supply of lithium ore is less than demand. Therefore, as long as there is a gap between supply and demand relationship, Tianqi Lithium is very confident in lithium prices.

On July 13th, Pilbara (Perbala), a lithium -oriented Optimum Lithium Lithium Miner, held a seventh lithium concentrate auction, with a transaction price of $ 6188/ton, a 2.55%transaction price from June 23. It is its. For the first time in the auction history, it fell for the first time. Based on the freight of $ 90/ton, the cost of battery -grade lithium carbonate is about 440,000 yuan/ton.

From July 2021 to June this year, PILBARA conducted six lithium concentrate auctions, with the transaction price of $ 1250, $ 2,240, $ 2,350, $ 5,650, $ 5955, and $ 6,350, respectively.

The industry pointed out that the previously high price of Pilbara auction gradually increased the price of lithium concentrate long -term associations, and at the same time, it was also the confidence when the mining factory and the downstream of the new round of lithium concentrate long association were signed. The first adjustment of the auction price may mean that the future trend of the continued rise in the price of lithium concentrates in the future will be partially contained.

However, from the perspective of demand, the automobile industry is still expected to be better.

According to the latest data from the China Automobile Association, my country's new energy vehicle industry is still in high prosperity. In June, the production and sales of new energy vehicles completed 590,000 and 596,000, respectively, an average of 1.3 times year -on -year. From January to June, the production and sales of new energy vehicles completed 2.661 million and 2.6 million, respectively, a total of 1.2 times year-on-year, and the market share reached 21.6%. In addition, from the history of the sales volume of new energy vehicles in my country, the second half of the year is the real peak sales season of new energy vehicles, superimposed the previous car stimulus policies, and new energy vehicles to go to the countryside. The demand for automobiles is expected to be further released in the second half of the year. The China Automobile Association has raised the annual sales forecast of new energy vehicles to 5.5 million vehicles.

Red Star News reporter Wu Danruo

Edit Yang Cheng

- END -

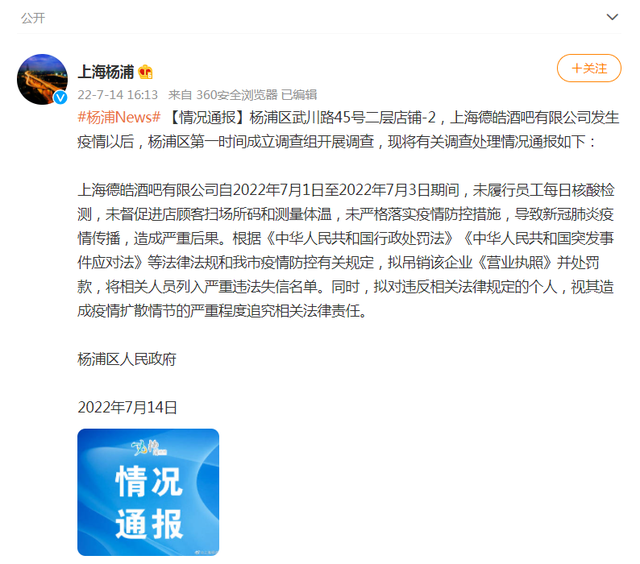

Do not strictly implement the prevention and control regulations, prevent epidemic prevention of epidemic dissemination, punishment!

01According to the official Weibo of Yangpu, Shanghai on July 14, Yangpu District ...

Henan Qinyang 丨 Chongyi Town, this "Tianzhang Party Class"!

In order to solidly promote the establishment of the Five Star branch, it has cont...