Multiple factors cause euro exchange rates to fall

Author:Xinhuanet Time:2022.07.14

Xinhua News Agency, Frankfurt, July 13 (International Observation) Multiple factors caused the euro exchange rate to fall

Xinhua News Agency reporter Shan Weiyi Shao Li

In the past three weeks, the exchange rate of the euro to the US dollar has continued to decline, and on the 12th, it even fell to the lowest point of nearly 20 years in the European foreign exchange trading market to one euro for nearly 20 years. Analysts generally believe that multiple factors have led to the decline in the exchange rate of the euro to the US dollar, and the disadvantaged euro may further push the inflation rate in Europe.

European Central Bank data shows that on the 12th, the exchange rate of the US dollar to the US dollar fell from 1 to 1.0098 the previous day to 1 to 1.0042, and since the beginning of 2022, a cumulative decline has exceeded 11%.

The weakening of the exchange rate of the euro to the US dollar is mainly due to the recent slowdown in European economic growth. According to the latest predictions of the European Central Bank, the euro zone economy will increase by 2.8%in 2022, and will increase by 2.1%in 2023 and 2024. Compared with the March forecast, the economic growth rate in 2022 and 2023 is expected to be significantly reduced. The European Central Bank stated that if the energy supply is severely interrupted and the price has soared, it is expected that the euro zone economy will increase by only 1.3%in 2022, and it will shrink by 1.7%in 2023.

Secondly, the continuous rise in the euro area's inflation is also an important reason for the decline in the euro exchange rate. Preliminary statistics released by the EU Statistical Bureau on the 1st show that the energy and food prices of the euro zone continued to soar, and the inflation rate in June was 8.6%at an annual rate of 8.6%, a record high.

Third, the European Central Bank's interest rate hike is far lower than that of the Federal Reserve Commission, which has increased the interest rate gap between Europe and the United States. The economic and financial cycle of the euro zone lags behind the United States, so compared to the strong performance of the US dollar, the euro direction tends to be weak. The market's expected increase in the Federal Reserve's increase in interest rate hikes at the end of July has led to a stronger exchange rate in the US dollar.

In addition, the European energy supply crisis continues to ferment. On the 11th, the "Beixi-1" pipeline was closed and maintained to exacerbate European energy dilemma, and the European economy was covered with a shadow.

Citi Group's currency analyst Ibrahim La Barry predicts that the euro will continue to fall after falling to parity with the US dollar.

The disadvantaged euro may further push the European inflation rate and exacerbate the worries of the euro zone falling into decline. Affected by the rise in energy prices and the depreciation of the euro, the pressure of imported energy costs in the euro zone will further increase. The June meeting of the European Central Bank Management Commission shows that because the US dollar is the main price of oil imported oil in Europe, the euro has continued to depreciate on the US dollar and directly affects inflation.

In the context of high inflation and the deterioration of economic prospects, the normalization of the European Central Bank's monetary policy is facing challenges. Too fast and hikes may trigger the European debt crisis. Increasing European interest rates, while controlling inflation, also inhibit economic growth, and will cause problems in some member states of some euro zones.

The EU Council Executive Vice Chairman Dongbrovskis said that in the face of unprecedented high inflation, the European Union needs to introduce more targeted measures.

![]()

[Editor in charge: Feng Li]

- END -

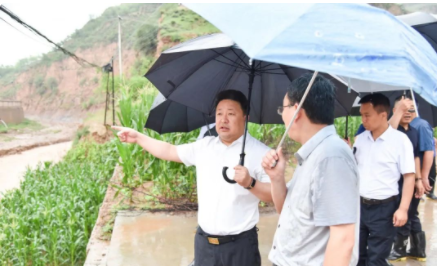

Lin County: Yao Shushan's in -depth surveys to guide flood prevention and geological disasters prevention and control work

On July 15th, Yao Shushan, deputy secretary of the county party committee and coun...

The eighty old man was lost, and the police station was fully forced to retrieve it

Jing Fei is Wang Shan's cover reporter Xie YingDirector Pan, such a hot day, thank...