Break 9!The US CPI renewed in June for more than 40 years, opened the door to 100 basis points in interest rate hikes?

Author:Daily Economic News Time:2022.07.13

On July 13, data from the US Labor Statistics showed that the United States CPI in June was 9.1%year -on -year, the highest increase since November 1981, up 1.3%month -on -month, reaching the highest level since 2005. The core CPI in the United States increased by 5.9%year -on -year, with a previous value of 6%.

According to statistics, gasoline, housing and food are the main factor to promote CPI soaring. Energy prices rose 7.5%in June, almost doubled from 3.9%in May, and increased by 41.6%year -on -year. Among them, gasoline prices rose 11.2%month -on -month, up 59.9%year -on -year, the largest year -on -year increase in the data since March 1980.

Natural gas prices rose 8.2%month -on -month, up 38.4%year -on -year, reaching the largest increase since October 2005. Power prices also increased in June, up 1.7%month -on -month. Food prices increased from month -on -month growth, an increase of 1%, an increase of 10.4%year -on -year.

At the same time as high inflation, Americans' income is decreasing. According to statistics, the actual personal income of the United States in June decreased by 1%.

The three largest opening of the US stocks fell, and the Dow fell 0.94%to 30691.16 points; the S & P 500 index fell 0.88%to 3785.14 points; the Na index fell 0.83%to 11171.27 points.

Picture source: Futu Niu Niu Screenshot

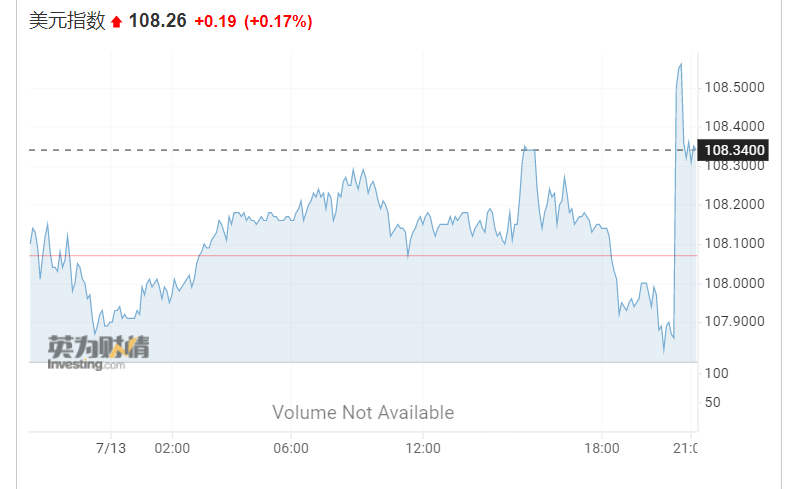

The US dollar index futures have soared above 108. As of press time, it is now reported to 108.207. RMB rose to 6.732 against the US dollar, and the euro fell to 1.0024 against the US dollar.

Image source: Yingwei Caiqing

The New York Commodity Futures Exchange COMEX gold futures price also fell sharply by $ 20, once fell to $ 1704.80. As of press time, the futures price fell by about 0.5%to $ 1716.80/ounce.

High -agglomeration data shows that American inflation is still not as expected as many economists expect. Earlier, the Wall Street Journal has analyzed that "the pressure of inflation in the United States is almost ubiquitous." The Wall Street Journal predicts that the US CPI in June may approach 9%and continue to operate high this fall.

In this context, the Federal Reserve is more radical to raise interest rates.

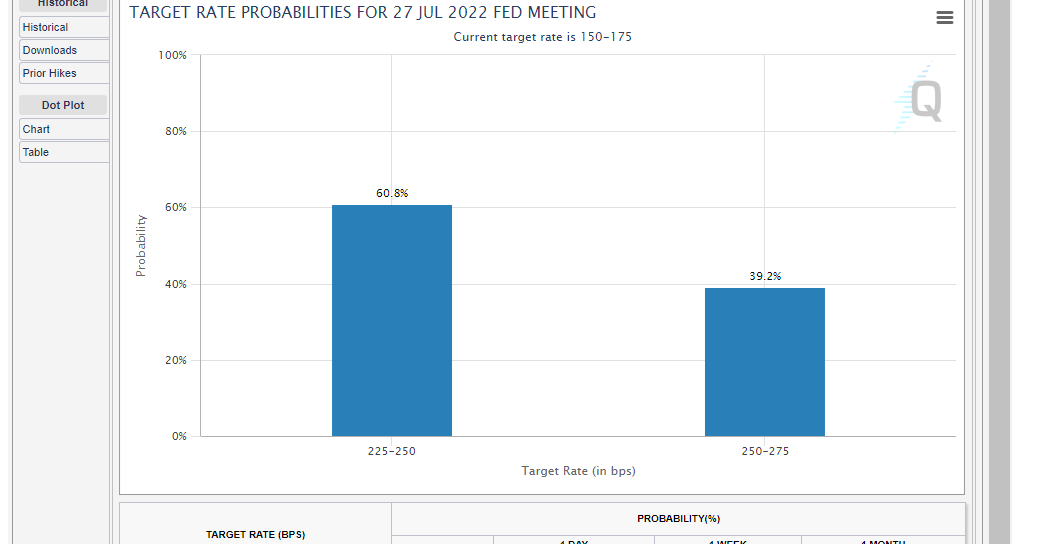

After the June CPI data was announced, the US interest rate exchange market showed that traders are now expected to have the possibility of 100 basis points raising interest rates in July. The interest rate of the contract in July rose to 2.416 %, about 83.6 basis points higher than the current valid federal fund interest rate. This means that the market believes that the rate hike has reached 75 basis points.

In addition, the "Fed Observation" tools of the Zhishang Institute show that as of press time, the market is expected to raise interest rates by the Fed in July of 100 basis points.

Image source: The "Fed Observation" tool of Zhishang Institute

Daily Economic News

- END -

"Finance and Economics" Liu Yuanchun: Don't worry too much about the economic rebound in the second half of the year

Liu Yuanchun: Don't worry too much about the economic rebound in the second half o...

Better to serve the company "go out"!Shenzhen trade promotes multiple measures and promote

On the morning of June 13, Shenzhen Commerce Bureau, Shenzhen Customs, Municipal Trade Promotion Commission, Municipal Judicial Bureau, and Shenzhen International Arbitration Institute signed a memora