Standard Chartered Bank Wealth Management Department: Raising China's shore and offshore stocks in Asia are "superpatients"

Author:Economic Observer Time:2022.07.13

Economic Observation Network reporter Wan Min on July 13, 2022, Standard Chartered Bank's Wealth Management Department released the Global Market Outlook in the second half of 2022. In the macro aspect, it is expected that the Fed will raise interest rates by 150 basis points to 3.25% by the end of the year to 3.25%. The interest rate exceeds the "neutral" level of the Federal Reserve 2.5%. As the Fed's policy becomes restricted, the risk of US economic decline in the next 6-12 months will increase significantly in the next 6-12 months.

The report pointed out that the high inflation and continuous rise, coupled with the increasing hardened global central bank, increasing the possibility of a substantial slowdown in economic growth. At the same time, China is on the other side of the economic cycle and has more support for fiscal and credit policies. It is expected to gradually recover from the difficult challenges in the first half of the year.

Regarding the stock market, the Standard Chartered Bank Wealth Management Department believes that strong inflation globally has forced many central banks to tighten monetary policy, which may lead to slowing growth and weakening the company's profit prospects. Standard Chartered has reduced global stock allocation into the core position, while increasing the bond market. Asia (except Japan) is still an optimistic area in global stocks.

In Asia, Standard Chartered is optimistic about China and India. Although the discount of valuation with global stocks has returned to a long -term average, the differences in policy differences in China and the United States have become more prominent -China accounts for 40%of Asia (except Japan) stocks. Standard Chartered believes that this is the main promotion factor that region stocks may win the broader market globally. Standard Chartered China's offshore and shore stocks in Asia (except Japan) have been raised to "superpatients". In addition, Standard Chartered has raised British stocks to "optimistic" because it may benefit from energy, mining and finance that it may benefit from the high proportion of the high inflation industry.

For China's stock market, the above report proposes investment through hard manufacturing and renewable energy themes to increase China's "common prosperity" policy theme; adding "digital future" theme through network security sub -themes; through water resources shortage, electric electricity shortage, electric electric Car, green capital expenditure and clean technology add "climate" theme.

The reporter noticed that the Standard Chartered Bank Wealth Management Department has raised its outlook for the "essential" industry of the United States and European stock markets in the core holding industry of this report, while the "non -essential product" of the Chinese stock market has been raised. At the same time Lottery is not optimistic about the industry.

At the online communication meeting, Wang Xinjie, chief investment strategist of Standard Chartered China Wealth Management Department, said that in the context of the Federal Reserve ’s interest rate hike and the US economic recession, capital may withdraw from the United States in the future and invest in other currencies. Chinese assets are hot money. One of the candidates for international capital allocation needs is optimistic about the capital inflow of Chinese assets in the future.

Wang Xinjie believes that the support of China's policy on steady growth also requires the cooperation of fiscal policy. The most direct thing is the infrastructure and new infrastructure industries, and general business activities need time to recover. At the consumption level, new energy vehicles have a support policy for tax reduction and exemption, and look forward to more supportive policies in other consumer or service -related industries.

For bonds, the above report pointed out that in the next 12 months, the market may gradually pay attention to the downward risk of growth and create a more favorable environment for higher quality bonds. In view of the rise in recession risks, Standard Chartered has taken the developed market investment -level government bonds as hedging and raised it into a core position. Asian US dollar bonds are still optimistic, because their overall credit quality is high, and there are signs of China's further relaxation of policy support. As the rise in energy and food prices may lead to an increase in the default rate of some emerging markets, Standard Chartered has lowered the rating of emerging market US dollar government bonds to the core position.

For foreign exchange, Standard Chartered has a short-term neutral attitude towards the US dollar in the short term. In the next 6-12 months, it will be lighter to the US dollar, and it is expected that the US dollar will be topped in the second half of the year. Central banks around the world have followed the Federal Reserve and tighten monetary policy, aiming to avoid significant weakening currency and further increase in inflation — this should eventually make the US dollar pressure. In the short term, the Fed may still adopt the strongest position, and geopolitical risks may expand the demand for risk aversion assets.

Standard Chartered believes that gold is still a promising position and a variety of key investment portfolios. On the one hand, gold performed well in an environment where the US dollar weakened; on the other hand, if economic growth has slowed down or decline may occur, gold should benefit from the inflow of risk aversion funds.

For crude oil prices, Standard Chartered believes that oil prices may rise further. Due to the slow supply growth, the tightness of the idle capacity and the low inventory, it exceeded concerns about the slowdown in demand for the decline in global economic growth, and Standard Chartered maintains a bullish view of oil prices. In addition, the inventory of the US strategic oil reserve has fallen to the lowest level since 1987, and global oil inventory is still at a low level for many years.

- END -

The first highway of the "Numbers of the S still" in the country is opened to traffic

Correspondent Yang Tao Xue YongzhengRecently, Zhao (Tong) Le (Mountain) highway Qi...

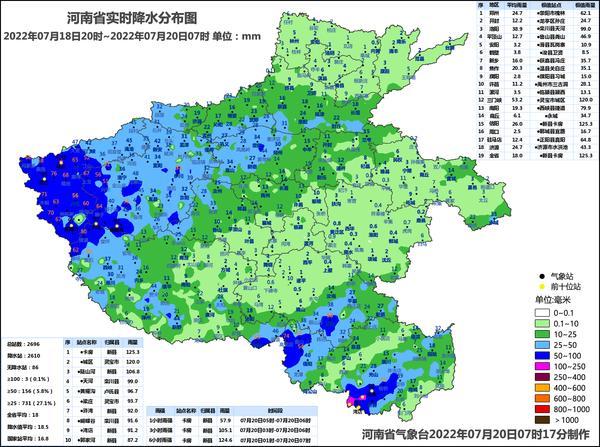

Heavy rain appeared in Sanmenxia and Xinyang!Today there are heavy rainstorms in these places

Henan Daily client reporter Li RuofanThe monitoring of the Provincial Meteorologic...