Top 12 in Henan!The latest Chinese listed companies are released from the top 500 | Extremely engraved

Author:Dahe Cai Cube Time:2022.07.13

Dahecai Cube "Extreme Carrier" No. 762

Dahecai Cube "Extreme Carrier" team reporter Xu Yan

On the evening of July 12, Fortune Chinese website released the Fortune 500 rankings of "Fortune" in 2022, considering the performance and achievements of Chinese listed companies in the world in the past year.

The annual revenue threshold for the company this year was close to 22.8 billion yuan, an increase of 31%compared with the threshold of nearly 17.4 billion yuan last year. The total operating income of the 500 listed companies on the list this year reached 6.2 trillion yuan, and the net profit reached 4.7 trillion yuan. Compared with the list of the previous year, the company's revenue and net profit on the list this year are compared with the list. Great improvement.

The top three of the list are still Sinopec, PetroChina and Chinese architecture. JD.com entered the top ten of the list for the first time, rose to 7th, and Alibaba ranked 11th. Didi, Weilai Automobile and the ideal car were on the list for the first time.

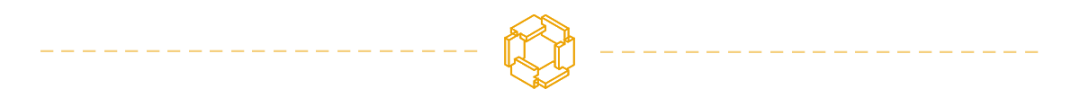

Wanzhou International, Luoyang molybdenum, Muyuan shares, Shuanghui Development, Anyang Iron and Steel, Jianye Real Estate, Shenhuo, Pingmei, Zhengmei Machinery, Yuguangjin Lead, Mingtai Aluminum, Yutong Bus On the list.

Wanzhou International Lead

12 listed companies in Henan to the list

The reporter of the Dahe Daily · Dahe Cai Cube sorted out and found that a total of 12 listed companies in Henan appeared on the 2022 "Fortune" China Fortune 500 list.

Those who led 12 Henan companies still are still Wanzhou International, ranking 71 in the country (6th from last year). In the past year, Wanzhou International's operating income was 17.6081 billion yuan, with a profit of 6.890 billion yuan.

Luoyang's molybdenum ranked second in Henan, ranking 74th in the country, an increase of 18 places from last year (92nd). Benefiting from the increase in profits of copper and cobalt business, Luoyang's molybdenum industry has become the only A -share listed company in Henan Province with a business income of more than 100 billion yuan in 2021. In 2021, the operating income of Luoyang's molybdenum industry was 173.863 billion yuan, with a profit of 5.106 billion yuan.

Wanzhou International and Luoyang molybdenum are also Henan companies that have entered the top 100 of the country.

Muyuan shares is the 174th place in the national list (ranked 204th last year), and the ranking has been greatly improved, ranking 3rd among Henan -listed companies. Although the pig breeding industry was cold in 2021, "Pig Mao" Muyuan shares still became the "king of Yu shares" for net profit of 6.904 billion yuan.

In addition, Henan listed companies on the top 500 list of China's top 500 in 2022 also developed Shuanghui, ranking 204th (151st last year); Anyang Iron and Steel, ranked 248th (last year 327); Jianye Real Estate, ranking 298th (261st); Shenhuo shares, ranking 358th; Pingmei shares, ranking 401st (last year 427); Zhengmei machine, ranking 408th (last year 383); Yu Guang Gold Lead, ranked 431st (469th last year); Mingtai Aluminum, ranked 464th; Yutong Bus, ranked 487th (436th last year).

Among them, Shenhuo and Mingtai Aluminum are new companies this year.

The total revenue of Henan companies on the list reached 757.797 billion yuan, with a total profit of 36.369 billion yuan. Although the newly listed corporate Shenhuo shares this year are relatively backward in the list, it has become the second highest net income from Henan enterprises with a net interest rate of 9.39%of the net interest rate of 9.39%.

The first three patterns are stable, JD.com's first top ten Kexing biological net asset yields have the highest yield

The first three patterns of the list this year have not changed. Ping An of China ranks fourth and is still the first of non -state -owned enterprises.

Both JD.com and Alibaba have improved. Among them, JD.com entered the top ten of the list for the first time, rose to 7th, and Alibaba ranked 11th.

The total operating income of the 500 listed companies on the list this year reached 6.2 trillion yuan, an increase of about 17.4%compared with the previous year's company; net profit reached 4.7 trillion yuan, an increase of about 9.2%over the previous year. Compared with the list of the previous year, the company's revenue and net profit on the list this year have been greatly improved. The annual revenue threshold for the company this year was close to 22.8 billion yuan, an increase of 31%compared with the threshold of nearly 17.4 billion yuan last year. Last year, China GDP exceeded 110 trillion yuan. The total revenue of 500 listed companies on the list this year reached 6.2 trillion yuan, exceeding half of China's GDP.

This year, there were 49 new listings and re -listing companies, of which Didi was on the list for the first time and ranked 75th with a total revenue of 173.8 billion yuan. Kexing Bio ranked 109th for the first time with a revenue of 125 billion yuan. In the field of new energy vehicles, Weilai Automobile and the ideal car were on the list for the first time, ranking 344th and 427th, respectively.

In terms of profitability, of the 10 most profitable companies, in addition to 6 commercial banks and insurance companies, Tencent Holdings Co., Ltd. ranked 4th in the profit list with a net profit of 224.8 billion yuan. The top ten of this year's profit list appeared in China Petroleum and COSCO Shipping Holdings Co., Ltd., ranking ninth and tenth of the sub -list. The total profit of these ten companies in last year was about 1.85 trillion yuan, accounting for about 39%of the total profit of the company, a slight decrease from previous years. In terms of net profit margin, the highest ranking is Chinese biopharmaceutical, with a net profit margin of 54%; the second place in the net profit margin list is Guizhou Maotai Wine Co., Ltd., with a net profit margin of about 48%.

This time, 49 listed companies in the Fortune 500 of "Fortune" failed to make a profit, and the total loss was about 436.3 billion yuan. Taking the loss figures showed by each company's financial report as the statistical basis, the first place in the losses is fast, with a loss of more than 78 billion yuan; Didi losses 49.3 billion yuan, ranking second in the losing list; Suning Tesco lost 43.2 billion yuan , Ranked third in the loss list. Huaxia Happiness Basic Co., Ltd., which is in debt dilemma, ranks fourth in the losses. Among all the companies on the list, the list of net asset yields (ROE) is the top of Koxing creatures. The vaccination has brought huge revenue and profits to the company in the short term. The company's ROE is close to 92%. The other two vaccine -related companies, Chongqing Zhifei Bio (58%) and China Biopharmaceutical Co., Ltd. (ROE for 48%) also appeared in the top ten of the list.

As international freight rates rose, Oriental Overseas (International) and COSCO Shipping Holdings ranked second and third in the ROE list with 74.6%and 67.1%, respectively. Last year, the 10 of the 10 companies with the ROE list accounted for 5 real estate companies. This year, no real estate company appeared in the top 40 in the ROE list; some of the reasons were that many large real estate companies delayed their annual reports for their own reasons. List.

Global economic acceleration recovery

The metal industry has the most companies on the list

From the perspective of the industry, a total of 60 companies in the metal industry have entered the list under the context of the price increase of large sects. A year -on -year increase of 1.7%. In addition, under the catalysis of the recovery and stable growth policy after the epidemic, in 2021, the total number of enterprises in the Fortune 500 list of the Fortune 500 list in 2021, with a revenue of 7.3 trillion yuan, an increase of 15%year -on -year.

The global economy accelerated after the epidemic impact was relieved in 2021. Among the top 500 list companies, in 2020, the epidemic, logistics, warehousing, tourism, hotels, ports, textiles and other industries on the list of companies on the low base +Under the recovery after the epidemic, the income increased year -on -year in 2021. In addition, the prices of commodities rose sharply under the imbalance of supply and demand, and companies such as chemical industry, oil, natural gas, and petrochemical companies also ushered in a high increase in revenue in 2021. The real estate industry has entered a downward cycle due to the strict control policy of the previous two years, and the real estate industry chain -related construction machinery, building materials and other industries have slowed down their income growth; affected by the "double reduction" policy of the education industry, the media culture and education industry The company's revenue of the list fell 4%year -on -year, and it was an industry that decreased year -on -year in the 35 industries.

In 2021, the digital economy construction continued to make efforts, and the industry maintained steady growth. The new infrastructure is an important foundation for the development of the digital economy. The current proportion is less than 10%, and the market space in the future is broad.

Responsible editor: Shi Jian | Audit: Li Zhen | Director: Wan Junwei

- END -

[Provincial Travel Development Conference] Qufu Power Supply Company: Go all out to ensure the safety and reliability of power supply supply

[Provincial Travel Development Conference] Qufu Power Supply Company: Go all out t...

Dongguan Chashan: "Source control+ecological repair" cares for a blue water and blue sky

There are mountains and water in Chashan, and the ecological environment is good. ...