The next unlucky egg is covered by the US dollar, the next unlucky egg is Argentina and Turkey

Author:Xiaoping Finance Time:2022.07.13

On the day after the year, during each round of the currency cycle, a strong US dollar withdraw the trigger, and several emerging market countries will be pulled out to "sacrifice the sky". This time, Sri Lanka has Game OVER.

Sri Lanka was the first victim who had a response to the Fed in this round of interest rate hikes. As high as 39%of inflation levels, and only 1.6 billion US dollars of foreign reserves forced it to declare bankruptcy due to "non -debt debts". However, in the context of the depreciation of exchange rates and inflation as the "main theme" of emerging markets at the moment, the "butterfly effect" brought by the Fed's interest rate hike may be manifested.

Throughout the Latin American debt crisis in 1983, the Asian financial crisis in 1997, the debt issues in Argentina in 2001, and the 2015 emerging market crisis were in the Federal Reserve's interest rate hike cycle.

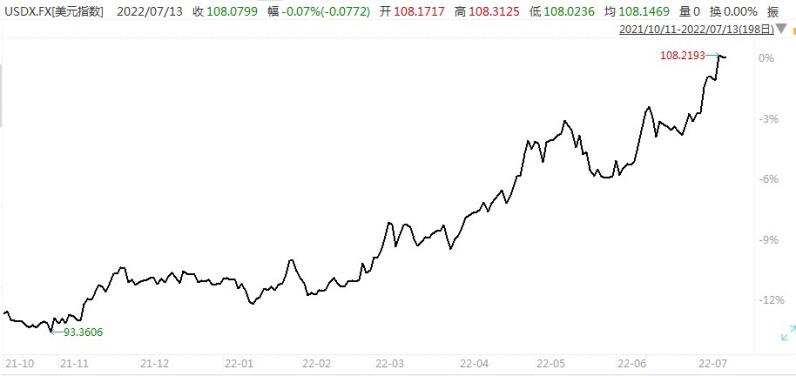

Since the beginning of this year, the trend of the US dollar is like the former virtual currency. It is like breaking bamboo. It has exceeded the high point in 2002 and has reached a maximum of 108.5. This is mainly due to the continuous interest rate hikes of the Federal Reserve. Fed Chairman Powell once said in the IMF conference on the global economy, "Federal Reserve is committed to rapid interest rate hikes to reduce inflation and suppress inflation. "".

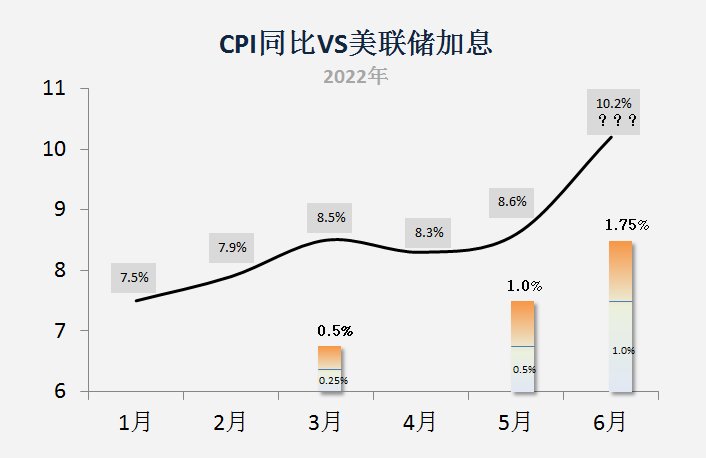

From the beginning of the year to now, the United States has risen all the way, and the year -on -year increase in CPI reached 8.6%year -on -year. The Fed also raised interest rates from March, and rose from 25bp to 50bp to 75bp each time. On July 13th, the June CPI data was announced. Everyone became a bird of surprise. It was already reported that the news in June will soar to 10.2%in June, resulting in the straight line of the three major stock indexes of the United States.

If the U.S. inflation is not well contained, it is foreseeable that the Federal Reserve's interest rate hike will not stop, and the US dollar index will have to continue to rise, which is a fatal blow for emerging market countries.

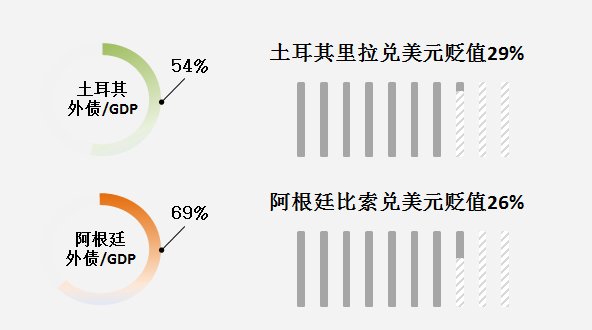

Argentina and Turkey may be the next victim of strong dollar. The depreciation of the exchange rate of Turkey and Argentina is 29%and 26%. Both countries have malignant inflation. The annualized inflation rate has been above 50%since this year. The risk of debt in emerging market countries is the highest.

On July 3, Argentina Economic Minister Martin Golzman suddenly resigned. The Argentine government immediately appointed economist Silvine Batakis. Three years ago, Argentina had had debt defaults, and then asked IMF for help. It had reorganized $ 65 billion in foreign debt, which was equivalent to 170%of the total product value of the year at that time. With the repeated epidemic in recent years, Argentina's economy has become deeper and deeper. In April this year, Argentina announced that it would not repay any debt in the next three years.

Turkey is not much better. On July 9, the international credit rating agency was well -down from Turkey's credit rating from B+to B, and confirmed that its economic prospects were "negative". Fitch said that the reason for this decision was the rising inflation of the country and concerns about its economic prospects.

- END -

Liyuan Street explores the "four one" model of social governance

Since the beginning of this year, Liyuan Street in Kuiwen District has promoted the work of grass -roots governance in accordance with the four one work ideas, and the social governance level has co

Little Fiction | He Jing: Niu La Drum

Text/He JingXi Rong is coming back! The news was passed on ten or ten, and the whole Xiyang Village knew it. The young and middle -aged young people in the village do not know who is fine Rong, but