Twelve pictures of the "Aesthetic" of the Northern Fund to understand!

Author:China Economic Network Time:2022.07.13

Since the opening of the Shanghai -Hong Kong Stock Connect in 2014, the Shenzhen -Hong Kong Stock Connect was opened in 2016, and the sources of funds in the north have continued to flow into A shares.

The first is to bring in -depth A -share value investment concepts: choose high -quality companies (profitability), buy (reasonable valuation) at reasonable prices, and share the value of company value (growth potential).

The second is to be labeled with the "Big Blue Chip" and become the "prophet duck" of the big blue chip market.

As everyone knows, under the change of the times, the "preferences" of funds in the north are also turning to the star ...

01

The "buy and buy" north funds is a belief in A shares. Since April of this year, the overseas market has shocked, and the funds in the north have "bought and buy". A shares have become a global "shelter", and they have also come out of the "independent market". Economic recovery is our foundation, and the liquidity is loose is our background. In addition, from the perspective of the entry rhythm of funds in the north, it has shown the "grabbing" model of running. The net purchase amount has soared from 6.3 billion yuan in April to 73 billion yuan in June, an increase of more than 10 times.

02

"What to buy" in the north, what are you "selling"? From the perspective of this year's monthly movement, it can be divided into the following categories: first, the banks that are continuously favored, there are low valuation banks, and there are high -profile power equipment; the other is to return to Xinhuan, including medicine, creature and food and beverages (6 Monthly counterattack, from large sales to large buying); Third, it becomes old love, mainly colored (large buying from January-March, but selling sharply in May to June); fourth, it is continued to be abandoned, Mainly steel.

03

Looking at the perspective, the TOP10 industry is purchased from the Northern Global Capital: From blue chips to track. In 2019, banks, home appliances, and pharmaceuticals ranked in the first three seats for foreign investment; The core color metal also appeared on the TOP10 list; in addition, the beauty of medical beauty also emerged, becoming a fragrant citron for funds in the north.

04

Bei Shang Fund Press: The power equipment snatched the head of the food and beverages. At the end of 2019, food and beverages were still the "heart love" of funds north, and the market value of positions accounted for 19%. However, when the situation moved, the vicissitudes of the sea. In the middle of 2022, the market value of the positioning of power equipment accounted for from 2%to 17%, resisting the food and beverages. It can be seen that funds have no eternal labels, and what is unchanged is the pursuit of good assets.

05

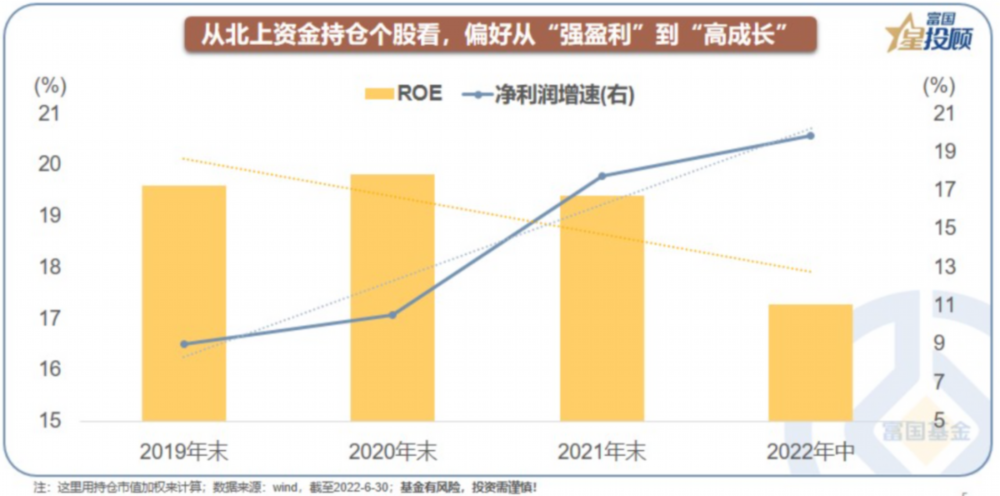

The configuration preferences of the north to the north, from "strong profit" to "high growth". A set of obvious data, since 2019, the ROE trend of the capital holding of funds northward, and the growth rate of net profit has risen. That is to say, for the funds on the north, the certainty has gradually greeted the growth, and behind this is also the waves of the times of Beta.

06

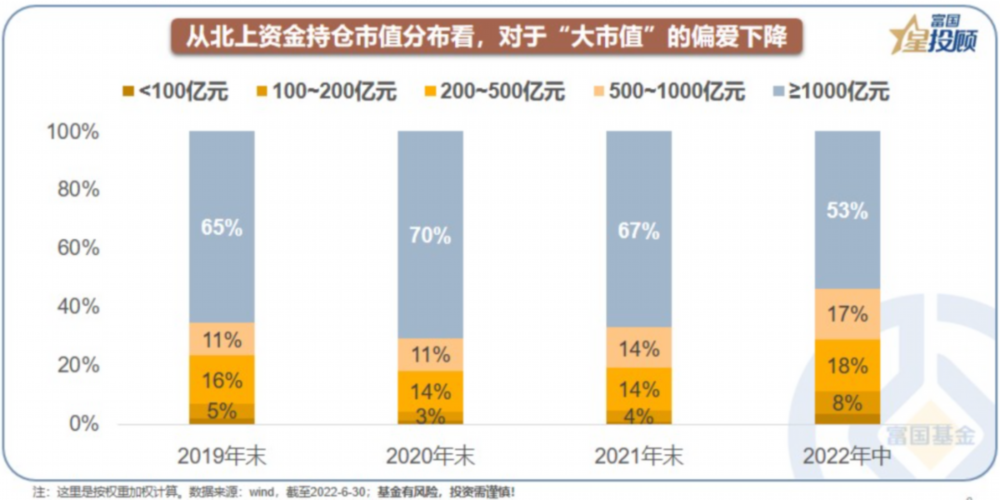

The preference for big tickets on big funds has declined and no longer "beautiful". Under the impact of the new crown "Black Swan" in 2020, the funds in the north are still more willing to embrace the big white horse with the moat, and the proportion of more than 100 billion market value companies still rise. However, since 2021, as the impact has gradually declined, the proportion of allocation of over 100 billion market value companies has dropped significantly by 17 percentage points. The consecration light of the "beauty contest" has begun to spread to companies below 100 billion.

07

The extreme differentiation still exists: in this era, what is missing is not money, and the lack of good assets. Among the capital holding of the north, the top 1%of the stock accounts for 40%+position value, and the top 10%of the stock accounts for 80%+positioning market value. The extreme differentiation also confirms that sentence, "Because of scarcity, it is precious."

08

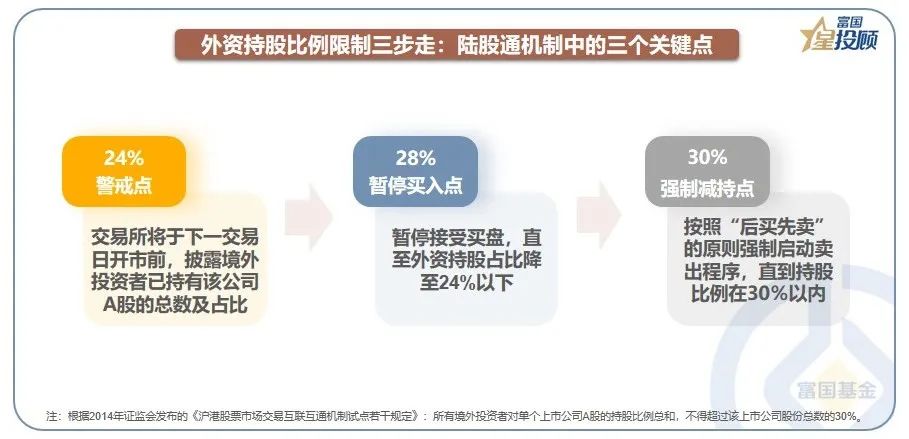

So what is the true love of foreign capital? It must be the company of "top grid". In fact, since the opening of the interconnection, foreign -funded "buying and buying" is not unsatisfactory, but is limited by the "three red lines". Specifically, one is 24%of the warning line, the second is to suspend the purchase of 28%, and the third is to enforce the holding line by 30%. According to statistics, there are 15 companies that have been warned since this year, and 17 in 2021, while only 8 and 3 in 2020 and 2019, respectively.

09

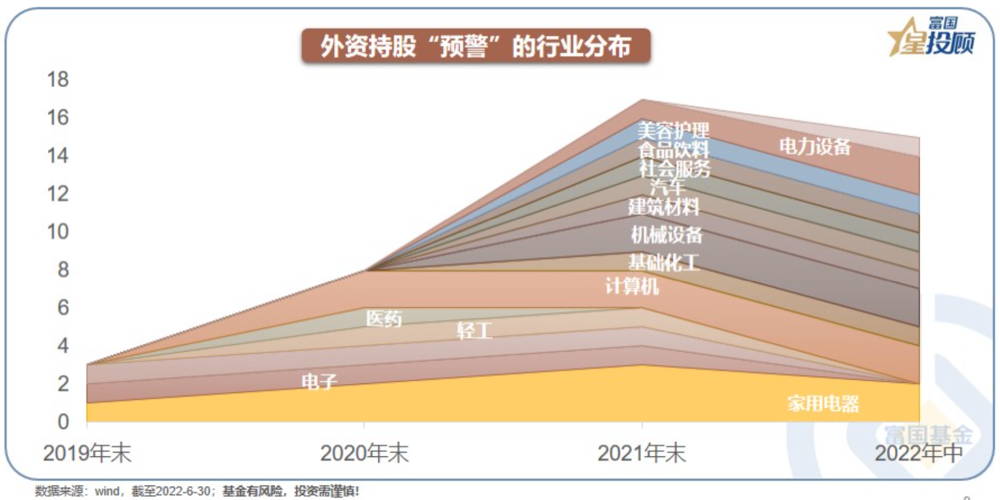

Foreign -owned "warning" company characteristics 1: fishing in more waters. From the perspective of the industry, since 2019, the "warning" industry has become increasingly diversified, and it has covered many fields such as new energy, medical beauty, social uniforms, automotive, building materials, machinery, chemicals, computers, and other fields. This also reflects that foreign capital has gradually expanded its capacity circle, and in more segmentation tracks, Alpha is deeply excavated.

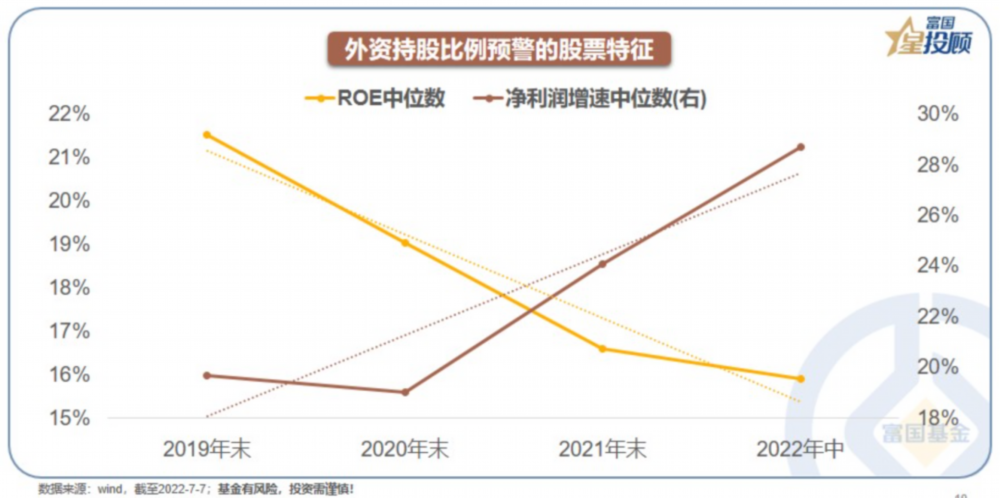

10

Foreign -owned "warning" company characteristics 2: Growth is more important than certainty. Similar to the characteristics of the capital holding of funds in the north, it is also the downward trend of the ROE. From the end of 2019 to the middle of 2022, the median ROE has decreased from 22%to 16%; and the median net profit growth rate rose from 20%to 29%.

11

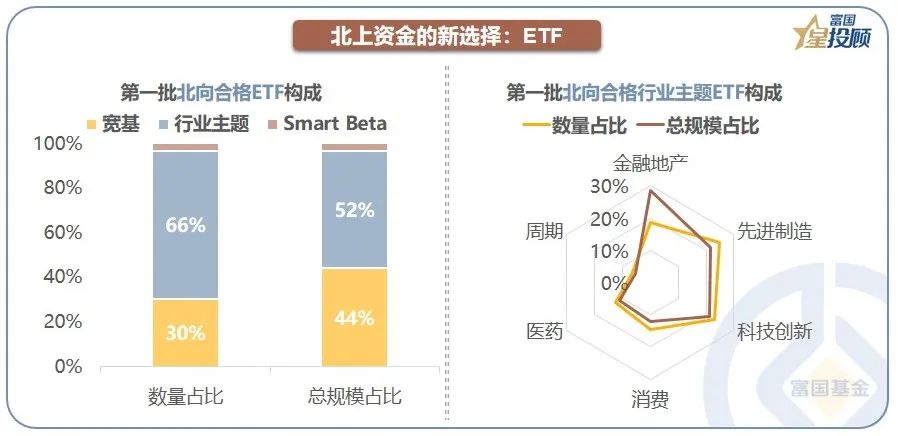

In addition to buying the company directly, the funds north also have a new choice: industry ETF. On July 4 this year, ETF was officially included in the interconnection. From the perspective of the first batch of qualified ETFs in the north to pass, the industry theme was mostly, and the number accounted for 66%, and the scale also accounted for half of the sky. Among them, the three major themes of financial real estate, advanced manufacturing and technological innovation account for about 70%, which is a cockpit stone.

12

The north -go funds layout interconnect and interconnected ETF, just as the road to "buy A shares" can be reached thousands of miles.From the perspective of the turnover of the eTF turnover on July 4, the proportion of Shanghai and Shenzhen Stocks accounted for less than 1%.However, after the opening of the Land Stock Connect, the proportion of the turnover of the capital in the north in A shares also gradually increased from less than 1%in the early days to about 12%, becoming an important force for A shares.It is believed that over time, the funds on the north will also become the "new forces" of ETF.

- END -

Do you believe it?There is a sea of rapeseed!

Speaking of NaquWhat everyone thinks of the first time isBlue lakes and green gras...

Huang Zhiwei, former deputy director of the Standing Committee of Yichun Municipal People's Congress, was subject to disciplinary review and supervision investigation

Huang Zhiwei, former deputy director of the Standing Committee of Yichun Municipal...