The five major questions about the five major questions of the Henan Village Bank case are about to be opened.

Author:Jinan Times Time:2022.07.13

These village banks have reached the step that cannot be withdrawn to withdrawal. In fact, it is accompanied by a long "quantity change" process, and there is no lack of "warning".

With various attention, the Henan Village Banking Cases ushered in major progress. The Henan Banking Regulatory Bureau and the Henan Provincial Local Financial Supervision Bureau issued an announcement on the 11th: the category of the category of the category of the category of the category of the category of the category of the category of the category of the accounting of the new people's livelihood village and the town bank, the Shangcai Huimin Village Bank, the Huanghuai Village Bank, and Kaifeng New Oriental Village Bank Carry out advancement.

The announcement is clear: the first batch of mats on July 15th, the cushion target is customers with a single person's single merger of 50,000 yuan (inclusive). If the single -person consolidation amount of a single institution is more than 50,000 yuan, the paid will be paid one after another, and the paid arrangements will be announced separately.

This means that some people involved in the amount of less than 50,000 yuan are expected to get a cushion, which also marks the substantial step of the aftermath of the case.

However, from the perspective of public information, Henan Village Bank's "difficulty in withdrawing" incident still has some key questions to be clarified.

Is "deposit" or "financial product"?

On July 10, the Xuchang City Public Security Bureau of Henan Province reported that a group of criminal suspects were arrested. Among them, such a key expression has made the outside world pay special attention:

Since 2011, the criminal gang headed by the suspect Lu Yi's criminal Lu Yi has passed the self -employment platform and a batch of funds developed by Junzheng Zhida Technology Co., Ltd., a third -party Internet financial platform and the establishment of the criminal gang. Customers carry out storage and marketing financial products ...

This should be the first time that the way the bank involved in attracting funds to the banks is the first time that the banks involved in attracting money and selling financial products. Among them, whether the "financial product" is deposit is related to different rights protection.

Because the nature of the absorbing amount is "deposit", it is protected by the "deposit insurance regulations" -deposit insurance implements a limited amount of payment, and the maximum payment limit is RMB 500,000. If the nature of the money is characterized as a "financial product", the uncertainty of subsequent rights and interests is much greater. In this announcement announcement, it is also pointed out that "do not pay for high interest rates or funds suspected of illegal and criminal funds for additional channels." Is the "additional channel acquisition of high interest rates" here is "financial products"? In this regard, we may need to make more detailed response explanations to the society in a timely manner.

What should be responsible for the third -party Internet financial platform?

As shown in the above Xuchang Public Security, Henan New Fortune Group has used the third -party Internet financial platform in the process of attracting funds. What responsibilities do these platforms have to be held? There is still no relevant authoritative news.

According to media reports, many of the village and town banks involved in the village and towns are from other places. Many of them save money to the village banks involved through third -party platforms. Inside, the media mentioned by the media are Xiaoman and Xiaomi Financial and many other platforms.

These platforms have played a role of credit endorsement in the process of grabbing reserve in Henan Village Bank, which are not famous. Otherwise, it seems difficult to explain that several villages and towns in Henan can absorb tens of billions of funds from many places across the country in a short time.

Therefore, in the case of a third -party platform in the Henan Village Bank case, what role does it play, what responsibilities should we bear, and the relevant departments have been involved in the investigation? It is also advisable to disclose relevant information to the society in time.

Can the online trading system be investigated together?

The incident has been exposed for nearly three months, and the relevant departments have announced that it has been involved in the investigation for several months. However, in the process, the public found that the villages and towns, which were originally at the cusp of the wind, still "moved".

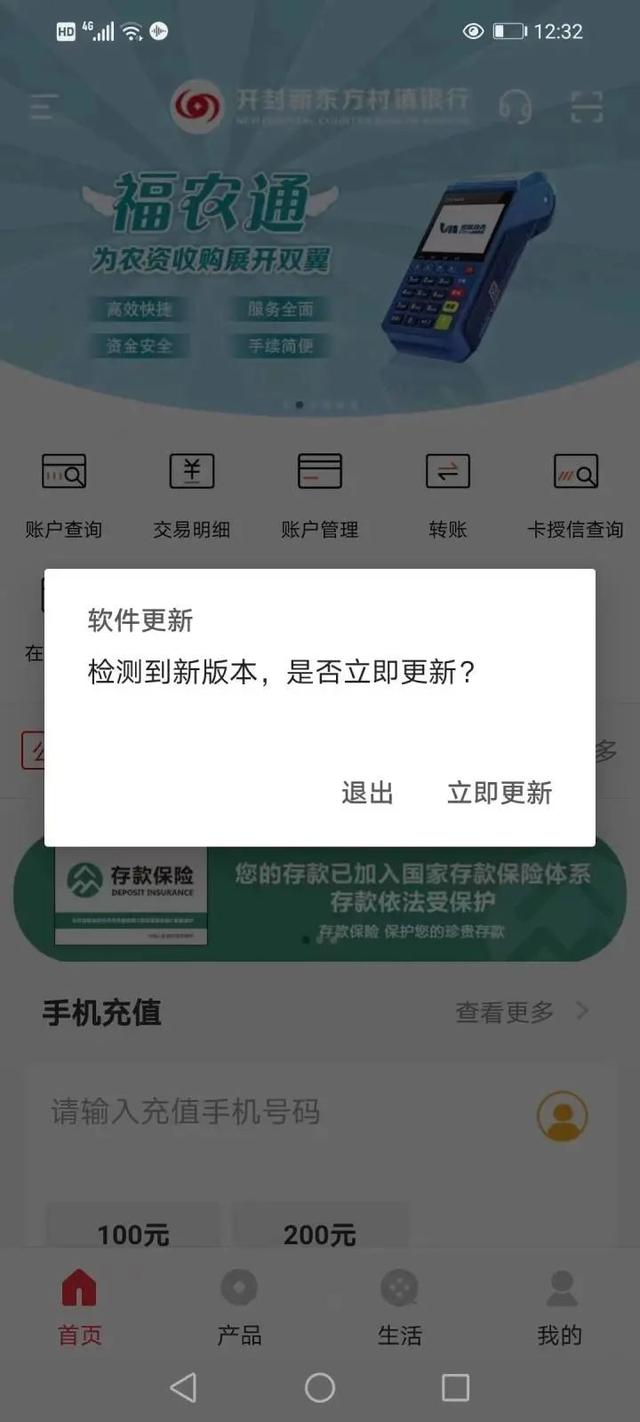

First, on June 26, some reserved households found that Kaifeng New Oriental Village Bank, which was closed before the online trading system, briefly opened the "ten minutes" online transactions. In response, the bank involved responded that the situation was abnormal in individual operating permissions for mobile banking. On July 7th, there was a storage household that broke the news: "Kaifeng New Oriental Village Bank APP is compulsory update system version. The new version has no channel for withdrawal and transfer."

Picture based on Tianmu News

In this regard, the bank staff involved said: "Our Android version of the mobile phone bank is upgraded. This upgrade is forced to upgrade. The unbound version will not be able to use the function of the mobile banking. This button can be visible but cannot be withdrawn. The Apple version is expected to be upgraded next week.) If the online business recovers, the withdrawal button will be used normally. "

These two incidents should also be included in the scope of the incident.

The health code becomes red twice, how can the loopholes be completely solved?

On June 22, Zhengzhou notified some villages and towns' banks to be investigated and accountable for the red code incident. According to the notification at that time, a total of more than 1,000 villages and towns banks were given a red code, which was an illegal operation. The investigation accountability notification is also very clear about the qualitative of related behaviors: the awareness of the rule of law and the awareness of the rules is weak; seriously damage the seriousness of the health code management provisions, causing serious adverse social impacts, which is a typical chaos.

After more than ten days, the Zhengzhou Big Data Administration issued the situation on the 8th stating that on the evening of July 7, the Zhengzhou Big Data Administration had technical problems during the upgrade of the data interface of the health code system, resulting in some abnormal health code abnormalities After emergency response, it has been returned to normal at 8 o'clock on July 8.

The data interface of the health code system is upgraded. How to ensure the seriousness of health code management also requires a more thorough answer and processing. In any case, the vulnerability of "random red code" should be completely resolved. Illegal and illegal operations lasted for more than ten years. Where is the core issue?

According to the notification of the Xuchang City Public Security Bureau on June 18, Henan New Wealth Group Investment Holdings Co., Ltd. has been suspected of using village and township banks to implement a series of serious crimes since 2011.

In other words, the illegal and even illegal operations of village banks involved have lasted for more than ten years. Why did you find it in time under the bottom line of the regulations?

According to the Sanlian Life Weekly recently reported that in recent years, village and towns involved in the incident have repeatedly lended loans. For example, Yuzhou New Minsheng Bank has repeatedly lended loans due to illegal loans such as lending and pre -loan investigation, which has caused administrative penalties. In addition, people familiar with the matter said that the village banks have a very serious asset rate, and they are even predicted about 5 years ago -sooner or later.

Based on the above information, it can be seen that these village banks have reached the step to withdraw money, which is actually accompanied by a long period of "quantitative change", and there is no lack of "early warning". It can be assumed that if the supervisory force can be valued as soon as possible, there should be a lot of opportunities to avoid the ending of today. Therefore, the question behind it should not be avoided.

From the perspective of which perspective, the Henan Village Bank incident is regrettable. At this time, only on the basis of clarifying the truth and thorough investigation, help customers try to get back their own legitimate rights and interests. In the process, relevant aspects should also pay attention to communication, respond to the demands and questions of customers and public opinion in a timely manner, and avoid causing new trust loss and contradictions. I hope that the upcoming cushion can really become a good start.

It should be pointed out that village banks have now become the "small bank" with the largest number of institutions, the smallest single size, the most basic level of the unit, and the most prominent supporting customers, and the most prominent supporting farmers' small characteristics are of great significance to meet the financial demand in rural areas. It is not possible to lose confidence in the development of the entire village banking system because of the "difficulty of withdrawal" of several village and township banks in Henan this time. Of course, some of the problems exposed are indeed worthy of the entire industry mirror.

(Red Star News)

Edit: Zhao Shanshan

- END -

From today, the 16 bus lines in Linyi are temporarily adjusted, please pay attention to travel

The construction of urban road supply drainage project projects due to Tongda Road...

National Health and Health Commission: 77 cases of cure and discharge of new cure for new cure for new cure for new cure for new crown pneumonia on June 26

Xinhua News Agency, Beijing, June 27th. The National Health and Health Committee r...