Get a bumpy way?The new helm of Ziguang Group has led more semiconductor mergers and acquisitions

Author:Daily Economic News Time:2022.07.12

On July 11, Semiconductor Star Company Ziguang Group Co., Ltd. (hereinafter referred to as Ziguang Group) released news that the company's equity and new directors, supervisors, and general managers had completed the registration procedures for the company's equity and new directors, supervisors, and general managers on the same day.

From the reorganization plan was opposed by the former chairman, to the exit of the original shareholders Tsinghua Holdings Co., Ltd. and Beijing Jiankun Investment Group Co., Ltd., the road of Ziguang Group, which lasted for one year and 8 months Filling. After the reorganization, Ziguang Group's company also had different degrees of personnel changes, causing the industry to worry about the loss of talents.

However, Li Bin, the chairman of Ziguang Group, is the "acquaintance" of the semiconductor capital market. It not only dominates the cross -border mergers and acquisitions investment and post -investment management of more than 10 billion yuan in large semiconductor and core technology industries. Upstream and downstream companies are chairman.

As of now, Ziguang Group has not disclosed the post -reorganization direction and business arrangements. Where the new journey of Ziguang Group and its subsidiaries will be attracted to the market's attention.

100 billion reorganizations and reorganizations

On July 11, the reporter of "Daily Economic News" learned from the relevant persons close to the battle investment party that on the afternoon of July 11, the manager of Ziguang Group had held a handover meeting with Zhilu Jianguang. The chapters and business management affairs were fully transferred. Ziguang Group also sent an email notice to all creditors to inform the creditors that the creditors would pay the remaining cash claims in full on July 12. Essence

At the same time, on the evening of July 11, 2022, the two "Ziguang" listed companies issued an announcement saying that Ziguang Group has completed the registration procedures for industrial and commercial changes, and its 100%equity has been registered under the name of Zhiguang core. Pay the account of this equity change of 54.9 billion yuan to the administrator of Ziguang Group, and change to the indirect controlling shareholder of listed companies. Due to the no controlling shareholder and the actual controller of Zhiguangxin, the actual controller of the listed company was changed from the Ministry of Education as an unreal controller.

Photo source: Shiguang Guowei Announcement Screenshot

The above -mentioned relevant persons said that the successful completion of Ziguang Group's equity marked the work of the judicial reorganization implementation stage. However, looking back at the experience of more than this year, the road of Ziguang Group's reorganization is not completely smooth.

In November 2020, a serious debt crisis broke out in Ziguang Group. In July 2021, the Beijing Intermediate People's Court ruled that Ziguang Group entered the judicial reorganization in accordance with the law of creditors. According to previous disclosure data, as of November 30, 2021, the total debt of Ziguang Group and other debt of Ziguang Group, which was preliminarily reviewed by the manager, reached 144.782 billion yuan.

On December 13, 2021, the manager and Zhilu Jianguang officially signed an investment agreement and announced the reorganization plan. Shortly after that, Zhao Weiguo, then chairman of Ziguang Group, and Jiankun Group, which holds the shareholding Ziguang Group, publicly opposed the reorganization plan, thinking that Ziguang Group was a liquidity issue, and questioned the loss of reorganization.

The managers of Ziguang Group immediately responded, saying that Jiankun Group and Zhao Weiguo's personal dissemination of false remarks in an attempt to interfere with and affect the process of judicial reorganization of Ziguang Group; they believe that Zhao Weiguo has frequently carried out the domestic and foreign mergers and acquisitions expansion through huge amounts of financing, which caused the liability scale to be over. Large, coupled with poor management and management, eventually appeared in debt crisis.

After a "bullet" for a while, the stalemate did not last too long. The Jiankun Group finally dropped the reorganization plan at the second creditors meeting on December 29, 2021. The administrator of Ziguang Group also voiced again in the above -mentioned meeting, saying that there was no problem that deliberately lowered the valuation and caused the loss of state -owned assets.

The progress of reorganization has been much more smooth. On January 14 this year, the Beijing First Intermediate People's Court ruled that the reorganization plan was approved and the reorganization procedure was terminated, and the implementation stage began. According to the reorganization plan, the period of reorganization is 6 months, from January 14 to July 14, 2022. According to the above -mentioned relevant persons, on March 31st this year, strategic investors intend to invest in reorganization to settle 60 billion yuan in cash for debts; on April 15th, the debt debt owner paid the first phase of the debt interest interest; 6 On the 30th, the distribution of debt -to -debt stocks to creditors was completed on the 30th.

Purple light personnel changes

After the reorganization, Zhao Weiguo has no figure in the management of Ziguang Group.

According to the information of Ziguang Group's official website, the board of directors of Ziguang Group is currently composed of four directors such as chairman Li Bin and Xia Xiaoyu. As for the management of Zhiguangxin, the company currently has seven members of the board of directors, of which chairman Li Bin, director Xia Xiaoyu and Hu Donghui are jointly appointed by shareholders Guangzhou Shengyue, Wuhu Zhi'an, Wuhu Xinhou and Zhiguangchang; Shao Jianjun was appointed by Jianguang Guangming; director Chen Jie was appointed by Zhuhai Zhiguanghua; Director Yu Long was appointed by Hebei United Electronics.

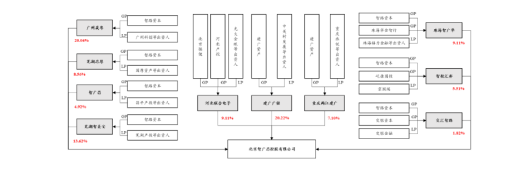

As for the Zhiguang core of the equity, according to the announcement of the listed company, the shareholders of the general partners and the shareholders of the executive affairs were separated by Zhilu Capital, including Guangzhou Shengyue, Wuhu Zhi Mei'an, Wuhu Xinhou and Zhiguangchang. The shareholders 'shareholding ratio is 47.13%; the shareholders of Jianguang Assets as ordinary partners and partners of executive affairs include Jianguang Guangming and Chongqing Liangjiang Jianguang. The shareholders' shareholding ratio is 27.32%.

Picture source: announcement screenshot

Share capital with other companies as ordinary partners, and either parties cannot be unilaterally controlled or jointly controlled, including Zhuhai Zhiguanghua, Zhijunhui, and intertwined Zhilu. %. The shareholders of Hebei Industry Investment as ordinary partners and executive partners are Hebei United Electronics, which holds 9.11%of the shareholders. In this regard, Minsheng Securities Analyst Ma Tianyu released an analysis on July 12 that the decentralized equity institutions of Zhiguangxin are similar to international technology companies such as Microsoft and Apple, which is conducive to the future development of Ziguang Group to attract more resources.

It is worth mentioning that according to the official website of Ziguang Group, Li Bin, who is the chairman of Zhiguangxin and Ziguang Group, has led more than 10 billion yuan of large -scale semiconductors and core technology industries for cross -border mergers and acquisitions investment and investment. Management, he has also been a SMIC, and is currently a number of corporate executives.

Among the several companies who are chairman, Laosheng Technology Co., Ltd. is a mobile communication chip design enterprise; Ruineng Semiconductor Technology Co., Ltd. mainly attack semiconductor power devices; United Technology is a semiconductor semiconductor seal testing enterprise. Among them, Ruineng Semiconductor Technology Co., Ltd. submitted an IPO application to the Shanghai Stock Exchange in August 2020 and intends to be listed on the Science and Technology Board; but in June 2021, the application materials were withdrawn.

As early as last year's reorganization plan disclosed, analysts proposed in an interview with the reporter of the Daily Economic News that they were concerned about the loss of talents in the future of Ziguang Group. After the reorganization, Ziguang Group's company also had different degrees of personnel changes.

Specifically, in August last year, Ziguang Guowei (SZ002049, a stock price of 200.7 yuan, and a market value of 121.8 billion yuan) issued an announcement saying that the board of directors received a written resignation report submitted by Director Diao Shijing on August 20. Consissed any position of the company.

On February 11 this year, the legal representative and chairman of the 5G communication chip company Ziguang Zhanrui (Shanghai) Technology Co., Ltd. (hereinafter referred to as Ziguang Zhanrui), a 5G communication chip company, changed from Zhao Weiguo to Wu Shengwu. In the same month, Ziguang Zhanrui disclosed that Chu Qing no longer served as the company's chief executive officer and appointed CEO of the company.

Judging from the performance alone, Chu Qing is a "hero" of Ziguang Zhanrui. He joined Ziguang Zhanrui in 2018. In 2019, Chu Qing sorted out three business directions for Ziguang Zhanrui in an interview with the media: consumer electronics, industrial electronics , Pan -connected. In January of this year, Ziguang Zhanrui handed over a good performance. In 2021, revenue achieved 11.7 billion yuan, an increase of 78%year -on -year, consumer electronics business revenue increased by more than 60%year -on -year, and industrial electronics revenue increased by more than 120%year -on -year.

Daily Economic News

- END -

Night Reading | Ying Cry Preface · Chinese Dream

Yingxing Preface · Chinese Dreamwich/Shi Zhifeng is difficult to think of the sta...

What does the itinerary "picking the stars" mean?Will the threshold of inter -provincial flow be reduced?Expert interpretation

Today, the communication stroke card officially canceled the Star mark.On June 29,...