Investigation Report of the KPMV Securities Industry: In 2021, revenue and net profit achieved a double -digit increase of 40 securities firms. IT investment of more than 200 million yuan

Author:Economic Observer Time:2022.07.12

Image source: Tuwa Creative

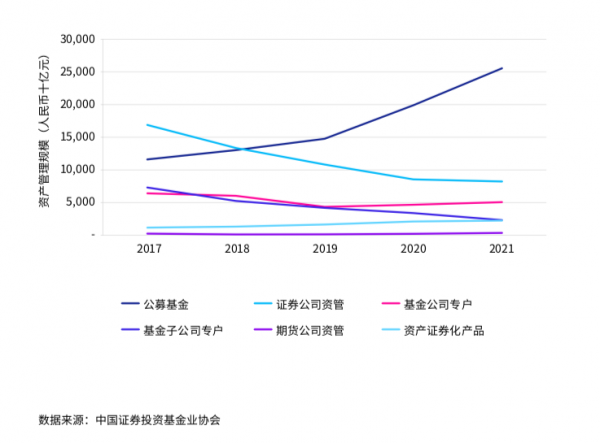

Economic Observation Network reporter Li Xiaodan's new regulations for the transition period, and the asset management industry has entered a new stage of public offering and net worth. The "2022 China Securities Industry Investigation Report" released by KPMA shows that the scale of integrated asset management represented by active management in 2021 has increased significantly, and the scale of single asset management that has been greatly affected by the "de -passage" policy has continued to shrink. As of the end of 2021, the total asset management business of the securities company totaling RMB 8235.2 billion, a decrease of 4% from the same period in 2020. However, the net income of the annual asset management business in 2021 continued to maintain steadily, an increase of 6% to RMB 31.5 billion from the previous year to RMB 31.5 billion. Yuan.

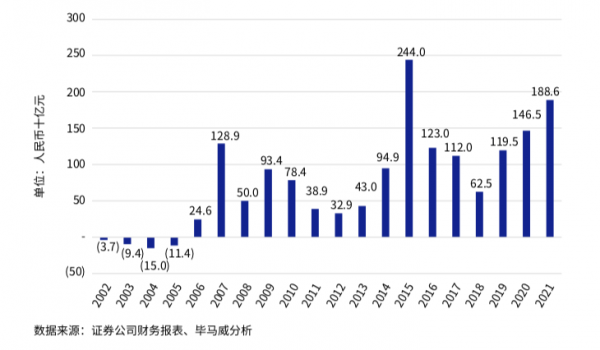

In 2021, operating income and net profit of the ponds in 2021 were RMB 501.1 billion and RMB 188.6 billion (the caliber of the parent company's financial statements), which increased by 12%and 29%from 2020, respectively. The report summarized and analyzed the annual report data released by the 140 securities companies announced by the China Securities Industry Association, and the income of various business lines of securities companies increased compared with the previous year.

Figure 1: Net profit realized by China Securities Corporation over the years

2021 is the last year of the transition period of the new regulations of asset management. The overall scale of public fund business and fund company special account business has continued to rise. Continuous optimization; benefiting from the continuous accumulation and investment demand of residents' wealth, the total scale of public funds will be reached high.

Figure 2: From 2017 to the end of 2021

According to data from the China Securities Investment Fund Industry Association, as of the end of 2021, the total scale of public fund business was RMB 29%, an increase of 29%from the same period of 2020. As of the end of 2021, the total asset management business scale of the securities company totaling RMB 8235.2 billion, a decrease of 4%from the same period of 2020: Among them, the scale of the scale of the asset management plan was RMB 3648 billion, an increase of 75%from the same period in 2020; a single asset management plan; a single asset management plan RMB 4037.3 billion, a year -on -year decrease of 32%. According to the report, this shows that under the requirements of "de -passage", the securities company's asset management has continuously improved active management capabilities and accelerated the optimization of asset management business structure.

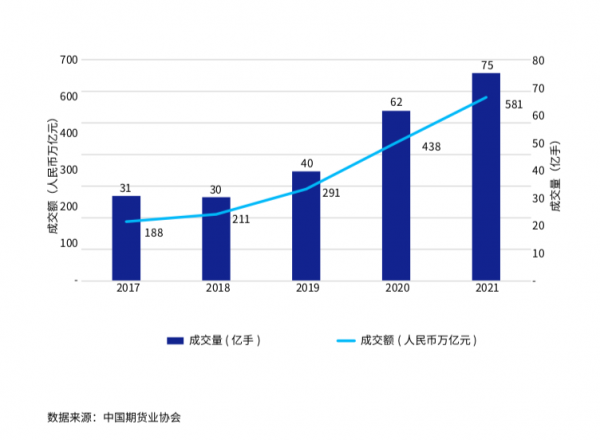

In 2021, the price of commodities fluctuated violently, and the demand for risk management products increased sharply. The scale of the domestic futures market transactions hit a record high. The domestic exchanges option futures transactions increased from 87 to 94 in 2021, and the market further diversified. The Guangzhou Futures Exchange was officially unveiled in April 2021, marking the official establishment of the fifth domestic futures exchange. As of May 2022, the Guangzhou Futures Exchange has been listed on 16 periods of goods, including carbon emission rights.

Figure 3: From 2017 to 2021, futures transaction status

In addition, the overall volume of domestic stock index futures in 2021 declined, and the specific manifestations were: 2021 stock index futures trading volume of 66.74 million hands year -on -year decreased by 10%year -on -year. The decline in the stock index futures market is mainly due to the decline in the trading volume of the China C Securities 500 Index. In 2021, due to the continuous fermentation of the epidemic, the risk of inflation gradually risen, the tightening of the global central bank's monetary policy, the geopolitical risks intensified, the market investment sentiment was cautious. In 2021, the CSI 300 Index and the CSI 500 Index were relatively high compared to 2020, so the turnover was stable compared with last year. In 2021, the annual turnover of the stock index futures was RMB 90 trillion, a year -on -year increase of 2%.

Zhang Chudong, the leader of the KPMG China financial service industry, believes that the securities industry has gone through a key year: the reform of the registration system continues to advance, the Beijing Stock Exchange's market is open, the market is open to deepen, the industry access is further relaxed, the securities industry adheres to service The development of the real economy and wealth management is to actively give play to the core hub of the capital market, and continue to help accelerate the construction of a high -level and double -cycle new pattern.

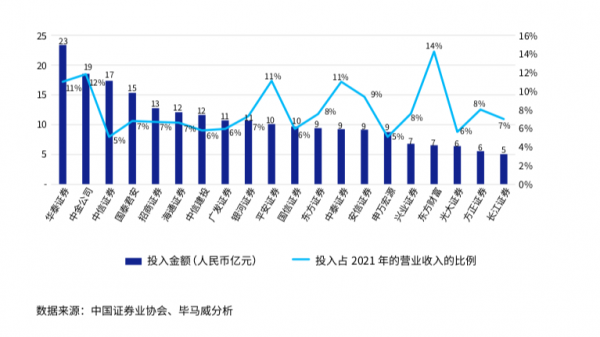

The report also pointed out that increasing investment in information technology, empowering business with fintech technology, and promoting business development with scientific and technological progress have become an important means for various securities firms to improve their competitiveness. According to the ranking of 2021 securities companies released by the China Securities Industry Association, the amount of information technology in the industry in 2021 was as high as RMB 33.8 billion, an increase of 29%year -on -year. There are 40 brokers who have invested more than RMB 200 million, and a total of 10 brokers who have invested more than RMB 1 billion. Compared with last year's IT investment amount, the top fifteen brokers in the investment are relatively stable, basically in the upward trend. Only a few brokerage firms decreased year -on -year, and some brokerage companies ranked rapidly. Most of the brokers who have invested IT are head securities firms, and small and medium -sized securities firms have relatively small IT investment. It can be seen that large securities firms can use the differentiated advantages brought by fintech, and seek rapid development by vigorously carrying out technological empowerment business and creating digital fintech platforms.

Figure 4: In 2021, the investment of the Securities Company in the previous 20 of the IT investment "Financial technology and digitalization will become the core driving force for the next strategic cycle of the securities industry. Business development, continuous deepening of asset allocation capabilities, and scientific and technological supervision to help business development. "Zheng Hao, the partner of the KPMG China Securities and Fund Consultation, believes that the application of advanced fintech and new digitalization concepts to the traditional business and management of securities firms. To better respond to the needs of various types of investors for industry service capabilities, it will become the decisive factor in whether the securities industry can develop steadily in the market in the future, and has long promoted the change of business and management models in the securities field for a long time.

As the forefront of economic and financial opening up, the capital market continues to speed up with the internationalization process, and the two -way opening of the capital market has continued to deepen. Liao Runbang, the owner of the Securities and Fund in KPMA Pacific, said that as the most important professional institution in the capital market, securities companies are constantly clarified by the two -way policy guidance of "going global" and "introduction". As an important participating entity in the capital market, Chinese and foreign institutions should firmly seize the strategic opportunities formed by the high -level two -way opening pattern of the capital market to accelerate. On the one hand, domestic securities companies actively explore cross -border businesses and make internationalization into the next one. One of the important growth engines of the strategic cycle; on the other hand, foreign securities firms accelerate the layout in China, enrich the main level of the market, and further stimulate market vitality.

- END -

Lanzhou, Gansu: From the 11th, the city's public places have been implemented for a week of temporary management and control measures

A notice on the implementation of temporary management and control measures in public places in the cityIn order to further reduce the flow of personnel, reduce the risk of cross -infection, and striv

In 2022, the Yinling Lecture Plan plans to recruit 5,000 lecture teachers

The reporter learned from the Ministry of Education on July 12 that the General Of...