Today, 1 euro = 1 dollar, for the first time in the past 20 years!Gold also plummeted, what happened?

Author:Daily Economic News Time:2022.07.12

draw! The euro is "expensive" over the US dollar, and the general cognition of market players in the past 20 years is being subverted.

At about 17:00 on July 12, Beijing time, the euro hit the US dollar at a time and even fell below the parity (that is, 1 euro against 1 US dollars). Seeing this last time, it was dating back to December 2002.

As of press time, the euro exchange rate against the US dollar

Due to energy supply problems, the expectations of economic recession have stressed that the economic decline in the euro zone has recently fallen violently. After the beginning of the year's maintenance of "Nord Stream 1" this Monday, the decline of the euro began to accelerate.

There are many opinions that falling to parity may be just the beginning of the euro. Lee Hardman, a exchange rate analyst at Mitsubishi Daily Financial Group, pointed out in a commentary email sent to the reporter of "Daily Economic News" that once the euro fell below the price of the US dollar, the weakness of the euro may even accelerate. And open channels for the euro against the US dollar between 0.9500 ~ 1.0000. "

It is worth mentioning that the US dollar index officially broke through the 108 mark, a new high since October 2002. Over the past year, the US dollar has risen by 18%on a basket of currencies, and technical indicators show that its rise may continue. Under the heavy pressure, the golden gold at the beginning of the year has finally been unable to support it. Recently, the international gold price has rapidly fell below the 1,800 US dollars. As of 14:00 Beijing time on the 12th, it was reported at 1726 US dollars/ounce, compared with March 8th The US $ 2050 fell nearly 16%.

The euro continues to fall? Last week's short position reached $ 2.2 billion

Last week, short euro has become one of the "most popular transactions".

Fengye Bank strategist Shaun Osborne and Juan Manuel Herrera Betancourt wrote in a report on Monday that compared with other major currencies, the euro position has changed the most. Last week, the net short position increased by $ 769 million. 2.2 billion US dollars, the largest since the end of November last year. According to Bloomberg, the strategist of Nomura International and HSBC told customers last week that it is expected that the euro's bulls will still have more losses in the future.

Many investment banks believe that falling to parity may still be the beginning of the decline in the euro.

According to Reuters, on July 11, local time, Russia's largest single pipeline of natural gas to Germany- "Beixi 1" began annual maintenance work. Therefore, it is expected that it will be suspended for 10 days (July 11th to July 21st) Natural Gas Transmission. The market is concerned that the pipeline cannot be recovered as scheduled under the geopolitical game, which has led to further upgrading in the European energy crisis, becoming the "last straw" that crushes the economy of the euro zone and forced the European Central Bank to suspend interest rate hikes.

The German Bank of Foreign Exchange Research George Saravelos previously stated that "if the" Beixi No. 1 "completely stops natural gas transmission", the euro may fall below the price and challenge 0.95 points.

Image source: Zerohedge

Kaspar Heense, a senior investment portist manager of Bluebay Asset Management, said that cutting off Russia's supply may lead to European distribution system. If this happens, "we will see a serious decline in Europe. This may be a very long winter."

Heense said that Lanwan Assets has been shorting the euro since last month. He predicts that if Russia stops supply, the euro will fall to 1 euro against 90 cents.

Nomura international strategist Jordan Rochester predicts on Tuesday that the euro against the US dollar may fall to 0.98 before August; the Dutch International Group (ING) believes that in the worst case, the euro will fall to 0.9545 in the next weeks.

"Daily Economic News" reporter noticed that since the conflict between Russia and Ukraine, the market's concerns about the European economy have been increasing. The initial value of the euro zone in June increased by 8.6%year -on -year, setting a new high since 1997 that can be traced back to 1997. Behind the euro area inflation is the risk of supply unstable, leading to the rise in various commodities such as energy and food, the tightening of the family's wallet, and the concerns of the stagnation of corporate activities that have stagnated energy.

Preliminary data released in late June shows that the economic growth of the euro zone has deteriorated sharply in June to a 16 -month low. The manufacturing output has shrunk for the first time in two years. The most obvious. Enterprises have also reduced the output of the next year to the lowest level since October 2020. The stagnation and deterioration of demand and deterioration are widely attributed to rising living costs, tightening financial conditions, and energy and supply caused by the Russian and Ukraine conflict and epidemic conditions. Chain interrupted.

Specifically: The comprehensive PMI of the euro zone fell to 51.9, the previous value was 54.8, a 16 -month low; the PMI of the euro zone manufacturing fell to 52, the previous value was 54.6, which was a 22 -month low; the euro zone manufacturing output index It is 49.3, with a previous value of 51.3, a 24 -month low; the PMI of the euro area service industry fell to 52.8, with a previous value of 56.1, a 5 -month low. Goldman Sachs currently estimates that the probability of recession in the euro zone will fall into a decline in the next year, higher than the United States (30%). Goldman Sachs pointed out that "the biggest risk facing Europe is the chaos in energy supply." The overall trade income and expenditure of the euro zone deteriorated due to high energy prices. As of April, the euro zone has been losing money for six consecutive months, which is also a factor that prompted the euro depreciation.

Image source: Visual China-VCG11425073728

Analysts: Slowing global economy is concerned about strengthening the attraction of the dollar

Regarding the continuous strengthening of the US dollar index, Lee Hudman believes that the market's concerns about the rapid slowdown of global economic growth have supported the recent upward trend of the US dollar.

Hudman said in a comment email sent to the reporter of "Daily Economic News" that "the market is particularly concerned about the European economic prospects, and this is caused by further stop supply caused by Russia's tightening energy supply. The concerns about the rapid slowdown of global economic growth have strengthened the appeal of relatively secure US dollars and helped the US dollar index hit a 20 -year high. "

He further stated that as the Fed adheres to the plan to speed up his interest rate hike to cope with the risk of inflation, the US dollar is also more attractive. In general, the development of the situation is still conducive to further strengthening the dollar in the short term. "The latest IMM position report shows that the market leaves space for speculative US dollars. The main risk we face the US dollar will be the US June CPI data released on Wednesday, Eastern Time."

Hudman also pointed out that the constant energy supply restrictions are facing greater challenges when the European Central Bank is facing monetary policy.

The latest monetary policy statement issued by the euro area last month showed that the bank hopes to start raising 25 basis points at the later meeting of this month, and then rate hikes at 50 base points in September.

Hudman believes that this situation has been fully digested in the European interest rate market. After September, market participants are still expected to continue to raise interest rates until the policy interest rate is close to 1%before the end of the year. "As the downlink risks of the euro zone continue to increase, these expectations are more likely to fail; if the European Central Bank's measures cannot satisfy market participants and further suppress the bank's interest rate hike space, the downside risk of the euro will be strengthened. "

"In this case, we expect the loser trend of the euro to remain unchanged. Once the euro fell below the price of the US dollar, the weakness of the euro may even accelerate, and open channels for the euro against the US dollar at 0.9500 ~ 1.0000. Hudman added to reporters.

Another analysis pointed out that from the perspective of the US dollar, the US dollar liquidity is tightening in the background of the Fed's tightening, and the background of the global economic recession intensifies risk aversion, which stimulates the US dollar index to rise to 108 points under extreme conditions.

The analysis pointed out that from the perspective of the euro perspective, the Russian -Ukraine conflict has intensified the risk of stagnation in the economic stagnation of the euro zone. In addition, the European Central Bank's tightening expectations exacerbate the internal economy and finance. It is expected that the extreme depreciation of the euro may cause the application and reserves of the euro in the international currency system. This may require major countries to re -cooperate with currency swaps or other methods to rebuild the euro confidence.

"Daily Economic News" reporter noticed that the euro performed weak shortly after the birth of 1999, and fell below the level of $ 1 at the end of the same year. By 2002, the euro currency began to circulate, and the exchange rate of the euro to the US dollar resumed to a parity level. After that, the euro continued to appreciate, reaching a high level of about $ 1.6 in 2008. However, since then, economic concerns such as the European debt crisis have spread, and the exchange rate of the euro to the US dollar has declined.

Gold price plunge

Under the strong dollar, the commodity performance of the US dollar is not satisfactory, and gold has also fallen sharply recently.

In the past two weeks, the price of gold has fallen below the $ 1,800/ounce mark in one fell swoop, and on July 7th to $ 1736/ounce. This is the second largest decline this year. The gold price has fallen below the $ 1730/ounce mark this week. The price of gold is US $ 1737/ounce. Judging from the COT (trader's position report) two weeks ago, active funds and large speculators have continuously increased short positions.

According to the First Finance and Economics, a commercial trader of a foreign bank told reporters: "Prior to the gold fell below $ 1,800, it showed a large stop loss disk, and the bulls may encounter more blows. Last week's price decline was nearly 3%, obviously did not show the characteristics of insurance assets, suggesting that the participants noticed the risk of additional margin. "He also said that the next step in the target price may be at the support level of $ 1721/ounce. Breaking this position, focusing on the position of $ 1700/ounce.

In the first half of this year, under the background of the actual return and interest rate hikes, the price of gold is still strong. This comes from the global central bank's expectations of the diversified allocation of reserves assets. It is also related to the conflict between Russia and Ukraine and related sanctions. The $ 2050/ounce mark. However, as the Federal Reserve ’s interest rate hike has become increasingly aggressive, the attractiveness of gold has begun to decline as a non -interest rate asset. Traders and strategists interviewed by reporters generally believe that after the Fed's radical interest rate hike cycle slows down, gold prices may regain the kinetic energy. "Once the Fed's interest rate hike is slightly smaller than the market expectations and the US dollar is topped, gold should meet the expectations and perform well." FAWAD RAZAQZADA, a senior analyst of City Index, told reporters.

At present, the demand for further diversification of the central bank in the world still exists. For example, in the first quarter of this year, the official gold reserves of the global central bank increased by 84 tons, and the net purchase volume doubled a month -on -month increase. In the middle and long term, the supporting factor of gold prices mainly comes from the core risk aversion asset status of gold, from physical gold demand led by India and China, as well as increasing reserve allocation.

(Disclaimer: The content and data of the article are for reference only, and it does not constitute an investment proposal. Investors operate according to this, the risk is on its own.)

Reporter | Cai Ding

Edit | Cheng Peng Gaohan Dubo Gai Yuanyuan

School pair | He Xiaotao

Part of the integration of the first Finance

Cover picture source: Vision China (it has nothing to do with graphic and text)

| Daily Economic News nbdnews original article |

Reprinting, excerpts, replication, and mirroring are prohibited without permission

Daily Economic News

- END -

Extremely review | 36 -year -old woman upgrades to be a grandma, is it really good to blow her "winner in life"?

Ji Mu News commentator Qu JingA few days ago, a woman born in Nanyang, Henan relea...

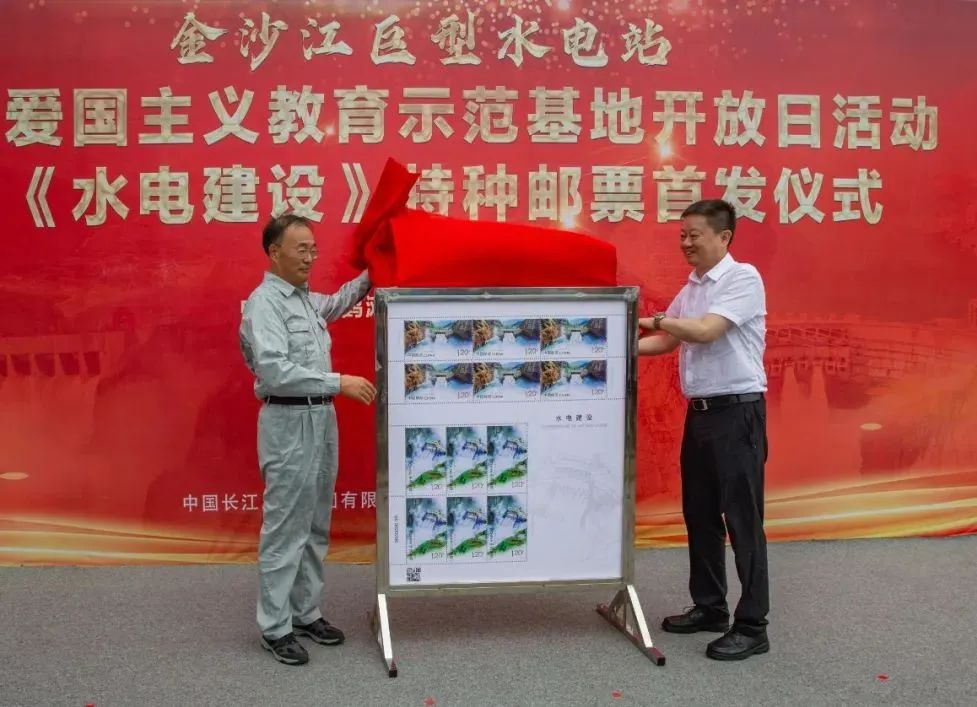

China Post has issued a traceable stamp Baihetan and Wudongde to appear on the "National Business Card"

On June 28, the opening day of the opening day of the National Patriotic Education...