10 days 9 boards, nearly 1.6 times, is the good day of thermal power companies coming?

Author:Jiang Dongwen Time:2022.07.12

In the context of dual carbon strategy, build new power systems with new energy as the main body in the long run!

Facing the heavy responsibility of carbon reduction and transformation, the performance of thermal power enterprises seemed to be at a loss for a while. On the one hand, the price of coal was high and devoured the profits of the thermal power plant. On the other side, the pressure of the transformation layout was small.

Especially during the period of "welcoming the peak", the supply of coal is sufficient and whether the supply of coal has become a decisive factor.

Under such an environment, Ganneng's shares have gone out of 9 consecutive boards. Is this the new expectation of the market's profit reimbursement in the market?

one

10 days of 9 daily limit boards, the maximum increase is nearly 160%. Da Niu Ganneng (000899.SZ) became a hot spot in the market. A shadow.

On July 11, after experiencing the Jiulian board, Ganneng's shares opened high, and the maximum increase in the market reached 9.61%. As of the closing of 3.30%, it was reported at 14.41 yuan, with a total market value of 14.06 billion yuan. The current stock price is close to 2015 in 2015 History high in June.

It is worth mentioning that since June 28, Ganneng's shares have risen for ten consecutive trading days, and have recorded the closing daily limit of the Jiulian board. On July 11, the company's stock price fluctuated sharply, and the session rose to touch the daily limit.

From June 28th to July 11th, the highest price of Ganneng shares a 159.73%increase in just 10 trading days, becoming a new "monster stock" in A shares. Since April 27, the stock has increased by more than 232%.

Behind Ganneng's stock price soared nearly 1.6 times, there are no shortage of capital activities, and Ganneng shares have also attracted the attention of the exchange.

On July 8th, according to the Shenzhen Stock Exchange, from July 4th to July 8th, the Shenzhen Stock Exchange adopted self-discipline supervision measures for 71 brokerage trading behaviors, involving abnormal transactions such as lift suppression and false declarations in the disk; Recently, Ganneng shares, which have been abnormal, and the blue shield convertible bonds of abnormal fluctuations, conduct key monitoring; a total of 13 major issues of listed companies have been checked, and reported on 3 cases of violations of laws and regulations on the CSRC.

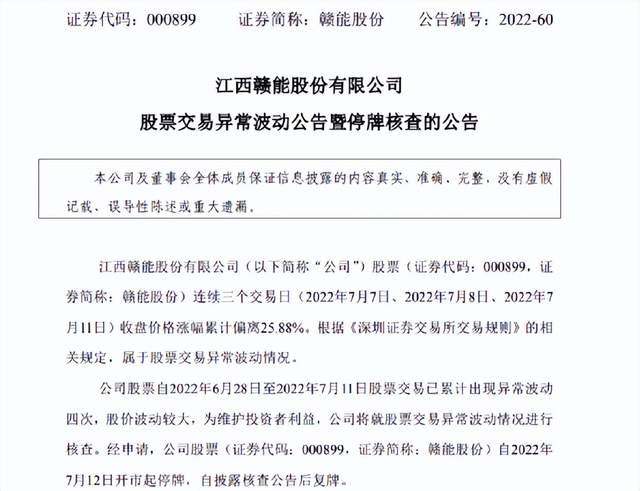

Sure enough, after July 11, Ganneng shares announced that the company's shares have fluctuated four times from June 28, 2022 to July 11, 2022, and the stock price fluctuates greatly. The company will check the abnormal fluctuations of stock transactions. After the application, the company's shares stopped on the market on July 12, 2022, and resumed trading since disclosed the announcement of the verification announcement.

two

As of now, Ganneng shares have a total of 39,400 shareholders.

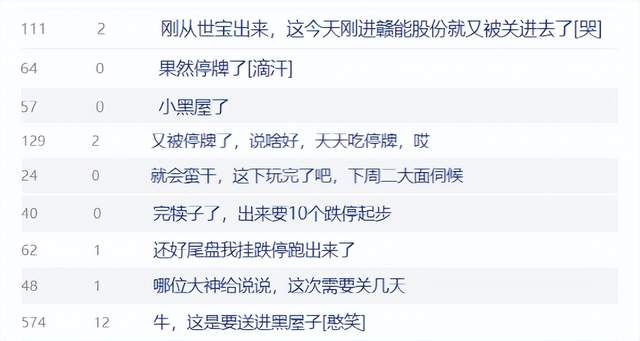

As soon as the news of Ganneng's "emergency braking" suspended trading came out, nearly 40,000 shareholders were stunned. "Sure enough to suspend trading."

Public information shows that Ganneng shares is a state -owned enterprise in Jiangxi Province (the controlling shareholder is Jiangxi Investment Group Co., Ltd. (hereinafter referred to as Jiangchu Group), holding 39.72%, and the actual control of the Jiangxi Provincial SASAC). In November, it was listed on the Shenzhen Stock Exchange that month and was the only power listed company in Jiangxi Province.

Ganneng Co., Ltd. was jointly established by Jiangxi Investment Group Co., Ltd. and State Grid Jiangxi Provincial Electric Power Co., Ltd. in 1997 to land in the capital market, mainly engaged in power production and sales. The company's actual control of the Jiangxi Provincial SASAC is the only power listed company in Jiangxi Province.

Mainly operating thermal power generation, hydropower and new energy power generation. The installed capacity of photovoltaic power generation is 67.08MW. It is understood that as a provincial energy platform, Ganneng shares will focus on developing new energy power generation during the "14th Five -Year Plan" period.

Ganneng shares, as an old -fashioned thermal power listed company, are obviously not enough to support strong performance in the secondary market.

According to the 2021 report's financial report, Ganneng's operating income was 2.6996 billion yuan in 2021, an increase of 0.84%year -on -year, reaching a historical high; the net profit loss attributable to shareholders of listed companies was 248 million yuan, a year -on -year decrease , And for the first time in the company for the first time in the decade.

It is worth mentioning that since last year, due to high coal prices, the operating performance of thermal power -related companies is not satisfactory!

Three

It can only be said that the situation of Ganneng's shares is only one of the many thermal power companies.

Choice data shows that 51 of the 82 appliance companies have declined year -on -year net profit, 31 of which have decreased by more than 50%and 22 losses.

Looking back at 2021, the rise in coal prices basically runs through the year. In mid -January of that year, coal prices reached 1150 yuan/ton. Affected by the staged decline in demand, it fell to about 571 yuan/ton at the end of February. In May, he turned to 950 yuan/ton again. The highest coal price is 2600 yuan/ton.

According to Ganneng's shares, the average unit price of its comprehensive coal in 2021 rose 44.28%compared with the same period of the previous year. Affected by the increase in fuel costs at a high level of coal prices, Ganneng's recent operating performance was not ideal.

In the performance trailer announced last night, the net profit of Ganneng shares is still declining year -on -year. The performance forecast said that the company is expected to achieve a net profit of 31 million yuan to 45 million yuan in the first half of the year, a year -on -year decrease of 41.07%to 59.4%; Mother's net profit was 29.37 million yuan to 43.37 million yuan, a year -on -year decrease of 42.4%to 61%. Ganneng's 2022 first quarterly report showed that the company's main income was 742 million yuan, an increase of 25.53%year -on -year; net profit of returning to the mother was 1.015 million yuan, a year -on -year decrease of 103.75%; the loss of non -net profit was 1.278 million yuan, a year -on -year decrease of 104.83%.

Regarding the decline in the two performances above, Ganneng shares mentioned that the company's performance changes stemmed from increasing coal cost. In the first half of this year, the unit price of comprehensive coal in the first half of the company's thermal power plant rose 24.62%from the same period of the previous year.

You know, Ganneng shares are mainly thermal power business.

In the first half of this year, the installed capacity of Ganneng's shares was 1.578 million kilowatts, and the proportion of thermal power, hydropower, and photovoltaic installations accounted for 88.7%, 6.34%, and 4.97%, respectively, and the per network of electricity accounted for 92.54%, 6.21%, and 1.24%.

Unrestrained

The trend of coal prices is a key factor affecting the profitability of Ganneng and other thermal power companies.

The increase in friction costs caused by weather and epidemics is the main cause of energy prices in 2021. High energy prices in 2022 are more related to Russia and Ukraine.

After the cost increases, the amount of electricity on the production side of Ganneng shares decreased year -on -year. Although the transaction volume of sales has risen significantly, it is difficult to offset the impact of increasing costs.

According to Ganneng's previous disclosure of the power of the Internet in the first half of 2022, in the first half of 2022, the company realized the number of internet power capacity of 3.124 billion kWh, a decrease of 13.80%from the same period last year. 92.54%, an increase of 29.12%over the same period last year.

In terms of sales, Ganneng's market -oriented transaction power in the first half of 2022 was 2.891 billion kWh, accounting for 92.54%of the Internet power, an increase of 29.12%over the same period last year.

However, the two-season peak season of coal demand is in the second half of the year, that is, the peak summer in July-August and the winter heating period of the winter heating industry before the Spring Festival from November to the following year, and the demand for the replenishment of the library in mid-October Starting, coal prices will benefit from traditional seasonal demand support in the second half of the year.

Since June, the maximum power load of the state power grid operating area exceeds 844 million kilowatts, and the electricity load in Northwest, North China and other regions has grown rapidly, reaching 8.81%and 3.21%compared with the same period last year.

Since July, it has been accelerated by large -scale high temperature and economic recovery across the country. Multi -site electric load has continued to rise. The power sector of Ganneng shares is in a strong growth trend as a whole.

As of the closing of July 11, the Wind Power Index closed at 4325.1, an increase of 1.73%, an increase of more than 35%from the end of April at the end of April.

On July 6, the China Electric Power Enterprise Federation predicts that in 2022, the growth rate of the entire social power consumption is between 5%-6%, and the growth rate of electricity consumption in the second half of the year will be higher than the first half of the year.

Ganneng's stock price has skyrocketed, and it is also driven by popular concepts such as pumping storage, super critical, and photovoltaic.

In April of this year, Ganneng shall sign a project investment cooperation agreement with the Shanggao County People's Government of Yichun City, which will invest 500,000 to 600,000 kilowatts of centralized photovoltaic power generation projects and comprehensive energy service projects. Formation photovoltaic power generation project.

On June 8th, Ganneng Co., Ltd. announced that the controlling shareholder Jiangtou Group and China Electric Power Construction Group East China Institute formed a consortium to participate in the bidding of the owners of the pumping storage project in Jiangxi Province and obtained the development right of the Ganxian water pumping storage project. The total investment of the project was 7.5 billion yuan, and the installed capacity was 1.2 million kilowatts.

Circuit stocks are always lithium batteries, photovoltaic, semiconductors, CXO and other industries. Because of the development relationship of the industry, the track camp will not be added in the short term. But theme stocks are different. A shares will appear on the hype of the subject matter anytime, anywhere, and the reason for the hype is only one news.

Do you think that after the net profit of the first half of the year, can you continue to rise?

Reference materials:

"Ten Days Nine Board, Ganneng Shares for Stamp View", Industrial Energy Circle

"Sudden! 10 days 9 daily limit "demon stocks", suspend trading to check! ", China Fund News

"10 days rose nearly 1.6 times, Ganneng shares announced the suspension of trading for verification", Global Tiger Finance

"Ganneng Co., Ltd. 10 consecutive boards! Is the good day of thermal power company coming? ", International Finance News

"10 days 9 boards, new" demon stocks "Ganneng shares are suspended! In the first half of the year, the net profit was pre -decreased by more than 40 %, which was previously subject to the key monitoring. "The 21st Century Business Herald

- END -

Henan Zhoukou: Integrity culture enters the park to set up the party and mass "Lianxin Bridge"

Zhoukou Daily · Zhou Dao client reporter Peng Huiwen/PictureRecently, when enteri...

2 new epidemic high -risk areas, 40 mid -risk areas in Shanghai

The Office of the Leading Group for the Prevention and Control Work of the New Crown Pneumonia Epidemic Event: According to the requirements of the New Coronatte Virus Pneumonia Prevention and Contro