"Lithium King" Ganfeng Lithium Industry is planning to acquire overseas lithium salt lake projects for $ 960 million

Author:Cover news Time:2022.07.12

Cover reporter Liu Xuqiang

On July 11, although the A -share salt lake lithium -lifting sector was affected by market comments, the "Lithium King" Ganfeng Lithium did not stop it to expand its resource map.

The reporter noticed that Ganfeng Lithium Industry has the reason for lithium ore profits. Since last year, with the rise in lithium carbonate prices, the company's profits have risen, but internal control vulnerabilities such as insider trading have also revealed.

As of 11 am on July 12, Ganfeng Lithium fell 1.18%to 100 yuan/share.

It is intended to contribute $ 962 million aiming at two lithium salt lake assets in South America

After the market on July 11, Ganfeng Lithium announced that the company's board of directors agreed that the company will acquire 100%of Lithea's Lithea company through the wholly -owned subsidiary Ganfeng International, and the total consideration of the acquisition will not exceed 962 million US dollars.

Ganfeng Lithium Industry Announcement, it is planned to acquire overseas lithium salt lake projects for $ 960 million

It is reported that Lithea is mainly engaged in acquisition, exploration and development of lithium mining rights. Its main assets of Pozuelos and Pastos Grandes Lithium Salt Lake Projects (hereinafter referred to as "PPG project") are lithium salt lake projects in Salta, Argentine, including two blocks, including two pieces. Lithium salt lake assets. The main product of this mine is lithium carbonate produced by lithium salt lake brine, mainly used as raw materials for the production of lithium batteries. After calculation, the total amount of lithium carbonate in PPG projects was 11.06 million tons.

In terms of production capacity, the PPG project plans the production capacity of 30,000 tons of lithium carbonate at an annual output of 30,000 tons, and can be expanded to the production capacity of 50,000 tons of lithium carbonate. According to the company, according to the professional consultant hired, the average price of lithium carbonate in the past 5 years is $ 16,000 as a long -term reference price, and conservative calculations are made at 40 years of production of 30,000 tons of lithium carbonate. It was US $ 1218 million, and the internal yield of the after -tax internal yield was 30%.

Ganfeng Lithium said that this transaction will help the company to further strengthen the layout of upstream lithium resources, increase the company's self -sufficiency rate, enhance core competitiveness, and meet the company's upstream and downstream integration and new energy vehicle industry development strategy.

In addition, the company also reminded that the transaction has not yet been filed in the relevant competent authorities in China, affected by the changes in Argentina's policy, the assessment of the total resource volume is inconsistent with the actual total resource volume, and the price fluctuations of lithium products.

The reporter learned that as of now, Ganfeng Lithium has deployed lithium mine resources worldwide, and has controlled multiple overseas high -quality lithium ore resources in Australia, Argentina, Ireland, Mexico and other places.

Zhuochuang Information data shows that the average price of lithium carbonate on July 11 has reached 450,000 yuan/ton

Lithium price increases The profit of the company has increased internal control, but there is a loophole

Since the beginning of last year, the prices of lithium carbonate have also risen due to surge in downstream demand. According to Zhuochuang Information, the price of lithium carbonate rose from 70,000 yuan/ton in early 2021 to 350,000 yuan/ton at the end of 2021.

Under the industry dividend, companies such as Ganfeng Lithium Industry made a lot of money. The annual report of Ganfeng Lithium 2021 shows that the company achieved net profit of 5.228 billion yuan, an increase of 410.26%year -on -year.

Since the beginning of this year, lithium battery materials have not stopped price increases. Zhuochuang Information data shows that the average price of lithium carbonate on July 11 has reached 450,000 yuan/ton. In addition, the person in charge of Qinghai's annual output of 10,000 tons of lithium carbonate companies recently stated that the lithium carbonate market has been activated again after entering June. At present, the price of electric carbon has increased by about 20,000 yuan/ton compared with early June. In combination with actual sales, the situation of lithium carbonate supply has not changed.

At the same time, the wealth -making story of lithium companies is also continuing. The first quarter report of the Ganfeng Lithium industry showed that the company's net profit during the reporting period was 3.525 billion yuan, an increase of 640.41%year -on -year.

It is worth mentioning that the company's performance continues to be better, but negative news is reported at the management level. On the evening of July 3, Ganfeng Lithium Industry issued an announcement that the company was investigated by the Securities Regulatory Commission for suspected A -share listed company's stock secondary market transaction. In fact, this is not the first time that Ganfeng Lithium has been punished for information disclosure. As early as May 7, 2020, Ganfeng Lithium received a warning letter from the Securities Regulatory Commission due to the irregularity of insider information registration management.

- END -

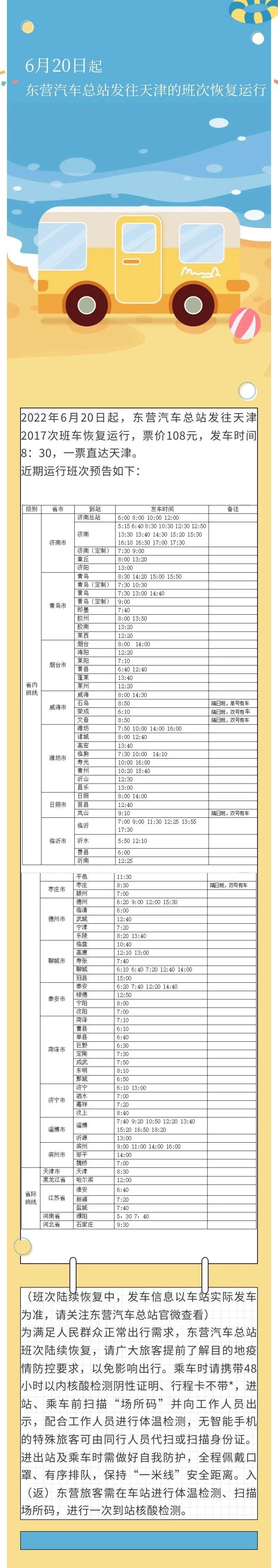

@Will recover from the 20th!

Dongying New Media Center Media Matrix

National Health and Health Commission: 148 new local diagnosis cases yesterday and 678 cases of 678 cases of non -symptoms infected

According to the website of the National Health and Health Commission, at 0-24 on ...