Fined 500,000!Announcement on the administrative penalty decision of Ali Tencent

Author:China Well -off Time:2022.07.12

On July 10, the State Administration of Market Supervision and Administration made administrative penalties for the case of unreasonable implementation of operators who did not apply for illegal implementation in accordance with the law, and announced the administrative penalty decision in accordance with the law. It is reported that this public case is a transaction that should be declared in the past but not declared.

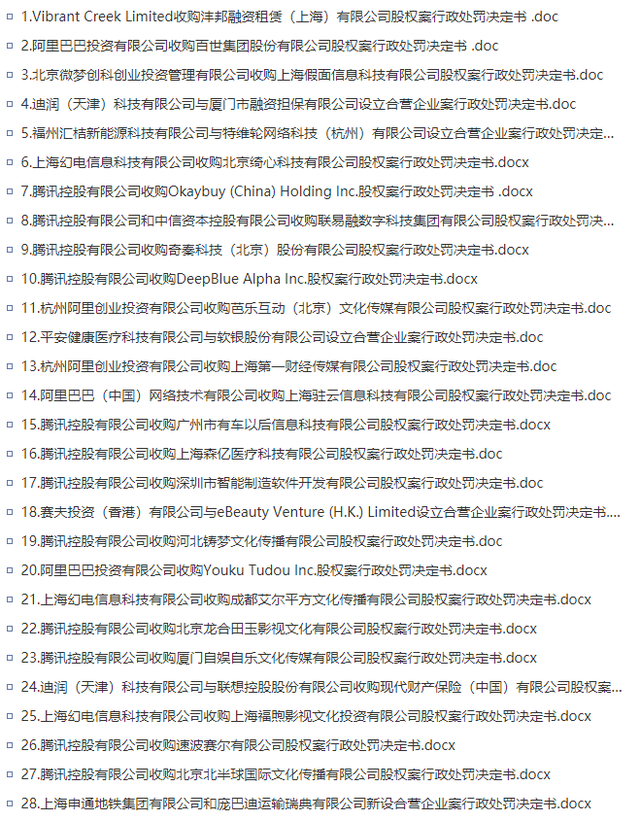

28 Administrative Penalty Decisions

The administrative penalty decision shows that the number of fines involving Tencent Holdings Co., Ltd. (hereinafter referred to as "Tencent") is 12, which involves 5 companies of Alibaba (China) Network Technology Co., Ltd. (hereinafter referred to as "Ali"). 3 photos of Shanghai Magic Information Technology Co., Ltd. (that is, "station B"). The above cases all constitute the concentration of operators who did not declare illegal implementation in accordance with the law, but did not have the effect of exclusion and restricting competition.

List of this public case

The remaining large Internet companies that have been punished include: Didi (Fuzhou Huiji New Energy Technology Co., Ltd.), Sina Weibo (Beijing Weimeng Chuangke Entrepreneurship Investment Management Co., Ltd.), Ping An Health Medical Technology (Ping An Health Medical Technology Technology Co., Ltd.) Wait.

Among Tencent's fines, the main cases include the equity of Tencent's acquisition of CITIC Capital Holdings Co., Ltd., Qiqin Technology (Beijing) Co., Ltd., Hebei Tumeng Culture Communication Co., Ltd., etc. This calculation has a total of 6 million yuan.

There are 5 cases involving Ali, mainly including Alibaba Investment Co., Ltd. (hereinafter referred to as "Ali Investment") acquisitions of Best Group Co., Ltd., Ali Investment acquisition of Youku Tudou, Hangzhou Ali Venture Investment Co., Ltd. to acquire Shanghai First Financial Media Co., Ltd. For the company's equity, each case is fined 500,000 yuan, and a total of 2.5 million yuan is fined.

A total of 3 tickets involved in station B, mainly include the acquisition of Beijing Qixin Technology Co., Ltd., Shanghai Fuyu Film and Television Culture Investment Co., Ltd., and Chengdu Elfang Culture Communication Co., Ltd.. Yuan.

The General Administration of Market Supervision stated that this public case is a transaction that should be declared in the past but not declared. With the in -depth advancement of anti -monopoly regulatory supervision, the awareness of centralized application for corporate operators has continued to improve, actively investigating historical transactions, actively reporting that they have not declared their behavior in accordance with the law and actively cooperate with the investigation. The State Administration of Market Supervision has resolutely implemented the decision -making and deployment of the Party Central Committee and the State Council, fully supported the development of enterprises, is accelerating the completion of the cleanup of stock cases in accordance with the law, helping enterprises to light up, and promoting the sustainable and healthy development of enterprises and industries. The remaining punishment decisions will be made public.

Why does Ali and Tencent always be fined

It is reported that this is the second time Tencent and Ali have been punished for the second time that the cases of operators who did not declare illegal implementation in accordance with the law this time.

On January 5, 2022, the State Administration of Market Supervision announced that 13 causes did not declare the punishment of the case investigation of the case of the case of the case of illegal implementation in accordance with the law. Tencent, Ali, Bilibili and other companies were listed. There are two cases, one of the cases of Bilibili and Jingdong. The relevant cases were fined 500,000 yuan.

In addition, Alibaba, Tencent, Meituan and other Internet platform giants have received administrative penalties from the General Administration of Market Supervision last year.

On April 10, 2021, the General Administration of Market Supervision issued a notice that Alibaba had a dominant position in the market for the online retail platform service market in China. Since 2015, the abuse of the market domination status has put forward the "two selection" requirements for merchants in the platform. According to the "Anti -Monopoly Law", the Alibaba Group was ordered to stop illegal acts and imposed a fine of 455.712 billion yuan in its domestic sales in 2019, with a fine of 18.228 billion yuan.

On July 10, 2021, the merger of Huya and Douyu, led by Tencent, was suspended, becoming the first case of the economic field of my country's platform forbidden to concentrate.

On July 24, 2021, the General Administration of Market Supervision made an administrative penalty decision on the acquisition of the concentrated behavior of Tencent Holdings Co., Ltd. (hereinafter referred to as Tencent) to acquire China Music Group's equity illegal implementation operators, and ordered Tencent and its affiliated companies The copyright fee payment method of prepaid funds, etc., will restore market competition.

On October 8, 2021, Meituan was administrative penalties for the implementation of the "two selection and one" monopoly behavior in the online catering and takeaway platform service market in China. Yuan, which fined its domestic sales of 114.748 billion yuan in 2020, with a fine of 3.442 billion yuan.

The new monopoly method of "strict" is

In the past two years, with the strengthening of law enforcement, the concept of antitrust has gradually "flying into the home of ordinary people." The revision of the Anti -Monopoly Law has been starting from the launch to the landing. It has received widespread attention due to the interests of all parties.

The revision of my country's Anti -Monopoly Law was launched in 2019. The State Administration of Market Supervision released the "Anti -Monopoly Law" Revised Draft (Public Solicitation Draft) "in January 2020. On October 19, 2021 The thirty -first session of the Standing Committee of the 13th National People's Congress was submitted for review.

In November 2021, the relatively independent National Anti -Monopoly Bureau was upgraded in the State Administration of Market Supervision.

On June 24, 2022, the 35th meeting of the Standing Committee of the 13th People's Congress reviewed and approved the "Decision on Modifying the Antitrust Law of the People's Republic of China". From time to time. Article 9 of the new "Anti -Monopoly Law" increased in the general rules part, requiring that "operators must not use data and algorithms, technology, capital advantages, and platform rules to engage in monopoly behaviors prohibited in this law." In addition, "abuse of market domination The chapter of the status is added, which adds to Article 22, which stipulates that "operators with market dominance shall not use data and algorithms, technology, and platform rules to engage in the abuse of market dominance in the preceding paragraph." It reflects the platform Response and response of economic development.

From "strengthening supervision" to "promoting development", the policy tone or from antitrust and rectification, to the active role of the platform, and promote the healthy development of the platform. Li Zongguang, chief economist of Huaxing Capital, believes that Internet rectification has emerged.

Some people in the industry have stated that the General Administration of Market Supervision announced the ticket and once again conveyed signals to the market to strengthen the investigation of centralized behavior of illegal implementation operators. Supervise relevant market entities to better understand the relevant requirements of antitrust supervision, enhance the awareness of antitrust composition, and help maintain a market environment of fair competition.

According to Article 20 of the Anti -Monopoly Law, "the concentration of operators refers to the following circumstances:

(1) The merger of the operator;

(2) The operator obtains control of other operators by obtaining equity or assets;

(3) Operators can obtain control over other operators through contracts or other operators or can impose a decisive impact on other operators. "

Article 21 stipulates that "if an operator concentrates to meet the application standards stipulated by the State Council, the operator shall declare to the State Council's antitrust law enforcement agencies in advance, and those who have not been declared shall not be implemented."

Article 48 stipulates that "if an operator violates the provisions of the provisions of this Law, the State Council's anti -monopoly law enforcement agency shall order the implementation of centralized, shares or assets, transfer operations within a time limit, and take other necessary measures to return to the state before concentration. Can be punished for less than 500,000 yuan. "

Article 49 stipulates that when the fines stipulated in Article 46, 47, and 48 of this Law, the antitrust law enforcement agency shall consider the nature, degree and extent and extent of illegal acts, and Factors such as lasting time. "

(China Xiaokang.com Comprehensive Market Supervision website, People's Daily, CCTV News, Beijing Youth Daily, Financial Times and other reports)

- END -

The "circle of friends" in the demonstration area expands again!The Yangtze River Delta Developer Alliance ushered in 12 new members

Yesterday, the Friends Circle of the Yangtze River Delta Ecological Green Integrat...

Hunan Daily Promote 津 Changdezin's first contradiction mediation "321" working method

Recently, Huang, a villager Huang, a villager in Shanyan Village, Jiashan Street, ...