Recent financing recovery in June increased credit in June 2.81 trillion

Author:Daily Economic News Time:2022.07.11

On July 11, the central bank issued financial statistics data, social financing scale stocks and incremental reports in June 2022.

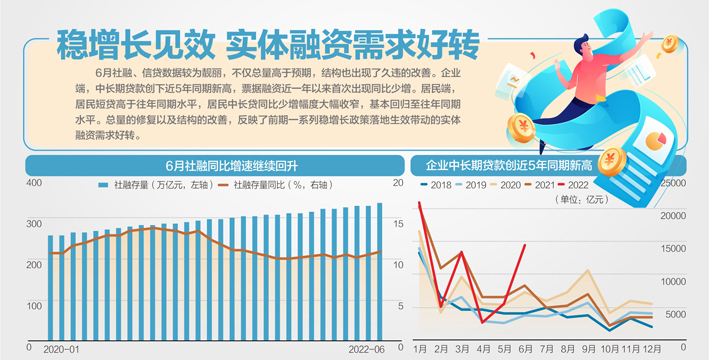

Data show that at the end of June, the generalist currency (M2) and narrow currency (M1) increased by 11.4%and 5.8%year -on -year, respectively, and the growth rates were 0.3 and 1.2 percentage points higher than the end of the last month, respectively. In June, RMB loans increased by 2.81 trillion yuan, an increase of 686.7 billion yuan year -on -year. During the same period, the scale of social financing increased by 5.17 trillion yuan, an increase of 1.47 trillion yuan over the same period last year.

Source: People's Bank of China, West China Securities Yang Jing's picture Visual China Map

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said in an interview with the reporter of the Daily Economic News that in June, financial data reflects that the demand for real economy financing has been significantly warmed up. From the perspective of structural perspective, residents' willingness to invest in enterprises has increased, real estate has gradually recovered, and domestic demand kinetic energy is accelerating the recovery; from the year -on -year growth rate of social finance and M2, domestic currency supply has maintained a steady growth, and continues to create a suitable environment for the real economy recovery.

M2 growth rate a hit 5 and a half years at a new high

"Daily Economic News" reporter noticed that in June, M2 and M1 increased their backlishes with a double -month increase, an increase of 11.4%and 5.8%year -on -year. It is worth noting that the M2 growth rate has maintained a rise since this year. As of now, the M2 growth rate has reached a new high since December 2016.

Zhou Maohua said that the year -on -year growth rate of M2 continued to operate above 11%, mainly because economic activities recovered, and the market financing interest rate center moved downward, driving the demand for the real economy financing demand to recover, and the currency creation was active and improved. At the same time, fiscal policy continued to make efforts, adding basic currencies.

Wang Qing, chief macro analyst of Dongfang Jincheng, believes that the M2 at the end of June was 11.4%year -on -year, and the growth rate was 0.3 percentage points higher than the end of the last month. At the end of June, the main reason for M2's year -on -year growth rate was that the monthly loan was increased more than that of the monthly loan. At the same time, the fiscal expenditure was stronger, and the fiscal deposit was reduced year -on -year.

Regarding the rise of M1's growth rate, Wang Qing said that M1 accelerated 1.2 percentage points from the end of last month. This is related to the increase in enterprise production and investment activities in the process of economic restoration, and on the other hand, it is also related to the heating of the property market in June. However, the current M1 growth rate is still significantly lower than the M2 growth rate. The main reason is that the current property market is still at a low operation, housing companies are selling sluggish, and short -term deposits of enterprises are greatly affected. The active of the real economy is still insufficient, and there is still a way to go to the level of economic restoration to normal growth in the later period.

Zhou Maohua believes that the year -on -year growth rate of M1 is better than expected. It is mainly driven by corporate operating activities, and the domestic real estate market recovers.

Optimization of RMB credit structure

Data show that RMB loans increased by 13.68 trillion yuan in the first half of the year, an increase of 919.2 billion yuan year -on -year.

From the perspective of the sub -department, household loans increased by 2.18 trillion yuan, of which short -term loans increased by 62.9 billion yuan, and medium -to -long -term loans increased by 1.56 trillion yuan; enterprises (affairs) industry units loans increased by 11.4 trillion yuan, of which short -term loans increased by 29,900 In terms of 100 million yuan, medium- and long -term loans increased by 622 trillion yuan, bill financing increased by 2.11 trillion yuan; loans of non -banking financial institutions increased by 10.3 billion yuan.

From a single -month data, in June, RMB loans increased by 2.81 trillion yuan, an increase of 686.7 billion yuan year -on -year. From the perspective of the growth rate, the balance of RMB loans at the end of June was 2.0635 trillion yuan, an increase of 11.2%year -on -year, and the growth rate was 0.2 percentage points higher than the end of the previous month, 1.1 percentage points lower than the same period last year.

Zhou Maohua said that the demand for real economy financing in June was recovered and the credit structure was optimized. From the perspective of new loans and structures in June, domestic enterprises and residents' financing demand is improving. On the one hand, corporate investment demand has increased. In June, the company's medium and long -term loans rebounded strongly, which increased more than year -on -year, and the decline in bill financing reflected the resumption of the willingness to invest in enterprises. On the other hand, consumer demand for residents recovers. Residents 'short -term new loans in June increased year -on -year, reflecting the accelerated recovery of residents' lives, and driving consumer demand significantly.

Wang Qing believes that due to the influence of the duster at the end of the quarter, the loan in June increased the seasonal phenomenon from the previous month, but the increase of 700 billion yuan year -on -year, setting the highest new scale in the same period, indicating that the regulatory layer has repeatedly required "enhance the total credit volume to enhance the total amount of credit. In the context of the stability of growth, the total function of monetary policy adverse period adjustment is fully exerting. More importantly, with the power of infrastructure investment and the recovery of the property market, in June, the medium- and long -term loans of enterprises increased significantly year -on -year, and residents' medium- and long -term loans increased significantly year -on -year, and the loan period structure improved.

"Daily Economic News" reporter noticed that the increase in social financing in June was 5.17 trillion yuan, an increase of 1.47 trillion yuan over the same period last year. At the end of June, the scale of social financing was 33.427 trillion yuan, an increase of 10.8%year -on -year.

Zhou Maohua believes that the social finances rebounded strongly in June, which increased year -on -year. It was mainly promoted by the demand for real economic credit and the amount of special debt issuance of local governments, reflecting the strong demand for domestic real economy financing. The main reason is that domestic economic activities have steadily recovered, driving credit financing demand Heating back; the large amount of special debt issuance reflects the regulation of domestic and counter -cyclical policies in the country, and also reflects the policy effect of advanced efforts.

Daily Economic News

- END -

From Shenya to a "Asian Games Tour" in Zhongshan

On June 23, Zhang Hongming, the former deputy secretary of the Hangzhou Municipal ...

Youth Rongshang successor help digital Fuzhou Construction -Fuzhou E -commerce Merchants will complete the generalization

Fuzhou News Network June 23 (Reporter Shi Leilei/Wen Zheng Shuai/Photo) Fuzhou E -...