Nearly 70%of the super -synchronization average Knights Dairy breaks into the North Stock Exchange

Author:Daily Economic News Time:2022.07.11

Another regional dairy company sprints IPO. Recently, the Inner Mongolia Cavaliers Dairy Group Co., Ltd. (hereinafter referred to as the Cavaliers Dairy) disclosed the prospectus (declaration draft) and planned to be listed on the Beijing Stock Exchange.

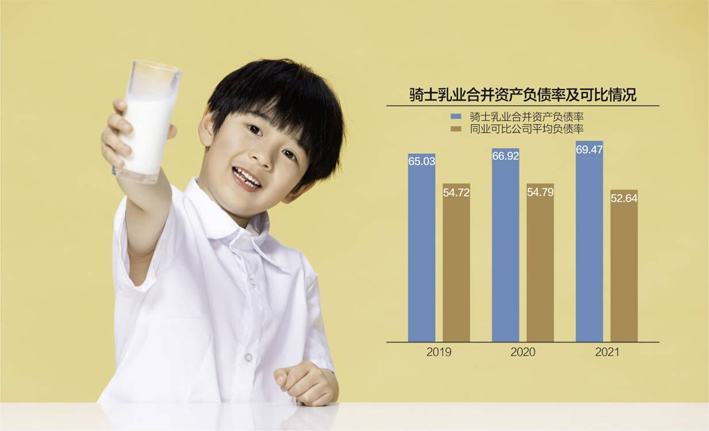

Data source: Reporter sorted out pictures of pictures of Yang Jing

The Cavaliers Dairy is a regional dairy company with nearly 70 % of its revenue from Inner Mongolia. In recent years, it has developed well. From 2019 to 2021, the Cavaliers dairy realized operating income of 636 million yuan, 707 million yuan, and 876 million yuan, respectively, with net profit attributable to 37.418 million yuan, 22.881 million yuan, and 55.727 million yuan, respectively.

However, the reporter of the Daily Economic News found that in the past three years, the Cavaliers Dairy's consolidated asset -liability ratio was 65.03%, 66.92%, and 69.47%, respectively. The overall liabilities of the company were significantly higher than that of the same industry. At the same time, under the market pattern of the domestic dairy industry Illi and Mengniu giants, the Cavaliers Dairy also admits that market competition has become increasingly fierce.

The company's business scale expands faster

The Knight Dairy business mainly includes three major sections, namely the sugar industry, pastoral sector, and dairy industry. In 2021, the sugar industry contributed about 43.62%of the company's revenue, and the pastoral sector and the dairy industry contributed 30.83%and 24.99%of revenue respectively.

The Cavaliers Dairy Shedo Pavilion mainly sells fresh milk. Its customer targets are mainly large dairy companies such as Mengniu Dairy (HK02319, a stock price of HK $ 37.850, a market value of HK $ 149.7 billion), Yili (SH600887, a stock price of 36.11 yuan, and a market value of 231.1 billion yuan).

In 2021, the Cavaliers sold 319 million yuan and 60.815 million yuan to Mengniu and Yili Company. Mengniu (affiliated company) and Yili (affiliated company) were the first and third largest customers of the Cavaliers Dairy, respectively.

The Dairy sector of the Cavaliers Dairy also uses differentiated competitive strategies. The main products are low -temperature yogurt and milk powder. In 2021, the company's low -temperature yogurt achieved a revenue of 130 million yuan, accounting for about 60%of the revenue of the dairy industry. The milk powder realized revenue of 28.07 million yuan, accounting for about 13%of the revenue of the dairy sector.

The main products of the Cavaliers Dairy's sugar industry include three types: white sugar, honey, and beet meal. Among them, white sugar products contributed about 316 million yuan in revenue in 2021, accounting for 36.66%of the company's overall revenue, and about 80%of the revenue of the sugar industry sector.

In terms of performance, from 2019 to 2021, the Cavaliers dairy realized revenue of 636 million yuan, 707 million yuan and 876 million yuan in revenue; during the same period, net profit attributable to mothers was 37.418 million yuan, 22.881 million yuan, and 55.727 million yuan, respectively. In the first quarter of 2022, the Cavaliers dairy achieved a revenue of 170 million yuan, and the net profit attributable to the mother was 26.1212 million yuan, an increase of 112%year -on -year.

Although the performance of the Cavaliers' dairy in recent years is better, the company has obtained a lot of government subsidies each year. The prospectus shows that from 2019 to 2021, the various government financial subsidy funds in the current profit and loss of the Cavaliers dairy are 10.136 million yuan, 11.493 million yuan, and 7.4594 million yuan, respectively, accounting for 27.09%, 50.23%and 50.23%of the current net profit. 13.39%.

While the performance is generally good, the liability ratio of the Cavaliers Dairy has continued to rise in recent years. The prospectus (declaration draft) shows that as of the end of 2019 to the end of 2021, the Cavaliers Dairy's consolidated asset -liability ratio was 65.03%, 66.92%, and 69.47%respectively; during the same period, the average liabilities ratio of the company's comparison companies were 54.72%, 54.79%, and 52.64%. Essence The overall liability level of the Cavaliers Dairy is higher than that of the same company, and it is ranked among domestic dairy companies. In this regard, the Cavaliers Dairy explained that the main reason is that the company's business scale has expanded rapidly, the demand for mobile funds is high, the financing channels are relatively single, and they are mainly funded by debt financing.

Most ingredients rely on foreign purchases

It is worth mentioning that the important raw materials of the Cavaliers Dairy Dairy products are fresh milk. In addition to their own ranch supplies some fresh milk, most of the company's raw milk depends on foreign purchases.

Most raw milk relies on purchasing foreign procurement, which has added more unpredictable risk factors to a certain extent.

In this regard, the Cavaliers Dairy said that the company's cooperative pasture is a large -scale breeding pasture. With the improvement of the overall breeding level and the cooperation ranch for many years, the company's raw milk supply is fully guaranteed in terms of quality and quantity. And the company has never had any food safety accidents.

As a regional dairy company, the Cavaliers dairy industry admits that it is facing increasingly fierce market competition.

At present, the dairy resources are rapidly concentrating towards a few dairy giants, and the sales revenue of the top ten dairy companies accounts for more than half of the total revenue of enterprises above designated size. Mengniu and Yili Giants have been stable. The two leaders will maintain a high speed growth in the next few years, while the new dairy (SZ002946, a stock price of 11.67 yuan, a market value of 10.116 billion yuan), Guangming Dairy (SH600597, a stock price of 11.94 yuan, a market value of market value, a market value of market value 16.461 billion yuan) and Sanyuan (SH600429, the stock price of 499 yuan, a market value of 7.571 billion yuan) followed closely.

"In the future, first -tier brands across the country may acquire small and medium -sized dairy processing enterprises in the industry through mergers and acquisitions, and control the upstream raw material milk resources through investment expansion and take effective measures to further increase their brand awareness and influence in the domestic market, so as to thusIncreased market competition, bringing a large market impact on small and medium -sized dairy companies including the company. "The Cavaliers Dairy said that as overseas dairy companies such as Nestlé and Wyeth have entered ChinaAt the same time, it has gradually involved in the field of liquid milk, and the domestic dairy industry competition is even more intense.In response to this IPO -related matters, the reporter of "Daily Economic News" called the Cavaliers Dairy many times on July 8, 2022, but no one answered the phone.

Daily Economic News

- END -

Heze Public Transport Group carried out the training of "at the beginning of the mission to overcome the mission"

Reporter Zhou QianqingOn the morning of July 18th, the fifth session of the Heze P...

Haiyou New Theory | "Love Like Spring" by people of Jinan

It is common for reporters to donate money. I know that there are many colleagues ...