Nine years ago, I borrowed 18 million and didn't pay it back?Fudan Fuhua, which continuously loses, involves the dispute between the loan contract

Author:Daily Economic News Time:2022.07.11

On July 11, Fudan Fuhua (SH600624, the stock price was 7.19 yuan, and the market value of 4.923 billion yuan) ushered in the daily limit. After the market, Fudan Fuhua announced that the company received relevant legal documents such as civil prosecution, which mainly involved Shanghai Quanchun Industrial Development Co., Ltd. (hereinafter referred to as "Shanghai Quanchun") and Shanghai Fuhua Entrepreneurship Investment Co., Ltd. (hereinafter referred to as A dispute between the loan contract between "Fuxing Venture Capital") and Fudan Fuxi.

"Daily Economic News" reporter noticed that Fudan Fuhua's performance in the past two years has continued to lose money. In 2021, the net profit attributable to shareholders of listed companies was 105 million yuan.

In the annual report of 2021, the company mentioned that the total profit, net profit, and net profit attributable to shareholders belonging to the parent company compared with the reasons for the same period of the same period last year. Development Co., Ltd.'s net profit increased compared to the same period last year.

Image source: Visual China-VCG11456494102

The listed company was sued and said that he would contact the original management to verify the relevant situation

The cause of the defendant of Fudan Fuxi has to start with a loan.

According to Shanghai Quanchun description, on December 30, 2013, Fuhua Chuangzun and Fudan Fuhua made a large amount of borrowing to the outsider Shun Jie Construction (Group) Co., Ltd. (hereinafter referred to as "Shun Jie Construction") in the case of business development. Essence

According to the receipt account of the two instructions, Shun Jie Construction remitted a borrowing of 18 million yuan into the account of Fuhua Venture Capital. On August 21, 2017, the two built 2 million yuan from Shun Jie, and Shun Jie Construction remitted 2 million yuan to the aforementioned account of Fuhua Venture Capital. In June 2022, Shun Jie Construction of the case transferred the claims involved to Shanghai Quanchun.

After that, Shanghai Quanchun filed a lawsuit in the court. Shanghai Quanchun requested that Fuhua Chuangzhun and listed companies jointly returned the principal of 20 million yuan in loans and paid 10.689 million yuan in interest and bear litigation costs. Later, the court informed that the listed company would conduct pre -mediation on July 14.

Fudan Fuhua stated that the lawsuit was not in the stage of court, and it was temporarily unable to accurately judge the impact on corporate gains and losses. The company is actively contacting the original management to verify the relevant situation. It will take relevant legal measures in accordance with the law to safeguard the legitimate rights and interests of the company and shareholders, and to perform the information disclosure obligations in a timely manner according to the progress of the case.

Short -term borrowing high performance in the past two years has poor performance in the past two years

Fudan Fuda, which has not been repaid in arrears, has also faced a certain amount of funding pressure from the business data over the years.

From the end of 2013 to the end of 2021 and the end of 2022, the balance of monetary funds of Fudan Fuhua was 344 million yuan, 238 million yuan, 209 million yuan, 384 million yuan, 270 million yuan, 357 million yuan, 297 million yuan, 3.07 3.07 100 million yuan, 310 million yuan and 324 million yuan.

Although the balance of monetary funds of Fudan Fuxing has remained at a level of more than 200 million yuan, debt also maintained on a higher horizontal line. During the reporting periods above, the short -term borrowings of Fudan Fuxing reached 644 million yuan, 197 million yuan, 279 million yuan, 428 million yuan, 335 million yuan, 369 million yuan, 387 million yuan, 413 million yuan, 444 million yuan, and 444 million yuan, 444 million yuan, and 444 million yuan, and 444 million yuan. 495 million yuan.

In 2013, the year when Fudan Fuhua initially built a loan from Shun Jie, the short -term debt level of listed companies was significantly higher than other years. In the 2013 annual report, for the sharp increase in short -term borrowing, Fudan Fuxi said that it was mainly caused by increasing the corresponding increase in mobile funds loans to expand the scale of operating scale.

So, does Fudan Fuhua's operating performance improved? It doesn't seem to be. From the perspective of operating income, from 2013 to 2021, although the operating income of Fudan Fuhua rose from 952 million yuan to 1.041 billion yuan, the revenue was very unstable, during which it fell to 671 million yuan.

From the perspective of the net profit of the home, the company can still achieve a net profit of 33.712 million yuan in 2013, and by 2019, it will only achieve only 4.8592 million yuan.

In 2020 and 2021, the net profit of Fudan Fuhua directly became negative, which was -596.571 million yuan and -105 million yuan, respectively.

According to the annual report, in 2020, the decline in the performance of listed companies was affected by factors such as the delay in the sales plan of Haimen Park supporting residential projects in the Fuxihua Park and the preparation of asset impairment in the company. In 2021, the net profit of listed companies declined due to factors such as the preparation of asset impairment by the company's participation companies.

Daily Economic News

- END -

376 million square meters!The Jiaodong Water Tuning Project Complete Subsequent Water Mixing 2021-2022

Volkswagen Daily reporter Fang BiaoOn July 2nd, the reporter learned from the Shandong Water D adjustment project operation and maintenance center that as of June 26, the Jiaodong water transfer proje

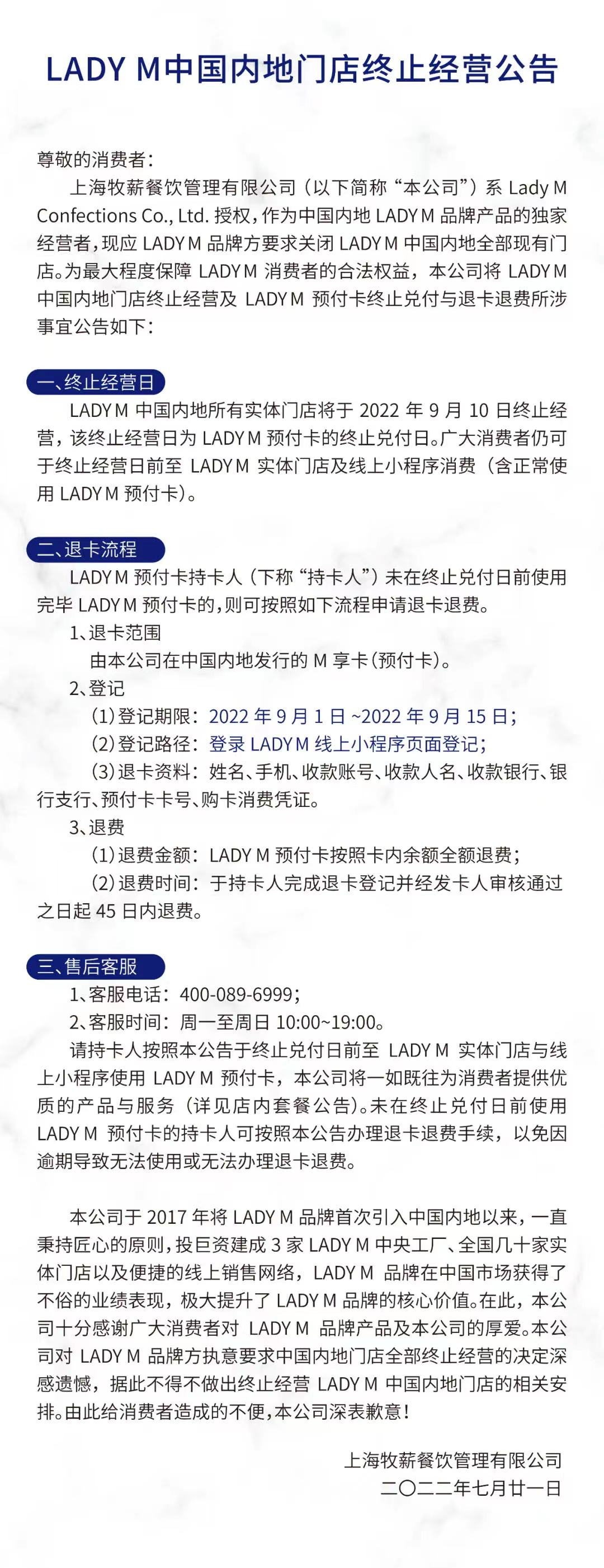

Ladym will close all the stores in the Mainland.

In the past two days, the news of the baking market has continued. In addition to ...