Sanitaryon leader Arrow Card Breakthrough Deep City Main Board Industry Red Sea Racing or accelerates head company shuffle

Author:21st Century Economic report Time:2022.07.11

21st Century Business Herald reporter Han Yi Beijing report

Recently, the CSRC announced that it will be held on July 14, 2022 to review the initial issues of companies such as such companies such as Rongbai Home Group Co., Ltd. (referred to as such an arrow home furnishing).

The 21st Century Economic Herald reporter noticed that under factors such as real estate regulation, dual energy consumption dual control, and upstream raw material prices soaring, the ceramic bathroom industry has overall pressure in recent years. In the first quarter of this year, more listed companies have exposed losses and market competition Further intensification, the industry is ushered in a new round of shuffling.

The arrow brand home camp in the ceramic bathroom industry is financing, expanding production capacity, layout of new marketing network construction, and will once again change the industry competition pattern.

Facing a reshuffle competition

Public information shows that one of the companies that have entered the ceramic bathroom industry earlier in the country in China have become the leading enterprises in the domestic ceramic bathroom industry. According to EUROMONitor data, in 2018, the company's market share in the health ceramic market is 7.3%, and the seat List the domestic sanitary market at the forefront of domestic brands.

From the reporting period from 2018 to the first half of 2021, the operating income of Wrigward Home achieved operating income was 6.810 billion yuan, 6.658 billion yuan, 6.502 billion yuan, and 3.336 billion yuan, respectively. The net profit of home -to -mother returned mother was 197 million yuan and 556 million yuan, respectively. , 589 million yuan and 158 million yuan. At the performance level, the profitability of Arrow Card Home Corporation crushed most of the same industry listed companies during the reporting period.

It is worth noting that the industries in Wrigley Home are not calm and affected by the factors such as policies, environmental protection, and market constraints. In recent years, the entire building of the Tao industry is obvious, and the company is facing more intense industry competition. The arrow home admits that the development of the industry is facing multiple disadvantages.

It is understood that the threshold of the bathroom industry has low entry. In recent years, the number of enterprises engaged in the bathroom industry in China has continued to increase, but most companies have a small scale, low product grade, poor quality, limited marketing capabilities and product development capabilities, and homogeneous products. More serious, most of them rely on price wars to compete for market share. At the same time, in recent years, the price of raw materials such as the market price of ceramic raw materials, chemical raw materials, and coal prices has risen, which has led to the continued increase in production costs in industry enterprises, which has greatly reduced the profit space of the industry.

According to the latest data released by the China Architectural Sanitary Ceramics Association, from 2016 to 2020, nearly 500 ceramic companies on the rules were eliminated, and the number of enterprises in the industry has been reduced from more than 1,600 to more than 1050; By 2760, it fell 15.45%.

In terms of the number of sanitary ceramic market companies, according to the statistics of the China Architectural Sanitary Ceramics Association, a total of 356 sanitary ceramic companies above designated size in 2020, a decrease of 6 compared with 2019, and realizing the main business revenue of 70.01 billion yuan, a decrease of 3.42% year -on -year decreased by 3.42% year -on -year The total profit was 6.879 billion yuan, a year -on -year decrease of 5.41%.

The 21st Century Economic Herald reporters preliminary statistics that among the A -share listed companies with the arrow home, most of the losses have occurred in the first quarter of this year.

The main competitors of arrow homes in the main competitors of sanitary ceramics, tiles and custom home furnishing industries include TOTO, Kohler and other international brands, as well as Jiu Mu Group, Huida Sanitary Ware (603385.SH), Hengjie Sanitary Ware, Dongpeng Holdings (003012.SZ ), Mona Lisa (002918.SZ), Emperor Oujia (002798.SZ), Opai Home (603833.SH), Sofia (002572.SZ), Songlin Technology (603992.SH), Jianlin Home Furnishing ( 603408.SH), Yuexin Health (002162.SZ), Seagull Housing (002084.SZ) and other domestic brands.

In the first quarter of this year, Huida Sanitary Ware, Dongpeng Holdings, Mona Lisa, Yuexin Health, Seagull Housing Workers and many other A -share listed companies suffered losses.

"With the acceleration of the industry's transformation and upgrading, low -end backward production capacity and low -efficiency companies will be accelerated."

Faced with industry competition, Jianzai Home believes that future industry competition will enter the new era of contesting, service, operating efficiency, and resource acquisition. It is the key to listed ceramic enterprises with brands, channels, services, products and funds. The strategic opportunity period.

"In 2021, a number of ceramic companies on the head have deployed large -scale investment expansion. The large -scale entry of capital will accelerate the removal of the reshuffle of the building and further enhance the industry concentration." Tianfeng Securities Analysts The reporter from the 21st Century Economic Herald pointed out that if ceramic companies in the industry's head camp can achieve capital assistance and innovate development, they are expected to get out of the industry cycle.

Reverse market fundraising to expand production

According to the China Architectural Sanitary Ceramics Association, the other side of the Red Sea competition in the ceramic industry is showing a more concentrated market competition pattern. With the intensification of market competition, the advantages of the brand, scale, and resources of the industry head enterprises are becoming more and more obvious. The rapid expansion of head companies, the market share of the top ten companies in the industry in the industry from 2016 to 2020 increased 3%, reached 18%, and the concentration of the industry at the end of the "Fourteenth Five -Year Plan" may exceed 20%.

In order to seize the market share and seize the opportunity of the industry's reshuffle, in 2021, Tao Pottery companies such as Dongpeng Holdings and other head camps have opened mergers and acquisitions and expansion. According to statistics, in 2021, a total of 14 ceramic factories in the industry were successfully auctioned, with a total transaction price of about 640 million yuan. A number of high -quality assets fell into the hands of listed companies such as Dongpeng Holdings. In addition to mergers and acquisitions, the head ceramic enterprise also conducted a large -scale investment expansion in 2021. For example, Mona Lisa acquired Gaoan to Mermaid's new materials, and a total of 15 production lines were put into production.

However, as the head camp enterprise, the arrow home furnishings have obviously lacking the rapid expansion of the capital power in the early days of the reporting period. The company urgently needs capital transfusion, optimizes the asset structure, expands the company's capacity, and realizes innovative development.

The prospectus shows that at the end of each issue of the first half of 2018 to the first half of 2021, the asset -liability ratios of Arrow Ace Home reached 82.95%, 76.05%, 67.56%, and 64.87%, while the industry's average asset -liability ratio was 42.40%, 44.23%, and 44.23%, and 47.37%and 49.49%, except for the first half of 2021, the company's asset -liability ratio is 30 percentage points higher than the industry average.

In 2019 and 2020, the arrow brand has increased its capital and expansion and financing to introduce foreign investors. Although the company's capital structure has been improved, the company's mobile ratio and speed ratio are still lower than those in the same industry comparable company and asset -liability ratio. Higher than the comparison company in the same industry.

"The company has less accumulation in the early stage of the company, and because it has not yet been listed, the financing channels are relatively limited, and the scale of equity financing is relatively small.

In order to improve the operating conditions, Jianzai Home stated that it is necessary to expand financing channels and expand the scale of production and sales.

In this listing, Jianzai Home plans to raise 1.809 billion yuan, setting a new high in the industry's listing financing in recent years. The company plans to use 482 million yuan for the transformation of smart home product production capacity technology, 460 million yuan for an annual output of 10 million sets of water faucets and 3 million sets of shower projects, and 174 million yuan for the technology transformation of the smart home research and development testing center, 90.5475 million Yuan is used for the transformation of the intelligent upgrade technology, 263 million yuan for marketing service network upgrades and brand building, and 340 million yuan to supplement mobile funds.

"Listing fundraising project is a key step in the company's strategic development." Wrig card Home said that the smooth implementation of the company's fundraising project will effectively expand production capacity, enhance the company's product market competitiveness, expand market coverage capabilities, and achieve long -term growth of the company's performance. Provide important support.

Jianzai Home believes that the company has great advantages in terms of brand awareness, product category layout, design and development capabilities, and sales network coverage. The market share, the main business still has huge incremental market space.

"The overall concentration of the ceramic bathroom industry is low, and the market competition is relatively fierce. As the real estate industry's regulation and control continues and environmental protection standards continue to stricter, market competition will further intensify, and the industry will usher in a round of shuffling." A securities company researcher will go to the 21st century to the 21st century Economic Herald reporters said that in the competitive landscape of the industry's accelerated reshuffle, excellent enterprises focusing on brand building and green environmental protection and continuous increase in R & D investment will stand out, and companies with lack of independent brands, backward channel construction, and weak technological innovation capabilities will be Facing elimination.

Industry analysts pointed out that at the same time as listing, the arrow home furnishings throw a large -scale fundraising to expand production capacity. Most of the funds will be intelligently renovated, the construction of R & D centers, and brand marketing network upgrades, or it will once again stir the competitive pattern of the ceramic bathroom industry. Essence

Under the rapid expansion, companies such as arrow home furnishings also face greater risk of market changes.

Jianbai Home prompts in the prospectus that whether the new production capacity of the fundraising project can be digested by the market and achieved the expected goals. It is not only affected by market demand, market competition, and external macroeconomic environment. Constitution of technical support and other factors. If there are adverse factors such as market demand and the development situation of the industry, the risk of the company's fundraising project cannot meet the expected returns.

- END -

Survey of Dazhou Primary School in the United States: Police inaction, systemic failure

Xinhua News Agency, Beijing, July 18th. Nearly 400 police officers against a gunma...

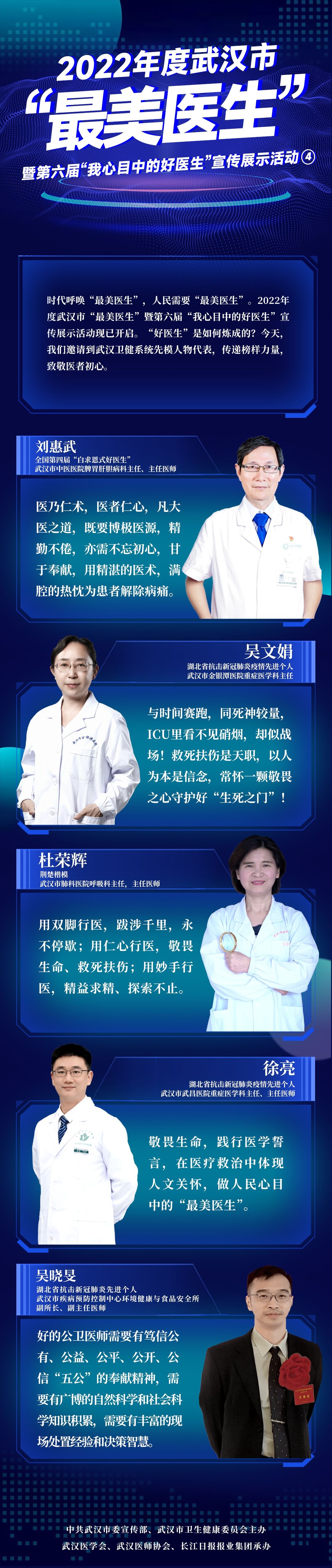

How is "good doctor" made?

The times call for the most beautiful doctor, and the people need the most beautif...