Xie Yangchun et al.: Land investment in third- and fourth -tier cities in housing companies

Author:Zhongxin Jingwei Time:2022.07.11

Zhongxin Jingwei, July 11th.

Author Xie Yangchun Kerui Research Center Research Director

Researcher at Wu Jiazheng Kerui Research Center

Land is an important "reserve grain" for the survival and development of housing companies. At present, on the one hand, due to the reasons limited by the pressure of funds and deleveraging pressure under the new market situation, the investment in housing enterprises has become more cautious in investment in third- and fourth -tier cities; on the other hand Land reserves in core first -tier and second -tier cities with high profits and strong risk capabilities.

The scale of land transactions of third- and fourth -tier land decreased by 21%year -on -year, and the investment ratio of the top 100 fell to a low point

Since 2021, the scale of land transactions in third- and fourth -tier cities has fallen all the way. From the market and enterprise level, it can be seen that the current third -tier and fourth -tier cities are facing a situation where housing companies have gradually adjusted the focus of investment. The market is downturn, the inventory is high, the demand is severe or the main reason, and the pressure of capital accelerates the pace of the evacuation of real estate enterprises.

During the previous round of real estate rising cycle, under factors such as the monetization resettlement of the shed reform and the loose policy, the third- and fourth -tier cities experienced a pop rising market, especially the strong third -tier cities' property market was very hot. The land of third- and fourth -tier cities is the focus of the layout of private housing enterprises, and it has also become the backbone of the land market.

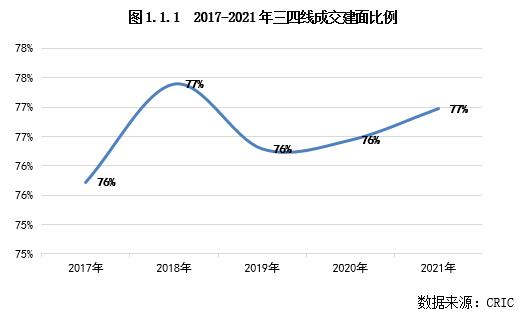

According to Kri Rui data, from 2017 to 2021, despite the decline in market heat, the transaction area of third- and fourth-tier cities accounted for a total of 75%of the national land transaction ratio.

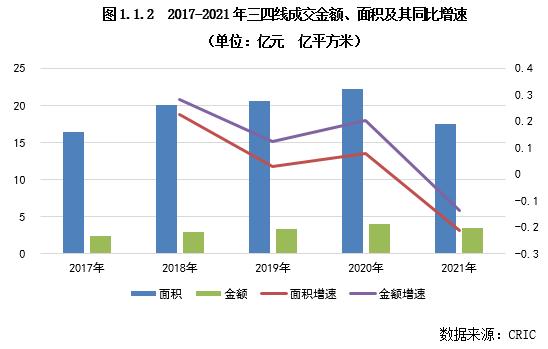

With the changes in policies and markets, the land heat of third- and fourth -tier cities has turned sharply: From the perspective of the transaction building area, before 2020, the scale of land transactions of third- and fourth -tier land has always maintained a positive growth. However, the development point of development was ushered in. The transaction area was only 1.749 billion square meters. The growth rate was negative for the first time, a year -on -year decrease of 21%, and the land transaction value was 3.47 trillion yuan, a year -on -year decrease of 14%.

Many housing companies have taken the market rhythm in a wave of third- and fourth -tier markets in 2017 and 2018, and they have gained a lot.

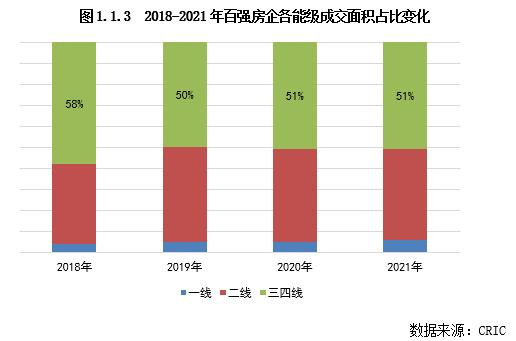

According to Kerry data, the top 100 housing companies in 2018 accounted for nearly 60%of the area in third- and fourth -tier cities. Compared with the value of new landing units in 2018 and the average sales price in 2018, 50%of the value of real estate units decreased than the average sales price than the sales, which confirmed that even if the popularity of third- and fourth -tier cities was declining, there were still half a few houses. Enterprise investment is still sinking.

Starting from the fourth quarter of 2018, the decline effect of the shed reform has gradually increased, and some third- and fourth -tier markets have cool down significantly. Hall companies have begun to shrink low -level cities in investment and gradually return to second -tier cities.

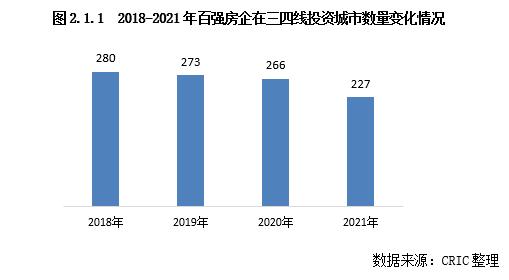

Data show that in the fourth quarter of 2018, the proportion of typical housing companies in investing in land acquisition in second -tier cities has basically been the same as the third and fourth -tier line. In the following three years, the proportion of the third and fourth lines had fallen to about 50%, a decrease of nearly 8 percentage points from 2017.

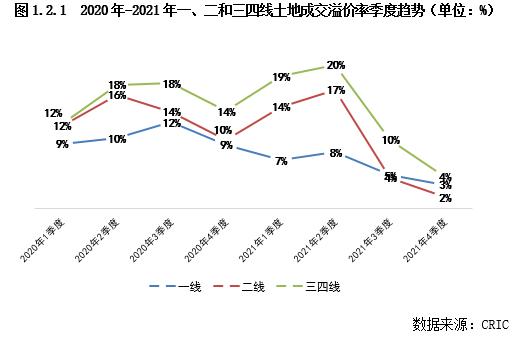

In 2021, the land market in third- and fourth -tier cities was "hot first and then cold". The average premium rate of the land market in the first half of the year remained at about 20%, which was higher than 2020. But in the second half of the year, the average land premium rate dropped to 8%, and in the fourth quarter, it was only 4%, a record low.

The land market for third- and fourth -tier cities continued to continue until 2022. The average land premium rate was only 3.6%, a decrease of 0.8 percentage points from the previous month, and the year -on -year decrease was more prominent, reaching 14.4 percentage points.

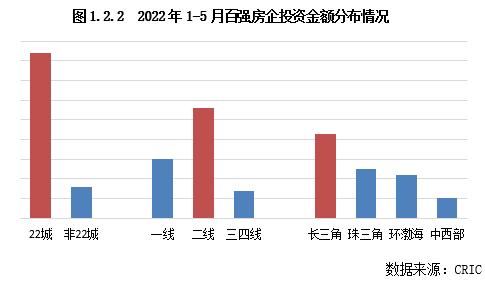

As of the end of May 2022, the top 100 housing companies with extremely cautious investment strategies concentrated 84%of the investment amount in the key 22 cities. The proportion of cities outside 22 cities accounted for only 16%. The hot top three and fourth -tier cities in the group are mainly.

The third- and fourth -tier property market of the Yangtze River Delta and the Pearl River Delta is more attractive

Since the investment ebb of the third and fourth -tier property market in 2021, the top 100 housing companies have played a "differential card", and some hot topic and some hot topic third and fourth -tier cities in the Yangtze River Delta and the Pearl River Delta.

Since 2018, the proportion of housing companies in the Yangtze River Delta has continued to increase. In 2021, the proportion of land investment in the Yangtze River Delta region reached 62%, an increase of 9 percentage points from 2020, and a significant increase of 15 percentage points from 2018.

In addition, the proportion of investment in the top 100 housing companies in the Pearl River Delta has been stable at about 25%, and the change is not large; however, the proportion of third- and fourth -tier investment in the central and western regions has continued to decline.

Specific to the city level, 7 cities have occupied the top 10 investment amount of the top 100 housing companies for 4 consecutive years, including Wenzhou, Foshan, Nantong, Jiaxing, Xuzhou, Wuxi and Changzhou. Most of them are hot cities in the Yangtze River Delta area Foshan is located in the Pearl River Delta area. It can be seen that the location of the third and fourth -tier cities, as well as the association with the core cities around, is an important factor that attracts investment in housing enterprises. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Blue Ribbon Briefing | June 2022

1Joint multi -party and organize a public welfare beach togetherOn June 4th, the B...

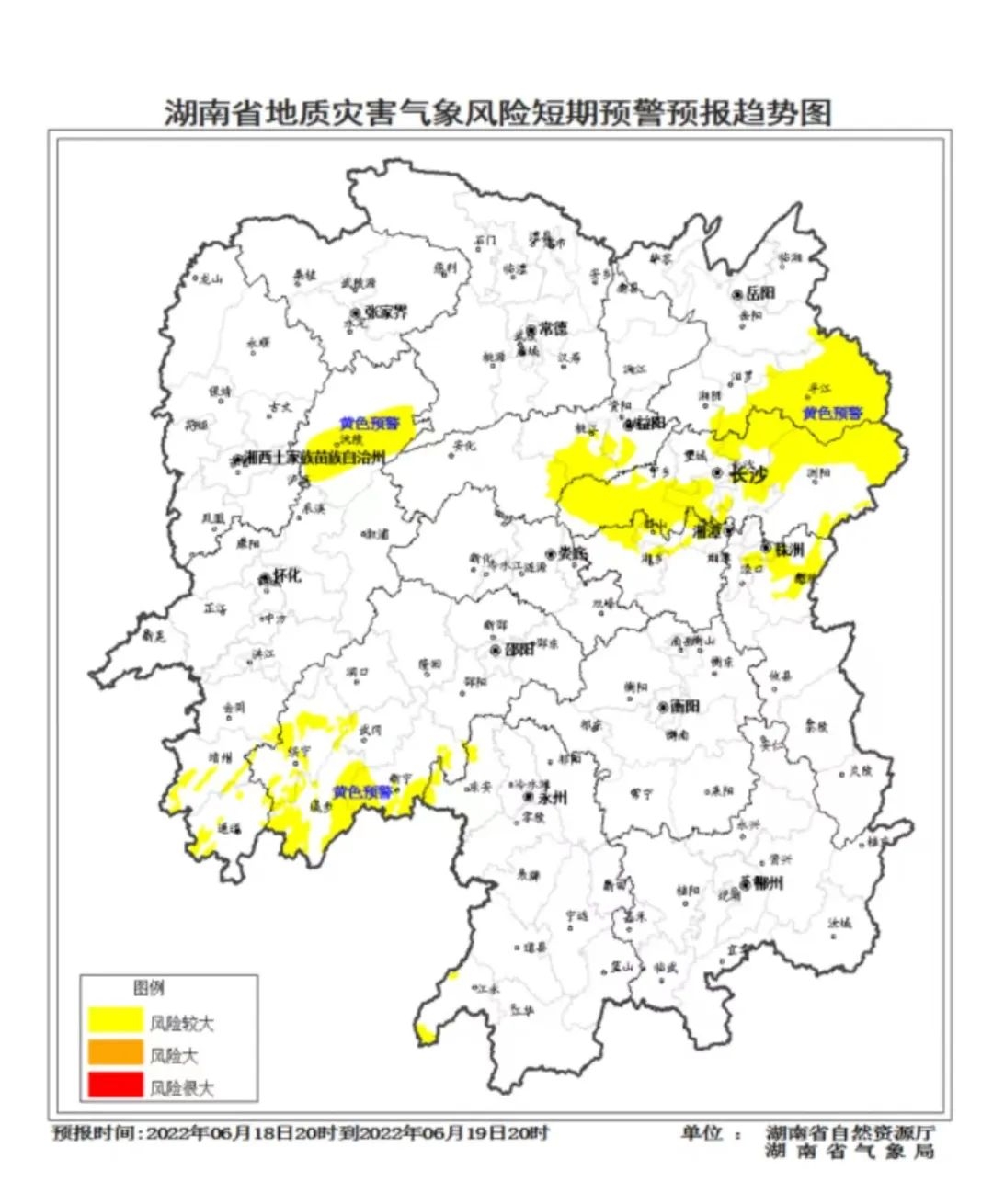

up to date!Hunan starts the flood prevention level IV emergency response!

According to the current flood conditions and meteorological forecasts, in accorda...