The increase in listed companies in the North Stock Exchange to 136 industry expectations to be released by the Beijing Stock Exchange Index

Author:Colorful Guizhou.com Time:2022.07.11

Reporter Meng Ke

Recently, the Beijing Stock Exchange's public issuance and acceptance reached a peak. As of July 10, the number of queuing companies increased to 136. In the past two weeks (June 27th to July 10th), a total of 59 companies have updated the issuance of the issuance review. Compared with the previous two weeks (25 companies updated the release of the audit status) significantly accelerated.

"With the gradual increase of the number of high -quality listed companies, the brand effect and scale effect of the Bei Stock Exchange will gradually be formed, laying a good foundation for market reforms such as the Bei Stock Exchange market index." Chang Chunlin told the Securities Daily reporter.

59 companies update the issuance of the issuance review status

According to the "Securities Daily" reporter, according to the website of the Beijing Stock Exchange, from June 27 to July 10, a total of 59 companies updated the issuance of the issuance of the review, of which 43 were newly accepted by the listing, and the review status of the 15 companies was updated to the question. Inquiry, one company stopped the listing process.

Liu Jing, the new chief analyst of Shen Wanhongyuan's specialty, told a reporter from the Securities Daily that the number of companies in the Beijing Stock Exchange has increased significantly in the past two weeks, which is related to two factors. First, after the amendment of the layered management measures this year, in the first half of the year, in the first half of the year, in the first half of the year, the first half of the year The number of innovative companies reached a record high and provided high -quality resources for the Bei Stock Exchange.

Judging from the layered situation in the first half of 2022, a total of 515 new -level companies, of which 348 companies meet the financial conditions of the Bei Stock Exchange, accounting for 67.57%. The 89 new entry companies have submitted the Beijing Stock Exchange to list the counseling filing materials.

In terms of performance, the overall profit level of the queuing company is comparable to the company's listed company. According to a reporter from the Securities Daily, the number of net profit in the above 136 queuing companies in 2021 was 42.11 million yuan, while the 102 listed company of the Beijing Stock Exchange was 42.82 million yuan.

"Judging from the quality of the queuing company, compared with the previous improvement, it has been significantly improved." Zhang Keliang, the person in charge of the city business of Bohai Securities, said in an interview with the "Securities Daily" that the establishment of the Beijing Stock Exchange was reduced on the one hand, which reduced the company on the one hand, which reduced the enterprise on the one hand, which reduced the enterprise. The threshold for listing has improved the efficiency of listing, so high -quality enterprises are also willing to go public directly on the Beijing Stock Exchange.

Chang Chunlin said that 136 queuing companies have excellent texture, high growth, and profitability such as profitability. These companies adhere to the road of innovation -driven development. After the full cultivation of the New Third Board market, it has achieved rapid development. Standards for the listing.

Market expects the Beijing Stock Exchange Index

The data shows that the current average time of the project review (from acceptance to approval/registration) is 143 days. Enterprises with good quality and diligence of intermediary agencies will be more efficient.

According to this calculation, the number of public issuance companies will double at the end of this year. Industry insiders predict that with the basis of quantity, the Beijing Stock Exchange Index will also be released to provide investors with more transaction options and guidance.

"The Bei Stock Exchange Index has always been expected by the market." Zhang Keliang said that the launch of the Bei Stock Exchange Index requires a certain number of listed companies, and it also needs a certain market operation time. From the current point of view, the number of listed companies listed by the Beijing Stock Exchange has been improved to a certain extent, but the base is still not large enough. It is recommended that the Beijing Stock Exchange's comprehensive index can be launched first, and the relevant industry indexes are continuously improved in the future. It is expected to be launched smoothly in the fourth quarter of this year.

Chang Chunlin expects that the Beijing Stock Exchange Index will refer to the listing time and liquidity indicators, mainly market value indicators, and establish a regular adjustment mechanism. Therefore, companies with good liquidity and high market value among the listed companies in the Bei Stock Exchange will be given priority to the Bei Stock Exchange Index.

He further stated that the launch of the Beijing Stock Exchange Index is of great significance. On the one hand, it is convenient for investors to understand the market and enhance the brand effects and influence of listed companies in the Beijing Stock Exchange; on the other hand, promoting financial institutions to develop various types of index products, attract various institutional investors to enter the market, and improve the market The level and activity of liquidity are of great significance. (Securities Daily)

- END -

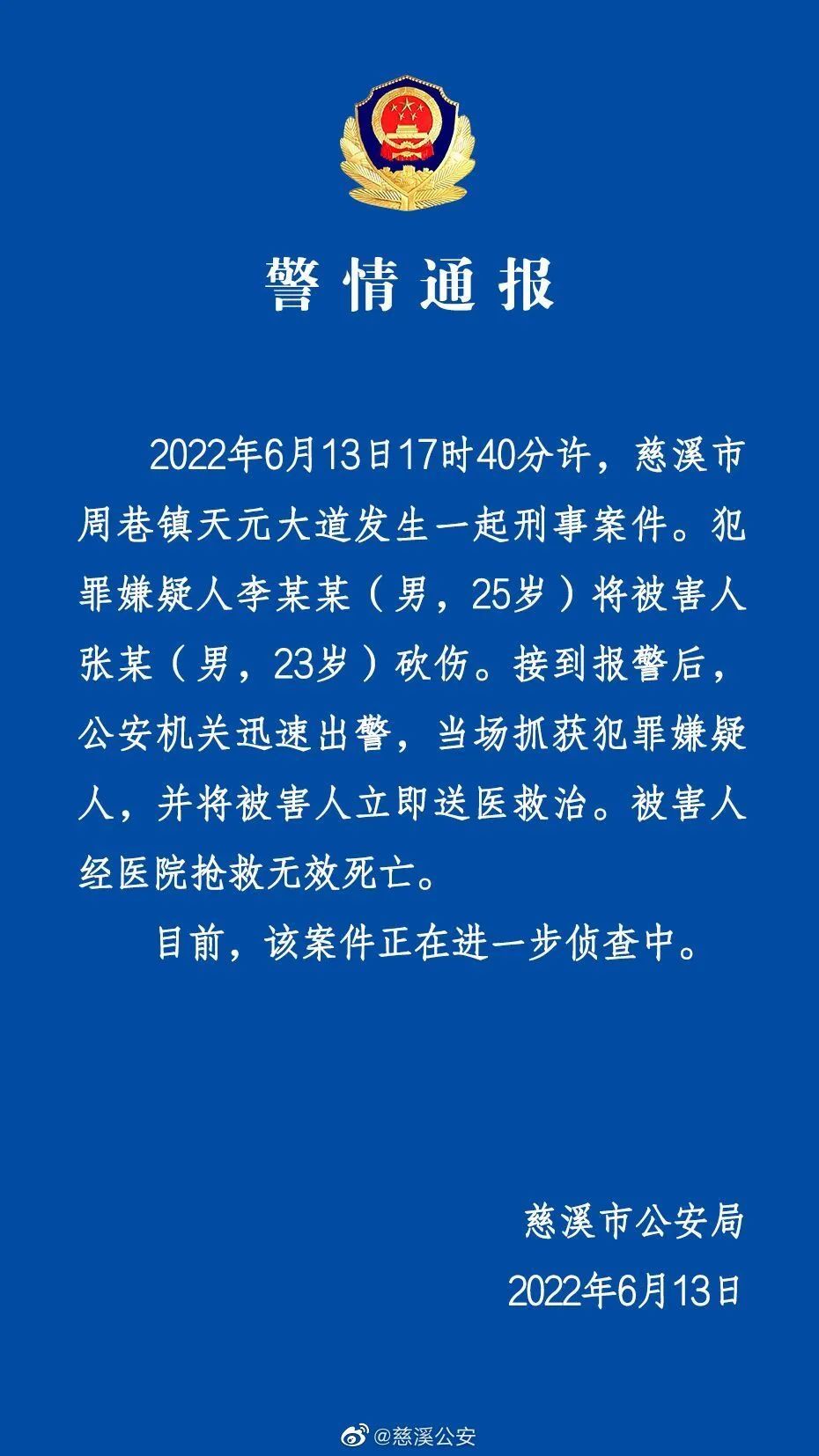

Zhejiang Cixi notified, "capture on the spot"

A criminal case in Cixi, Zhejiang died of a criminal case. Police: The suspect was...

Literary performances enter the community police and civilians jointly guarantee safety

Recently, the Communications Yanta Brigade Electronic City Squadron and Public Sec...