CPE Yuanfeng wants to raise 20 billion yuan, listed companies rush to LP

Author:Rongzhong Finance Time:2022.07.11

More and more listed companies have begun to combine with head institutions. In the turbulent economic environment, it brings a new dawn to the cold winter of fundraising.

After a brief impact of the epidemic, good news from the venture capital circle continued to raise funds.

On July 6, Sequoia China completed a new phase of about 9 billion US dollars fund raised, and this round of fundraising exceeded 50%. On July 1, Yueyue Capital announced the first account of nearly 4 billion yuan in the new dual currency fund. On June 30, Chende Capital completed the fourth phase of RMB funds, with a total scale of 2 billion, including two funding funds each. On June 20, the public for the Capital's RMB fund completed the first barrier, the scale of fundraising exceeded 1 billion yuan, and the capital was more than 10 billion yuan in capital management.

Among these news, there is a fundraising news that "does not show the mountains and not exposure" hidden, that is, CPE Yuanfeng.

On July 1, Washinga Gene issued an announcement saying that the company would invest 200 million yuan in its own funds to participate in the subscription of Xiamen Yuanfeng Equity Investment Fund Partnerships and other value -in -value property shares. The fund manager is Beijing Panmao Investment Management Co., Ltd., and the executive partner Xiamen Yuanfeng Investment Co., Ltd. is actively controlled by CPE Yuanfeng Tianyu.

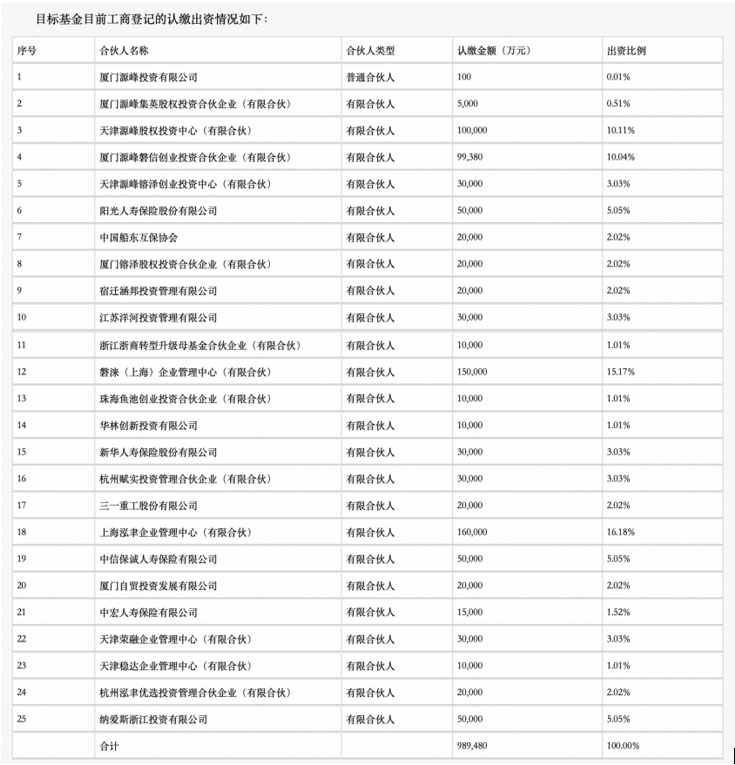

This fund is mainly invested in industry sectors such as medical and health, consumption and Internet, technology and industry, software, and enterprise services. The raising scale is planned to be 20 billion yuan, which is the forefront of the recent fundraising volume. What's more important is that in addition to the Washinga Fund, there are also LPs such as many insurance institutions, government parent funds, and industrial capital. Under the current fundraising environment, such a relatively heavy LP number is rare.

The previous week, Hengtong Optoelectronics, a listed company, had just invested 49 million million yuan in CPE Yuanfeng, Suzhou Hengtongyuan Public Investment Partnership (limited partnership).

Behind 20 billion yuan, Naisi, Yanghe Group, Sanyi Heavy Industry, and Xinhua Life gathered together

CPE Yuanfeng is one of the representatives of China's private equity investment PE. It is "solo" by the original CITIC Industry Fund's original class, LLF team, and focuses on technology and industry, medical and health, consumption and Internet, software and enterprise services. For the four key areas, it is currently supported by more than 200 institutional investors at home and abroad.

According to the data, as of March 2022 (not audited), the total amount of CPE Yuanfeng assets was 43.8014 million yuan, the total liabilities were 24.825 million yuan, net assets were 1,897,400 yuan, and the asset liabilities ratio was 56.68%; 321.50 million yuan, a net profit of -170.71 million yuan.

The Xiamen Yuanfeng Equity Investment Fund, which is involved in the subscription of Huada Fund, plans to raise a funds of 20 billion yuan. In addition to Huada, it also includes Sunshine Life, Yanghe Group, Xinhua Life, Zhonghong Life, Sanyi Heavy Industry, Na Ai Ai Ai Sri Lanka, Zhejiang and Zhejiang business transformation and upgrading parent funds, Huarin Securities, Shanghai Shengda Yuan Information Technology, Zhuhai Yuchi Venture Capital, China Ship Else Mutual Protection Association, Xiamen Free Trade Investment Development and other many talents. At present, in the fund registration and subscription of the fund, Zhejiang Zhejiang Commercial Transformation and Upgrade Mother Fund subscribed 100 million yuan, Sany Heavy Industry subscribed for 200 million, CITIC Baocheng Life Insurance 500 million, and Naisus invested 100 billion.

It is worth noting that Naisus Investment has participated in CPE Yuanfeng Capital Fund in three times in 2016, 2020 and 2021. After this time, the cumulative capital contribution was about 2 billion yuan. The Na Eris Group was established in 1968. It was formerly a local state -owned "Lishui Wuqi Factory". It was restructured to a joint -stock company at the end of 1993. It has become a leading company in China Fast Capital Products. The annual sales have exceeded 25 billion yuan. Dozens of countries have R & D centers and have deployed extensive sales channels. In 2006, the establishment of Naisi Zhejiang Investment Co., Ltd. began to involve equity investment.

In addition, as early as March, Zhaoyan New Pharmaceuticals issued an announcement to subscribe to the Xiamen Yuanfeng Equity Investment Fund Partnership (Limited Partnership) RMB 200 million fund shares, and the source of funds was its own funds. On the same day, Zhao Yan's new medicine also voted 50 million to Huagai Capital's capital Great Health Industry Fund.

Zhaoyan New Medicine was established in Beijing in 1995. This is a star company in the CRO industry. The company's helm was born in 1964 Feng Yuxia. According to public information, Feng Yuxia and Chairman of Shu Tai Shen Zhou Zhiwen are husband and wife, and both graduated from the Academy of Military Sciences.

After graduating, Feng Yuxia worked for three years at the Institute of Poison and Drugs of the Academy of Military Sciences. In 1995, Feng Yuxia went to the sea to start a business. In 2002, Zhou Zhiwen founded Shu Tai Shen Pharmaceutical. In 2011, Shu Tai was listed on the Shenzhen Stock Exchange. Six years later, Zhao Yan's new medicine knocked on the clock on the IPO of the Shanghai Stock Exchange. In February last year, Zhaoyan New Pharmaceutical was listed on the Hong Kong Stock Exchange. At present, the total market value of Shu Tai Shen is 6 billion, while the A -share market value of Zhaoyan New Pharmaceuticals exceeds 50 billion.

Before listing, Zhaoyan New Pharmaceutical has received the Pre-IPO round of financing participated by CPE Yuanfeng. However, as of July 1, Huada Fund issued the subscription announcement that Xiamen Yuanfeng Fund has not yet appeared in the subscription list of industrial and commercial registration. Essence

PE/VC fundraising recovery frequency newspaper

In the first quarter of this year, institutions in the first -level market were not very smooth. On the one hand, the government guidance of the fund's review process has become longer and the funding process has slowed down; on the other hand, due to the downturn of the entire economic situation and the secondary market, coupled with the influence of the epidemic, the confidence of social funds is insufficient, and most of the investors are watching. However, in the past two months, the emotions of the capital market have continued to pick up, and a new turnaround has appeared in VC/PE fundraising.

In April, a total of 656 institutions in the Chinese market participated in the establishment of funds, 84%of institutions set up 1 fund, and 10%of institutions completed two new sets of funds. According to recent years of fundraising data, although the number of new funds fluctuates a large fluctuations, the overall trend has risen year -on -year and continues to maintain 20 % or more.

In May, a total of 2011 funds were raised in 201. The total of 51.85 billion yuan in the amount of raised funds disclosed in 198 funds. Among them, the 195 funds that disclosed the total amount of the collection totaled 40.3 billion yuan; the remaining three foreign currency funds raised a total of 11.581 billion yuan. In addition, the total scale of the fund raised TOP10 reached 32.339 billion yuan, accounting for 62.4%of the total scale, and the head effect was still obvious. Entering June, good news of fundraising continued.

On June 1st, NEEO Fund announced the completion of the first phase of the RMB Venture Capital Fund for the first time, including ultra -map software, smart online, Bile Technology, Shanghai Yingzhen and other investors and many listed companies. Subscribe.

On June 9th, the Kaihui Fund announced the establishment of an early risk fund of 100 million euros. The fund was jointly established with its long -term investor French National Investment Bank (BPIFRANCE) and Kaihui invested company encrypted security platform. Companies from seeds to Series A, excavate the global web 3.0 investment incubation opportunities. This is the third fund announced by the Kaihui Fund in the past two weeks. The other two funds include: 3 billion -scale RMB two -phase growth funds and 500 million euros Global Medical Fund.

On June 12, Yingke Capital held a fund signing ceremony with the Hubei Tianmen City Government. The two parties planned to jointly implement the "Special Fund Program for the Golden Wutong Industry" and set up an industrial landing fund of 5 billion yuan.

On June 20, Jiangsu Temple invested 45 million yuan to invest in Yida Capital. On the same day, Sequoia India and Southeast Asia, a subsidiary of Sequoia Capital, announced the launch of two new funds, which are Early Capital Capital's early risk and growth funds (about 2 billion US dollars) and Sequoia Capital Southeast Asia Exclusive Fund (about 850 million US dollars in scale To.

In the first half of this year, due to the impact of the macro environment, the participating entities of the first -level market can be said to have different degrees of difficulties at both ends of the fundraising. Fortunately, local finances are constantly actively releasing investment potential. In many provinces and cities, they may introduce relevant scientific and technological innovation support policies, or prepare government guidance funds to leverage the social capital investment industry. In addition, more and more listed companies have begun to actively combine with head institutions to bring a new dawn to the turbulent economic environment.

As of May, more than 170 listed companies have participated in the establishment of industrial funds this year. The investment fields are mostly related to the company's own industrial chain, such as Jiangfeng Electronics, Sanbang, Well, Ningde Times, Hengrun Pharmaceutical, Rainbow Group, Ruisong Group, Ruisong Group, Ruisong Group, Ruisong Group Many companies such as Technology and Starnet Ruijie have announced the establishment of industrial funds. Most branches are based on their own industrial chain layout, such as investing in new energy, semiconductors, new materials, medical health, pet consumption, etc.

Since the second quarter, although the market turmoil still has many uncertainty, investors still show strong confidence in the future of China's capital market, which can be seen from the continuous news of fundraising. Some investors also told Rongzhong Finance that "As the state -owned Assets LP became stronger and the industrial LP rose rapidly, the far -reaching impact will gradually appear in the future."

Huada "has to cast"

It is said that Huayi has invested LP this time.

Washington Fund was established in 1999 and was listed on the Shenzhen Stock Exchange in July 2017. The main business is to use technical means such as genetic testing, mass spectrometry, and biological information analysis to be scientific research institutions, enterprise institutions, medical institutions, and social health organizations. Provide research and precision medical testing services. At present, it has covered more than 100 countries and regions around the world, including more than 2,000 scientific research institutions and more than 2,300 medical institutions in China, of which more than 300 three hospitals; more than 3,000 overseas medical and research institutions such as Europe, America, and Asia -Pacific. Since its listing, Huada Gene has continued to build and expand the "Huada Ecology" through investment.

For example, in May 2017, Huada Gene Strategic Investment Investment in the well-known British biological information analysis service provider Kang Jianyco; in December 2017, Washinga Gen's strategic investment "industry-leading precision medical data platform company-Judao Technology"; In the same year, in December, Huada's Ophthalmology was invested. In addition, Huada Gen has invested 128 million star startups "Gainga Technology" in the field of tumor gene testing.

In February 2022, Huada Gene bought genetic data for 760.575 million yuan. Huada Gene said that the company is optimistic about the development prospects of the consumer genetic testing industry and group genome research service industry where Shenzhen "knows technology". The inventory method increases the capital and transfer some equity of the target company, with a total transaction amount of 53 million. Huada has always had the reputation of "Huangpu Military Academy" in the gene industry. For 18 years, nearly a hundred former Chinese who have dreams of dreams have successfully graduated from Huada and joined the genetic industry's entrepreneurial army. In the process of building an ecosystem, on the one hand, Huada Gene, on the one hand, through the high -quality enterprise founded by Lord China before investing, on the other hand, it has become more open to investment.

In 2016, Huada Medical Equity Investment Fund, a subsidiary of Huada Gene, was established. Focusing on the three areas of biomedicine, medical devices and genetic technology, it has invested in Bori Technology, Yingnot Biology, Lukang Bio, Ai Xin, Ai Xin, and Ai Xin. Dawei and other more than 20 projects.

Industrial strategic investors are not like simple fund financial investors just pursue simple financial returns, but more considerations based on strategic business collaboration. Washington has the industrial advantages and industrial scientific research capabilities of BGI's genes, and also has a deeper industrial law to understand the ability and industrial thinking.

In addition to his own investment, Huada Fund also continued on the LP road. In addition to the CPE Yuanfeng, which was shot this time, as early as 2019, Huada Gene had invested 60 million to recognize the medical fund of Songhe Capital, Guangzhou Songhe Medical Jian Entrepreneurship Investment Partnership (limited partnership).

For Huada Gene, in early 2017, the listing of A shares should be an important turning point in its development process. With the previous entrepreneurial process and business scale, it won the title of "Tencent of the Gene Sequencing World". It was also the first highlight moment. Essence However, after listing, Huada Gene, just like the majority of companies that have begun A shares, inevitably encountered various tests.

According to the data of Huada genes, the company realized operating income of 6.766 billion yuan in 2021, a year -on -year decrease of 19.42%; the net profit attributable to shareholders of listed companies was 1.462 billion yuan, a year -on -year decrease of 30.08%. Regarding the decline in performance, Huada Gene stated that the competition in the new crown business market has intensified, the global new crown nucleic acid reagent and detection unit price decrease, and the changes in some countries and regions. Related profits have decreased compared to the higher base in 2020.

In the first quarter of 2022, the performance of Huada Gene continued to decline, with operating income of 1.430 billion yuan in the first quarter, a year -on -year decrease of 8.52%; net profit attributable to shareholders of listed companies was 330 million yuan, a year -on -year decrease of 37.06%. From the perspective of business, the revenue of the new crown of Huada Gene is the most obvious.

Recently, the country has conducted special investigations on a large -scale nucleic acid testing agency, and many unqualified institutions have gradually been "excavated". According to incomplete statistics from the media, 250 nucleic acid testing agencies have been ordered to rectify, and 26 other institutions have been ordered to suspend nucleic acid testing business by themselves. Insufficient business, inspection personnel, irregular testing operations, etc.

Once, at the beginning of the new crown epidemic, the BGI decippped the new crown virus sequence for the first time, and the preliminary research and development of the testing kit was completed in just 72 hours. Huada Gene also took the lead in completing the research and development of a number of new crown virus detection kits and won multiple domestic and international qualifications. The "Fire Eye Nuclear Acid Detection Lab" is an innovative product for Washinga Gene to respond to the emergency new crown epidemic.

In 2020, in order to rapidly improve the detection capacity of the new crown nucleic acid, the Huada team only used 5 days to quickly build a fire -eye nucleic acid detection laboratory with a daily detection capacity of 10,000 people, becoming many anti -epidemic facilities such as Thor, Vulcan Mountain, and square cabin. The outpost, maximize the technological advantages. Subsequently, the Fire Eye nucleic acid detection laboratory of Huada Gene was quickly copied to Shenzhen, Guangzhou, Beijing, Foshan, Shijiazhuang and other cities. The daily detection capacity can reach up to 2.1 million nucleic acid samples.

However, in 2021, the business income of the comprehensive solution of Huada Gene Precision Medicine Testing Solution (mainly a comprehensive solution for the new crown virus nucleic acid testing kit and the "fire eye" laboratory integrated solution) 3.382 billion yuan, a year -on -year decrease of 39.20%. The proportion of the company's revenue also dropped from 66.24%to 49.99%. If the new crown epidemic is a test of the overall strength of the University of China, then the post -epidemic era is the beginning of another big test of Wasteen ’s genes.

- END -

Comprehensively promote the spirit of the Provincial Party Congress

The 15th Party Congress of the Provincial Congress depicts the grand blueprint of the common prosperity and prelude to the provincial region of Zhejiang Province in the next five years. The task book

Lixian Meteorological Observatory continues to release thunder and yellow warning signals

Lixian Meteorological Observatory continued to issue a lightning yellow warning signal on June 09, 2022 00:25: It is expected that it is expected to be daytime to daytime.Bashe Town, Leiba Town, Beidi