There are counts | June cash management product returns inventory

Author:Cover news Time:2022.07.11

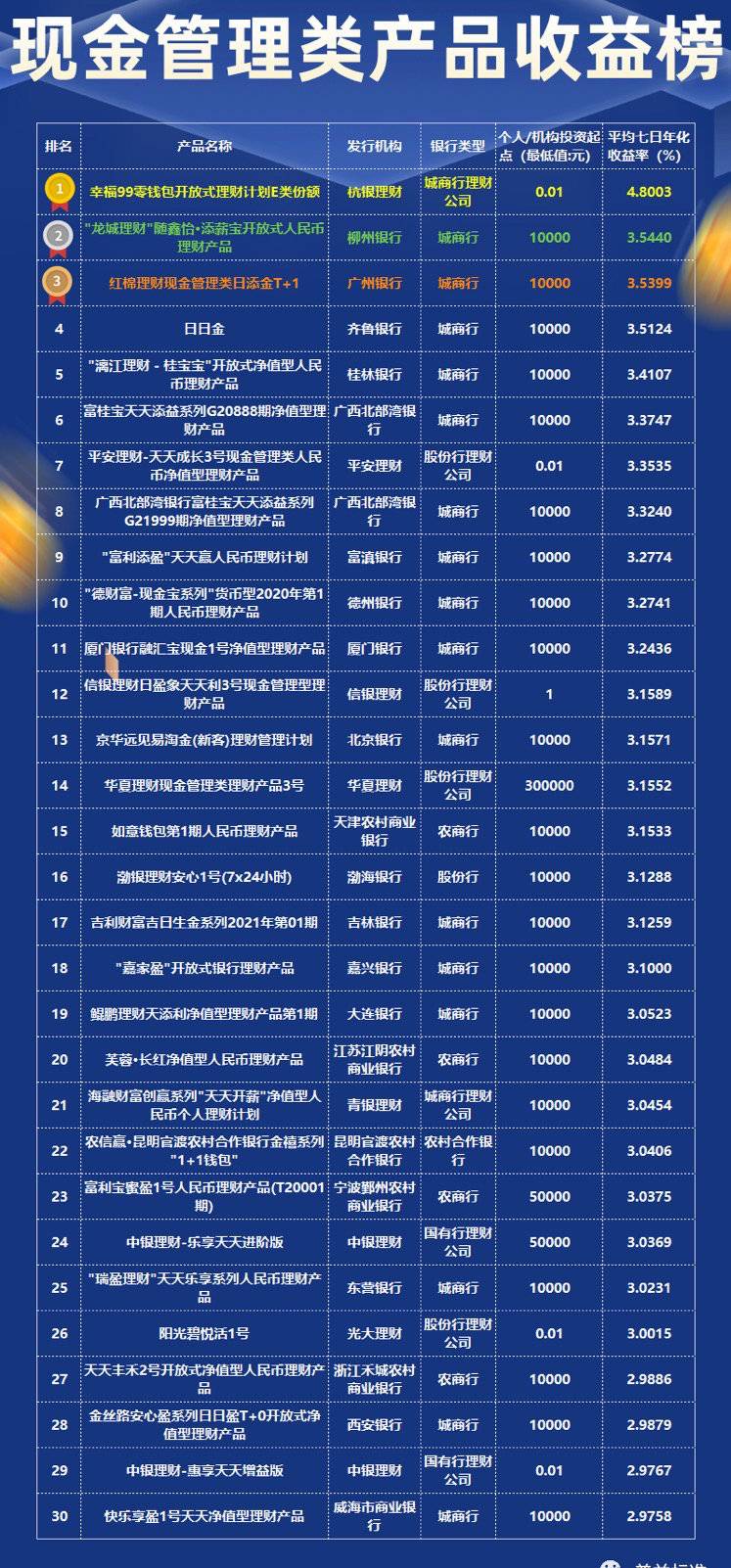

After more than three years of transition period, the new asset management regulations officially began to implement in 2022. At the same time, the rectification of cash management wealth management products has also been continuously promoted. So what is the income of cash management products in various institutions in June 2022? According to data disclosed by the public channels, the Puyi Standard selected a public offering of public offering of public offering of public offering of public offering of public funds from June 1 to June 30, 2022 from June 1st to June 30th, 2022. The average 7 -day annualized yield of the month is ranked. On the whole, the income of cash management wealth management products in urban commercial banks still dominates.

In this list, the average annualized return rate of the share of the open 99 pocket open wealth management plan is 4.8003%, which is the championship; The average 7 -day annualized yield is 3.5440%, ranking second; Red Cotton Financial Cash Management Category Daily T+1 an average 7 -day annualized return rate is 3.5399%, ranking third.

Income: The average annualized return on the 7 -day list of all listings was 3.2283%, a slight decrease from the previous period; the average annualized return on the 7 -day product on the list was 2.9758%, a slight decrease from the previous period. In addition, the average 7 -day annualized return of 11 products exceeded the average annualized return of all products of all products, a decrease of 1 model from the previous period.

Institutional distribution: Among the types of institutions, the number of products in the city commercial banks has the largest number, with a total of 16 products, accounting for 53.33%; followed by the Rural Commercial Bank and Shares' Financial Company, there are 4 products, accounting for 13.33%. On the whole, the income of cash management wealth management products in urban commercial banks still dominates.

Figure 1

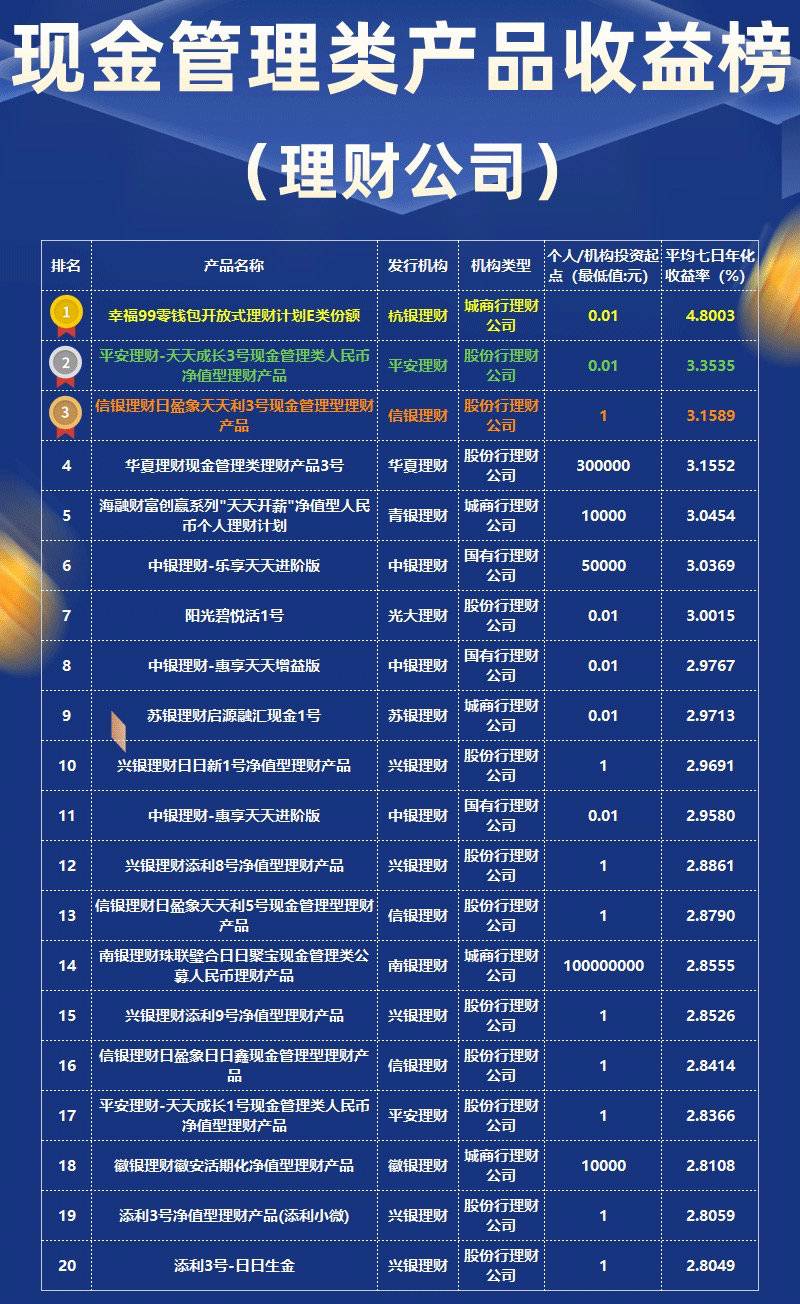

Cash management income list of wealth management companies

In this list, the average annualized return rate of the share of the open 99 pocket open wealth management plan is 4.8003%, ranking first; Ping An Finance-Tiantian Growth 3rd Cash Management RMB net value-type wealth management products The annualized yield is 3.3535%, ranking second; the average annualized return on the average 7 -day cash management wealth wealth management product of Xinyin Wealth Management Day of Xinyin Bank is 3.1589%, ranking third.

Income: The average annualized return on the 7 -day product on the list was 3.0500%, which was slightly increased from the previous period; the average annualized return on the 7 -day product on the list was 2.8049%, which was slightly increased from the previous period. In addition, the average 7 -day annualized return of 4 products exceeded the average of the average 7 -day annualized return of all products of all products, a decrease of 3 models from the previous period.

Institutional distribution: There are 12 products on the shareholders' wealth management company, 3 products on state -owned bank wealth wealth companies are on the list, and 5 products have 5 products on the list of urban commercial banks. Among them, there are 5 products on the list of Xingyin Financial Management; BOC Financial Management and Xinyin Financial Management has 3 products on the list.

Figure II

Cover reporter Dong Tiangang

- END -

Reverse the championship!Congratulations to Wang Chuqin/Wang Manyu

On the evening of the 16th Beijing time, the WTT (World Table Tennis Professional League) Star Challenge Budapest Station staged a mixed doubles final. The Chinese group Wang Chuqin/Wang Manyu pulled

Notice on the Fifth Anniversary Knowledge Contest of the "People's Republic of China Traditional Chinese Medicine Law"

School of Science and Technology of Chinese Medicine SciencesPublic account ID: CA...