18 trillion!Turn the "good policy" of tax refund into "real effects"

Author:China Economic Network Time:2022.07.11

Core point: Yang Fei, the author of China Economic Net column, believes that it is necessary to continue to promote the implementation of the combined tax support policy. In particular, the "good policies" such as tax refunds have been transformed into "true effects" to help economic operation quickly recover. At the same time, we should also explore the linkage with other policies to comprehensively reduce the cost of corporate costs, further stimulate the internal and medium -sized enterprises' endogenous power, innovation capabilities and development vitality, and continuously improve the competitiveness of the industry.

Since the beginning of this year, my country has implemented a new combined tax support policy to help market entities relieve difficulties. As the "highlight", the implementation of large -scale VAT retain tax refund policies has attracted much attention. The latest statistics show that as of June 25, the tax refund of the taxpayer account exceeded 1.8 trillion yuan.

In recent periods, affected by factors such as complex evolution of geopolitical geopolitics and recurrence of domestic epidemic, many market players have encountered difficulties. In particular, the majority of small and medium -sized enterprises, facing realistic issues such as high raw material prices, insufficient orders, difficulty in using workers, slow financing for financing, and high logistics costs. In this regard, the party and the government adhere to the general tone of steady progress, give full play to the advantages of sufficient macro policy space, many macro -policy tools, etc., strengthen cross -cycle and counter -cyclical adjustment, and play a series of "combination boxing" in the main body of the market. Essence

Tax reduction and fee reduction are the most fair, direct and effective measures to help enterprises relieve rescue. Earlier this year, the central government clearly proposed to increase tax refund. After the National Two Sessions, the implementation plan of the tax refund policy was further refined. From April 1st, the new tax refund policy was officially implemented. Today, the taxes over 1.8 trillion yuan have really refunded it to the enterprise in the form of "real gold and silver", which gave the market entity a "reassinual pill".

From the perspective of scale, small and medium -sized enterprises are the main subject. The market subject is the toughness and potential of my country's economic development. The key to the main body of the market is to protect small and medium -sized enterprises. The large -scale retention tax refund implemented this year, which was clearly made "priority arrangement of small and micro enterprises" at the beginning. Relevant statistics show that since April, the number of taxpayers who have obtained tax refunds have accounted for 94.5%of the number of small and micro enterprises, a total tax refund of 756.3 billion yuan, accounting for 44.4%; medium -sized enterprises tax refund was 37.83 billion yuan, accounting for 22.2 22.2 %. This is enough to show that there are many types of new combined tax support policies, large scale, and wide coverage. The majority of small and medium -sized enterprises are the main beneficiary group of tax refund policies.

From the perspective of the industry, the six industries including manufacturing have benefited significantly. In the production and operation, "light -fitting simplicity", leaving tax refund effectively increased the confidence, courage and confidence of the development of the enterprise. Statistics show that from April 1st to June 25th, 6 industries including the manufacturing industry, which enjoyed the total amount and increased the total amount of tax refund, obtained 991.2 billion yuan in tax refund, of which the manufacturing tax refund was 441.1 billion yuan. For manufacturing enterprises, retention tax refund has positively impact in terms of improving profit levels, reducing procurement prices, relieving capital pressure, and improving cost structures. Innovation and research and development are inclined to enhance the added value and core competitiveness of manufacturing products.

At present, global economic growth has slowed down and high inflation operations. Domestic economic development is facing three pressures of demand shrinkage, supply impact, and expected weakness. In order to hedge the impact of new coronary pneumonia's epidemic and slow down the pressure of new economy, we must enhance the continuity, stability and sustainability of the tax refund policy. It is necessary to continue to promote the implementation of a combined tax support policy, especially the "good policies" and other "good policies" such as tax refund into "true effects" to help the economy operation quickly recover. At the same time, we should also explore the linkage with other policies to comprehensively reduce the cost of corporate costs, further stimulate the internal and medium -sized enterprises' endogenous power, innovation capabilities and development vitality, and continuously improve the competitiveness of the industry. (China Economic Network columnist Yang Fei)

Economic Daily-China Economic Network Review Theoretical Channel is open for submission. Original reviews and theoretical articles can be sent to CEPL#CE.CN (#to@). For details, please refer to Economic Daily-China Economic Network Review Theory Channel's Publishing Channel.

Related articles: How to understand the three dimensions of large -scale value -added tax retained tax refund

Ensure the tax refund funds directly to the market subject

- END -

Carry out dredging action to restore the road neat and smooth road

Maiji District Rong Media Center (Reporter Bai Li Lu Zhihui) Affected by heavy rai...

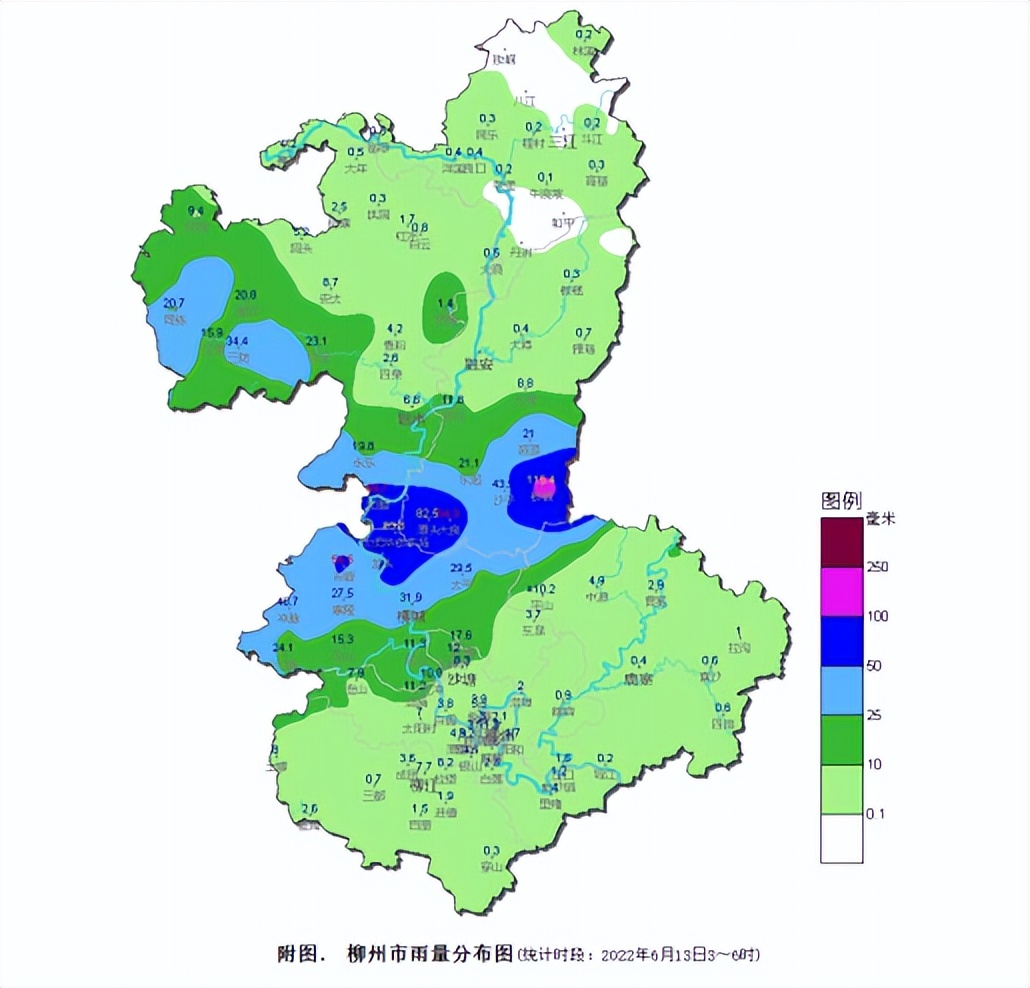

Multiple schools in Liuzhou suspend classes!Emergency response level increases again

This morning Liuzhou has fallen into heavy rainstormsWater to the multi -road sect...