Guangzhou Digital RMB and local financial industry are innovative and integrated, helping rural rejuvenation and benefiting the people

Author:Yangcheng Evening News Yangche Time:2022.07.10

Wen, Figure/Yangcheng Evening News all -media reporter Hang Ying correspondent Zhu Jin Xie Dexin

Since Guangzhou has officially approved the third batch of digital RMB pilot areas in April this year, the Guangzhou Local Financial Supervision and Administration Bureau has actively explored the integration of digital RMB and the local financial industry's innovation, helping rural revitalization and benefiting the people.

At the 11th China (Guangzhou) International Financial Trading · Expo (referred to as the Golden Fair), which was just concluded, a "digital RMB" and "digital financial innovation" exhibition area was set up to announce the launch of the country's first local financial digital infrastructure platform -"Guangzhou local financial digital infrastructure platform", accelerate the promotion of local financial institutions to strengthen the innovation of digital RMB application scenarios and financial services innovation.

"Insurance+small loan+digital RMB"

Help a small loan company to develop "Agricultural Insurance Digital Coin Loan"

With the opening of the digital RMB payment channels in many consumer places and public institutions in Guangzhou, the digital wallet as a digital RMB carrier will become the new domestic payment traffic port, bringing new customer traffic and business opportunities to local financial institutions. At the same time, local financial institutions use digital RMB for transactions to avoid handling fees, which will help further reduce settlement costs. If the smart contract function of digital RMB is used, the use of loan funds can also be agreed in the future to strengthen credit fund management.

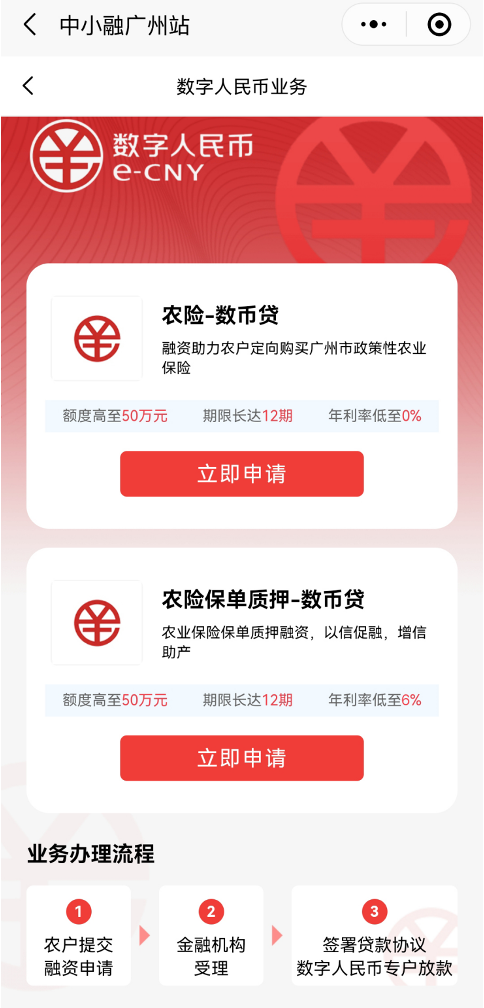

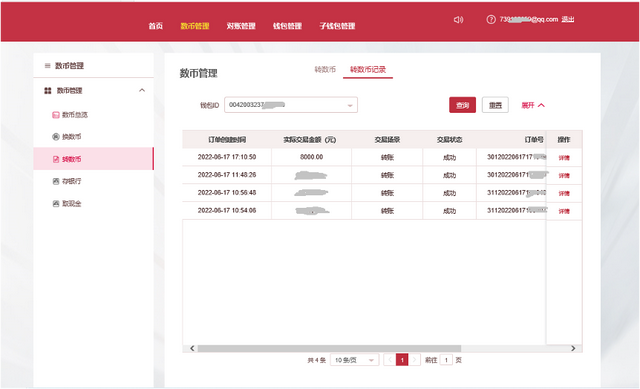

Recently, under the support of the Guangzhou Local Financial Supervision and Administration Bureau, Guangdong Yingfeng Inclusive Interconnection Micro Loan Co., Ltd. (hereinafter referred to as "Yingfeng Small Loan") was launched based on digital RMB development. ", Combined with the credit data services of the local financial digital infrastructure platform in Guangzhou, Yingfeng Small Loan tailored an online small loan product that provided financing support for agricultural insurance for farmers-" Agricultural Insurance Digital Loan ". After the farmer opens the digital RMB wallet, you can apply for the "agricultural insurance digital currency loan" financing product online, and the loan is agreed to be issued to its digital RMB wallet when signing a loan contract. After receiving the payment, you can purchase agricultural insurance products such as Pacific Insurance and other institutions through digital RMB wallets.

Recently, the "Dragon Boat Water" in Guangzhou has been fierce and frequent rainfall. The enthusiasm and urgency of farmers to purchase agricultural insurance have been greatly improved. Guo Guo, a large rice planting farmer in Huadu District, applied for "Agricultural Insurance Digital Coin Loan" through online, and experienced the various convenience brought by the digital RMB wallet. After the Bank of China Digital Renminbi Wallet, the online application obtained a currency loan of Yingfeng Pratt & Whitney Loan, and paid to the coin account of the Pacific Property Insurance through the currency wallet. The entire process does not exceed 1 hour. Insurance provides convenient financing and payment convenience, and improves the ability of farmers to resist natural disasters and economic risks.

"Dangdang+Digital RMB"

Local financial institutions test water "pawnt coin loan"

In order to implement 19 financial bailout articles in Guangzhou, under the guidance of the Guangzhou Local Financial Bureau, Guangzhou Folk Financial Street Credit Data Technology Co., Ltd. and the Guangzhou Micro Loan Industry Association guide banks, insurance, microfinance, pawn, pawn, and pawn, and Factory registered members of the local financial digital infrastructure platform in Guangzhou, serving the financing needs of local small and micro enterprises, individual households, and farmers. Under the authorization of the borrower, financial institutions can check the other party's credit status through infrastructure platforms, coupled with the "customized" payment of digital RMB wallets to help financial institutions improve the level of risk control and give higher amount of financing credit.

Recently, Guangzhou Xinheng Shengdang Co., Ltd. has launched a "insurance order pledge countless coin loan loan in the agricultural field and catering of the agricultural field and catering in the agricultural field and catering service industry that was less involved in the agricultural field and catering service industry that was rarely involved in the agricultural field and catering through the registration. "And" pawn coin loan "innovative products. For Li Moumou, a catering merchant who recently affected by the epidemic affected by the epidemic, Li Moumou and others, the company has issued several "pawn coin loans". Assistance has appropriately improved the financing credit quota and loan period, reduced financing interest rates, and facilitates small and micro enterprises to quickly solve financing issues.

All parties speed up application scenarios innovation

First establish a digital RMB application ecosystem

The reporter noticed that the recent insurance -based digital RMB financing service innovation based on insurance in Guangzhou, and Guangzhou Branch of China Pacific Property Insurance Co., Ltd. has given positive cooperation and support. It is reported that Pacific Property & Casualty Insurance is one of the earliest insurance institutions that carry out digital RMB insurance business in China. Aiming at how digital RMB serves the rural revitalization and benefit of the people in Guangzhou, Zhong Guodong, secretary of the party committee and general manager of the Guangzhou Branch of Pacific Property & Casualty Corporation, said that Tai Bao, as the head state -owned enterprise unit in the insurance industry, is in artificial intelligence, big data, blockchain, blockchain , Remote sensing technology and other emerging technologies to accelerate the application, supplemented by data collection and analysis of the whole area, to open up the online full process of intelligent customized insurance services for customers, and cultivate new products and new formats such as smart terminals, online services, remote control. The digitalization of the city insurance industry provides a model. "In the future, our company will continue to increase the scope and convenience of digital RMB to purchase insurance products, and continuously enrich the application scenarios of digital RMB benefit people."

In response to the recent innovation of digital RMB financial services, the relevant person in charge of the Guangzhou Local Financial Supervision and Administration Bureau said that since the third batch of pilot areas of digital RMB in Guangzhou in April this year, Guangzhou CityThe seven key people's livelihood areas such as entertainment and medical treatment have all landed in the special application scenarios, and have achieved preliminary results.Source | Yangcheng Evening News · Yangcheng School

Responsible | Li Zhiwen

- END -

The latest personnel in a county in Guizhou

Data-nickName = Sky Eye News Data-ALIAS = Tianyanxinwen Data-SIGNATURE = Kaitian E...

[Micro Anime] A fantasy journey of a green onion

Hello everyone! My name is green onion, five elements belong to wood, and straight...