Camping fire to 618, the head brand has obvious advantages, and niche brands rely on subdivided breakouts

Author:CBNData Study Agency Time:2022.07.08

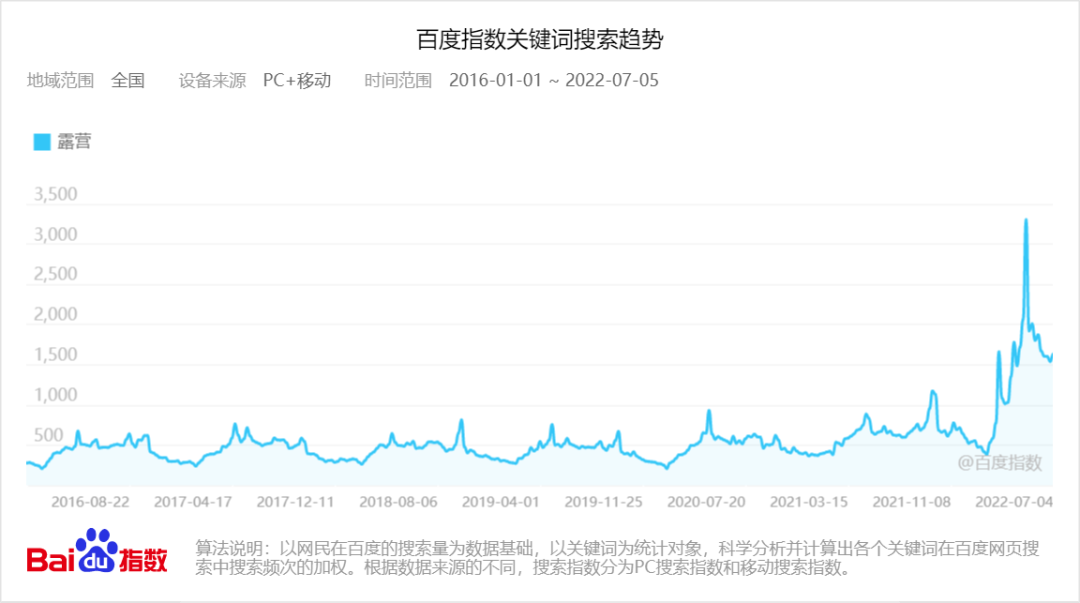

In 2022, camping is undoubtedly one of the most "outsiders" lifestyles. Due to the promotion of the epidemic and social media, this niche project that originally belonged to professional outdoor enthusiasts has received unprecedented attention and heated discussion. Baidu Index shows that in the past long period of time, the popularity of camping was relatively stable, only a small trend during the small holidays such as "May 1st" and "Eleventh". In 2021, the camping began to enter the public horizon, the search index continued to rise, and reached its peak in recent years during the "May 1st" period in 2022.

Data source: Baidu index; data statistical period: 2016.01.01-2022.07.05

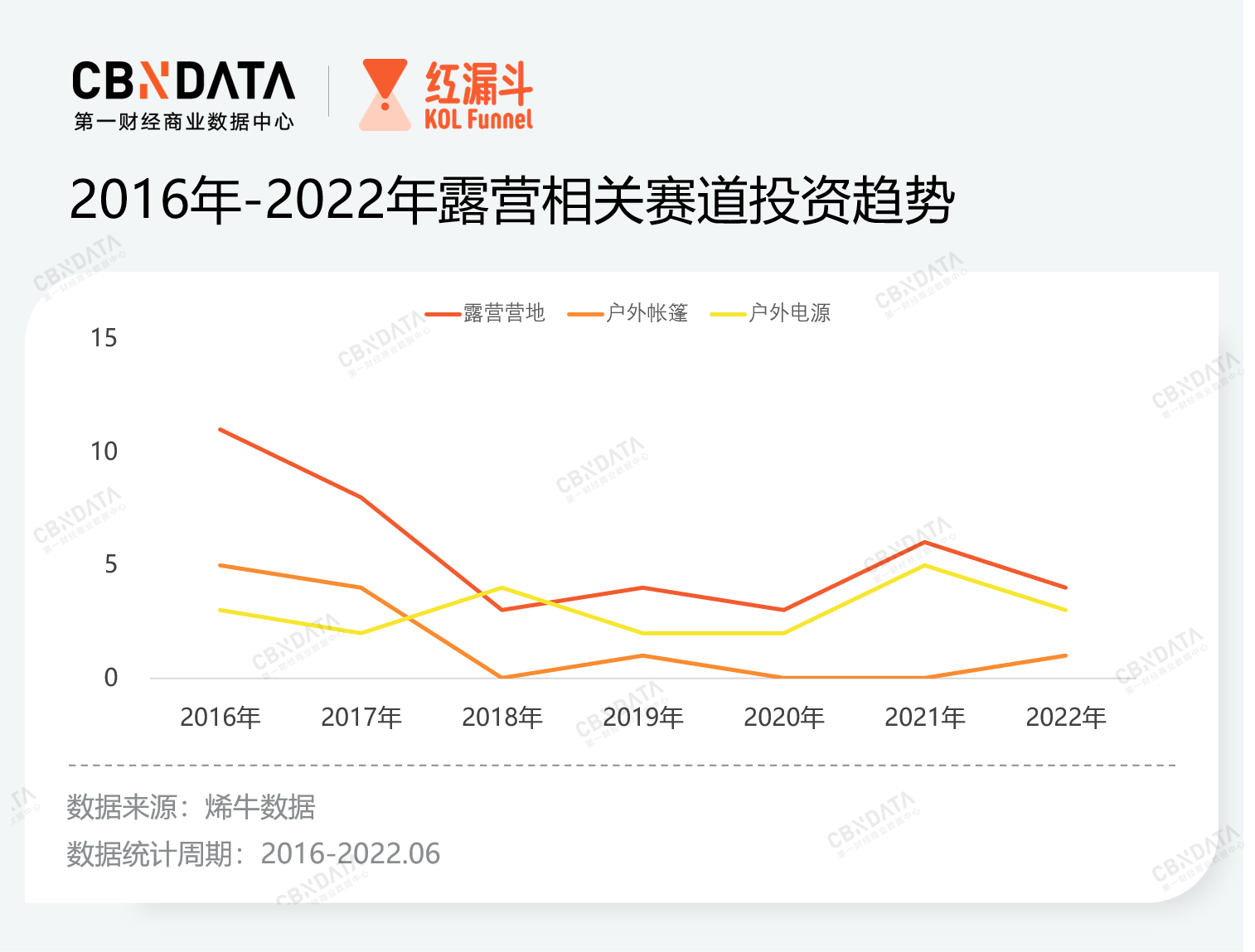

The capital market has also affirmed the prospects of the camping market, but related investment events are limited to the "camping camp", a professional and heavy asset track, and the investment projects are not as much as possible. If the scope is enlarged to the outdoor field, the number of outdoor tents and outdoor power sources have risen in recent years, which is also related to the popularity of niche projects such as camping. It is worth noting that the data of the oxen showed that before 2021, the only business -related business -associated camping and mostly established before 2015; now a group of new companies focusing on camping business have successively completed angel round financing to inject the track injection of the track. Fresh power.

On the consumer side, the camping boom is more vivid and vivid. With the hobbies of camping become the topic of the whole people, enthusiasts will still carefully select professional camps and purchase full sets of equipment. New players will value the social attributes and emotional values of camping. Putting on snacks is also a pleasant camping experience. This allows the camping to get rid of the excessive dependence on the holidays. The suitable spring and summer interaction and the intersection of summer and autumn can be regarded as the peak period of camping consumption.

The 618 that just ended was also the first promotion faced after the full screen of the camping. CBNDATA combined with Nint Ren Tuo, through data inventory analysis of the segmented category of camping equipment, the brand's performance in the first half of 2022 and 618, trying to discover the potential category and the black horse brand.

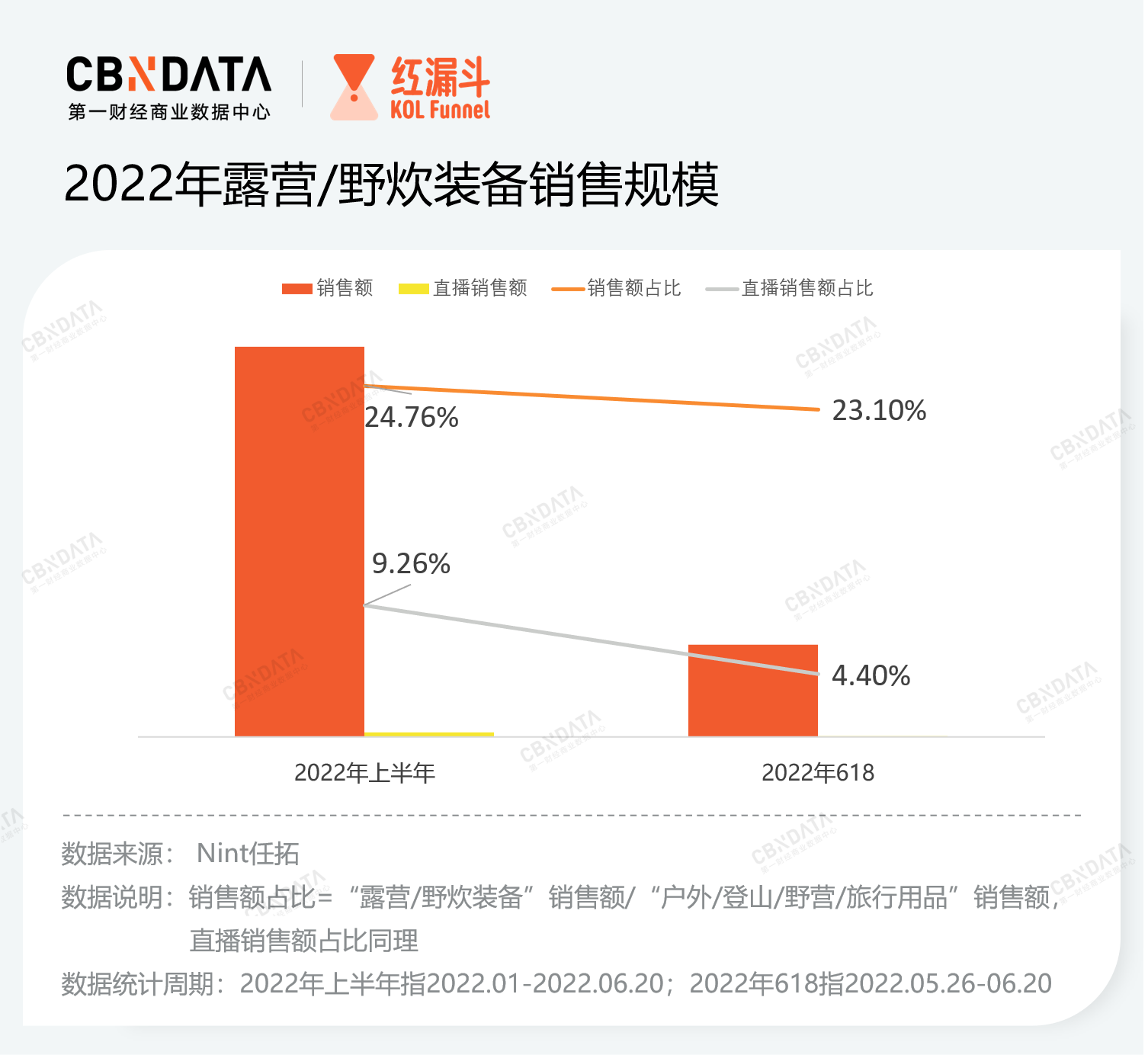

The "camping style" has not swept the live broadcast room; the trend of centralization of the brand is obvious

The overall results show that as far as the "camping/picnic equipment" contributes to the "outdoor/climbing/camping/travel supplies", more than 20%of the sales proportion is sufficient to prove its market size. It may be because consumers are purchased directly after being planted by the hot -planting equipment of the social platform, and camping supplies are more limited by outdoor experts and super -head anchors. There are not many highlights of live sales of this type of purpose. In the future, the scenes of the live broadcast room need to be displayed and planting grass to seek further growth.

From the perspective of brand performance, compared with the 618 major promotion period and the first half of the marketing period, the TOP10 brand list is relatively stable, the centralization trend of head brands is obvious, and only one brand has changed. As mentioned earlier, different types of players have different requirements for equipment. The "Exquisite Party" requires a full set of rituals, and the "portable party" focuses on the fun of camping itself. To seize this trend, the advantage of the head brand is that there are enough categories. It can be able to prepare for different product portfolios for different consumer groups and recommend different product portfolios. Different partitions such as "exquisite camping", "hiking camping", "leisure camping" are divided into different partitions in the store. Essence Mu Gao Di, which ranks TOP5 in 618 this year, even launched the "home camping" area, extending the camping scene to the balcony and living room, to a certain extent to break the restrictions on camping for camping at home isolation and no time travel.

However, this does not mean that the brand must follow the "large and complete" route. The Japanese brand Iwaki is mainly furnace supplies. The products mainly improve the windproof and portable functions. Due to the relatively low purchase frequency of furnace supplies, the brand did not enter the TOP10 brand list during the 618 period. However, in recent years, there are many scenes of camping, restaurants, households, and gatherings. There are also many grass posts used on Xiahongshu. Therefore, the brand's long -term sales performance in the first half of 2022 is the only one among the TOP10 brands during this period. The furnace brand.

The Blackttae, which replaced the Rock Valley in the 618 period, was founded in 2008 and was originally positioned as a parent -child camping. Under the trend of national camping, the brand began to extend to the mass consumer market, and announced the upgrade of brand vision during 618 this year, making articles on the value of product appearance and atmosphere, and exploring the division of product series around urban camping, outdoor camping, and field exploration. Recently, the brand has also announced the launch of joint products with the animal family IP "HFAMILY" in the variety show "Life". A series of actions, we can see that the brand intends to turn the target group to young people and trendy clan to find different spaces.

Picture source: BlackDeer Black Deer flagship store

Specifically to the third -level category, CBNDATA chose "Outdoor Leisure Furniture", "Camping Tent/Sky Screen and Accessories", "Furnace/Tableware/Picnic Barbecue", "Wandal Anti -Pad/Pills/Pillow/Sleeping Bags" further analysis. During the first half of this year and 618, the total sales accounted for nearly 95%, which largely represented the situation of the entire "camping/picnic equipment" category.

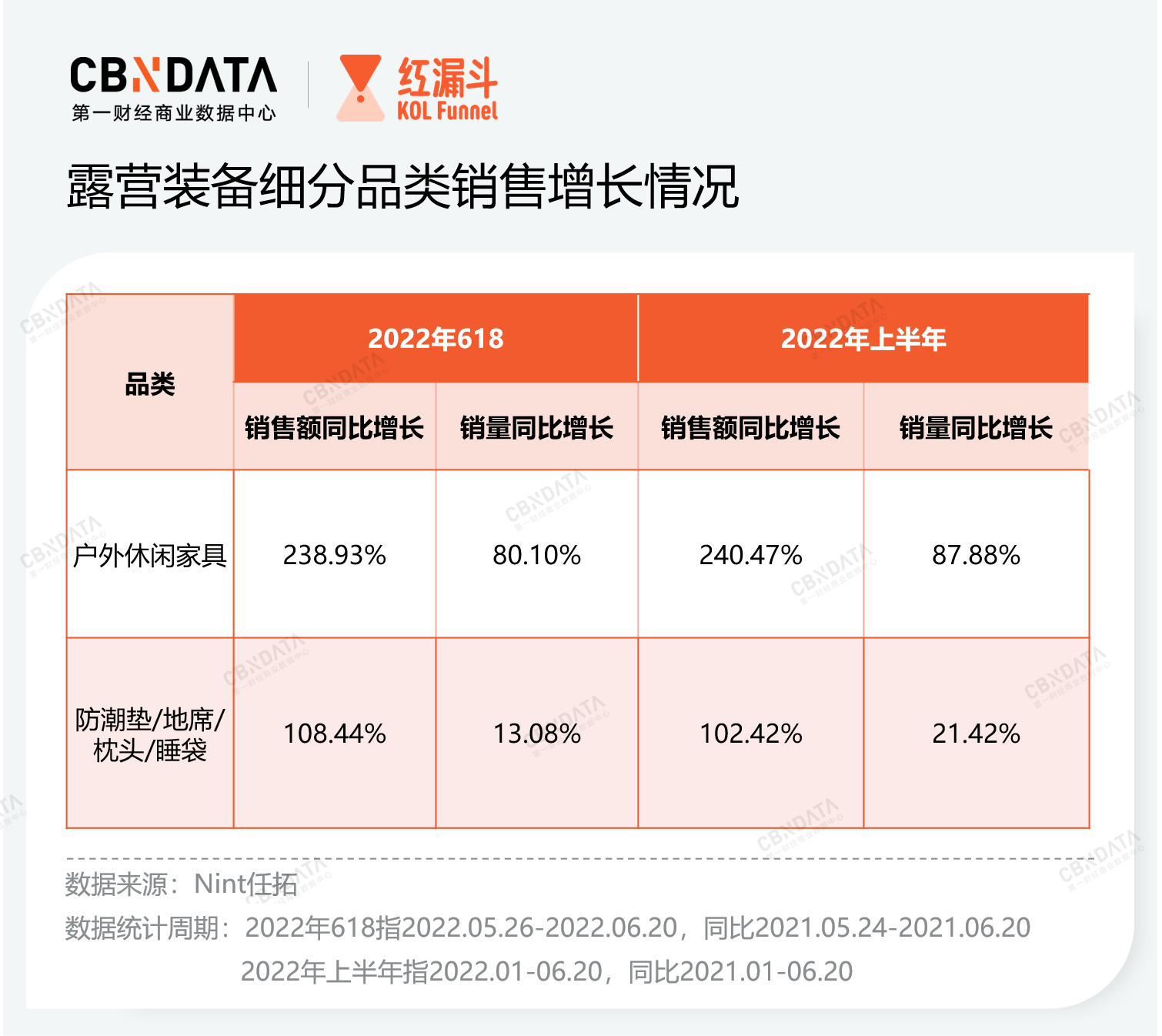

Among them, except for the sales of "furnace/tableware/picnic barbecue supplies", in the first half of this year and the period of 618, the remaining three categories have achieved a year -on -year increase. The reason may be that the picnic barbecue supplies depend on the field of camping in the wild. The epidemic conditions in various places in the first half of the year have repeatedly led to restrictions on out, and the popular city camping and park camping scenes cannot be barbecue. However, according to Nint's data, outdoor refrigerated boxes and thermal insulation boxes have become a new face in this category single product list, which is a relatively certain growth point. Tent and sky curtain function upgrades, combined packages drive other category consumption

As one of the essential items for camping, the "Camping Tent/Sky Doom and Accessories" is a strong category with a high share in the camping equipment market. It occupies nearly 40 seats in the TOP100 single -product list of "camping/picnic equipment". As the scale of camping groups expands and demand is upgraded, the hot -selling tent products have also made a series of improvements. From the perspective of this detailed category purpose list, compared to 618 last year, this year's shortlisted items have increased "ultra -light", "vinyl sunscreen", "rainproof", "two rooms", "two rooms", and "two rooms". The functions such as one hall "and other functions; the sky curtain and the Indian pyramid tent who brushed the screen because of the high value and easy to produce the screen.

It is precisely because of the high market share of the tent that the head camping equipment brands have basically launched different types of tents and sky curtain items, and the brand list is still firmly occupied by these head brands. However, some niche brands have grown rapidly with cost -effectiveness and face value. For example, the lowest price in urban wave shops has the lowest price of less than 150 yuan, and products of the same size are priced at more than 300 yuan in NatureHike stores. For entry -level players, it can get a "film artifact" for more than 100 yuan, which can be said to be a very cost -effective experience.

For brands, the role of tents is not only to form a "big single product" effect and attract popularity for the store. The brand also uses a tent as the main body to launch a wealth of combined packages to meet the needs of different types of players. Taking a tent of the camel as an example, there are nearly 40 types of combinations, covering less than 300 yuan of tent products, ranging from 300-600 yuan, including "tent+hammock+picnic cushion+moisture pad" different arrangement combinations. Simple package, exquisite package and night camp package containing 4-12 camping equipment. According to NINT Ren Tuo's data, the product is topped with the list of "Camping/Camping Equipment" single product list of 618 this year; currently the official store shows that the monthly sales are more than 10,000.

"Exquisite camping" drives furniture and household supplies to extend outdoors, and consumption is high -end

For the "exquisite party" and enthusiasts who focus on camping quality, camping is an experience of deeply close to nature. In addition to tents, it is necessary to prepare a full set of equipment such as carts, tables and chairs, barbecue stoves, and sleeping bags to fill the sense of ritual. Although many camps have launched a full set of camping services, for camping enthusiasts, they have the freshness and happiness of a "new home" with their families and friends outdoors outdoors, far greater than "enjoying it."

This consumption characteristics are reflected in the two categories: outdoor leisure furniture, moisture -proof pads/place/pillow/sleeping bags. The obvious changes are that the scale of categories has increased significantly and the high -end product trend is obvious. NINT Ren Tuo data shows that compared with 2021, the sales and sales of these two categories in 2022 have increased, and the growth rate of sales is much higher than sales. If the conversion is unit price (sales/sales), the average value increases by 60%-90%year-on-year. This means that consumers have higher requirements for product quality, portability, and face value. For the brand, it also needs to start from these aspects to provide inspiration for upgrading products and launching new products.

Compared with the list of outdoor leisure furniture items during the 618 period, last year, the four -seat inflatable mattress occupied four seats in TOP10 items, this year has fallen out of the top 20. The reason may be that this year's "but night camping" and "city camping" became a trend, and the mattress has been temporarily "forgotten" by consumers. Correspondingly, portable tables and chairs, camping cars, and camping cars have become popular items. It is reflected in the brand list, the TOP10 brand has undergone a big shuffle. Due to the loss of the sales of inflatable mattresses due to losing the sales of inflatable mattresses, brands such as Antarctica and Yingtai have insufficient advantages in new popular items and fell out of the top ten. Top brands such as primitive people and NatureHike have improved the details of leisure furniture products, such as upgrading load -bearing capabilities, reducing installation steps, launching the "two -in -one" products of camp cars and folding tables, which are recognized by consumers. The main business of the newly included brand Yadai is a camp car. The "BAVAY" series products include a variety of styles such as flat folding models, gathering models, and exquisite camping models. Shopping shopping cars, outdoor children's RVs, expanding urban white -collar workers and home users.

For the category of "moisture -proof pads/ground seats/pillows/sleeping bags", consumers' core demands are different depending on the product. When buying products such as picnic pads and moisture -proof pads, consumers value face value and portability; when buying sleep products, consumers pay more attention to core performance such as professionalism and warmth, moisture -proof. Nint Ren Tuo's data shows that NatureHike (Novas) tops 618 sales list for two consecutive years. Its founder was originally engaged in outdoor industry business and launched the Mo -American brand in 2010. In April this year, the brand completed nearly 100 million heads of financing. Due to the brand's foundry background and the advantages of product development, sleeping bags, air cushions and other sleep products have won the first sales of Tmall single categories. The fourth -ranking brand of Black Ice of 618 starts from the sleeping bag business. The duck down and goose down series are more recognized by professional outdoor circles. This year, 618 also achieved good results. The reason may be that professional enthusiasts take advantage of the 618 major to buy outdoor warm sleep supplies. With the help of social media, camping has become a well -deserved "wind", and the brand has also taken the opportunity to gain short -term dividends. From the performance of various categories and brands in the first half of 2022 and 618, we can see the trend of camping economy. However, hot events are changing rapidly, and the brand on the venture on the venture needs to "take off", and it also needs further reasonable planning and pavement. Nowadays, it is the peak of the summer tour. In the future, it will be a popular timing of camping in the future. The brand wants to think about the short -term dividends as a long -term advantage. After all, it will return to the insight into the in -depth consumption trend and use it in product research and development. Which brands can "grow red" and which dark horse brands have risen, we can observe further.

Author: Tingmu

Edit: backlight

- END -

Zhang Yulan: "Zhi" in his heart "wish" in his heart

With such a group of people, they voluntarily gave up to rest, abandon their compa...

Xihua County Meteorological Bureau issued a thunderstorm orange warning [level/serious]

Xihua County Meteorological Observatory issued a thunderstorm and orange warning signal at 15:43 on June 8, 2022: It is expected that within 3 hours in the next 3 hours, Dongwangying Township, Da Wang