Guangdong issued 610 million yuan in "red envelopes" of 279,000 companies

Author:Guangdong Provincial People's Time:2022.07.08

According to the Guangdong Provincial Taxation Bureau of the State Administration of Taxation, since the implementation of the social insurance payment subsidy policy of small -scale micro -profit enterprises in manufacturing, Guangdong (excluding Shenzhen) has recently issued 610 million enterprises to the first batch of 279,000 "exemption and enjoy" enterprises that meet the conditions. Yuan subsidy.

According to the "Notice on Implementing the Implementation of Manufacturing's Social Insurance Payment Subsidies on Social Insurance Payment Subsidies on Social Insurance to Social Insurance Payment Subsidies" jointly issued by the Guangdong Provincial Department of Human Resources and Social Security, the Guangdong Provincial Department of Taxation, the State Taxation Bureau, and the State Taxation Bureau Shenzhen Municipal Taxation Bureau. Provincial small -scale micro -profit enterprises with basic pension insurance for employees who have registered and accumulatory employees can receive subsidies for more than 6 months. The subsidy standards are issued by the enterprise employee basic endowment insurance premiums (excluding personal payment) from April 2021 to March 2022 from April 2021 from April 2021, and each household does not exceed 50,000 yuan. Subsidy funds are issued at one time, and the policy is valid until November 30, 2022.

"The subsidy funds are issued at one time. In order to ensure that the policy of benefit enterprises is fully enjoyed, we have accurately selected eligible enterprises through the conditions prescribed by the documents, determine the subsidy standards, and actively distribute the subsidy to the social security to pay social security Accounts for fees. For enterprises that do not sign a deduction agreement with the tax authority, the tax authority will actively obtain the receipt account from the enterprise and directly enter the "red envelope '" red envelope' into the unit account. " People say.

In order to achieve subsidies to distribute "exemption to enjoy", the Guangdong Provincial Taxation Bureau actively cooperated with the provincial finance, human society, and the People's Bank of China to work together to cooperate with data calculation, simplify the distribution process, and open up funds to subsidize the "green channel". According to reports, this time the tax department issued subsidy funds to the enterprise for the first time, and the number of enterprises involved in a large number. The taxation department has repeatedly argued and tested with relevant departments in the early stage of the method, elements, and processes to ensure that the subsidy funds can be accurate and accurate. Directly reach corporate accounts in time.

In addition to "exemption to enjoy", the "Notice" also clarifies the process of "active application". If the company that does not suffer the cumulative payment month due to arrears, the eligible payment may apply to the tax authority to receive subsidies before the prescribed time. The Guangdong Provincial Taxation Bureau reminded that the centralized distribution time is from July 1st to July 15th. Enterprises that meet the conditions for application but have not received subsidies can apply to the competent tax authority before August 29. Those who have met the issuance conditions will be issued before November 30.

Source: Southern Daily

- END -

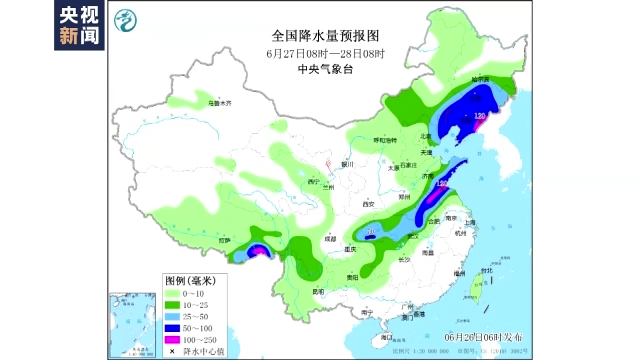

How does this round of rain develop?What impact will it bring?Expert analysis

According to the forecast, this round of rainfall will be the strongest rainfall p...

Swimming training!Transition from "scale" to "White Bar in Langli"

Today is the 7th year of the 7th year of the sky with youHot summerThere is an agg...