Investing 70 million yuan in new energy subsidiaries!Vietnam Power Directors voted for abandoned votes, and the Shenzhen Stock Exchange sent a letter urgently

Author:Daily Economic News Time:2022.07.07

Recently, the proposal of automotive power assembly supplier Yuebo Power (SZ300742, a stock price of 15.75 yuan, and a market value of 2.2 billion yuan) set up a new energy subsidiary to set up the regulatory attention of the Shenzhen Stock Exchange.

It is understood that in order to further optimize the company's business structure and in -depth expansion of new energy vehicle business, and improve the industrial layout, the board of directors of Vietnam Power reviewed and approved the establishment of a holding subsidiary Nanjing Huibojitong New Energy Power Technology Co., Ltd. (Yuebo Power Tenture Company Name, hereinafter referred to as new energy subsidiaries).

The planned new energy subsidiary's registered capital is 100 million yuan, of which Vietnam Bo Power contributes 70 million yuan in its own funds and 70%of the registered capital of subsidiaries. The following is referred to as Huitong Yidong) 30 million yuan in capital, accounting for 30%of the registered capital of subsidiaries. The business model of new energy subsidiaries is to sell new energy power assembly products to the vehicle factory. New energy subsidiaries will complete the sales to the vehicle by the vehicle in accordance with the needs of the terminal manufacturer.

However, when the proposal was reviewed, Jiang Yuanguang, director of Vietnam Power, voted for abstaining votes, and reasons for the reasons for abstaining to reserve opinions on the current stage of foreign investment. From the perspective of Vietnam's power flow, Jiang Yuanguang's reasons seem to be sufficient. As of the end of last year, Vietnam ’s motivation had 583 million yuan of bank borrowings needed to be repaid within one year. The company's mobile debt was higher than the total amount of liquid assets of 360 million yuan. As of the end of the first quarter of this year, the company's monetary funds were 16.0267 million yuan, while short -term short -term The borrowing balance is as high as 675 million yuan, and the short -term debt repayment pressure is high.

Regarding the pressure on funding, when the Vietnam Power said in the inquiry letter of the Shenzhen Stock Exchange, the company and the shareholders of the company and the cooperative shareholder Huidong Yidang will not pay the registered capital of the new energy subsidiary in the short term. There are clear arrangements.

Picture source: company announcement

It is worth mentioning that in order to solve the pressure of capital liquidity, Yue Bo's power also plans to borrow from the company's actual controller Li Zhanjiang, and the loan amount is up to 200 million yuan. The actual controller Li Zhanjiang also has hundreds of millions of yuan of funds from borrowing, and the loan method is equity pledge.

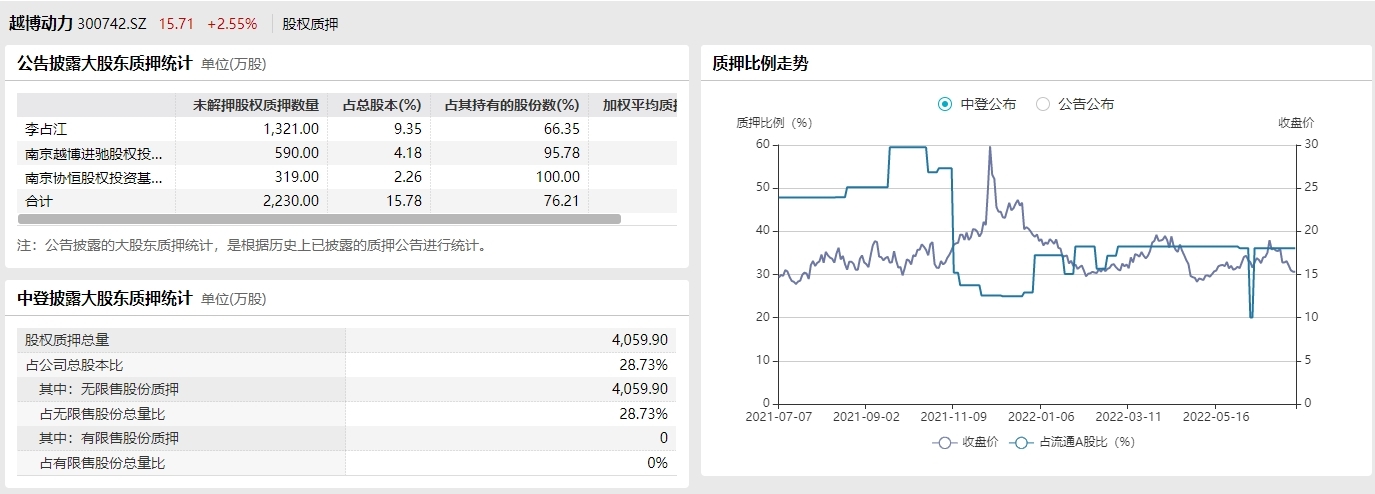

According to Wind data, Li Zhanjiang and the two subsidiaries controlled by the actual control, as a major shareholder of the Vietnamese power, have pledged huge pledge of the shareholding equity of the Vietnam Bo Dynamic Power. 76.21%of the shares accounting for 15.78%of the total share capital of Yue Boqi, of which Li Zhanjiang pledged 13.21 million shares, accounting for 66.35%of its equity, and 9.35%of the total share capital of Yue Bo.

Yuebo power equity pledge status picture source: wind data

According to the announcement of the Vietnam Bo Power, it was calculated from the starting point on April 14 this year. The actual controller Li Zhanjiang's equity pledge loan returned by the demand for half a year was 195 million yuan.

In response to why the Vietnam Power was so expensive to set up a new energy subsidiary, the reporter of the Daily Economic News repeatedly dialed the call from the Office of the Vietnam Power Division Division, but as of the press time, the phone was not connected.

Zhang Xiang, Dean of the New Energy Vehicle Technology Research Institute of Jiangxi New Energy Technology Vocational College of New Energy Technology, told reporters: "From the perspective of my experience, the establishment of a sales subsidiary may help the parent company to avoid risks. After the sales session, there is no contract relationship between Party A and B between the parent company and the final purchase of the product. If the product quality occurs, the sales subsidiary can apply for bankruptcy protection after completing their own assets, and at the same time, it can preserve the parent company. The interests are not affected. "

In Zhang Xiang's view, the newly established new energy subsidiary may receive policy support from the local government. In the past one or two years, policies have been inclined to the new energy industry in many places, and new energy subsidiaries can obtain tax incentives or even tax exemption. At the same time, talent introduction and office land may also be taken care of. "The finances of the subsidiary can take the account independently and indirectly allow the Yuebo power to get the tax incentive." Zhang Xiang said.

Daily Economic News

- END -

Assistant to Russian President: Russia and Ukraine's recovery negotiations have not progressed

Xinhua News Agency, Moscow, June 14th (Reporter Hedi) Russian presidential assistant Ushakov said on the 14th that Russia and Ukraine's restoration of negotiations have not progressed.According to Tas...

Meiqiang pushing the chip bill to suppress China, Zhao Lijian: purely moved against the current, it will fail

[Global Times reporter Ni Hao Yin Ye Ping Hanwen] The United States two parties fi...