Anhui launched supply chain financial assistance micro operation

Author:Hefei Evening News Time:2022.07.07

For small and medium -sized enterprises to relieve difficulties, on July 5, the Provincial Department of Economics and Information Technology, Provincial Local Finance Bureau and other departments jointly launched the "Anhui Provincial Supply Chain Financial Aid Micro Action Plan", which will serve thousands of core enterprises within the year and cover 100 hundreds of hundreds Wan Xiaowei market subject. At the same time, the reporter learned from the Provincial Department of Economics and Information Technology that the special operation of "Ten Billion Enterprises" financing services carried out by Anhui Innovation has issued a total of 428.6 billion yuan in special loans this year and 151,000 households in serving enterprises.

Will provide financing support for millions of small and micro enterprises

Anhui is an important base in the country's important agricultural product production, energy, raw materials and processing manufacturing bases. The development of many core enterprises in the province is inseparable from a developed supply chain network. The small and micro dealers on the supply chain are sufficient for the supply chain, and the loan of small and micro enterprises on the chain can easily lead to "insufficient blood supply" in the chain.

Taking Conch cement as an example, more than 20,000 dealers in the country have exceeded 300 million orders on the cloud each year. "We have done engineering. The accounting period is generally more than 3 months. The cash flow cannot be connected." The pressure on the account period made the dealer Cheng Cunyu feel distressed. Since the cooperation between Conch Cement with financial institutions such as online merchants to build supply chain finance last year, Cheng Cunyu's troubles have disappeared. He has obtained millions of digital supply chain procurement loans. It took 21 times more time. The mobile phone operation, and it is really convenient to go back and pay back. "

"In addition to online Commercial Bank, many financial institutions such as Anhui Branch, Postal Savings Bank, Anhui Branch, and Provincial Rural Credit Society will also carry out digital supply chain financial innovation services in the province." According to the relevant person in charge of the Provincial Local Finance Bureau The national over 500 brands, including leading enterprises such as Conch Cement, Tsuen Yin Gaoke, Huilong Agricultural Money, etc. Anhui Province, have access to the digital supply chain financial system. Obtain online credit services, used to pay for brand -oriented payments and purchases. "

Supply chain financial services, helping core enterprises in the industry chain to better play the "protagonist halo". The reporter learned that Anhui will also focus on the development goals and tasks such as the three emerging industries and three -way upgrade projects in the province, and strengthen the innovation chain, industrial chain, supply chain, data chain, service chain, and talent chain of financial services.

Cumulatively issued a new special loan of 428.6 billion yuan in the first May

Li Jing is a person in charge of a infant supplies manufacturer in Hefei. Last year, she returned to their hometowns to start a business from coastal areas. Some time ago, affected by the epidemic, the product could not be distributed a large backlog, and the payment could not be returned in time.

"Bank loans pay more than 40,000 yuan per month and interest. Because the logistics interruption cannot be issued, there are some difficulties in the flow of mobile funds." After learning about Li Jing's difficulties, Zhejiang Commercial Bank Hefei Branch work The personnel helped the enterprise for three months of extension and repaid interest. "The monthly repayment of the principal and interest payments reached more than 20,000 yuan. For the situation of the enterprise, the bank also recommended some financial products to alleviate the short -term funding difficulties."

Li Jing's urgency was relieved, thanks to the special action of "ten billion -dollar enterprises" financing services in Anhui innovation.

Like the aid operation, this special operation also provides full -process credit financing services for small and medium -sized enterprises. "In order to better help the enterprise rescue, we have innovated and developed a series of financial innovation products such as specialized new loans, equipment purchase loans, technological transformation loans, and perurone hero loans, which has strongly solved the difficulty of financing for small and medium -sized enterprises. Question. "According to the relevant person in charge of the SME Bureau of the Provincial Department of Economics and Information Technology, the special operation and cooperation bank has expanded to 14. As of the end of May, special operations have issued a total of 428.6 billion yuan in special loans this year and 151,000 households in serving enterprises. Essence

He reports all the media reporter Lotte Yinzi

- END -

The "Hot Land Plan" is reported to the first "Hema County" in Hebei to settle in Fuping

A few days ago, the first Hema County in Hebei Province officially settled in Fupi...

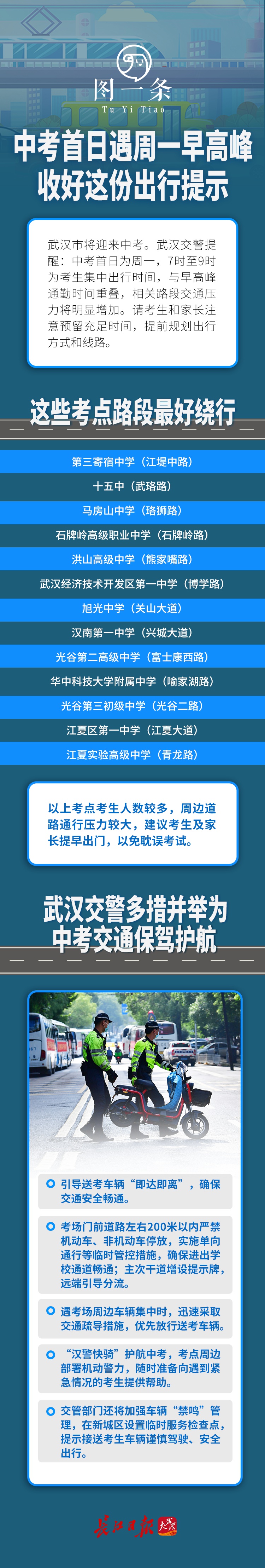

caution!Monday morning peak overlap with it

Coordinating 丨 Ma Mengya organizes, design 丨 Wang Yuzhe[Edit: Deng La Xiu]For mo...