In the second quarter, the institutional research list was released, and this A -share listed company was investigated more than 1,000 times

Author:Zero One Finance Time:2022.07.03

Source | Caixing

Author | Hou Ye

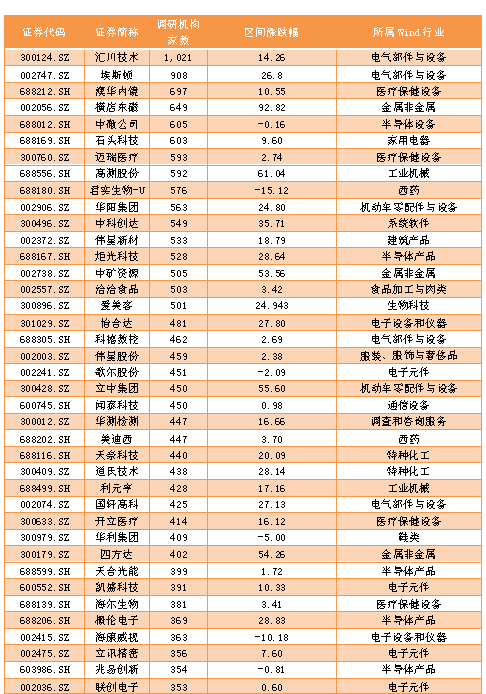

Since the end of April, A shares have stepped out of the Mavericks, market confidence has been continuously strengthened, and the enthusiasm of institutional research has also risen. Wind data shows that from April 1st-July 1st, a total of 2,955 listed companies received a total of 98,470 institutional investigations, an increase of 27.5%compared to 77224 in the first quarter. Judging from the first 50 data from the survey, 41 companies' stock prices obtained positive income in the second quarter, and the number of risers accounted for more than 80%.

Generally speaking, equipment companies involving new energy fields are most favored by institutional investors. Among them, semiconductor and their electronic components listed companies are also important areas of institutional research. In the second quarter Over 500 times, obtained a survey of the organization.

From the perspective of the sector, the popularity of the science and technology board and the GEM is more popular than the main board. Among the top 50 companies, 17 science and innovation board listed companies, and 14 listed companies in GEM. Specifically, the Head of the Industrial Control Lottery Hiroisagawa Technology (300124.SZ) was ranked first in 1021 investigations, and the second place was Eston (002747.SZ). SH), Hengdian East Magnet (002056.SZ), Sino -Micro Corporation (688012.SH), and Stone Technology (688169.SH) obtained more than 600 investigations.

Institutional research list: Huichuan Technology

Huichuan Technology, including Gao Na Capital, Sequoia Capital, Huitianfu, Central Europe, Morgan Stanley, and UBS, domestic and foreign head institutions participated in the latest research activities. During the investigation, investors mainly conducted centralized investigations on the company's new energy and the company's layout of the external environment.

1. Q: What are the advantages of the new energy vehicle business, the advantages of the company and competitors? The market share of motors, electronic control, power assembly and other products and the growth of the entire business?

Answer: In the development of new energy vehicle business, Huichuan specifically reflects the personality of Huichuan. In 2016, the company decided to enter the new energy vehicle business, hoping to obtain large business growth with a large investment. Comparing the company's new energy vehicle business with competitors, there are two relatively large advantages: ① fast response. New energy vehicles have changed rapidly, developing a model is very fast, and model sales will be upgraded for 1-2 years. As a new entry, Huichuan needs to break through with the ability of "fast" in this field. ② China's engineers and the dividend of the industry chain, the new energy industry chain is the most complete in China. Huichuan seized the advantages of the bonus and supply chain of high -quality engineers. These two points are the advantages of the competition between Huichuan and international brands.

The market share of each product of the new energy vehicle business is related to the shipments of various models of downstream customers. With the newly acquired fixed -point projects in 2021, the new energy vehicle business orders continue to show a rapid growth state this year. From the growth of fixed -point and orders, we have seen several structural changes: ① Customer structure changes: In addition to new forces and customers, traditional car companies such as GAC, Great Wall, and Chery have gradually increased in our orders. ; ② Model structure changes: The company's past supporting facilities are mainly full electric models. Now there are supporting products in hybrids, plug -in and full -power models, especially in the hybrid model market. ③ Product structure changes: change the pattern of electrical control alone in the past. At present, there are more fixed points in motor, power assembly, power supply and other products. From these structures, we are changing in a good direction. The company's business effectiveness in new energy vehicle business has also been greatly improved.

2. Q: How to treat the differences in domestic and foreign epidemic prevention policies or cause some manufacturing outflow? Under the current international situation, how can Huichuan's international supply chain and cost control be cope with?

Answer: The statement of manufacturing outflow was mentioned a few years ago. This is a normal phenomenon. The manufacturing industry must pursue relatively low cost and localization delivery. As China ’s labor costs have risen in recent years, and the pressure of personnel management has increased, manufacturing costs are indeed rising, so a small number of enterprises will inevitably move, but most of them will stay in the Chinese market. Some enterprises have moved active relocation due to the global layout of the enterprise. Many leading companies have been born in the Chinese market in recent years. They not only have a leading position in the Chinese market, but also have better competitiveness in the global market. In the process of globalization, these companies take the initiative to move out, which will bring the suppliers of Chinese manufacturing equipment and industrial control products together. Therefore, Huichuan is also implementing the global layout in the face of this relocation. At present, the company's income structure accounts for a small proportion. 2022 is the internationalization year of the company. We must vigorously promote international business, realize the globalization of customers, talents, manufacturing and research and development, and eventually become a global company.

For internationalization, the company has several preliminary judgments: ① Automation is the field of changing production methods, serving the people's clothing, food, housing. ② In the future development of the world manufacturing industry, some special practices accumulated by Huichuan, especially the most complicated, widest, and most application scenarios in China. contribute. From the perspective of the supply chain, it is feasible to promote internationalization. The future internationalization of Chinese companies must be GLOCAL (GLOBAL+LOCAL), that is, internationalization must be first, and then localized on the basis of internationalization. Huichuan will move to internationalization through the GLOCAL model, so that global knowledge, production capacity, employment, customer timely service satisfaction, etc. are strengthened. This is the best international path for emerging companies in China. The company is in Europe this year, and the concept of GLOCAL will be continuously launched in South Asia, and it will achieve internationalization in R & D, manufacturing, service, and logistics centers. In the promotion of GLOCAL, the company will insist on: ① as small as possible and use equipment to go to the sea; ② try to use localized people. The cost will not increase too much. The higher the cost, the more customers are willing to bear the increase in prices. Judging from these two aspects, the cost pressure of the company's going out. Institutional research list: Eston

Eston is an intelligent manufacturing enterprise from an industrial chain from automated core components and motion control systems, industrial robots to robot integration applications. Investors mainly ask questions based on the cost of company products, industry opportunities, and humanoid robots.

1. Q: How can the company respond to the problem that the cost is high and the gross profit margin is not obvious?

Answer: Over the past year, the global supply chain has been affected by various factors, and the price of raw materials has risen significantly, which has a certain impact on the company's gross profit margin. The company has adopted some measures since the second quarter of last year to improve the gross profit margin status by reducing costs and increases, including: (1) to achieve localization of raw materials through research and development, reduce costs and achieve autonomy and controlling; Supply chain management and manufacturing efficiency are strengthened and refined management; (3) According to market changes, the price of product prices is adjusted in a timely manner, and the impact of the impact of the increase in some costs of the transfer of some costs is also actively expanding the market. Fresh and continuously improve the level of gross profit margin.

2. Q: What is the company's industry opportunities in the future?

Answer: (1) The company needs to seize the structural opportunities of the downstream industry applications. New energy such as photovoltaic and lithium batteries is the main market opportunity for the next two years. The development opportunities of the energy industry; (2) The development trend of long -term labor shortage and the development trend of aging society is becoming increasingly obvious. Robotic products can obtain more business opportunities for machine substitutions through ease of use and quality; The performance improvement of robots and the enhancement of brand influence. More and more customers will consider using domestic brands of robots. The scope of domestic robots will gradually expand, giving domestic robots more opportunities.

3. Q: How does the company think of Tesla's "humanoid robot"?

Answer: Tesla's "humanoid robot" is the field of artificial intelligence development with AI technology as its core. Intelligence is one of the directions of robot development in the future. The "humanoid robot" may be applied in some specific fields in the future, and it is estimated that the use of industrial fields will take a long time. Industrial scenarios have higher requirements for the safety and stability of robots, and are more designed as established work lines and completing specific work tasks. There are not many industrial scenarios of "humanoid robots". The company has not yet carried out corresponding R & D investment in the field of "humanoid robots".

Institutional research list: Sino -Micro Corporation

Sino -Micro Corporation, a leading domestic semiconductor equipment company, investors mainly ask questions around MOCVD devices.

Answer: MOCVD devices are currently widely used in lighting and display market applications. More importantly, the expansion of the MINILED and MicroLED markets, the development prospects of related markets are great. The important applications of MOCVD devices also include power devices. Market institutions predict that in 2026, global demand exceeds 800 MOCVD devices each year. Sino -Micro Corporation has development related products in three areas. The company will continue to develop lighting and display areas, including MINILED, Microled, and power device. The company is expected to cover about 75%of the MOCVD device market. The market space in the future is very broad. The company's current components of the company's etching equipment are about 60%, and the localization rate of parts and components of MOCVD devices is about 80%. The new product model Prismounimax? It is mainly designed for Mini-LED. Performance and complexity are improved a lot, providing more value to users, so the gross profit margin has increased significantly.

List of the situation of the top 50 companies in the second quarter of the institutional investigation

End.

- END -

How to achieve "zero carbon"?KPMG suggested that the industrial park can build a digital carbon management platform

Focusing on the goal of carbon -to -peak and carbon neutrality, there are currentl...

The style of work style is further enhanced to promote the orderly development of various tasks in the streets of Fushan New District in Shibei District

The streets of Fushan New District, Shibei District took the opportunity to improv...