Yang Delong: The rise of the consumer sector is rising with new energy as scheduled

Author:Dahe Cai Cube Time:2022.06.30

Yang Delong | Cube, everyone talks about column authors

On Thursday, June 30, with the favorable promotion of the epidemic prevention policy, the consumption sector such as liquor, tax exemption, and tourism rebounded sharply, driving the popularity of the entire market. After effective control of the epidemic in all parts of my country, the epidemic prevention and control measures gradually relaxed, and the Health and Health Commission announced the ninth edition of the epidemic prevention policy, which greatly reduced the isolation time of the entry personnel, which means that the impact of epidemic prevention and control on the economy will gradually decrease. On Wednesday, there was also news of inspiring. The Ministry of Industry and Information Technology stated that in order to facilitate the travel of the majority of users, the "Star Number" tag will be canceled from now on. This brings great convenience to the flow of people between cities, especially for people who travel travel. Many practitioners in the tourism industry have sent friends to celebrate. The cancellation of the stars in the itinerary is adapting to the form of the current epidemic prevention and control, reducing the restrictions on normal economic activities, and promoting economic recovery.

Among the "three -driving carriage" that drives GDP growth, consumption has exceeded investment and exports, becoming the most important engine to promote my country's economic growth. Affected by the strict prevention and control of the epidemic this year, the growth rate of consumption has declined significantly, and many months have even increased negative growth. Now that the epidemic is effectively controlled, consumption may usher in the opportunity to recover, even explosive growth. According to statistics, after the announcement code was announced, Ctrip, Qunar.com and other booking websites have increased significantly. When seeing the bottom on April 27, I suggest that you should maintain confidence and patience, make reverse investment, and cherish the timing of layout of high -quality stocks and high -quality funds under 3000 points. Because the factors that affect the stock market this year are actually temporary, especially the impact of the epidemic. Once the epidemic is effectively controlled, the economy will recover quickly. It is recommended that you lay out new energy first and then lay out consumption. The current market trend also verifies my judgment.

Since the market has seen a phased bottom on April 27, the new energy sector has risen sharply. New energy replacing traditional energy is the general trend. my country has led the world in terms of new energy utilization. It has developed more advanced and economical photovoltaic and wind power power generation techniques, allowing more new energy vehicles to replace traditional fuel vehicles, effectively guarantee my country's energy safety, achieve realization Energy independence, maximize the effective use of energy, occupy a favorable position in this energy revolution. In terms of traditional energy, my country does not have advantages. In addition to the large coal reserves, it is seriously dependent on imports in terms of oil. Once the international trend changes occur, it may cause my country's oil imports to be blocked, which is very detrimental to our energy safety. By using new energy vehicles to replace traditional fuel vehicles, it will get rid of excessive dependence on oil. At present, my country has formed an advantage in new energy in the industrial chain. The sales of new energy vehicles in my country accounted for near half of the world, and the effect of economic benefits is also very obvious. Some people predict that the scale of the industry chain of the entire new energy vehicle in my country will exceed 10 trillion yuan in the future. In terms of traditional automobile manufacturing, my country basically relies on Chinese and foreign joint ventures to quickly establish a automobile system. However The streets are running on the street. my country has the world's largest automobile sales market. It has a year's car sales of 28 million vehicles, but the car of my country's independent brands cannot take the mainstream. Therefore, it is a major historical opportunity to achieve a curve through the development of new energy vehicles.

The rise of new energy vehicles will drive a series of industries such as lithium batteries, components, and charging piles, which will be an important aspect of promoting my country's economic recovery. In terms of photovoltaic and wind power, according to the planning of relevant departments, by 2060, non -fossil energy consumption accounts for more than 80%, which means that the installation of new energy power generation such as wind power and solar power generation will reach billions of kilowatts, and it will become electricity, becoming electricity, becoming electricity, becoming electricity, becoming electricity, becoming electricity, becoming electricity and becoming electricity. Supply subject. At present, non -fossil energy consumption accounts for less than 10%, so the development space of photovoltaic and wind power is very large. The Qianhai Open Source Clean Energy Fund I managed from the top ten heavy stocks in the first quarter that I can see that I have deployed new energy vehicles, lithium batteries, photovoltaic, wind power, hydrogen energy and other industries, and seized the development of new energy in the long run. Historical opportunities.

Professor Michael Potter, a professor at Harvard Business School, pointed out in the book "National Competitive Advantages" that at the national level, the only significance of "competitiveness" is national productivity. The national economic upgrade requires the continuous improvement of productivity, and energy is one of the key production factors. Throughout the history of energy development, every reconstruction of the energy system releases huge power to promote economic efficiency, effectively promoting economic growth. In the first industrial revolution, coal became the protagonist, the second industrial revolution in the industrial revolution became the protagonist, and a new round of industrial revolution was driven by new energy. In other words, the new energy investment opportunities we are currently facing are a long -term investment opportunity, not short -term. It is recommended that you understand the investment opportunities of new energy from the perspective of the energy revolution.

While layout new energy, it is also recommended that you pay attention to the opportunity of consumer stocks. In 2016, I proposed the concept of Bailong horse stocks, that is, the leading stocks of the white horse stocks and the industry, mainly in the consumer white horse stocks. Since 2016, many consumer white horse stocks have risen 5-10 times. Although the outbreak has been spread in the past year and the double blows with high valuations, consumer stocks have caused a sharp fall, but this does not change the long -term investment value of consumer white horse stocks, and the decline in the stock price has just brought us better The chance of getting on the car. Qianhai's open source high -quality leader fund's top ten heavy positions in the first quarter focus on the layout of new energy leading stocks and consumer white horse stocks, aiming to seize the opportunity to benefit from the two major economic transformation benefits of new energy and consumption. Recently, consumer white horse stocks have begun to start quietly, especially liquor with strong profitability, which has become more prominent. Although the overall sales of liquor may not be like the previous growth rate, the first and second -tier liquor stocks with brand value have greater investment value. Some time ago, I attended the shareholders' meeting of the liquor stocks. Before the meeting, I had a high consensus with the well -known value investor Lin Yuan, but Bin Tea Syria, and we had a high consensus on the long -term investment value of consumer white horse stocks. Affected by the epidemic this year, the growth rate of consumption has declined, but these belong to the past. Once the epidemic control measures are relaxed, people can travel, travel and consumption, and the growth rate of consumption will inevitably occur. After these three years of the epidemic, many people feel dull at home, and the mood of wanting to go out is becoming more and more intense. It is said that some attractions have begun to be overcrowded, which reflects everyone's mentality. And after three years, many people have a more new understanding of life, and we hope to live in the present and improve the quality of life, that is, we often hear that we cannot increase the length of life, but we can increase the width of life. We cannot decide the length of life, but we can expand the width of life by improving the quality of life and improving the happiness of life.

Benefiting from consumption upgrades, brand consumer products have long -term investment value. Like my previous expectations, as the epidemic control measures gradually relaxed and the economy gradually returned to track, the country's stable economy policies and measures accelerated the effectiveness, and the overall economic recovery of my country's economy accelerated. In May, PMI was still below 50%, but in June has risen to more than 50%. In June, my country's manufacturing PMI was 50.2%, which was higher than 0.6%last month and was in the expansion range. The non -manufacturing PMI was 54.7%, and the comprehensive PMI output index was 54.1%, which were in the expansion range. This also allowed us to see the economy. Gradually recover. Large -scale enterprise PMI is 50.2%, which is higher than the critical point for two consecutive months, continuing the recovery expansion momentum; the PMI of the medium -sized enterprise is 51.3%, which is higher than 1.9 percentage points last month and rises to the expansion range. The level of prosperity has improved, and the PMI of small enterprises is 48.6%. High -tech and equipment manufacturing have accelerated. The PMIs of the two are 52.8%and 52.2%, respectively, higher than 2.3 and 3.3 percentage points higher than last month. The PMI of the consumer goods industry was 50.9%, which was higher than 0.7 percentage points last month, showing that the consumer goods industry continued to recover.

With the gradual implementation of the policy of supporting economic growth, the company's expectations have improved. The expected index of production and operation activities is 55.2%, which is higher than 1.3 percentage points of last month. It rises to a high point in nearly three months. The corporate confidence continues to rise. Therefore, from the perspective of economic data or the adjustment of prevention and control measures, we all have reasons to believe that the next step in the economic recovery will be further accelerated, and the A -share market is gradually getting better. After the start of the first wave of new energy, the new energy of consumer relay continues to promote the recovery of the market, which is important to grasp the market rhythm. It is a wise investment strategy to adhere to value investment and do a good job in the company's shareholders or configuration of high -quality funds.

Responsible editor: Yang Zhiying | Audit: Li Zhen | Director: Wan Junwei

- END -

KPL cover observation | The first day of the summer season was born XYG victory over Xi'an WE and still attracted controversy | See you every day

Cover reporter Cai ShiqiOn June 16th, the third week of the second week of the 202...

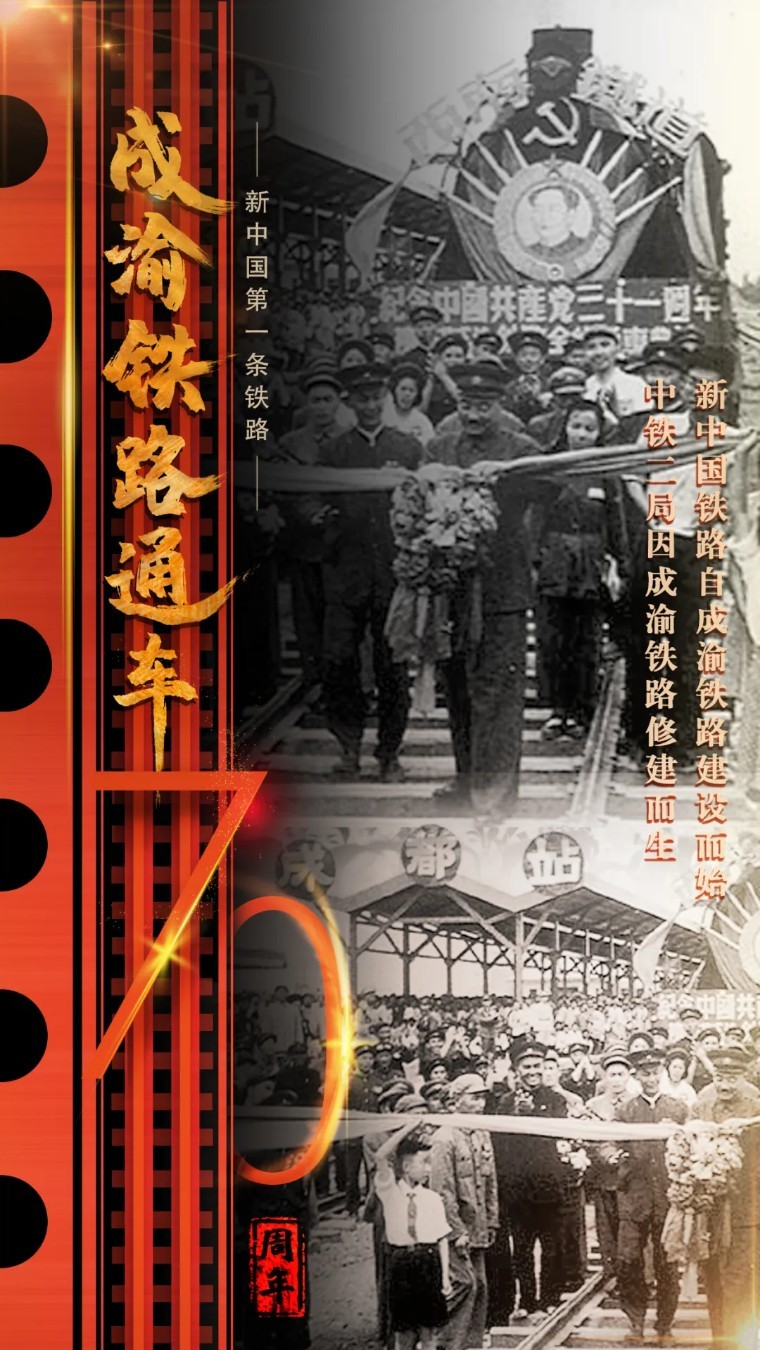

Today, the 70th anniversary of the opening of the Chengdu -Chongqing Railway

Chengdu -Chongqing Railway is after the founding of New ChinaChinese Communist Par...