Tomorrow!It's about your wallet

Author:Top news Time:2022.06.29

According to the announcement of the State Administration of Taxation, from March 1st to June 30th, 2022, individual residents who meet the relevant regulations need to handle the comprehensive payment of personal income tax for 2021.

According to the announcement, after the end of 2021, the residents need to summarize the income from four income obtained from the salary salary, labor remuneration, manuscript remuneration, and franchise fees from January 1, 2021 to December 31, 2021, and the expenses are reduced by 60,000 After the special deduction, special additional deduction, other deductions and eligible public welfare charities determined in accordance with the law, the personal income tax rate for comprehensive income is applicable and subtract the speed deduction. The tax amount has been paid in the year, and the amount of tax should be refunded or replenished, and the taxation or tax refund or taxation is applied to the tax authority.

The end of June is coming to an end, and the personal income tax in 2021 is about to end. If the comprehensive income of personal income tax in 2021 has not been paid, it will be operated according to the tax exchange phone APP operation guide according to this tax exchange.

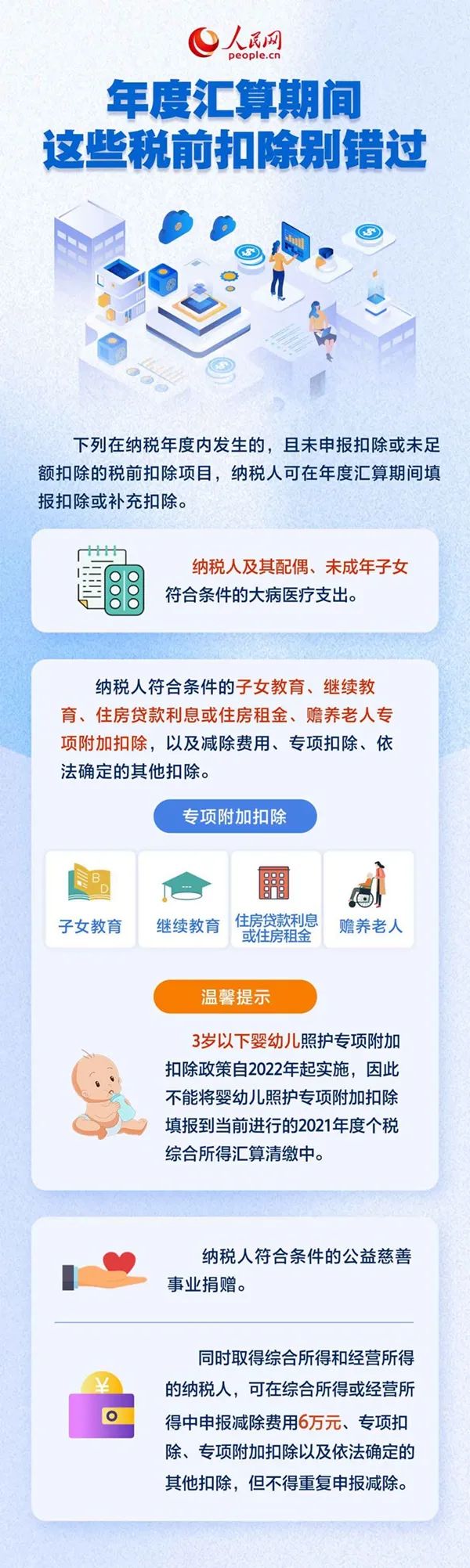

What tax deductions can be enjoyed during the annual exchange period, and a picture takes you to quickly understand the policy "red envelope".

Earlier, the research group of the China International Tax Research Association released the "International Research on the Annual Calculation of China's Personal Income Tax" showing that the average annual tax refund rate of China 2019-2020 was 48.65%, and the per capita tax refund of the year of 2019 and 2020 was 581.61 yuan. The current prepaid prepaid and settlement system in my country effectively avoids the trouble of "more prepaid, and then more tax refund". Enjoy reform dividends.

If you accidentally miss the deadline for tax exchange, can the taxpayer make up the declaration? It is understood that the taxpayer who missed on June 30, if it is a taxable person, can supplement the application for the application for tax refund, and handle it through the online tax refund window or through the offline tax bureau business hall. The time limit for tax refund is three years, and the tax refund within three years can be handled.

It is worth noting that the tax department reminds that the majority of taxpayers should handle personal income tax in accordance with laws and regulations, and carefully read the tax app to remind the reminder information. To complete the declaration of taxation within the statutory period, do not trust the various types of "tax refund secrets" on the Internet, let alone disseminate unofficial tax -related information on the online social platform, and be a taxpayer who is honest and trustworthy in accordance with the law.

————————————————————————

Source: CCTV News

- END -

The flavor of the old lady of Dongsan Daoxiang

The characteristic tourism garden is embellished between the blue brick and gray t...

A behavior, the father and son died | The ring of the car covering the car

On May 22, 2022, in Hebei, the Beijing -Kazakhstan Highway. At about 6 am, when the Hebei High -speed Traffic Police Beidaihe Brigade conducted a video patrol, he found that a heavy semi -semi -hangin