Reminder | Single tax calculation end at the end of June, the taxpayer who has not yet been handled hurriedly

Author:Sanxiang Metropolis Daily Time:2022.06.29

The 2021 individual taxation calculations ushered in the countdown and will end on June 30. The taxpayer who meets relevant regulations, if you forget to handle it before, have to hurry up the last time.

The content of the individual taxation is that the taxpayer's pre -paid tax "calculation general accounts" obtained by the salary salary, labor remuneration, manuscript remuneration, and franchise fees obtained from January 1st to December 31st, 2021 were taxpayers. , Retreat and make up. It is very convenient to recommend using the "Personal Income Tax" app for remittances.

Whether the special additional deduction is full and reasonable will also affect the tax refund, which is also the final amendment opportunity to fill in the previous year. It should be reminded that the care fee for infants and young children under the age of 3 as a new special additional deduction this year was effective from January 1, 2022, so this tax exchange does not involve the project.

According to the regulations, on June 30, the tax exchange is over. If the taxpayer has no objection to the results of the pre -filled declaration form, the system will automatically calculate the payable or tax refund. That's it; if you need to pay taxes, it can be exempted from one of the following three situations: First, the annual exchange is required to pay taxes, but the annual comprehensive income income does not exceed 120,000 yuan; the second is that the annual amount of taxation must not exceed 400 The third is that the pre -paid tax amount is consistent with the annual taxable amount or does not apply for the annual renewal tax refund. Those who need to pay taxes and do not meet the above -mentioned exemption conditions, be sure to make up for relevant taxes before June 30 to avoid being charged for late fees and affect tax credit.

The taxation department reminds that the majority of taxpayers should handle individual tax banks in accordance with laws and regulations, and truthfully fill in declaration projects such as income and special additional deductions. Do not trust various "tax refund secrets" online. For false reporting income and deduction of tax refund, the tax authority will not be refunded, recovered taxes and late fees in accordance with the law, and included in the list of key personnel of tax supervision to strengthen the review of the annual taxation of the three taxes in the future. Punishment according to law.

On June 16 of this year, the Taxation Bureau of Loudi City, Hunan Province reported that during the 2021 tax refund review, it was discovered and investigated and dealt with the special additional deductions for the medical specialty medical treatment of the major illness. After investigation, 14 taxpayers from a service management company misunderstood the false filing video of the Internet. In the case of unrealistic medical expenditure costs, false filling in specialized medical treatment for major illnesses. After the tax authority was found, the unit immediately visited the unit, interviewing the company's legal representatives and financial personnel, requiring the unit to strengthen policy propaganda and counseling, report to employees one by one, and correct them as soon as possible. Considering that the above -mentioned taxpayers have a good attitude and correct mistakes in a timely manner, the tax department has criticized and educated it without punishment.

All media reporter Pan Xianxuan intern Zhou Yang Gaoyuehan

(First instance: Zhu Rong Second Trial: Peng Zhiguo Third Trial: Zhang Jun)

- END -

Jinan will fully promote the use of electronic labor contracts

On June 29, the promotion site of the Electronic Labor Contract Promotion of Jinan...

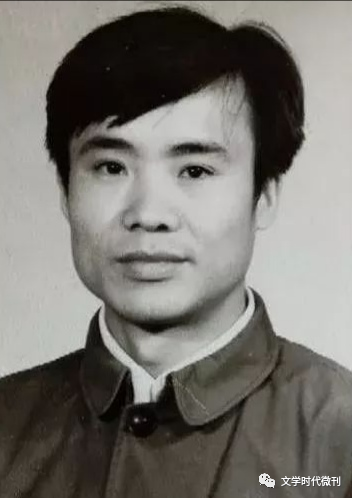

Southern Observation 丨 Qin Mingshu's 50 -year Pen Road

Often in a lonely late night, or the sunny afternoon, or the dripping dusk, the me...