Before June 30, don't forget to do one thing, close your money bag!

Author:Xinhuanet Time:2022.06.29

The discount of individual taxes in 2021 is approaching, and June 30 is about to end. If there is no tax refund or taxation, you have to handle it.

Complete a tax exchange before June 30

The 2021 individual tax exchange is calculated from March 1st to June 30th, 2022.

The so -called tax annual calculation is to "consolidate the annual income, calculate the tax based on annual", and then refund more. That is, the income of wages, salary, labor remuneration, manuscript remuneration, and franchise fees are merged into "comprehensive income", and individual taxes are calculated annually.

Since March, the tax refund has been on Weibo for a while, but many people who are not anxious have chosen to wait until June to apply for the annual tax of the year.

As the deadline is approaching, the taxation departments in many places have also reminded taxpayers to complete individual tax banks as soon as possible by sending text messages and calls to avoid missing tax rebates or tax -related risks.

"Dear taxpayer, hello! After the system, you may have a comprehensive tax refund of the comprehensive personal income tax of 2021. Please download the login personal income tax app in time and complete the transfer of calculation before June 30, 2022." After reminding the SMS, a netizen successfully refunded more than 500 yuan.

Be sure to make up taxes in time, otherwise the consequences are serious

There are tax refunds, and there are people who want to make up for taxes, and those who are dragging on the last few days to apply for tax exchange are often tax reimbursement.

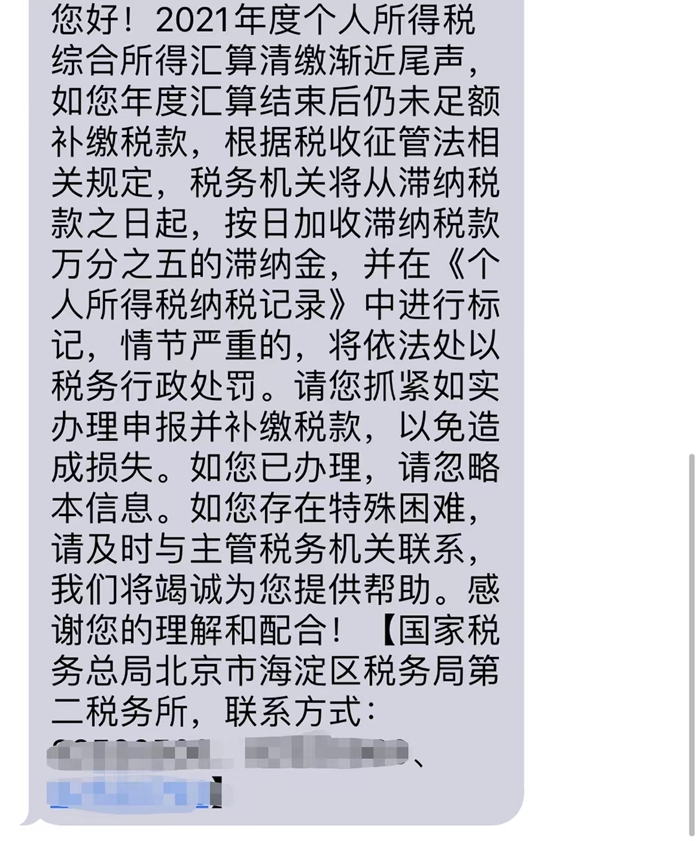

The stream (pseudonym), who had worked in a large Internet factory, told China Singapore Finance that this year he needed to pay more than 100,000 yuan in taxes and prepared to handle it on June 29. Recently, the tax department has sent a lot of text messages. Remind not to forget the tax replenishment, and at the same time talk about a bunch of overdue serious consequences.

SMS sent by the tax department. Interviewee confidence

If the taxpayer's comprehensive income income from more than 120,000 yuan and the amount of tax replenishment exceeds 400 yuan during the tax year, then tax supplementation is required. If you still have not paid taxes in full after the end of the remittance, it will face the consequences of being recovered, adding late fees and fined fines.

Recently, someone was fined.

Recently, the Inspection Bureau of the Hangzhou Taxation Bureau of Zhejiang Province, according to the report, filed a case and dealt with Lan Moumou's income and settlement cases. After investigation, Lan Moumou did not handle the comprehensive pay of personal income tax in 2020 according to law, and pays less than 24,400 yuan in personal income tax. After the tax department filed a case, Lan Mou took the initiative to apply for some taxes. The Hangzhou Taxation Bureau's Inspection Bureau has recovered taxes, charged late fees and fined a total of 46,700 yuan.

The relevant person in charge of the Hangzhou Taxation Bureau reminds the majority of taxpayers to handle the comprehensive income of personal income tax in accordance with laws and regulations, and taxpayers who need to pay taxes should apply for and pay taxes within the statutory period. In addition to the comprehensive payment of personal income tax in accordance with the law, in addition to recovering taxes, late fees and fines in accordance with the law, it will also be labeled in its "Personal Income Tax Tax Record" and included in the list of key tax supervision personnel. Three tax annual declarations have been strengthened for review.

Don’t believe in the "tax refund secret", do not report false declaration

When applying for a tax year, the taxpayer must handle it honestly. Do not report false declarations for tax refunds or less taxes, especially do not believe in the "tax refund secrets" on the Internet. For such false declarations, the taxation department with golden eyes is easy to discover.

Recently, some people have been investigated and punished for false declarations.

According to the report of the Taxation Bureau of Shenyang City, Liaoning Province, the 24 -year -old Xu, when he has no children who do not meet the special additional deductions of children's education, listen to the so -called "tax refund secrets" of the network, and will give birth to a foreign place born in 2011 in 2011 As their own children, relatives and children have filled up special additional deductions for their children's education. After the tax department reminded, Xu corrected the declaration and paid taxes in accordance with regulations.

The taxpayer of Xiamen City found that the taxpayer Liu had wrongly reported the special additional deduction of 3,600 yuan per year without obtaining the internal training certificate of the unit and not in line with the special additional deduction conditions of the continuing education of vocational qualifications. The taxpayer still adds his grandparents to the special additional deduction of the elderly to the elderly for the elderly, but not satisfied with the special additional deduction conditions of the elderly. After the tax authority reminded, Liu acknowledged the mistake and had corrected the declaration in accordance with regulations.

Did you get a tax exchange? Tax refund or tax supplement? (Li Jinlei)

- END -

Don't you know the provident fund business?Here is a real "cloud" to help you

Li Chunwei, a reporter from Yangcheng Evening News, reported that withdrawal of provident fund and applying for provident fund loans for some neighbors is a technical work. Many people who apply for

The first batch of expert outpatient list was announced!The Fangqiao Courtyard of Ningbo First Courtyard opened on the 30th

The Fangqiao Hospital of Ningbo First Hospital will be opened on June 30. Today (J...